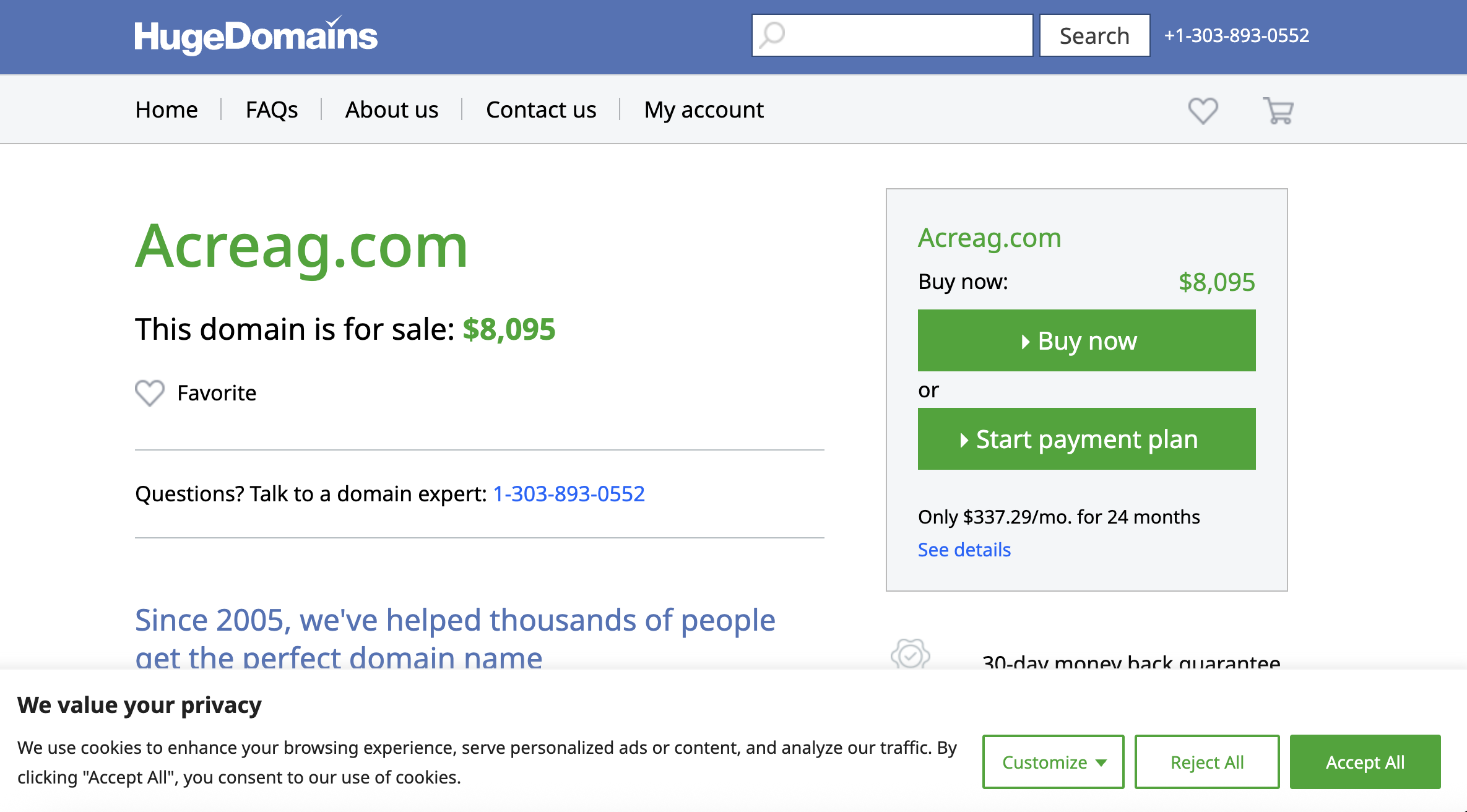

Acreag Under Scrutiny

As the number of online financial and investment platforms continues to grow, so does the challenge of identifying which services are genuinely transparent and which raise questions about legitimacy. Acreag is one such name that has appeared in searches and discussions, often prompting curiosity. But a closer look at the platform’s structure and disclosures reveals several areas of concern that potential users should be aware of.

This review explores how Acreag presents itself, what it offers, and the gaps in information and clarity that may affect your confidence and decision‑making.

Branding and First Impressions

The name Acreag is crafted to sound modern and professional, creating an impression that it might be a sophisticated financial or asset‑management service. However, a professional name alone cannot replace clear, verifiable information about operations and services.

A credible platform should explain:

-

What kinds of financial services it provides

-

How these services work in practice

-

What outcomes users can realistically expect

-

What risks are involved

In Acreag’s case, such explanations are limited or vague, leading to uncertainty about the platform’s true purpose.

