ActiveFXtrade Review: A Deep Dive Into a Shady Platform

In the fast-growing world of online trading, opportunities abound for investors who want to explore forex, crypto, and stock markets. Unfortunately, the same environment that offers legitimate investment opportunities is also plagued by fraudulent platforms designed to exploit unsuspecting traders. One such platform that has been raising red flags is ActiveFXtrade.

This review takes a closer look at ActiveFXtrade, examining its claims, practices, and the warning signs that suggest it may not be a trustworthy investment option.

Introduction: The Rise of Trading Scams

Over the past decade, online trading platforms have surged in popularity. From cryptocurrencies to foreign exchange markets, the potential for quick profits attracts millions of users worldwide. Alongside genuine brokers and exchanges, countless scam platforms have emerged, often disguised with flashy websites, promises of guaranteed profits, and fabricated testimonials.

ActiveFXtrade appears to fit neatly into this troubling pattern. At first glance, it presents itself as a modern, reliable trading broker with advanced tools and unbeatable returns. But when you dig deeper, the cracks begin to show.

What ActiveFXtrade Claims to Be

On its website and promotional material, ActiveFXtrade presents itself as a professional trading broker offering access to forex markets, cryptocurrencies, commodities, and sometimes even binary options. The platform often highlights the following claims:

-

High returns with little or no risk – suggesting traders can double or triple their investments in record time.

-

Sophisticated trading technology – boasting about state-of-the-art tools, expert advisors, and AI-driven algorithms.

-

Guaranteed payouts – promising users that withdrawals will be processed quickly and reliably.

-

Professional account managers – offering personal support to guide investors in making profitable decisions.

While these claims sound attractive, they should immediately raise suspicion. Legitimate trading always carries risk, and no broker can ethically guarantee profits.

First Red Flag: Unrealistic Profit Promises

The number one warning sign with ActiveFXtrade is the unrealistic promises of profit. Real trading involves volatility, and no serious broker can guarantee returns. Yet ActiveFXtrade often advertises daily or weekly profits that are too good to be true.

For example, many reports suggest that the platform claims investors can earn 10–20% daily returns simply by depositing funds. In the legitimate financial world, such figures are impossible without enormous risk. This is a common trick used by scammers to lure in beginners who may not understand market dynamics.

Second Red Flag: Lack of Transparency

Transparency is essential for any trustworthy broker. Reputable platforms clearly display:

-

Company registration details

-

Regulatory licenses

-

Physical office addresses

-

Leadership and management information

ActiveFXtrade, however, provides little to no verifiable information. The details on its ownership are vague, and attempts to track down corporate registration often lead to dead ends. Some traders report that the company hides behind offshore shell registrations in jurisdictions with weak regulations, making it difficult to hold them accountable.

Third Red Flag: Dubious Account Managers

Many users have reported that once they deposit money into ActiveFXtrade, they are contacted by so-called “account managers.” These representatives often pressure investors to deposit more funds under the pretense of unlocking higher profits.

The tactics used by these account managers include:

-

Aggressive upselling – convincing clients to invest larger amounts.

-

False urgency – claiming that a special trading opportunity is available only for a limited time.

-

Manipulation – making clients feel guilty or foolish if they hesitate.

This kind of pressure is not typical of legitimate brokers, who allow traders to control their own investment decisions.

Fourth Red Flag: Withdrawal Problems

Perhaps the most telling sign of a scam is difficulty withdrawing funds. Many complaints about ActiveFXtrade describe the same scenario:

-

Deposits are processed instantly and without issue.

-

Profits appear in the trading dashboard, making investors feel successful.

-

When attempting to withdraw, users are met with delays, excuses, or outright refusal.

-

Additional fees or taxes are suddenly introduced as conditions for withdrawal.

These barriers effectively trap investors’ money within the platform, with little to no chance of recovery.

