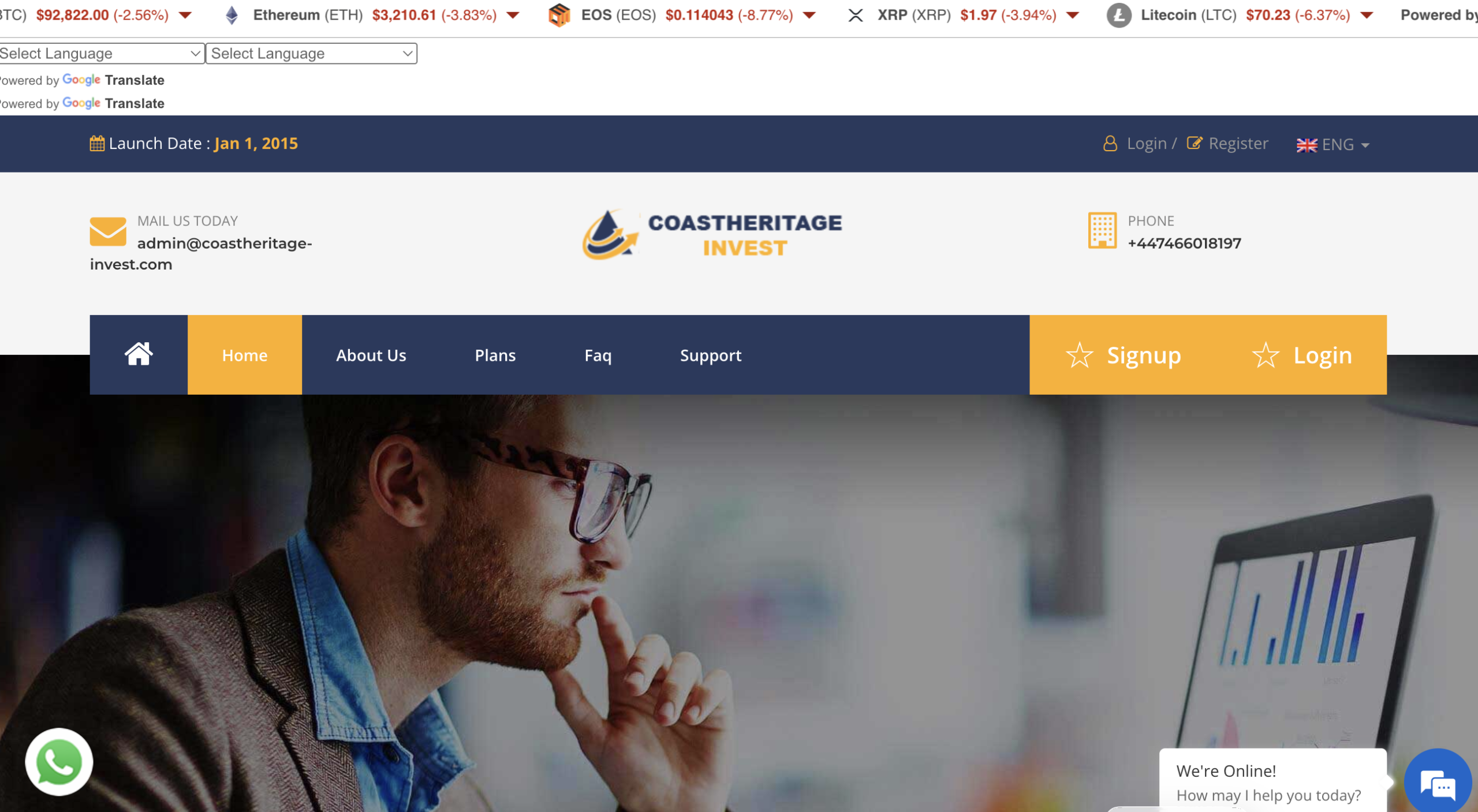

Coastheritage‑Invests.com Review and Analysis

In the crowded online world of investment services, Coastheritage‑Invests.com presents itself as a global financial investment platform offering high‑return opportunities in assets such as Forex and cryptocurrency trading. On the surface, its slick design and profit‑oriented promises may look appealing. However, deeper investigation and multiple independent trust evaluations reveal serious concerns about the platform’s legitimacy and operational transparency. This review explains what is publicly known about Coastheritage‑Invests.com, highlights critical warning signs, and explains why many observers recommend avoiding engagement with the site.

