ActivTrades Under Scrutiny by Traders

The global online trading industry has expanded rapidly, giving retail investors access to forex, CFDs, indices, and commodities through digital platforms. While this accessibility has created new opportunities, it has also made it harder for traders—especially beginners—to distinguish between reliable platforms and those that may not align with their expectations.

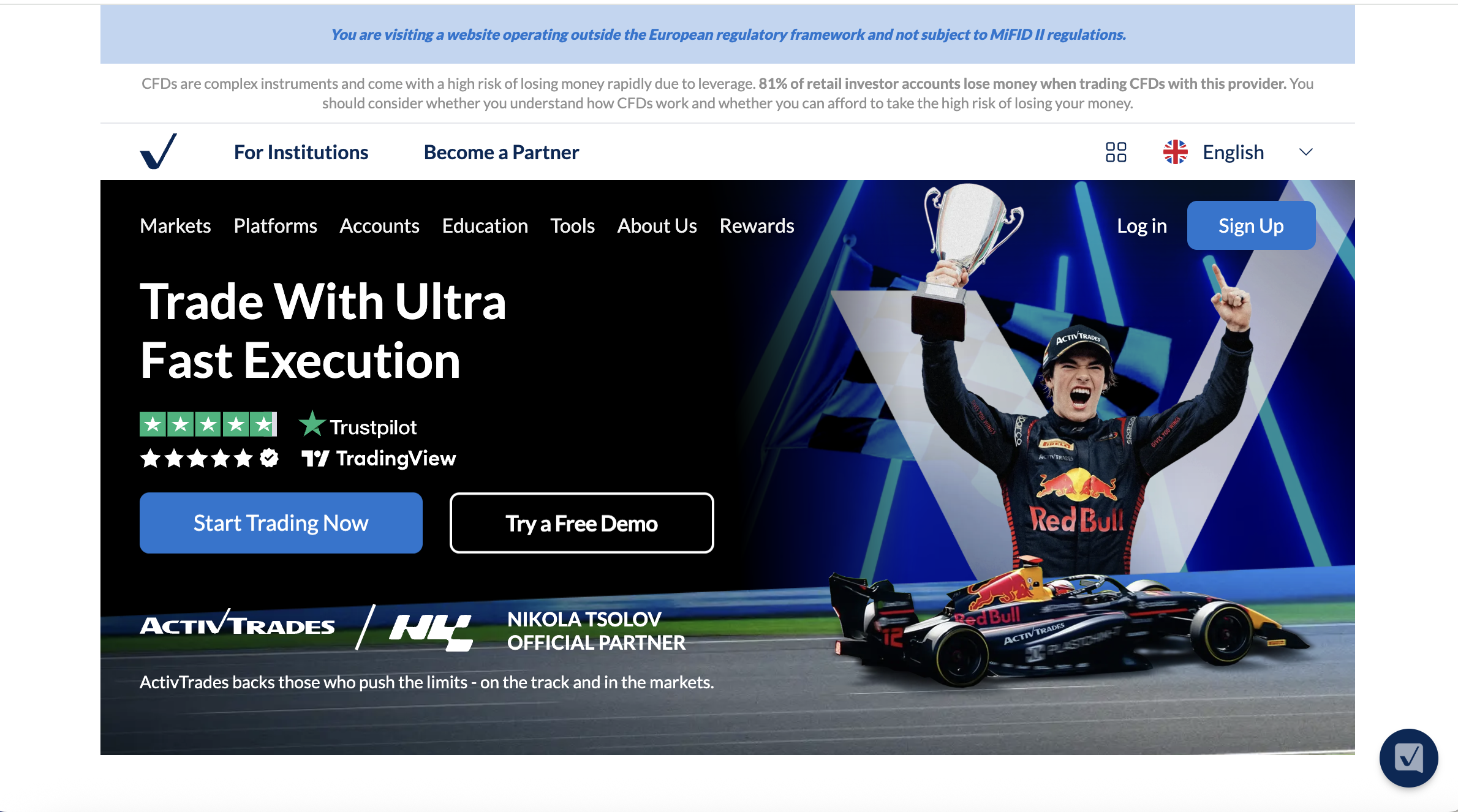

ActivTrades is a well-known name in the online trading space and is often marketed as a professional brokerage solution. However, despite its visibility, questions and concerns raised by traders continue to circulate. This ActivTrades scam review takes a closer look at the platform’s structure, operations, and reported user experiences to help readers make informed decisions.

What Is ActivTrades?

ActivTrades presents itself as an online trading broker offering access to multiple financial instruments. The platform promotes services across areas such as:

-

Forex trading

-

Contracts for Difference (CFDs)

-

Indices and commodities

-

Advanced trading platforms and tools

The company positions itself as suitable for both beginner and experienced traders, emphasizing execution speed, professional trading conditions, and educational resources.

While these claims may sound reassuring, investors should always look beyond promotional language and examine how a platform performs in real-world usage.

