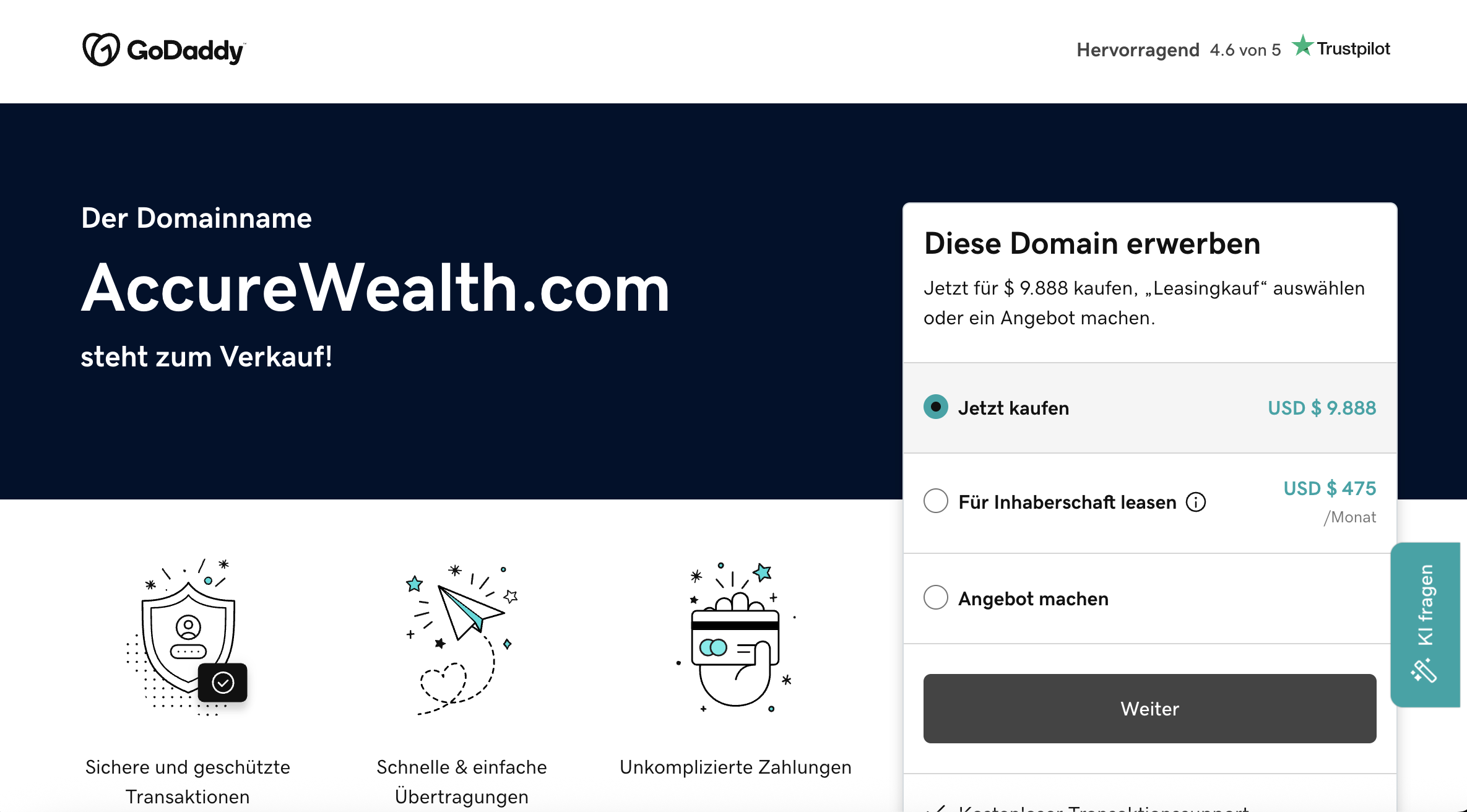

AccureWealth Warning Signs

In the expanding universe of online financial services, platforms with appealing names and slick branding often attract users seeking investment opportunities. AccureWealth is one such name that appears to position itself as a wealth-building or investment service. However, beneath the surface, there are several areas where the platform raises serious questions about transparency and accountability.

This review explores those concerns so you can decide whether AccureWealth is truly a credible platform or one that warrants caution.

A Catchy Name, But What Does It Mean?

Names like AccureWealth suggest precision, growth, and reliable financial returns. While marketing and branding matter, they do not substitute for clear operational substance. A trustworthy financial service must first explain what it actually does — not just how it wants to be perceived.

In the case of AccureWealth, the platform’s name creates expectations of reliable investment guidance or wealth management. Yet the details required to support such expectations are either missing or vague.