Fifth Red Flag: Fabricated Testimonials and Reviews

Scam brokers often create fake reviews and testimonials to appear legitimate. ActiveFXtrade appears to use this tactic heavily. On their website, you may find glowing feedback and stories of life-changing profits. However, many of these testimonials are generic, lacking verifiable details, and often use stock photos or stolen identities.

A quick search reveals numerous negative reviews from real users who report losing their funds. The contrast between these genuine complaints and the too-perfect testimonials further highlights the deception.

How ActiveFXtrade Operates

The operating model of ActiveFXtrade mirrors that of many other fraudulent brokers:

-

Attraction through advertising – social media ads and email campaigns that promise wealth.

-

Easy sign-up process – requiring minimal information to get started.

-

Small initial deposit – encouraging users to begin with an amount that feels safe.

-

Illusion of profit – showing fabricated trading results to convince investors to deposit more.

-

Escalation – account managers pressure clients to “upgrade” accounts with larger investments.

-

Locking funds – once enough money is deposited, withdrawals become difficult or impossible.

This cycle is designed to maximize the amount of money taken before investors realize the truth.

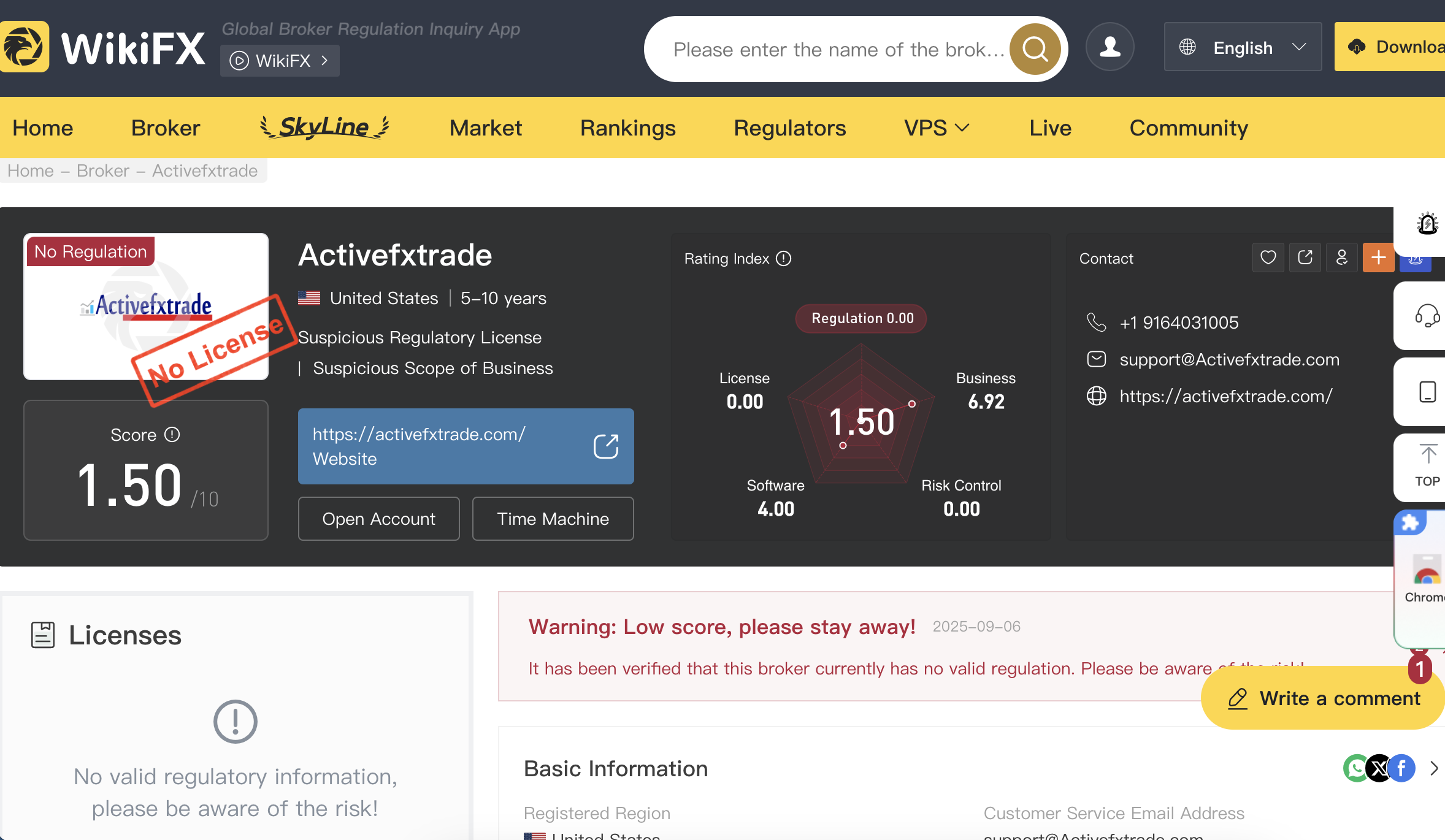

Regulatory Concerns

One of the clearest indicators of legitimacy is regulation. Genuine brokers are licensed by reputable authorities such as:

-

The Financial Conduct Authority (FCA) in the UK

-

The U.S. Commodity Futures Trading Commission (CFTC)

-

The Australian Securities and Investments Commission (ASIC)

-

The Cyprus Securities and Exchange Commission (CySEC)

ActiveFXtrade does not appear to hold licenses from any recognized regulatory body. Operating without proper authorization is a major red flag. It means the company can operate outside the boundaries of financial laws and offers no protection for investors.

User Experiences and Complaints

A growing number of users have shared their negative experiences with ActiveFXtrade. Common complaints include:

-

Locked accounts after requesting withdrawals.

-

Ignored communication when asking for refunds.

-

Sudden account closures once disputes arise.

-

False charges applied as excuses for blocking withdrawals.

These experiences align with the behavior of typical investment scams.