Platform Design and User Experience

One of ActivTrades’ most noticeable features is its polished and professional interface. The trading environment is structured to resemble industry-standard platforms, which can be comforting for users familiar with online trading.

Key aspects often highlighted include:

-

Clean dashboard layouts

-

Multiple platform options

-

Customizable trading tools

However, complexity can also be a challenge. Some users report that navigating the platform and understanding certain trading features requires prior experience. For beginners, this learning curve may lead to confusion, mistakes, or reliance on support and guidance that may not always be immediate.

Account Setup and Onboarding

Account registration on ActivTrades is generally described as structured and formal. Users are typically required to complete identity verification steps before gaining full access to trading features.

While verification is standard practice in the industry, some traders report that the onboarding process can feel lengthy or restrictive, especially when documentation reviews take longer than expected. Delays at this stage may frustrate users eager to begin trading.

Trading Conditions and Risk Exposure

ActivTrades promotes competitive trading conditions, but like all leveraged trading platforms, it exposes users to significant risk. CFDs and forex trading are inherently volatile, and losses can occur rapidly if positions move against expectations.

Some users report that:

-

Leverage amplifies losses quickly

-

Market volatility can lead to unexpected outcomes

-

Risk management tools require careful configuration

These risks are not unique to ActivTrades, but they are important to highlight, as new traders may underestimate how quickly losses can accumulate.

Withdrawal and Fund Access Concerns

One of the most discussed topics in ActivTrades scam review discussions involves fund withdrawals and account access.

While some users report smooth transactions, others describe experiences such as:

-

Withdrawals taking longer than anticipated

-

Additional verification requests during withdrawal

-

Confusion around processing timelines

In online trading, timely access to funds is essential. Any uncertainty or delay—whether procedural or technical—can erode trust and lead users to question platform reliability.

Transparency and Trade Clarity

Transparency is a key factor in evaluating any trading platform. Some traders have raised concerns about how clearly trades, fees, and execution details are presented.

Reported issues include:

-

Difficulty understanding fee structures

-

Limited clarity on certain trading costs

-

Confusion about execution outcomes during volatile markets

When users cannot clearly track how trades are executed or how costs are applied, it becomes harder to assess performance objectively.

Customer Support Experience

Customer support is another area where user experiences appear mixed. Some traders report professional and responsive assistance, while others describe slower response times when addressing complex issues.

Common concerns include:

-

Delays in resolving account-specific problems

-

Generic responses to detailed inquiries

-

Limited escalation options for unresolved issues

In financial trading, support quality can significantly impact user confidence—especially during high-pressure situations such as losses or withdrawal requests.

Marketing Claims vs. User Expectations

ActivTrades’ marketing emphasizes professionalism, reliability, and advanced trading solutions. However, user expectations do not always align with reality.

Some traders feel that:

-

Promotional messaging oversimplifies trading risks

-

Profit potential is emphasized more than loss exposure

-

Beginners may be drawn in without fully understanding complexity

This gap between marketing tone and actual trading experience is a recurring theme in discussions about the platform.

Common Issues Traders Report

Across various user discussions, recurring concerns include:

-

Steep learning curve for beginners

-

Inconsistent withdrawal experiences

-

Complex fee structures

-

High risk associated with leveraged trading

While these issues do not automatically imply wrongdoing, they highlight areas where traders must remain cautious and informed.

Why Caution Is Always Necessary

Even when dealing with established trading platforms, risk remains unavoidable. Financial markets are unpredictable, and platforms that offer leveraged instruments magnify both gains and losses.

Traders should always:

-

Understand the products they are trading

-

Read and interpret platform terms carefully

-

Test systems with small amounts first

-

Avoid emotional decision-making

Blind trust—whether in marketing or brand reputation—can lead to costly mistakes.

How Traders Can Protect Themselves

Before using ActivTrades or any similar platform, traders should consider the following steps:

-

Educate Yourself Thoroughly

Understand how CFDs, leverage, and margin work before trading.

-

Start Small

Test the platform with minimal exposure to assess execution and withdrawals.

-

Monitor Fees Closely

Review spreads, overnight fees, and other charges carefully.

-

Document Everything

Keep records of trades, communications, and transactions.

-

Avoid Overconfidence

Early success does not guarantee long-term profitability.

Final Thoughts on ActivTrades

This ActivTrades scam review does not make legal claims or definitive judgments. Instead, it highlights reported user concerns, operational challenges, and risk factors that traders should carefully consider.

While ActivTrades maintains a strong presence in the online trading industry, mixed user feedback suggests that the platform may not suit everyone—particularly inexperienced traders who are unfamiliar with leveraged instruments.

Online trading demands discipline, research, and realistic expectations. Regardless of platform choice, traders should prioritize transparency, risk management, and personal responsibility when navigating financial markets.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to activTrades, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as activTrades continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.