UKBondRates.com: What You Need to Understand

In the ever-expanding world of online investment opportunities, platforms promising secure and attractive returns often catch the eye of many investors. However, not all platforms operate with the transparency and reliability that investors deserve. UKBondRates.com is one such platform that has raised significant concerns among users and financial watchdogs. This review aims to provide a thorough examination of UKBondRates.com, highlighting the issues surrounding its operations and advising caution before engaging with this platform.

What is UKBondRates.com?

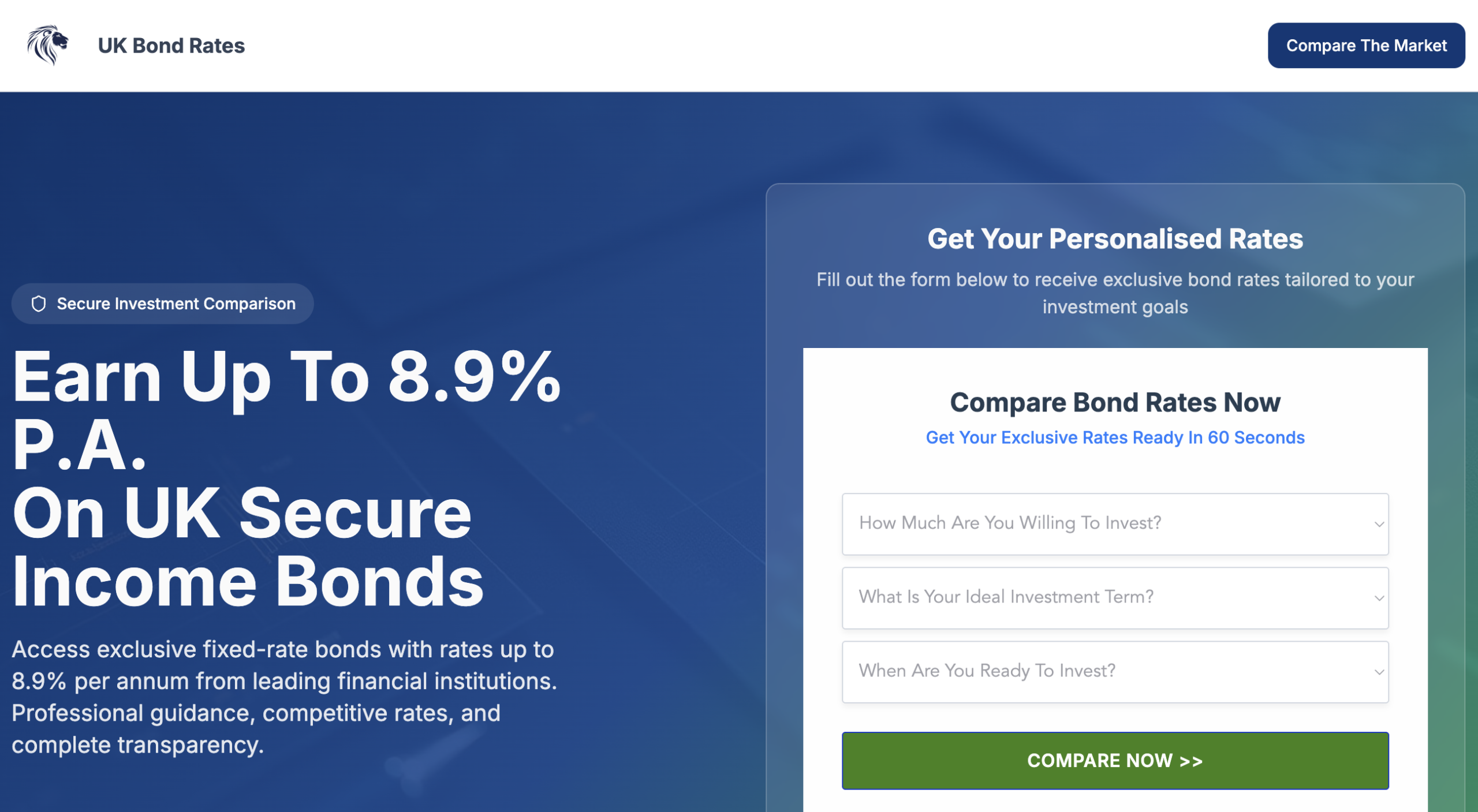

UKBondRates.com presents itself as a financial service offering investment opportunities primarily in fixed-rate bonds and similar financial products. The platform markets itself as a reliable source for stable returns, targeting individuals who want to secure their savings with guaranteed interest rates. The website features professional layouts and persuasive language designed to attract investors seeking low-risk, high-yield opportunities.

