AGA Trader Exposed: Investor Alert

Introduction

The rise of online trading has created incredible opportunities for investors worldwide. With just a smartphone or laptop, individuals can access forex markets, cryptocurrencies, commodities, indices, and stocks from virtually anywhere. However, alongside legitimate brokers and regulated platforms, there has been a surge in questionable operations that promise high returns but fail to deliver transparency, accountability, or investor protection.

One platform that has recently attracted attention is AGA Trader. Marketed as a professional online trading service offering attractive investment opportunities, AGA Trader presents itself as a gateway to financial freedom. But beyond the glossy website and bold claims, there are serious concerns that potential investors must carefully evaluate.

This comprehensive review takes a detailed look at AGA Trader’s claims, operational structure, warning signs, and the overall risks associated with engaging with the platform.

Overview of AGA Trader

AGA Trader promotes itself as an online brokerage platform offering:

-

Forex trading

-

Cryptocurrency trading

-

Commodities trading

-

Indices trading

-

Managed investment accounts

At first glance, the platform appears modern and convincing. The website typically features:

-

Claims of advanced trading tools

-

High success rates

-

Experienced account managers

-

Fast withdrawals

-

Secure transactions

However, as with many questionable trading platforms, presentation alone does not equal legitimacy. Investors must look beyond design and focus on regulatory standing, transparency, and operational integrity.

Lack of Regulatory Transparency

One of the most important factors when evaluating any broker is regulation.

Legitimate trading platforms are licensed and regulated by recognized financial authorities. These regulatory bodies enforce compliance standards designed to protect investors, including:

-

Capital requirements

-

Segregation of client funds

-

Transparent reporting

-

Complaint resolution mechanisms

In the case of AGA Trader, there is either no clear regulatory information provided or the information presented is vague and unverifiable. A trustworthy broker will clearly display:

-

Regulatory license number

-

Name of the regulatory authority

-

Registered business address

-

Legal company name

When these details are missing, incomplete, or difficult to verify independently, it raises significant concerns.

Unregulated platforms operate without oversight. This means investors have little to no protection if disputes arise or funds become inaccessible.

Unrealistic Profit Promises

Another common red flag seen with high-risk platforms is the promise of guaranteed or consistently high returns.

AGA Trader reportedly promotes:

-

High daily or weekly profit percentages

-

Low-risk, high-reward opportunities

-

“Expert-managed” accounts with consistent performance

In financial markets, profits are never guaranteed. Forex and cryptocurrency trading involve volatility and risk. Even the most experienced traders cannot guarantee steady gains without losses.

Any platform suggesting otherwise is misrepresenting the nature of financial markets.

Legitimate brokers focus on providing trading tools and market access—not guaranteeing profits.

Aggressive Sales Tactics

Many questionable trading platforms rely on aggressive marketing and sales strategies. Reports associated with platforms similar to AGA Trader often include:

-

Persistent phone calls

-

Pressure to deposit more money

-

Claims of limited-time investment opportunities

-

Emotional manipulation tactics

Sales representatives may create urgency by suggesting that a “special opportunity” will expire soon. This pressure tactic is designed to push investors into making quick decisions without conducting proper research.

Professional, regulated brokers do not rely on high-pressure sales tactics to attract clients.

Withdrawal Concerns

One of the most alarming issues reported in cases involving questionable brokers is difficulty withdrawing funds.

Common patterns include:

-

Withdrawal requests delayed indefinitely

-

Additional “fees” required before processing withdrawals

-

Requests for more deposits to “unlock” profits

-

Accounts suddenly restricted or suspended

A legitimate broker processes withdrawals according to clearly stated policies. While verification procedures are standard in the industry, they should not be used as a barrier to prevent access to funds.

When users experience repeated obstacles while trying to withdraw their own money, it is a major red flag.

Vague Company Information

Transparency is a core requirement in financial services.

With AGA Trader, there are concerns regarding:

-

Lack of clear company ownership details

-

No verifiable physical office address

-

Generic or template-style website content

-

Limited verifiable corporate history

Legitimate financial institutions provide detailed corporate information. They are proud to display their regulatory credentials and physical presence.

When ownership and operational structure remain unclear, investors should exercise extreme caution.

