ApexFinance.Capital: Insights from User Feedback

In the sprawling landscape of online investment platforms, ApexFinance.Capital has recently emerged as a name stirring concern among investors and financial watchdogs alike. While the allure of high returns and easy access to financial markets can be tempting, it is crucial to approach such platforms with a critical eye, especially when red flags suggest potential scams. This blog offers a detailed review of ApexFinance.Capital, highlighting the reasons why investors should exercise extreme caution and ultimately steer clear of this platform.

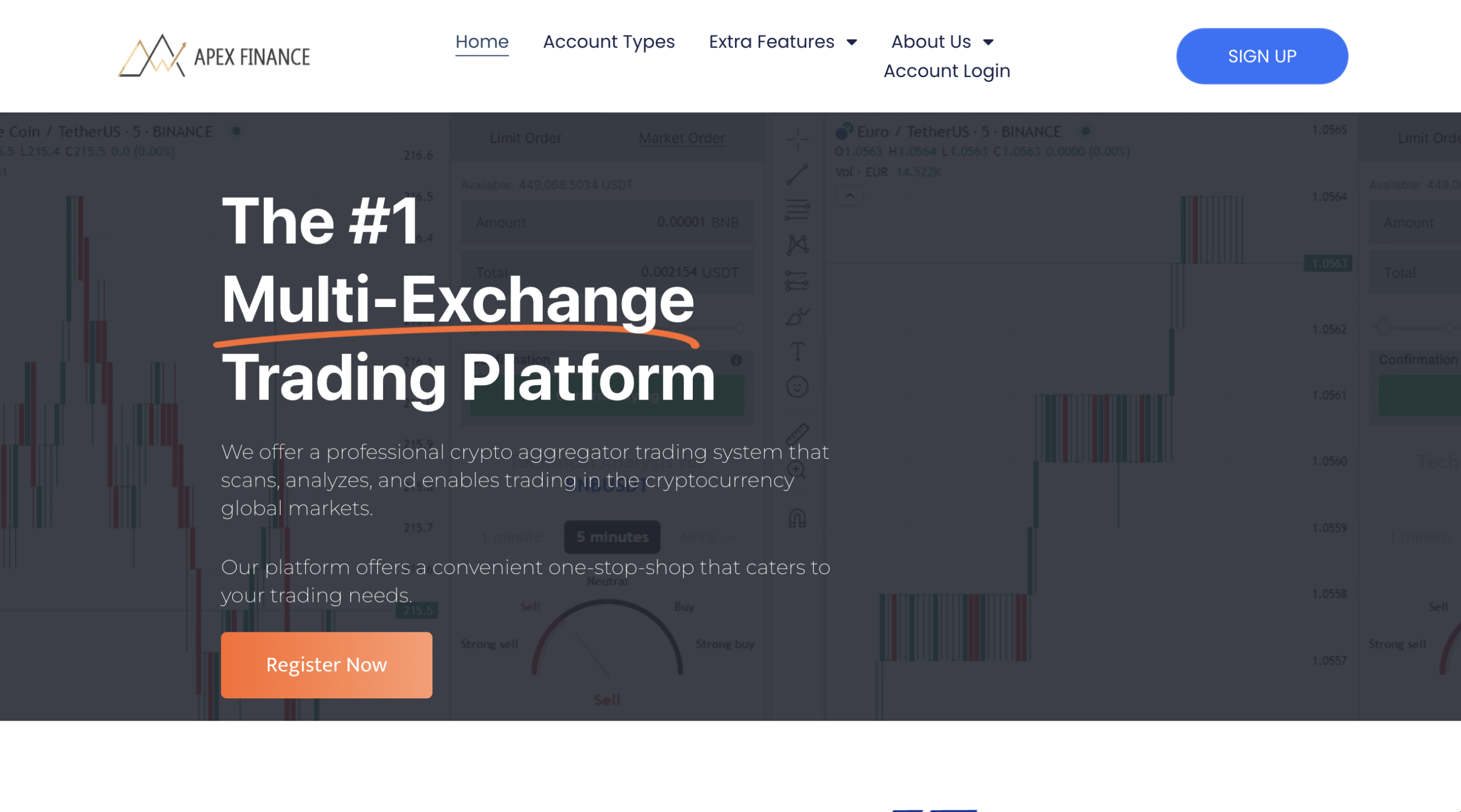

What is ApexFinance.Capital?

ApexFinance.Capital presents itself as an online investment platform promising lucrative returns through trading in forex, cryptocurrencies, and other financial instruments. The platform claims to offer sophisticated trading algorithms, expert management, and a user-friendly interface designed to attract both novice and seasoned investors. However, beneath this polished exterior lie numerous warning signs that call into question the platform’s legitimacy and ethical standards.

