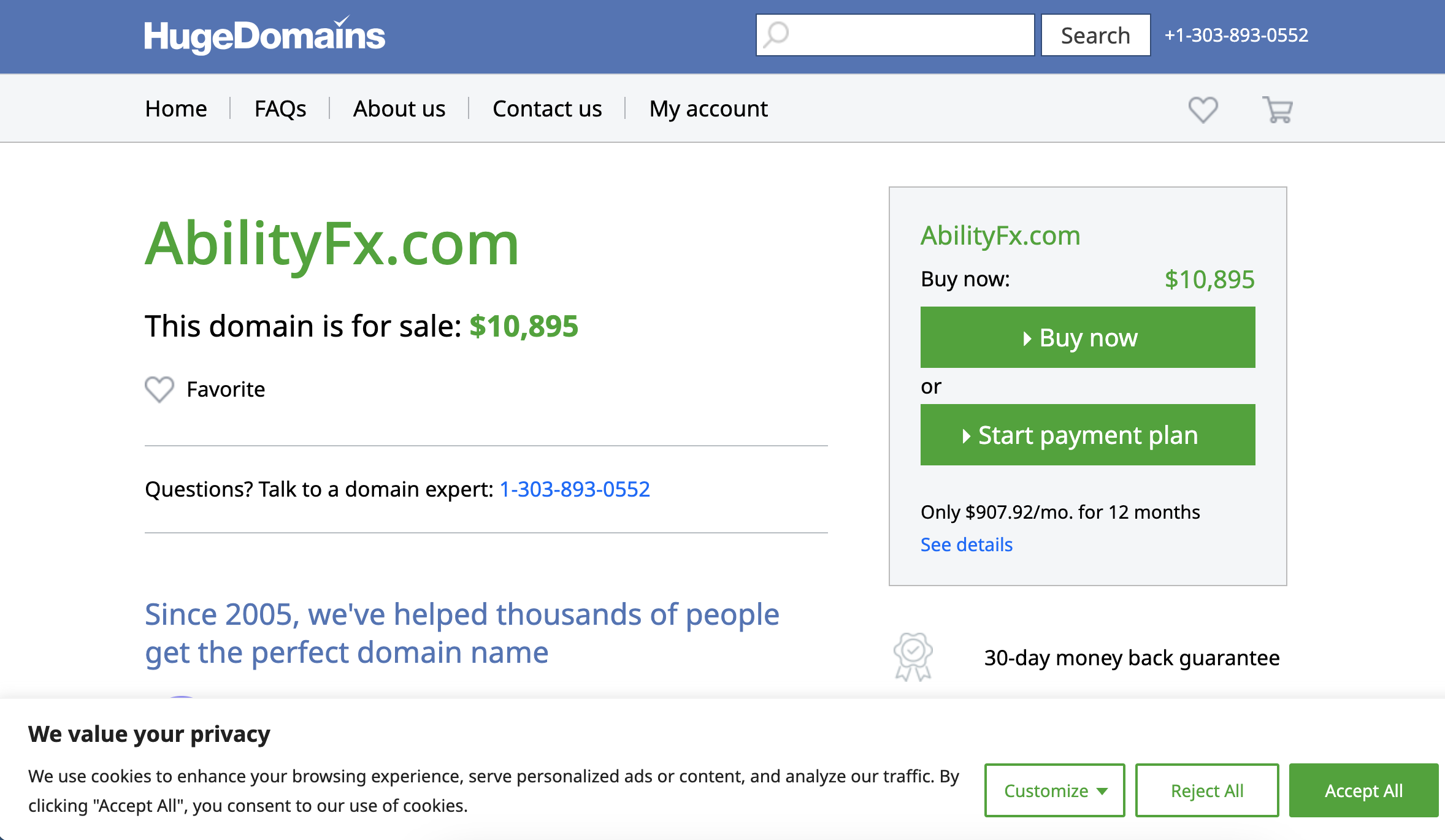

AbilityFX.com Review – Everything You Need to Know

Online trading platforms have become increasingly popular as more people look for ways to invest their money digitally. However, alongside legitimate brokers, there is a troubling rise in fraudulent operations designed to deceive unsuspecting investors. One such platform that has raised serious red flags is AbilityFX.com. In this in-depth review, we’ll break down the warning signs, questionable practices, and why investors should approach this broker with extreme caution.

What is AbilityFX.com?

AbilityFX.com presents itself as a professional online trading platform, offering access to forex, commodities, indices, and cryptocurrency markets. At first glance, the website appears polished and convincing, with promises of advanced trading tools, competitive spreads, and high returns on investments.

However, beneath the surface, multiple indicators suggest that AbilityFX.com may not be a legitimate broker. Many traders who have interacted with the platform report significant difficulties when attempting to withdraw their funds, raising suspicions that the site may be designed to exploit users rather than help them grow their capital.

Red Flags of a Scam Broker

When evaluating whether an online trading platform is genuine or fraudulent, there are certain warning signs investors should watch for. Unfortunately, AbilityFX.com displays several of these troubling characteristics:

1. Lack of Proper Regulation

One of the first steps in verifying a broker’s legitimacy is checking whether it is regulated by a recognized financial authority. Trusted brokers are typically licensed by organizations such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). AbilityFX.com, however, does not provide verifiable information about being registered with any regulatory body.

This lack of oversight means that if something goes wrong, investors have no legal recourse or protection. A broker operating without regulation is essentially free to operate outside the law.

