Acefinex Risk Assessment

Cryptocurrency and financial trading platforms are increasingly common, but not all are created with equal transparency or user protection in mind. Acefinex is one such name that circulates in online discussions. While its branding may suggest legitimacy and trading efficiency, a closer look at the platform’s public presentation raises important questions about its credibility and trustworthiness.

This review walks through the critical areas where Acefinex falls short and why potential users should evaluate it with caution.

Mixed Messaging: A Strong Name With Limited Clarity

The name Acefinex combines words associated with excellence and finance, creating an impression of a professional trading hub or exchange. A strong, professional name can be compelling — but branding should never be the basis for trust on its own.

For a financial service to be credible, it must clearly communicate what it does and how it operates. Unfortunately, Acefinex’s public description leaves many of these foundational questions unanswered.

Unclear Platform Purpose

A legitimate trading or investment platform typically outlines:

-

The categories of assets available (such as cryptocurrencies, forex, commodities, etc.)

-

How trades are executed

-

The technology or exchange infrastructure used

-

The roles of users and how earnings are generated

Acefinex’s public messaging is vague and general. It does not clearly explain:

-

What specific services users can access

-

How the platform facilitates trading or investment

-

Whether it provides brokerage services, exchange services, or portfolio management

When a platform fails to define its core purpose, users are left with ambiguity rather than understanding.

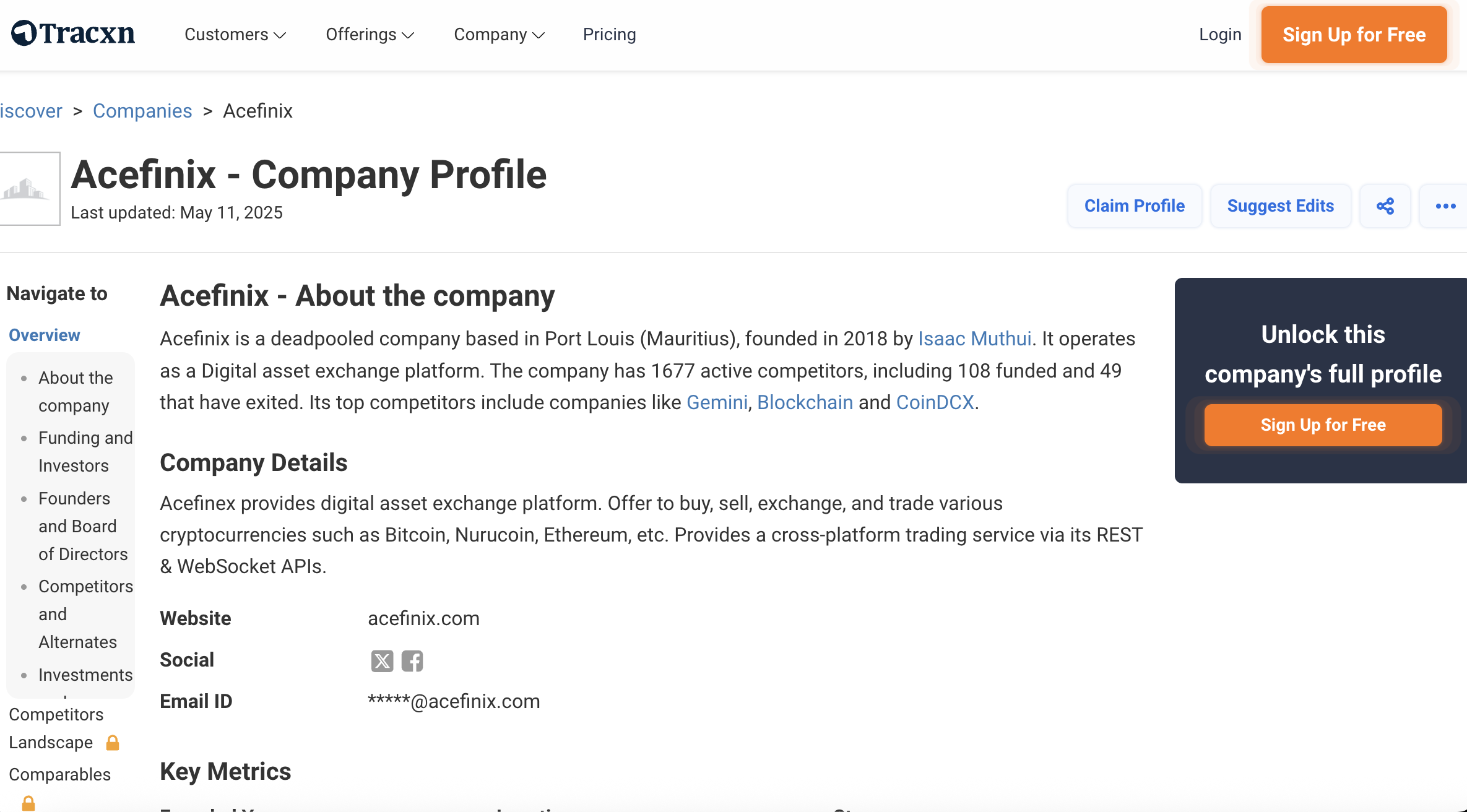

Lack of Verifiable Corporate Information

One of the most basic trust signals for any financial platform is transparent information about its corporate identity:

