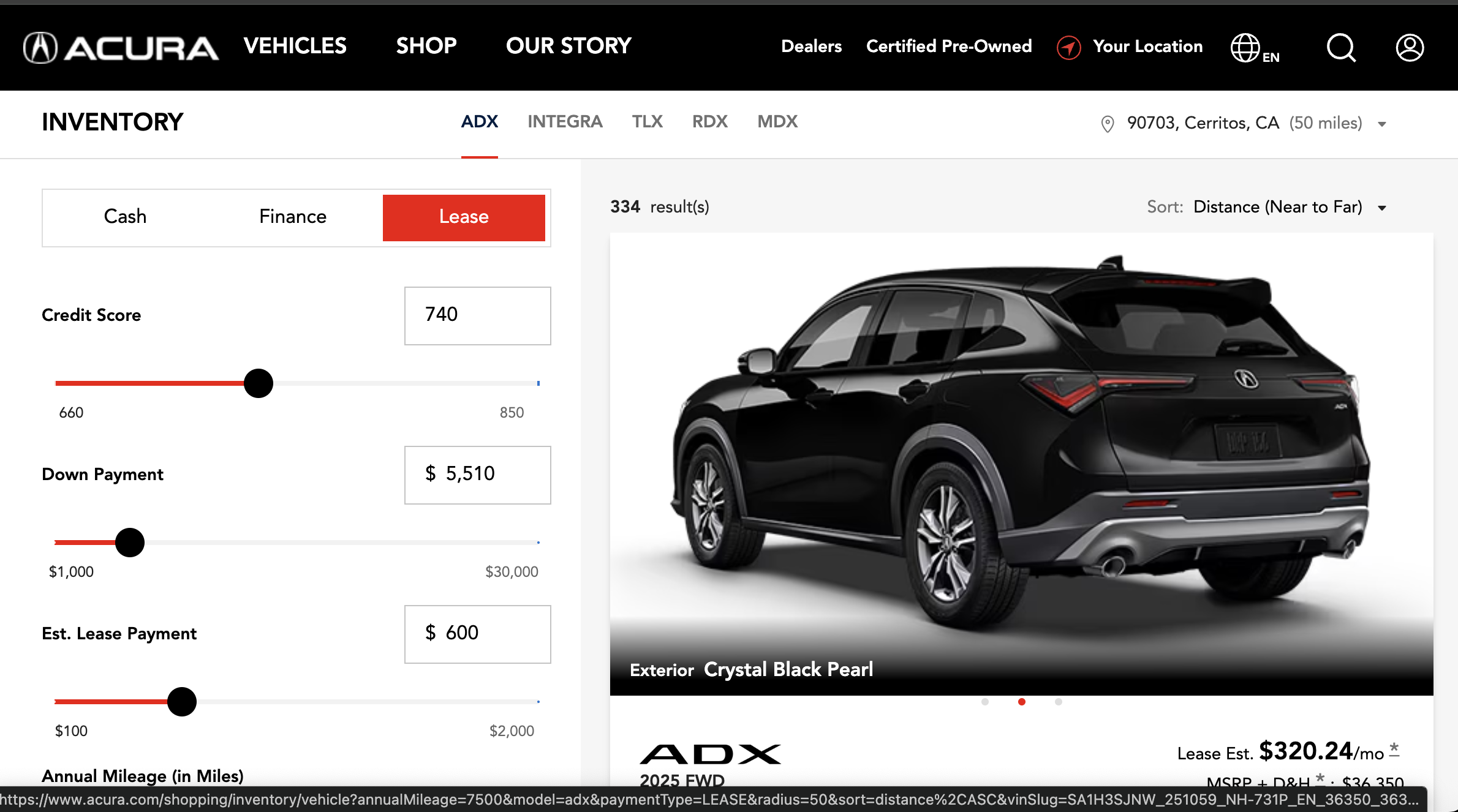

Acuratraders.art Raises Serious Concerns

In the booming world of online trading and digital investment, new platforms pop up every week promising easy gains, advanced tools, and professional support. But not all of them are built with users’ best interests at heart. One such platform that has sparked concern among traders and reviewers is Acuratraders.art.

This Acuratraders.art scam review investigates how this platform presents itself, how it operates behind the scenes, what users are reporting about their experiences, and the key warning signs that raise serious questions.

What Is Acuratraders.art?

Acuratraders.art markets itself as an online trading portal for forex, digital assets, and other financial instruments. The website emphasizes precision, speed, and streamlined access to global markets. It positions itself as suitable for both new and experienced traders, offering features like:

-

Accessible trading dashboards

-

Support from platform representatives

-

Claimed access to diverse asset classes

-

Tools designed to enhance trading performance

At first glance, the presentation may look professional and modern. But appearances can be deceptive — especially when the platform’s internal mechanics and real user experiences tell a different story.

Fast Signup, Immediate Contact

One of the first patterns reported by users is how quickly the platform engages with new registrants. After completing a simple registration form, many users report being contacted immediately by someone claiming to be a support agent or account manager.

