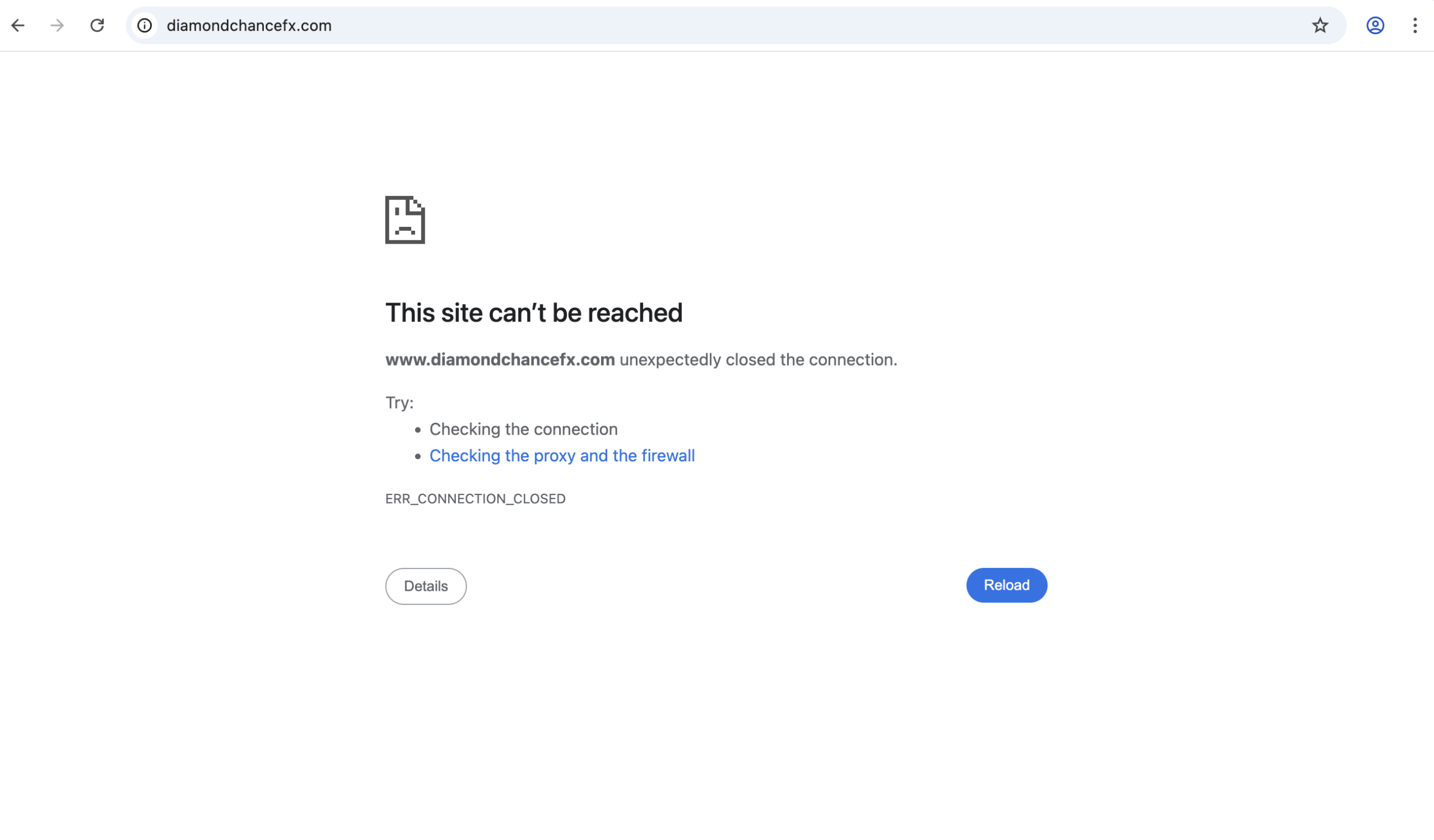

Diamond Chance FX Review: A Cautionary Analysis

In recent months, a new online trading and investment platform calling itself Diamond Chance FX (operating at diamondchancefx.com) has been promoted aggressively across social media and through online ads targeting investors interested in forex, cryptocurrency, real estate, and other financial markets. The platform presents itself as a sophisticated, fully regulated global investment powerhouse, complete with “world-class investment solutions” and promises of high returns. However, beneath that polished exterior lies a business model that raises significant red flags and serious concerns about its legitimacy.

This review examines these issues in depth and explains why investors should steer clear of Diamond Chance FX.