-

Registered business name

-

Jurisdiction of incorporation

-

Physical headquarters

-

Leadership or management team

Acefinex does not clearly disclose verifiable details in any of these areas. Without knowledge of who is behind the platform or where it is legally based, users cannot assess accountability or legitimacy. In the event of disputes or issues, the absence of clear corporate structure leaves users without a reliable point of reference.

Regulatory and Compliance Status Not Disclosed

Legitimate financial service providers often operate under some form of regulatory oversight, or at least clearly state their compliance posture. Regulatory frameworks provide:

-

Standards for transparency

-

Consumer protection mechanisms

-

Accountability obligations

-

Rules for handling client funds

Acefinex does not offer clear information about its regulatory status. There is no obvious disclosure of licensing, compliance with financial rules, or supervision by authoritative entities. The absence of regulatory visibility leaves users uncertain about whether the platform adheres to widely accepted financial standards.

Security and Fund Protection Not Explained

When it comes to financial platforms — especially those dealing with trading or digital assets — security is critical. Users should expect:

-

Clear data protection policies

-

Security protocols for accounts and personal information

-

Explanation of how assets are stored or managed

-

Measures against unauthorized access

Acefinex does not prominently describe its approach to security or how it protects user data and financial information. Without this information, users cannot gauge whether their interactions or potential assets would be safeguarded.

Independent Verification and User Feedback Is Limited

Platforms with established credibility typically have a public presence in community discussions, independent user reviews, and third‑party evaluations. These real‑world insights help prospective users understand how the platform performs over time.

Acefinex lacks a significant trace of credible, independent feedback from verified users. This absence of public reputation signals makes it difficult to assess:

-

Platform reliability

-

Withdrawal and deposit experiences

-

Customer support responsiveness

-

Overall user satisfaction

Without external validation, users must rely solely on the platform’s promotional content, which is not sufficient to verify its performance.

Customer Support Accessibility

Strong customer support infrastructure is essential for any financial service. Users should be able to:

-

Access assistance easily

-

Get timely responses

-

Resolve issues efficiently

Acefinex does not clearly showcase robust channels for user support or dispute resolution. The lack of visible, verifiable support mechanisms can leave users stranded if problems arise.

Marketing Language Over Operational Substance

Notably, Acefinex tends to favor promotional language without providing enough operational detail to back up its claims. Effective financial platforms balance marketing with clear, specific, and accessible explanations of how their systems work, what users can expect, and what risks are involved.

In the case of Acefinex, the emphasis is heavily on appealing language with fewer substantive disclosures.

Warning Signals Identified

Reviewing Acefinex reveals several patterns that should prompt careful consideration:

1. Undefined service model

The platform does not clearly explain how it operates or serves users.

2. Opaque corporate details

No verifiable information on corporate structure or leadership.

3. Missing regulatory transparency

No clear licensing or compliance frameworks are disclosed.

4. Unclear security communication

No prominent explanation of how data or assets are protected.

5. Limited public reputation

Few or no independent user experiences are available.

These patterns, combined, suggest a high degree of uncertainty surrounding the platform.

What This Means for You

Before engaging with any online financial or trading service, especially one that handles assets or potential funds, users should be able to confidently answer:

-

Who runs this platform?

-

What exactly does it offer?

-

Under what legal framework does it operate?

-

How are user assets and data protected?

-

What do independent users say about their experience?

If these questions cannot be answered clearly, the platform’s risk profile increases significantly.

Final Takeaway — Exercise Caution

Acefinex presents itself with a professional image and language that suggests reliability and opportunity. However, its lack of clear operational definition, corporate transparency, regulatory disclosure, and independent reputation signals creates uncertainty that users should not dismiss.

In the realm of online finance and digital asset interaction, transparency and accountability are not optional — they are essential. When foundational information is absent or ambiguous, proceeding without full understanding exposes users to unnecessary risk.

Until Acefinex offers clear, verifiable, and detailed information about how it functions, engages with regulations, and protects users, potential participants should approach the platform with caution.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to acefinex, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as acefinex continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.