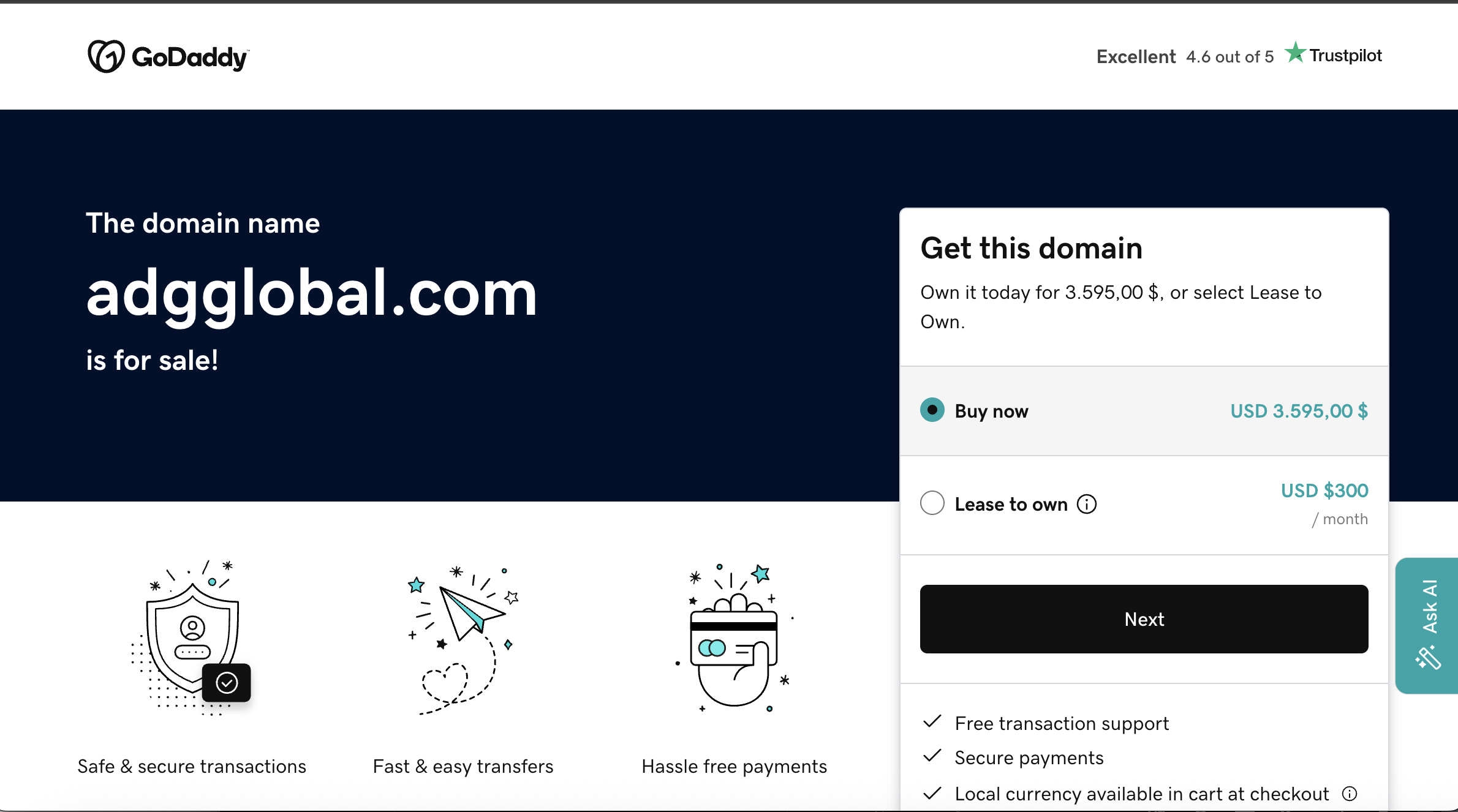

ADGGlobal.cc Trading Reality Check

Introduction

The surge of online investment platforms has created both opportunities and risks for traders worldwide. While many platforms offer legitimate services, others operate with limited transparency and questionable practices. ADGGlobal.cc is a platform that has recently attracted attention, but not necessarily for positive reasons.

Promising access to global financial markets, cryptocurrencies, and automated trading tools, ADGGlobal.cc presents itself as a professional broker. Yet, closer examination reveals gaps in regulation, accountability, and transparency. This review examines ADGGlobal.cc from multiple angles, highlighting operational risks and investor concerns.

Marketing vs. Reality

ADGGlobal.cc markets itself as a modern, user-friendly platform for traders of all levels. Its website emphasizes:

-

Access to multiple markets, including forex and crypto

-

Automated trading tools and professional oversight

-

High-yield investment plans

-

Fast deposits and withdrawals

While these features are appealing, the platform provides little evidence of how these claims are substantiated. There is no audited performance data, no independent verification, and limited operational detail. The reliance on marketing language rather than verifiable facts should raise caution for prospective investors.