Platform Overview: What It Claims to Offer

Coastheritage‑Invests.com markets itself as a UK‑based investment platform providing financial planning and investment services. The site claims to employ a team of experienced traders and analysts to help investors grow their capital through various investment plans. It also touts features such as:

-

Multiple investment plans with stated profitability

-

Fast or instant withdrawals

-

24/7 support services

-

Global accessibility

-

Advanced security protections such as SiteLock and Cloudflare deployment

These descriptions are meant to reassure potential investors that the platform operates like a legitimate financial services provider. However, the reality behind such claims is far less clear when evaluated against independent assessments.

Trust and Transparency: What Independent Data Shows

Several independent website trust and analysis services have rated Coastheritage‑Invests.com poorly:

-

The Scam Detector algorithm assigned the site a low trust score of 36.6/100. This score reflects indicators of questionable web behaviour such as proximity to potentially harmful sites, phishing, and spam signals.

-

Another analysis gave the website a 15/100 trust score, citing unrealistic return promises, lack of regulatory information, a very new domain, and hidden ownership details.

These independent metrics do not categorise the platform as a reliable financial provider. Instead, they suggest that it lacks many of the hallmarks of a professionally managed and transparently regulated service.

Domain Age and Ownership Transparency

The Coastheritage‑Invests.com domain was registered recently (in February 2025) and appears to be managed using a privacy protection service that obscures the real owner’s identity. While private WHOIS registration is not inherently fraudulent, it does make it more difficult for potential investors to verify who operates the business and whether any legitimate corporate structure exists behind the brand.

Legitimate financial services firms often publish clear corporate information, including registered business names, physical locations, and regulatory credentials. The absence or obfuscation of this information, combined with a short domain history, reduces confidence in the platform’s reliability.

Regulatory Standing and Official Warnings

A major concern surrounding Coastheritage‑Invests.com and related domains (coastheritage‑invest.com) is their regulatory status. The United Kingdom’s Financial Conduct Authority (FCA), which oversees financial services and investment firms in the UK, has issued warnings about COASTHERITAGE INVEST operating without permission. The FCA states that the firm is not authorised and advises people to avoid dealing with it. The warning covers both coastheritage‑invest.com and coastheritage‑invests.com.

This lack of authorisation has serious implications:

-

There is no oversight to ensure fair or lawful handling of customer funds.

-

Investors would not have access to key protections such as the Financial Ombudsman Service or compensation schemes if funds are mismanaged or lost.

Being listed on a regulator’s warning list is a critical indicator that caution is warranted. Many legitimate financial services providers are transparent about their regulatory status; Coastheritage‑Invests.com is not.

Promises of High Returns and Pressure Tactics

One hallmark of questionable investment platforms is the promise of unusually high returns in short timeframes. Independent reviewers noted that Coastheritage‑Invests.com presents plans claiming returns markedly above typical legitimate investment yields — sometimes advertised at very high percentages. Such figures are generally unrealistic in regulated financial markets.

These claims are often accompanied by urgency or pressure messaging, a common tactic to push individuals toward quick decision‑making without adequate due diligence. Websites that use “limited time offers” or implied scarcity should be approached with extreme caution.

User Reviews and Reputation Indicators

Looking at public review platforms yields additional concerning signals. On one review aggregator, www.coastheritage‑invests.com has a very low average rating (around 1.6/5) with numerous negative comments about user experience, withdrawals, and support. While some testimonials featured on these pages may not directly reference the platform (some appear misplaced or unrelated), the overall sentiment is predominantly negative.

A low and inconsistent review profile adds to the lack of confidence in the platform’s operations, especially when paired with dubious external analytics and regulatory warnings.

Why These Factors Matter

When evaluating any investment platform, transparency, regulatory compliance, operational history, and verifiable performance data should be basic entry criteria. Platforms that lack these fundamentals pose significant uncertainty. Without clear regulation or accountability, there is no effective mechanism to ensure that your funds are safeguarded or that promotional claims reflect real, achievable outcomes.

Final Thoughts

Coastheritage‑Invests.com exhibits multiple features that raise serious concerns about its legitimacy. Independent trust scores are low, ownership and regulatory information is lacking, and key financial watchdogs have flagged related brands for operating without authorisation. Investment opportunities that promise high returns with minimal oversight should be treated with caution.

If you are considering an online investment service, always verify:

-

Whether the firm is regulated by a recognised authority

-

The existence of verifiable corporate information and contact details

-

Independent user reviews and performance records

-

Whether returns being promised are realistic and achievable

Above all, choose platforms with transparent regulatory compliance and proven operating histories. In the absence of these, exercising caution and seeking professional financial advice before engaging is strongly recommended.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to coastheritage-invests.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as coastheritage-invests.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.