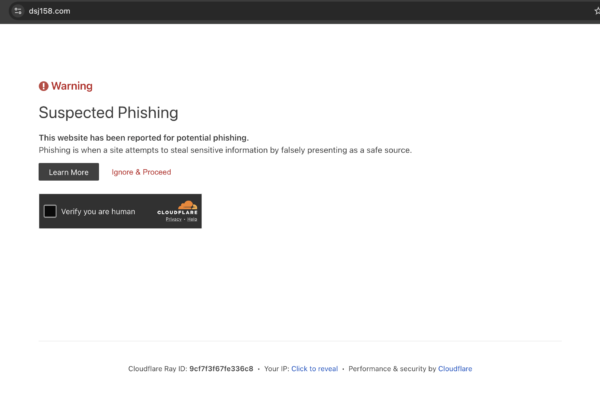

Website and Platform Concerns

While a professional-looking website can appear convincing, scammers often invest heavily in design to build trust.

Key issues to look for include:

-

Recently registered domain names

-

Limited operational history

-

Generic trading platform dashboards

-

Price charts that may not reflect real market conditions

In some cases, the trading interface may simulate profits to encourage further deposits. However, these numbers may not represent real trades executed in live markets.

Without independent verification of liquidity providers and trade execution, users cannot be certain their trades are genuinely placed.

Absence of Risk Disclosure

Reputable brokers clearly disclose the risks involved in trading. They typically provide:

-

Detailed risk warning statements

-

Percentage of retail accounts that lose money

-

Terms and conditions explaining liabilities

If AGA Trader downplays risk or emphasizes profits without equally highlighting potential losses, it suggests an imbalance in transparency.

Responsible financial platforms educate users about risks rather than overselling rewards.

Customer Support Concerns

Customer support is another critical factor.

Common warning signs include:

-

Delayed responses

-

Only email-based communication

-

Unreachable phone numbers

-

Representatives avoiding specific questions

A regulated broker maintains professional, multi-channel customer support systems, including phone lines, live chat, and clear escalation procedures.

If communication becomes difficult after depositing funds, this is a serious concern.

Comparison With Legitimate Brokers

To understand the difference, consider how established brokers operate:

-

They are licensed by recognized authorities.

-

They separate company funds from client funds.

-

They publish clear fee structures.

-

They do not guarantee profits.

-

They provide transparent withdrawal policies.

If AGA Trader fails to meet these basic standards, the risk level increases significantly.

Psychological Tactics Often Used by Questionable Platforms

Investors should also be aware of psychological manipulation techniques, including:

-

Displaying fake testimonials

-

Using stock images of “team members”

-

Creating fake positive reviews

-

Offering referral bonuses

-

Encouraging reinvestment of “profits”

These tactics are designed to build trust quickly and create social proof.

Independent research is crucial before making financial commitments.

The Importance of Due Diligence

Before investing in any platform, consider the following steps:

-

Verify regulatory status independently

-

Check domain registration age

-

Search for independent reviews

-

Confirm physical address authenticity

-

Review terms and conditions carefully

Skipping these steps can expose investors to unnecessary financial risks.

Who Is Most at Risk?

Inexperienced traders are often the primary targets. Individuals who:

-

Are new to online trading

-

Lack knowledge of financial regulation

-

Are seeking quick financial gains

-

Have been referred by acquaintances

Financial fraud often preys on urgency and optimism.

Education and patience are the strongest defenses against financial loss.

Warning Signs Summary

Here is a quick recap of potential red flags associated with AGA Trader:

-

No clear regulatory license

-

Guaranteed profit claims

-

Aggressive sales tactics

-

Withdrawal delays or barriers

-

Limited corporate transparency

-

Unverifiable trading activity

Even one of these warning signs warrants caution. Multiple red flags significantly increase risk.

Final Thoughts

Online trading offers legitimate opportunities—but only when conducted through transparent, regulated brokers.

AGA Trader raises serious concerns due to its lack of regulatory clarity, questionable operational transparency, and reported withdrawal difficulties. Investors should approach with extreme caution and avoid depositing funds without verifying every aspect of the platform.

Financial markets are inherently risky, but those risks should come from market volatility—not from uncertainty about whether a broker is legitimate.

The safest path forward is always thorough research, independent verification, and choosing properly regulated financial institutions.

Conclusion

AGA Trader presents itself as a promising online trading platform, but several warning signs suggest potential risks that should not be ignored. From unclear regulatory status to possible withdrawal issues, the platform does not appear to meet the transparency standards expected in the financial industry.

Investors are strongly advised to prioritize safety, due diligence, and regulatory verification before committing funds to any trading platform.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to agatrader.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as agatrader.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.