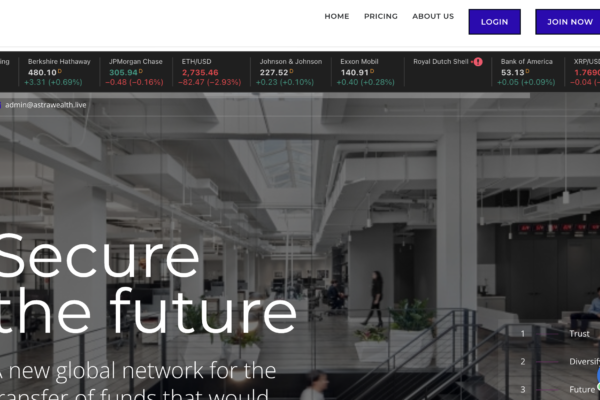

Service Overview and What It Actually Offers

A trustworthy financial platform clearly outlines its offerings — for example:

-

Trading or investment instruments

-

Account types and features

-

Fee schedules and cost structures

-

Order execution or asset management procedures

Acreag’s public information does not provide clear explanations of these aspects. The descriptions are broad and promotional rather than specific. Prospective users are left without a clear understanding of:

-

Which asset classes the platform supports

-

Whether it facilitates actual trading or investment

-

How profits or returns are generated

-

Whether fees or commissions apply

Without these details, it is difficult to assess whether Acreag provides genuine value or merely presents an appealing brand.

Corporate Identity and Accountability

An essential trust signal for any online financial service is corporate transparency. Users should be able to find:

-

The registered company name

-

Jurisdiction or country of incorporation

-

Leadership or management information

-

Official contact details

Acreag does not prominently disclose verifiable details about who owns it, where it’s legally registered, or who is responsible for governance. The lack of this information makes it hard for users to determine:

-

Who ultimately controls the service

-

Where and how it is regulated

-

What legal recourse exists in case of disputes

A platform that does not clearly identify its corporate identity raises doubts about accountability and long‑term reliability.

Regulatory Transparency and Compliance

Platforms dealing with financial transactions, investments, or trading services often operate under regulatory oversight. Being regulated by a trusted authority helps ensure:

-

Compliance with legal and ethical standards

-

Consumer protection mechanisms

-

A framework for dispute resolution

Acreag does not clearly disclose any regulatory status or compliance information. Without evidence of oversight or licensing, users cannot determine whether the platform operates under enforceable financial standards or safeguards.

Lack of regulatory clarity increases uncertainty for anyone considering engaging with the service.

Security and Data Protection Practices

Security is a critical concern for any platform that collects personal and financial information. Users should expect transparent communication about:

-

Encryption and data protection measures

-

Account security protocols

-

Privacy policy details

-

Safeguards against unauthorized access

Acreag does not provide detailed security information. The absence of clear security disclosures leaves users unsure about how — or even whether — their data and interactions would be protected.

This uncertainty is particularly concerning in a financial context where personal and financial data could be at stake.

Customer Support and User Experience

A strong indicator of platform credibility is an accessible, responsive support system. Users should be able to easily find:

-

Contact information

-

Help center or FAQ resources

-

Support response timelines

Acreag’s support infrastructure is not prominently detailed. When a platform fails to clearly define its customer support pathways, users risk being left without adequate assistance when it matters most.

Independent Feedback and Reputation Signals

Verified user reviews and independent feedback are invaluable for assessing how a platform performs in real‑world scenarios. Such feedback can reveal:

-

User satisfaction

-

Reliability of withdrawals and deposits

-

Platform responsiveness

-

Technical strengths and weaknesses

At present, there is minimal visible independent user feedback for Acreag on reputable forums or review outlets. The lack of verifiable user experiences makes it difficult for prospective users to objectively understand the platform’s performance.

Marketing Language vs. Operational Substance

A common warning sign in online financial platforms is heavy reliance on promotional language without detailed operational transparency. Effective platforms balance optimistic messaging with clear explanations of how features work, what costs apply, and what risks are involved.

Acreag’s content emphasizes opportunity without sufficient operational clarity, making it harder for users to differentiate between marketing and substance.

Identified Risk Patterns

Several concern patterns emerge from this review:

1. Undefined Service Framework

Acreag does not clearly describe what it offers or how it functions.

2. Limited Corporate Disclosure

There is no easily verifiable ownership or governance information.

3. Regulatory Visibility Is Missing

No clear indication of licensing or oversight.

4. Security Practices Not Clearly Communicated

User protection measures are not transparently described.

5. Minimal Independent Feedback

Little verifiable user reputation is available.

These patterns suggest a level of uncertainty that users should not dismiss lightly.

What This Means for Potential Users

Before interacting with any online financial platform, especially one associated with investing or trading, users should be able to answer confidently:

-

What exactly does this platform provide?

-

Who operates and legally controls the service?

-

Is the platform regulated or compliant with financial standards?

-

How are user data and interactions protected?

-

What do independent users report about their experiences?

If these questions remain unanswered or vague, the risk of engagement increases significantly.

Final Verdict — Caution Is Advised

Acreag’s branding and promotional messaging may appear appealing, but its lack of detailed service explanation, limited corporate transparency, unclear regulatory status, inadequate security information, and minimal independent feedback make it difficult to trust with confidence.

In financial environments, clarity, transparency, and accountability are indispensable. When these elements are not present, uncertainty becomes the dominant theme — and uncertainty is a risk factor that should not be ignored.

Prospective users should exercise caution and favor platforms that offer clear operational descriptions, verifiable ownership, regulatory transparency, and robust user protection before considering engagement.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to acreag, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as acreag continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.