What Diamond Chance FX Claims

The marketing messaging on Diamond Chance FX’s website positions the company as a leading investment firm with expertise in multiple asset classes including forex trading, crypto mining, stocks, NFT investment, and real estate. The site asserts that the company is “fully regulated,” has millions of investors around the world, and has been recognized with international awards for its services. Its “About Us” section features descriptions of global offices, advanced proprietary trading systems, and an established track record of delivering superior investment returns.

At face value, this description is appealing to anyone seeking to grow their wealth, especially those new to trading or who have been influenced by online success stories. Unfortunately, the substance of these claims does not hold up under scrutiny.

Lack of Regulatory Authorization

One of the most important factors in assessing any financial services provider is regulation by a recognized authority. Regulated firms are required to adhere to strict standards, such as segregating client funds, submitting regular audits, complying with anti-money-laundering laws, and offering transparent dispute mechanisms. Diamond Chance FX is notauthorized by major regulators to provide financial or investment services.

The UK Financial Conduct Authority (FCA)—one of the most respected financial regulators in the world—has explicitly warned that Diamond Chance FX is not authorised or registered to offer financial services in the United Kingdom. The FCA’s official warning makes clear that the platform may be providing or promoting financial services without permission and that consumers should avoid doing business with it.

When a firm claims to be “fully regulated” on its own website, yet appears on official warning lists as unauthorized, this is a strong indication that the regulatory claims are false or misleading. This practice is common among fraudulent brokers, which use fabricated licenses or misrepresent their regulatory status to create a veneer of legitimacy.

The absence of genuine regulatory oversight means that customers who open accounts and deposit funds with Diamond Chance FX do not receive the protections that come with regulated platforms. This includes investor compensation schemes, access to an independent financial ombudsman for complaints, or recourse in the event of misconduct or insolvency.

Misleading Representations and Dubious Claims

Beyond the regulatory issue, the platform’s marketing and legal materials contain other signs of concern:

-

Inflated or Unrealistic Performance Stats: The website claims to manage vast sums of assets and boasts huge investor counts and returns, without providing verifiable evidence. These kinds of impressive figures are often used by fraudulent schemes to lure in unsuspecting investors.

-

Contradictory Information: Diamond Chance FX’s own terms and conditions page states that the company does not function as a registered broker or investment adviser. It also reserves the right to close accounts, impose commissions, freeze access, or adjust customer positions—broad discretionary powers that generally should not be held by a legitimate, regulated intermediary.

-

Dubious Contact Information: The address listed on the website appears inconsistent (“Soi Phatthana 5, Lucknow, Uttar Pradesh, USA”), combining geographic elements from multiple regions, which is typical of scam setups that use fabricated addresses to obscure real locations.

Community and External Reports

Independent community discussions, such as forums frequented by forex and trading professionals, have flagged Diamond Chance FX alongside other suspicious or unregulated brands. Users have pointed out patterns typical of investment scams—platforms that:

-

Make exaggerated claims about performance and regulatory status.

-

Generate profits on user dashboards but then complicate or block withdrawals.

-

Require additional fees or deposits before funds can be released.

While these specific accounts are anecdotal, they align with the warning issued by the FCA and with known scam tactics used in digital investment fraud.

Common Scam Tactics Found in Similar Platforms

Scammers often combine multiple psychological and technical tricks to draw in victims:

-

Overly Positive Testimonials and Fake Awards: Presenting fabricated social proof to build credibility.

-

Promises of Guaranteed or High Returns: Claiming that the platform’s technology or strategy always delivers gains.

-

Pressure to Deposit More Funds: Once an initial deposit is made, investors are often encouraged to “unlock higher returns” by depositing additional funds.

-

Withdrawal Obstacles: Requests for extra payments or delays when an investor attempts to withdraw money. Genuine platforms do not require additional fees for standard withdrawals.

These patterns have been documented widely in relation to investment scams globally. They are not specific to Diamond Chance FX, but should alert anyone to the risk when combined with the other red flags listed above.

Final Assessment: Why You Should Steer Clear

The accumulated evidence paints a clear picture: Diamond Chance FX is an unregulated platform making representations that are not supported by independent verification. Its inclusion on regulatory warning lists and the absence of any reputable license strongly suggests that it is not a legitimate investment intermediary.

Investors should approach any platform like this with extreme caution and scepticism. Legitimate financial services firms are transparent about their regulatory status, provide verifiable licensing information, and adhere to standards designed to protect client interests.

Diamond Chance FX does not meet these basic standards.

Instead of risking capital on a dubious platform, potential investors would be better served exploring established, regulated brokers or investment firms with proven track records and clear oversight by recognized authorities.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to Diamond Chance FX, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as Diamond Chance FX continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.