Acomex Red Flags

In the digital finance and e-commerce space, platforms often promise efficiency, profit, or convenience. Acomex is a platform that has attracted attention online, but a detailed examination raises questions about its operations, transparency, and reliability.

This review provides a thorough look at Acomex’s structure, services, governance, and potential risks, helping prospective users make informed decisions before interaction.

Branding and Platform Positioning

Acomex markets itself as a hub for digital transactions and trading services. The name suggests accessibility and expertise, implying that users can engage in secure, profitable activities.

While strong branding is important, a platform’s credibility depends on the clarity of its services, regulatory compliance, and operational transparency — not just its name.

Service Offerings and Functionality

Acomex promises a range of services, but the specifics are vague. Users should be able to clearly understand:

-

Core Services: Whether the platform operates as a trading platform, payment processor, or investment hub.

-

Mechanics: How transactions, trades, or other operations are executed.

-

Fees and Costs: Any charges, commissions, or hidden costs associated with use.

-

User Responsibilities: What steps users need to take to engage effectively.

Currently, Acomex provides broad statements about opportunities and functionality without detailing how the platform works. This lack of operational clarity can confuse users and create uncertainty.

Corporate Transparency and Ownership

A key factor in assessing platform credibility is clear corporate information. Users should know who runs the platform, where it is registered, and how it is legally structured.

-

Ownership: Acomex does not publicly disclose the entity behind the platform or its executives.

-

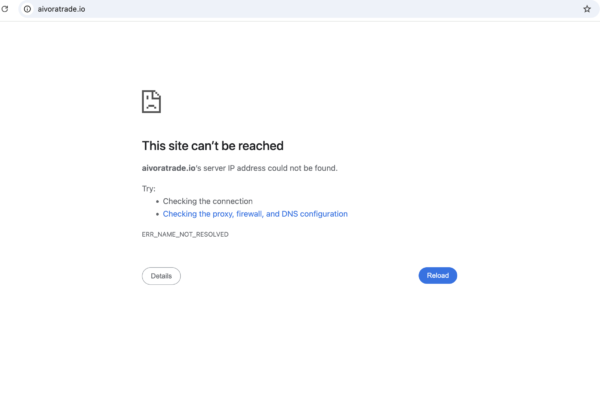

Jurisdiction: The country of registration or legal jurisdiction is unclear.

-

Contact Access: While a contact form exists, there is little information on response times or support processes.

The absence of verifiable corporate data reduces accountability and raises questions about governance.

Regulatory Compliance and Legal Oversight

Legitimate platforms, especially in finance or digital assets, typically provide information on licensing, regulatory compliance, and oversight mechanisms.

-

Licensing Information: Acomex does not provide details of any financial or trade regulatory oversight.

-

Consumer Protections: Without disclosed compliance, it is difficult to know what recourse users have in case of disputes or losses.

This lack of regulatory transparency increases the risk exposure for potential users.

Security and Data Protection

Security is crucial when handling financial data or personal information. Users generally expect:

-

Encrypted Transactions: HTTPS encryption for all sensitive data exchanges.

-

Secure Payments: Clear protocols for protecting payment information.

-

Data Privacy Policies: Transparent statements on how personal information is stored, shared, and protected.

Acomex’s website lacks detailed explanations of these security measures, leaving potential users uncertain about the safety of their data.

User Experience and Support

Customer experience is a key indicator of platform reliability. Important factors include:

-

Website Usability: Acomex is navigable, but some sections lack clear instructions or feature descriptions.

-

Support Availability: While contact options exist, timelines for responses and support quality are unclear.

-

Feedback Mechanisms: There is minimal visible independent user feedback, making it hard to verify claims or service quality.

Without robust support structures, users may face challenges resolving issues or obtaining timely information.

Operational Red Flags

Based on the review of publicly available information, several concerns arise:

-

Undefined Service Mechanics: Users cannot easily understand what the platform does.

-

Opaque Ownership: No clear corporate or executive information is provided.

-

Regulatory Ambiguity: No licensing or compliance information is disclosed.

-

Security Uncertainty: Lack of detailed data protection and payment security protocols.

-

Limited User Feedback: Minimal independent reviews make it hard to gauge performance.

These elements indicate elevated uncertainty about the platform’s reliability and credibility.

Shipping, Transactions, and Financial Considerations

While Acomex primarily focuses on digital transactions or trading, users still need transparency on:

-

Transaction Execution: How trades or payments are processed.

-

Timing and Confirmation: Expected timelines for completion.

-

Support in Case of Errors: How disputes or transaction failures are handled.

Without clear documentation, users cannot confidently anticipate how their interactions will unfold.

Marketing vs. Substance

Acomex’s website emphasizes opportunity and growth potential, but lacks detailed operational and security information. Users should distinguish marketing language from practical, actionable details.

A platform with credibility provides both a compelling vision and clear, verifiable instructions on usage, risk management, and governance.

Final Assessment — Approach With Caution

Acomex presents an attractive name and concept, but lack of operational clarity, limited corporate disclosure, absence of regulatory transparency, unclear security protocols, and minimal independent feedback highlight risks for users.

In digital finance or trading contexts, clarity, accountability, and security are essential. Without them, users face elevated uncertainty and should proceed cautiously.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to acomex, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as acomex continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.