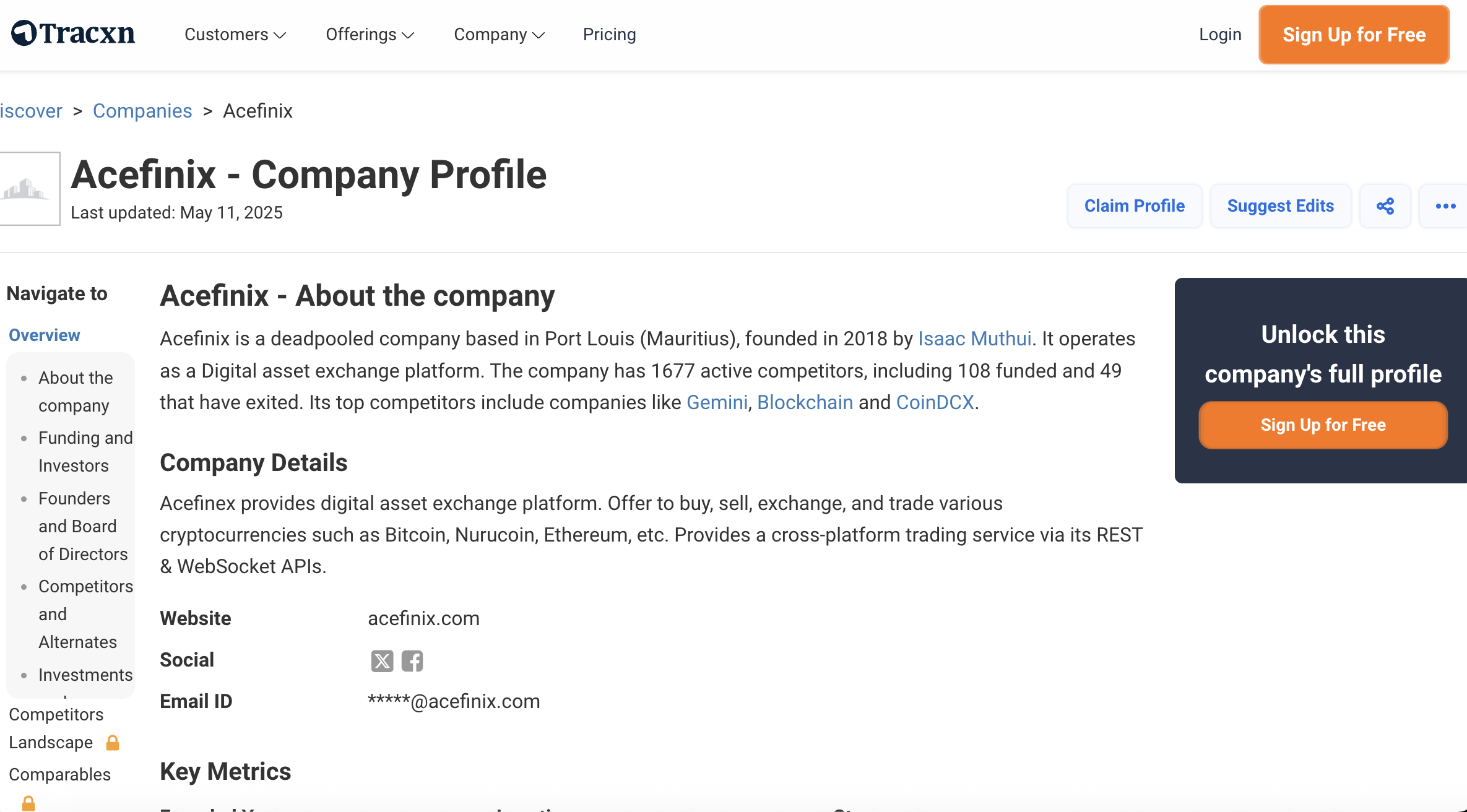

Acefinex.com Platform Analysis Report

The surge in online trading platforms has created opportunities but also risks for investors. Acefinex.com positions itself as a digital asset and trading service, promising efficiency and growth. However, a closer look at its publicly available information raises serious questions about its transparency, operations, and trustworthiness.

This review highlights key concerns for anyone considering interacting with the platform.

Brand Image vs. Operational Transparency

Acefinex.com uses branding and marketing language that implies professionalism and reliability. While an appealing interface and name can attract users, branding alone does not ensure credibility. Legitimate financial platforms provide clear, verifiable explanations of their services, which are essential for assessing risk.

Unclear Services and Value Proposition

A trustworthy platform clearly explains its offerings. Investors typically look for:

-

Types of supported assets

-

Trading or investment mechanisms

-

Fee structures and commissions

-

Account management processes

Acefinex.com lacks clear explanations of these core components. Prospective users are left unsure whether it functions as an exchange, a trading service, a brokerage, or another type of financial platform. This ambiguity is a significant warning sign.

Opaque Corporate Identity

Trust in any online financial platform depends on knowing who is responsible for its operations. Standard transparency practices include:

-

Registered company name and jurisdiction

-

Leadership or management disclosure

-

Physical office or contact information

Acefinex.com provides minimal information about its corporate structure. The absence of verifiable details leaves users without clarity on ownership, accountability, or where legal responsibility resides.

Regulatory and Compliance Uncertainty

Financial platforms generally operate under regulatory oversight, which ensures legal compliance and user protection. Even in the cryptocurrency space, reputable services disclose:

-

Licensing and jurisdiction

-

Compliance measures

-

Governing legal frameworks

Acefinex.com does not provide clear regulatory disclosures. Without this information, users cannot confirm if it operates under recognized rules or adheres to protective standards for traders.

Security Measures Are Not Explained

Platforms handling financial transactions or personal data should clearly describe how they secure users’ information and funds. This typically includes:

-

Data protection and encryption standards

-

Asset custody protocols

-

Access controls

Acefinex.com does not detail its security measures publicly. Lack of transparency in this area prevents users from evaluating how safely their data or funds would be handled.

Limited Independent Verification

A credible platform usually has verifiable user feedback available through forums, reviews, or independent sources. Users rely on these experiences to assess reliability, transaction accuracy, and support quality.

Acefinex.com lacks sufficient independent user accounts or verified reviews. Without external verification, potential users cannot reliably determine the platform’s performance or trustworthiness.

Customer Support Transparency

Effective platforms provide clear support channels for handling questions or issues. Acefinex.com does not clearly show how its customer service functions or how responsive it is. This lack of visible support creates uncertainty for users in case of disputes or operational problems.

Marketing Over Operational Substance

Acefinex.com emphasizes promotional messaging rather than operational transparency. While marketing can attract attention, the lack of detailed operational disclosure makes it difficult for users to make informed decisions.

Key Risk Indicators

Based on the available information, Acefinex.com shows several warning signs:

-

Undefined service model and value proposition

-

Opaque corporate identity

-

Missing regulatory and compliance disclosure

-

Unclear security measures

-

Limited independent feedback

These factors collectively indicate elevated uncertainty and potential risk for users.

Conclusion — Proceed With Caution

Acefinex.com presents itself as a professional trading platform. However, its lack of clarity in services, corporate governance, regulatory compliance, and security creates a level of uncertainty that cannot be ignored.

For investors and traders, transparency is essential. When core information is missing or ambiguous, proceeding without full understanding increases exposure to risk. Until Acefinex.com provides verifiable details on operations, governance, compliance, and user protections, caution is strongly advised.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to acefinex.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as acefinex.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.