According to multiple accounts:

-

Initial contact is often persistent

-

Messaging emphasizes quick deposits

-

Representatives highlight potential opportunities

This fast engagement can create pressure to act quickly and deposit funds before proper research is done — a tactic often used to shorten users’ decision-making time.

Dashboards That Tell a Story — But Not the Whole Truth

Once users fund their accounts, many describe seeing dashboards that display growing balances and apparent account gains. On the surface, this looks promising — until deeper scrutiny reveals serious transparency issues.

Users report:

-

Lack of detailed trade history

-

No independent verification of trades

-

Vague or incomplete execution logs

-

“Profit” numbers without clear underlying data

Without clear visibility into how trades are executed — timestamps, market conditions, or entry/exit prices — account balances shown on a dashboard are easy to manipulate. This creates an illusion of success without verifiable performance.

Withdrawal Nightmares Begin Here

For many traders, the real problems start when they attempt to withdraw funds — whether profits or original deposits.

Reported issues include:

-

Withdrawal requests delayed indefinitely

-

New requirements introduced only after requesting funds

-

Unexpected fees demanded before processing

-

Unclear timelines with no firm deadlines

Many users describe frustration as the platform suddenly becomes slow to respond, evasive in explanations, or reliant on confusing policy language.

Shifting Rules After Deposits

One of the most troubling patterns described by users is the appearance of new conditions only after funds are deposited. Traders report that terms which were not clearly disclosed before deposit suddenly become enforced at the time of withdrawal.

This includes:

-

“Verification requirements” only mentioned late

-

Additional fees unclear at the start

-

Conditions that seem retroactively applied

Financial platforms should clearly communicate all terms before funds are transferred. When terms shift after money is in the system, it undermines trust and raises serious questions about transparency.

Pressure to Deposit More, Not to Clear Issues

Even as users face blocked withdrawals and unclear terms, many report persistent pressure to add more funds.

Messages include:

-

Encouragement to upgrade account tiers

-

Claims that new deposits will unlock quicker withdrawals

-

Pressure “opportunities” tied to larger balances

This type of messaging is not guidance — it’s a sales tactic aimed at keeping funds within the platform rather than resolving user concerns.

Support That Shows Up Early and Disappears Late

Acuratraders.art appears responsive during the onboarding phase. Many users report quick replies when first registering or making a deposit. But when questions shift to account behavior, withdrawals, or transparency, support responsiveness reportedly weakens — sometimes to the point of disappearing entirely.

Traders describe:

-

Slow or superficial responses

-

Support that avoids direct questions

-

Follow-ups that never materialize

This inconsistency is a major concern. Platforms that truly prioritize users maintain consistent support throughout the entire user journey — not just during sign-up.

Transparency Gaps That Undermine Trust

A recurring issue across many user reports is a lack of clear, verifiable data on:

-

How trades are actually executed

-

Where funds are held

-

What fees apply and how they are calculated

-

Clear withdrawal procedures and timelines

Without this information, users are left in the dark about the true nature of their account activity and how their money is being used.

Patterns That Can’t Be Ignored

The issues reported by traders are not isolated incidents. Instead, they form a consistent pattern:

-

Promises of gains backed by dashboards, not verifiable trade data

-

Withdrawal obstacles and shifting conditions

-

Ongoing pressure to deposit more funds

-

Support that fades when issues arise

Taken together, these patterns suggest that Acuratraders.art prioritizes retention of funds over transparency and accountability.

How This Affects Investors

For anyone considering using Acuratraders.art, it’s important to understand how these behaviors affect real financial outcomes:

-

Displayed growth on dashboards may not reflect real trading

-

Access to funds can become conditional and time-consuming

-

Pressure-driven messaging may lead to emotional financial decisions

-

Opaque processes strip users of clarity and control

Investing without clarity is not investing — it’s speculation with invisible rules.

How to Protect Yourself

Before engaging with any online trading platform that exhibits similar behaviors, consider these steps:

1. Demand Full Transparency

Ask for:

-

Complete trade logs

-

Execution details

-

Clear fee breakdowns

A transparent platform provides this without hesitation.

2. Verify Withdrawal Processes

Test the withdrawal system early with a small amount to ensure it functions as expected.

3. Question Any Late-Term Conditions

If terms or requirements appear only after money is deposited, treat it as a major red flag.

4. Resist High-Pressure Messaging

Decisions should be based on research — not urgency or persuasion.

Final Assessment of Acuratraders.art

This Acuratraders.art scam review highlights a platform whose operational behavior raises significant concerns. From unverifiable profits and shifting rules to blocked withdrawals and persistent deposit pressure, the evidence suggests risk and uncertainty that should not be taken lightly.

Acuratraders.art may present a polished facade, but when real money is involved, transparency and accountability matter more than aesthetics.

In online trading, clarity is essential and access to funds is non-negotiable. Platforms that fail to uphold these principles demand skepticism.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to acuratraders.art, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as acuratraders.art continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.