Lack of Corporate Transparency

A significant red flag is the lack of clear corporate information. Legitimate trading platforms usually provide:

-

Legal entity name and registration

-

Physical office address

-

Management or executive team details

-

Jurisdiction of operation

ADGGlobal.cc does not clearly disclose these details. Without knowing who is responsible for the platform or where it is based, accountability becomes difficult, if not impossible. In high-risk financial environments, anonymity often correlates with operational risk.

Regulatory Status and Oversight

Regulation is a cornerstone of investor protection. Licensed brokers are required to comply with rules designed to safeguard client funds, maintain transparency, and provide dispute resolution mechanisms.

ADGGlobal.cc does not provide evidence of being licensed or regulated by any recognized authority. No license numbers, no regulator names, and no compliance certifications are available. Operating without regulation leaves users exposed to:

-

No legal protection for deposited funds

-

No independent oversight of trading activities

-

Limited recourse in disputes or fund recovery

This absence of regulatory supervision significantly increases investor risk.

Profit Claims and Investment Packages

ADGGlobal.cc promotes high-return investment packages, suggesting users can earn profits quickly and consistently. These claims are presented in persuasive, confidence-driven language.

However, in real trading markets, profits are never guaranteed. Cryptocurrency mining, forex, and other high-volatility instruments inherently carry risk. Platforms that promise stable returns with minimal risk should be approached with extreme caution. Overstating potential profits is a common tactic used to attract deposits.

Trading Infrastructure and Transparency

Another area of concern is the lack of clarity regarding ADGGlobal.cc’s trading operations. The platform does not clearly explain:

-

How trades are executed

-

Which trading software or liquidity providers are used

-

How market prices are sourced

-

Whether trading activity can be independently verified

Without transparency, users cannot confirm whether trading occurs in live markets or if account balances are manipulated internally. Displayed dashboards showing profits do not guarantee real activity and may create a false sense of security.

Fund Access and Withdrawal Challenges

A critical aspect of any investment platform is how it handles withdrawals. Reports from similar unregulated platforms suggest potential issues with fund accessibility, such as:

-

Delayed withdrawal requests

-

Additional charges imposed after deposit

-

Requests for repeated verification or documentation

-

Temporary account restrictions after profits are earned

Although ADGGlobal.cc does not openly display these complaints, users should be aware that such patterns are common in unregulated environments. Smooth access to funds is a fundamental sign of a legitimate trading service.

Pressure Tactics and Behavioral Marketing

ADGGlobal.cc appears to use persuasive account management and marketing strategies to encourage higher deposits:

-

Highlighting limited-time investment opportunities

-

Emphasizing rapid profit potential

-

Encouraging account upgrades to unlock “better returns”

-

Creating urgency to deposit more funds

These techniques prioritize inflow of capital over informed decision-making. Reputable brokers educate users about market risk and allow them to make decisions without pressure or urgency.

Customer Support Limitations

Effective customer support is vital for resolving issues, particularly when handling financial transactions. ADGGlobal.cc offers limited transparency in this area:

-

Minimal contact information

-

Unclear escalation procedures

-

No publicly visible support hierarchy

Weak support structures can create serious issues for users needing assistance with withdrawals, account access, or other urgent concerns.

Website Quality and Operational Signals

Examining ADGGlobal.cc’s website provides further insight into its operational credibility:

-

Broad and generic service descriptions

-

Marketing-heavy language with limited technical detail

-

Sparse risk disclosures

-

Limited legal or compliance documentation

These elements are typical of platforms that focus on appearance rather than transparency and accountability. While a sleek website may inspire confidence, it does not replace regulatory oversight or operational clarity.

Risk Assessment and Comparison

From a risk perspective, ADGGlobal.cc exhibits several red flags:

-

Lack of transparent ownership

-

No regulatory oversight

-

Ambiguous fund management

-

Pressure-driven deposit strategies

-

Limited support structures

Compared to regulated, established brokers, ADGGlobal.cc falls short in all critical areas, including credibility, accountability, and investor protection.

Conclusion

ADGGlobal.cc presents itself as a professional trading platform with wide-ranging services and lucrative investment opportunities. However, the absence of regulation, opaque ownership, unclear trading operations, and potential behavioral pressure tactics collectively indicate a high-risk platform.

Investors should approach ADGGlobal.cc with extreme caution. Trust in financial platforms is built on transparency, verified operations, and regulatory oversight—elements that ADGGlobal.cc currently lacks. Prudence, research, and risk awareness are essential before depositing any funds.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to adgglobal.cc, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as adgglobal.cc continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.