Despite these appealing features, several troubling aspects of UKBondRates.com raise questions about its legitimacy and trustworthiness.

Major Concerns About UKBondRates.com

1. Lack of Regulatory Compliance

One of the most critical issues with UKBondRates.com is the absence of clear regulatory registration. In the UK, any platform offering financial products such as bonds must be authorized and regulated by the Financial Conduct Authority (FCA). This regulatory oversight protects investors by ensuring transparency, accountability, and adherence to strict financial standards. UKBondRates.com does not provide verifiable evidence of FCA authorization or any other regulatory approval, which is a significant red flag for potential investors.

2. Opaque Ownership and Contact Information

Transparency is fundamental in building trust in financial services. UKBondRates.com fails to disclose detailed ownership information, management credentials, or a physical office address. The contact details provided are minimal and often lead to unresponsive or generic customer service channels. This lack of clear and accountable contact points makes it difficult for investors to seek assistance or verify the platform’s authenticity.

3. Unrealistic Return Promises

The platform advertises fixed returns that are unusually high compared to typical bond market rates. Such promises of guaranteed high returns with minimal risk are typically unrealistic in legitimate financial markets. Genuine bond products come with market-related risks, and credible providers communicate these clearly. UKBondRates.com’s marketing strategy of emphasizing high guaranteed returns without acknowledging risks should raise suspicion.

4. Aggressive Marketing and Pressure to Invest

Potential investors have reported receiving persistent calls and emails from UKBondRates.com representatives urging immediate investment. This high-pressure sales approach is often used to rush investors into decisions without giving them adequate time to research or consider alternatives. Responsible financial services respect the decision-making process and avoid coercive tactics.

5. Withdrawal Difficulties and Poor Customer Support

Users have reported significant challenges when attempting to withdraw their invested funds from UKBondRates.com. Withdrawal requests are often delayed or ignored, and communication with customer service can be frustratingly slow or non-existent. This breakdown in service quality is a common indicator of problematic operational practices.

6. Negative Feedback and Online Complaints

Independent forums, social media, and review websites contain numerous negative reports from individuals who have invested in UKBondRates.com. These complaints highlight issues such as unfulfilled promises, poor communication, and financial losses, contributing to a growing distrust of the platform.

Consequences for Investors

Engaging with UKBondRates.com can result in financial loss and emotional distress. Investors may find their funds locked in without access and face the frustration of unresponsive customer support. The platform’s lack of transparency and accountability can exacerbate these difficulties, leaving investors feeling vulnerable and uncertain about their financial future.

Importance of Due Diligence

The financial sector requires careful scrutiny before committing funds to any investment platform. UKBondRates.com’s lack of regulatory oversight, unclear company details, unrealistic promises, and aggressive marketing tactics highlight the necessity of thorough research. Investors should always verify the credentials of any platform, understand the risks involved, and avoid making hasty decisions under pressure.

Practical Advice for Investors

- Verify Regulatory Status: Confirm that the platform is authorized by the Financial Conduct Authority (FCA) or an equivalent regulatory body.

- Conduct Independent Research: Seek out unbiased reviews and feedback from multiple sources beyond the platform’s own marketing.

- Avoid Pressure Tactics: Be wary of any company pushing for immediate investment decisions.

- Check Contact Information: Ensure the platform provides verifiable contact details and test communication channels before investing.

- Seek Professional Advice: Consult with licensed financial advisors to evaluate investment opportunities objectively.

Conclusion: Exercise Caution with UKBondRates.com

UKBondRates.com displays several warning signs that suggest it may not be a trustworthy platform for investors seeking secure and transparent financial products. The absence of regulatory compliance, lack of clear ownership, unrealistic return guarantees, aggressive marketing, and poor customer service collectively raise serious concerns.

Investors should prioritize platforms that demonstrate regulatory approval, transparent operations, and respectful client engagement. Financial security and peace of mind come from partnering with institutions that uphold integrity and accountability—qualities that UKBondRates.com has yet to convincingly show.

In the complex ecosystem of online investing, prudence and vigilance are essential. UKBondRates.com currently falls short on these fronts, making it a platform that demands careful consideration and caution before any financial commitment is made.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to ukbondrates.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as ukbondrates.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.