Vague Description of Services

A legitimate investment or wealth management platform clearly articulates:

-

What services it offers

-

The mechanics of its investment strategies

-

Fee structures and expected costs

-

Risk disclosures and performance expectations

AccureWealth, however, offers generalized language without specific explanation of how investments are structured, executed, or managed. Without concrete information on services, users are left to interpret broad, undefined promises — a red flag in financial contexts.

Missing Corporate Identity

A professional financial platform typically discloses its legal entity, registration details, and leadership information. These elements help users verify:

-

Who operates the platform

-

Where it is legally based

-

How accountability is structured

AccureWealth does not make this information readily accessible or transparent. The absence of verifiable corporate identity leaves potential users without a clear point of reference — and no way to determine who is responsible for operations or accountable for outcomes.

When a platform’s ownership details are unclear, users cannot reliably assess credibility.

Regulatory and Compliance Ambiguity

Investment platforms that interact with client funds or provide financial guidance are expected to operate under some form of regulatory compliance — depending on jurisdiction and the services offered. Disclosure of regulatory status or license information signals that a service adheres to enforced standards and oversight.

AccureWealth does not clearly state any regulatory credentials or oversight frameworks. Without compliance clarity, users cannot determine whether the platform operates within legal and ethical boundaries or whether their interests are protected under applicable regulations.

The lack of visible regulatory disclosure is a significant gap in basic financial trust signals.

Security and Data Protection Not Clearly Stated

Trustworthy platforms provide clear information about how they protect user data, accounts, and any financial information shared with the service. Typical areas of security communication include:

-

Data encryption standards

-

Account protection measures

-

Policies on data retention and privacy

AccureWealth does not prominently outline these security practices. Users seeking clarity on how their personal or financial information would be protected are left without basic reassurance or visible policy explanation.

Lack of security transparency increases uncertainty about the safety of user participation.

Public Reputation and Independent Feedback — Minimal or Absent

Another key factor in evaluating a platform’s credibility is independent user feedback. Established services accumulate visible reviews, testimonials, or discussions in community spaces that provide a real-world view of user experiences.

AccureWealth lacks a clear public trail of verified user feedback. When no dependable user opinions are available, prospective participants have no way to assess:

-

Actual platform performance

-

Withdrawal or deposit experiences

-

Support responsiveness

-

Real-world user satisfaction

The absence of verifiable user feedback contributes to a high level of uncertainty and risk.

Customer Support Accessibility Unclear

Effective customer support is a sign of a service that takes user needs seriously. Users should be able to reach assistance through clear, accessible channels when questions or issues arise.

AccureWealth does not prominently display strong, verifiable customer support pathways. When support mechanisms are limited or unclear, users may face frustration and unresolved issues — especially if financial transactions are involved.

Marketing Language Without Substance

Another notable pattern is the platform’s reliance on broad, promotional language rather than specific operational descriptions. Effective investment or wealth platforms balance opportunity messaging with detailed explanations of:

-

How strategies work

-

What risks users face

-

How returns are calculated or distributed

-

What guarantees — if any — exist

AccureWealth emphasizes general opportunity but does not provide clear details on how it achieves what it claims. This imbalance between marketing and substantive operational information is a red flag.

Risk Indicators Identified

When evaluating AccureWealth, several signals arise that are commonly associated with platforms of uncertain credibility:

1. Undefined Services

No clear explanation of what the platform actually provides or how it operates.

2. Opaque Corporate Identity

Missing visible ownership, registration, and leadership details.

3. Regulatory Uncertainty

No clear indication of compliance, licensing, or oversight.

4. Security Ambiguity

No explicit information on data protection or account security.

5. Limited Public Feedback

A lack of verifiable user experience makes performance hard to assess.

These elements collectively raise questions about how — and whether — the platform delivers on its promises.

What This Means for Potential Users

Before engaging with any financial or investment platform, users should be able to answer key questions:

-

Who is operating the platform and where are they based?

-

What exactly does the platform offer?

-

How are funds handled and protected?

-

Is the platform regulated or compliant with financial authorities?

-

What do independent users say about their experience?

If these questions remain unanswered or ambiguous, the platform’s risk profile increases significantly.

Final Assessment — Approach With Caution

AccureWealth presents a name that suggests financial growth and opportunity. However, the platform’s lack of clear service definitions, absence of corporate identity, missing regulatory signals, and limited user feedback all point to a high degree of uncertainty.

In financial contexts, transparency is not a luxury — it’s a necessity. Platforms that fail to provide detailed information about how they operate, who runs them, and how they protect users’ interests should be approached with skepticism.

If AccureWealth cannot provide clear, verifiable answers to basic questions about its structure and operations, users are left with ambiguity — and ambiguity in financial engagement is a risk that should never be taken lightly.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to accurewealth it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as accurewealth continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.