Why People Fall for Scams Like ActiveFXtrade

It’s easy to wonder how anyone could fall victim to such platforms. The truth is, scams are designed to exploit human psychology. Common reasons include:

-

Greed and hope – the allure of quick profits is hard to resist.

-

Trust in professionalism – polished websites and jargon give the impression of legitimacy.

-

Fear of missing out (FOMO) – limited-time offers pressure people to act quickly.

-

Lack of financial education – not everyone understands the risks of trading.

By preying on these factors, platforms like ActiveFXtrade continue to attract victims.

How to Spot and Avoid Similar Scams

Protecting yourself from scams requires vigilance. Here are some tips to identify and avoid platforms like ActiveFXtrade:

-

Check regulation – always verify if the broker is licensed by a recognized authority.

-

Avoid guaranteed returns – no legitimate broker promises profits.

-

Research reviews – look for genuine, independent reviews outside the company’s website.

-

Test withdrawals – try withdrawing small amounts before committing larger funds.

-

Be wary of pressure tactics – a legitimate broker won’t force you to deposit more.

-

Trust your instincts – if something feels off, it probably is.

Final Verdict: Is ActiveFXtrade a Scam?

Based on the evidence, ActiveFXtrade displays nearly every hallmark of an online trading scam:

-

Unrealistic profit promises

-

Lack of transparency and regulation

-

Aggressive account managers

-

Fabricated testimonials

-

Widespread withdrawal issues

While it presents itself as a professional trading platform, the reality is that it poses a serious risk to investors. Anyone considering using ActiveFXtrade should exercise extreme caution—or better yet, avoid it altogether.

Conclusion

The world of online trading can be rewarding, but it is also filled with risks, especially from fraudulent platforms like ActiveFXtrade. Staying informed, skeptical of “too good to be true” promises, and vigilant about regulation can help protect you from falling victim.

If a platform resembles ActiveFXtrade in its promises or practices, it’s best to walk away before investing. Your financial security is worth more than chasing unrealistic profits.

-

Report ActiveFXtrade And Recover Your Funds

If you have lost money to ActiveFXtrade, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like ActiveFXtrade continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.