Warning Signs and Red Flags

1. Lack of Regulatory Oversight

One of the most glaring concerns with ApexFinance.Capital is its absence of credible regulatory licensing. Legitimate financial platforms operate under the supervision of recognized financial authorities such as the Financial Conduct Authority (FCA) in the UK, the Securities and Exchange Commission (SEC) in the US, or similar bodies worldwide. These regulators enforce strict rules to protect investors and ensure transparency.

ApexFinance.Capital, however, does not provide verifiable information about any regulatory approval. This lack of oversight means there is no formal mechanism to hold the platform accountable, leaving investors vulnerable to potential fraud.

2. Unrealistic Promises of High Returns

ApexFinance.Capital aggressively markets itself with promises of exceptionally high and fast returns on investments, often exceeding what is realistically achievable in legitimate markets. Such claims are a classic hallmark of scam operations designed to lure investors with the prospect of quick wealth.

In the world of finance, high returns are invariably accompanied by high risks. Responsible platforms emphasize this balance, educating their users about the potential for losses. ApexFinance.Capital’s marketing, however, glosses over risks and pressures users to invest more money quickly, a tactic commonly used to trap victims.

3. Opaque Business Model and Trading Strategy

Transparency is a cornerstone of trustworthy investment platforms. ApexFinance.Capital fails to provide clear, detailed explanations of its trading strategies, algorithms, or how exactly it generates profit. This opacity makes it impossible for investors to assess the legitimacy or soundness of their investments.

Furthermore, the platform’s terms and conditions are often vague or filled with legal jargon that obscures critical information, such as withdrawal policies, fees, and conditions for account closure.

4. Negative User Feedback and Online Complaints

A growing number of users have reported difficulties withdrawing their funds from ApexFinance.Capital. Complaints often include delayed or denied withdrawal requests, unresponsive customer service, and accounts being suddenly blocked without explanation.

These user experiences align with common scam behaviors where platforms accept deposits but create obstacles when users attempt to reclaim their money. Such patterns should serve as powerful warnings to potential investors.

5. Aggressive Recruitment and Referral Schemes

ApexFinance.Capital also appears to rely heavily on multi-level marketing tactics, encouraging existing users to recruit others via referral bonuses. This approach often prioritizes recruitment over genuine trading profits, resembling a pyramid or Ponzi scheme structure. In such schemes, returns for older investors are paid out from the deposits of new investors rather than from legitimate profits.

Why Steering Clear is the Safest Choice

Given the numerous concerns surrounding ApexFinance.Capital, the safest course of action is to avoid engaging with the platform altogether. Here are several reasons why:

- Protect Your Capital: Investing in unregulated and opaque platforms puts your money at significant risk of loss. Without regulatory protection, there is little recourse if the platform disappears or freezes your funds.

- Avoid Emotional and Financial Stress: Falling victim to a scam can cause severe emotional distress and financial hardship. Steering clear helps preserve your peace of mind and financial stability.

- Focus on Credible Alternatives: The financial market offers many legitimate platforms that prioritize transparency, regulatory compliance, and investor education. Choosing these ensures a safer investment experience.

How to Identify and Avoid Similar Scams

The ApexFinance.Capital case underscores important lessons for anyone venturing into online investment:

- Verify Regulation: Always check if the platform is registered with a recognized financial regulator. Regulators’ websites often provide searchable databases of licensed entities.

- Scrutinize Promises: Be wary of platforms promising guaranteed or unusually high returns with little or no risk.

- Research Thoroughly: Look for detailed information about the company’s background, team members, trading strategies, and user reviews from multiple sources.

- Test Withdrawal Processes: Before committing significant funds, test the platform’s withdrawal process with a small amount to confirm reliability.

- Avoid Pressure Tactics: Legitimate platforms do not rush you into investing or recruiting others. Be cautious if you face aggressive sales pitches.

Conclusion

ApexFinance.Capital exhibits many classic characteristics of an untrustworthy and potentially fraudulent investment platform. From its lack of regulatory oversight and unrealistic promises to opaque operations and negative user experiences, the evidence strongly suggests that engaging with this platform poses significant financial risks.

Investors are encouraged to prioritize safety, due diligence, and transparency when choosing where to place their hard-earned money. Steering clear of ApexFinance.Capital is a prudent decision that protects your financial wellbeing and helps maintain integrity in the investment ecosystem.

By remaining vigilant and informed, investors can navigate the complex world of online finance with confidence, supporting platforms that uphold ethical standards and contribute positively to sustainable financial growth.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to apexfinance.capital, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as apexfinance.capital continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.