2. Unrealistic Promises

AbilityFX.com’s marketing materials emphasize quick profits, easy returns, and “low-risk” trading opportunities. Such claims are highly misleading, as forex and cryptocurrency markets are inherently volatile. No legitimate broker can guarantee profits or risk-free investments.

Scammers often rely on these exaggerated promises to lure inexperienced traders into depositing more money.

3. Pressure Tactics

Several users have reported aggressive sales tactics from AbilityFX.com representatives. Common complaints include constant phone calls, requests for larger deposits, and pushing customers to “act fast” before opportunities disappear. This pressure-driven approach is a classic hallmark of scam operations.

Legitimate brokers encourage responsible trading and allow investors to make decisions at their own pace.

4. Withdrawal Issues

Perhaps the most alarming red flag is the widespread difficulty clients face when trying to withdraw funds. Many traders report that once money is deposited, it becomes nearly impossible to retrieve. Requests for withdrawals are often delayed, ignored, or outright denied.

In some cases, the broker demands additional deposits or taxes to be paid before releasing funds—another common scam tactic.

User Complaints and Experiences

Across multiple forums and review platforms, investors have voiced concerns about their interactions with AbilityFX.com. Common themes in these complaints include:

-

Blocked accounts: Some users claim their accounts were suddenly frozen after requesting withdrawals.

-

Disappearing support: Customer service becomes unresponsive once larger sums of money are deposited.

-

Constant upselling: Traders are pressured to invest increasingly higher amounts to “unlock” better trading opportunities.

-

False gains: Account dashboards often show profits that cannot be withdrawn, creating an illusion of success to encourage further deposits.

These patterns align with how many fraudulent brokers operate: drawing investors in with fake profits, then cutting off access to real funds.

Why Scam Brokers Like AbilityFX.com Target Investors

It’s important to understand why platforms like AbilityFX.com continue to surface. The appeal of online trading lies in its accessibility—anyone with an internet connection can get started. Unfortunately, this also makes it easy for bad actors to exploit beginners who may not yet know how to spot scams.

Some of the key reasons investors fall victim include:

-

Lack of regulation awareness: Many traders assume a professional-looking website equates to legitimacy.

-

Greed and urgency: Promises of fast profits encourage people to invest more than they can afford to lose.

-

Limited due diligence: Scammers know that many investors do not research brokers before depositing funds.

By the time investors realize they are dealing with a fraudulent operation, their money is often already lost.

Comparing AbilityFX.com with Legitimate Brokers

To highlight the differences between a scam broker and a trustworthy one, let’s compare some characteristics.

| Category | Legitimate Broker | AbilityFX.com |

|---|---|---|

| Regulation | Licensed by recognized authorities | No verifiable regulation |

| Transparency | Clear company details, physical office, compliance documents | Vague company info, unverifiable claims |

| Customer Support | Responsive, professional, available across multiple channels | Often unresponsive after deposits |

| Withdrawals | Smooth, regulated process with standard delays only | Repeated denials, excuses, or ignored requests |

| Marketing | Honest about risks, no guaranteed returns | Exaggerated claims of high profits and “no risk” |

This comparison makes it clear why investors should be wary.

How AbilityFX.com Operates – Common Scam Tactics

AbilityFX.com seems to employ several strategies commonly used by fraudulent brokers:

-

Attractive onboarding: They entice new investors with bonuses, account managers, and “exclusive opportunities.”

-

Building false trust: Users often see fake profits on their dashboards to make them believe the system is working.

-

Encouraging bigger deposits: Once initial trust is built, traders are pushed to deposit more funds to “maximize gains.”

-

Blocking access: When withdrawals are requested, excuses are made or accounts are frozen.

-

Disappearing act: In extreme cases, scammers shut down the website or rebrand under a new name.

Understanding these tactics helps investors recognize the warning signs earlier and avoid falling into the trap.

Lessons for Investors

The AbilityFX.com case highlights several important lessons for anyone considering online trading:

-

Always verify regulation: Before depositing any money, ensure the broker is licensed by a reputable authority.

-

Be wary of big promises: If a broker guarantees returns or advertises “risk-free” trading, it’s almost certainly a scam.

-

Research reviews and complaints: Other users’ experiences can provide valuable insights into a broker’s legitimacy.

-

Never invest more than you can afford to lose: This is particularly important when dealing with unverified platforms.

-

Trust your instincts: If something feels off—such as aggressive pressure to deposit more—it probably is.

Final Verdict – Is AbilityFX.com a Scam?

Based on the evidence, AbilityFX.com shows multiple red flags consistent with fraudulent brokers. The lack of regulation, unrealistic promises, aggressive tactics, and widespread withdrawal issues strongly suggest that this platform is not operating legitimately.

Investors are advised to stay far away from this broker. While the lure of fast profits can be tempting, the risk of losing your entire investment is far too high. There are many licensed and trustworthy brokers available today—there is no reason to gamble with a platform riddled with suspicious practices.

Conclusion

Scams like AbilityFX.com are unfortunately becoming all too common in the world of online trading. By understanding the warning signs, doing proper research, and approaching every broker with a healthy degree of skepticism, investors can better protect themselves.

The most important takeaway is that if a trading platform seems too good to be true, it probably is. The promises of quick, effortless wealth are often nothing more than bait. Legitimate trading requires patience, knowledge, and careful strategy—not blind trust in unregulated platforms.

AbilityFX.com serves as yet another reminder of why due diligence is crucial in the digital investment landscape. Stay informed, remain cautious, and always choose brokers who have proven their legitimacy through transparency and regulatory compliance.

-

Report Abilityfx.com And Recover Your Funds

If you have lost money to abilityfx.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like abilityfx.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.