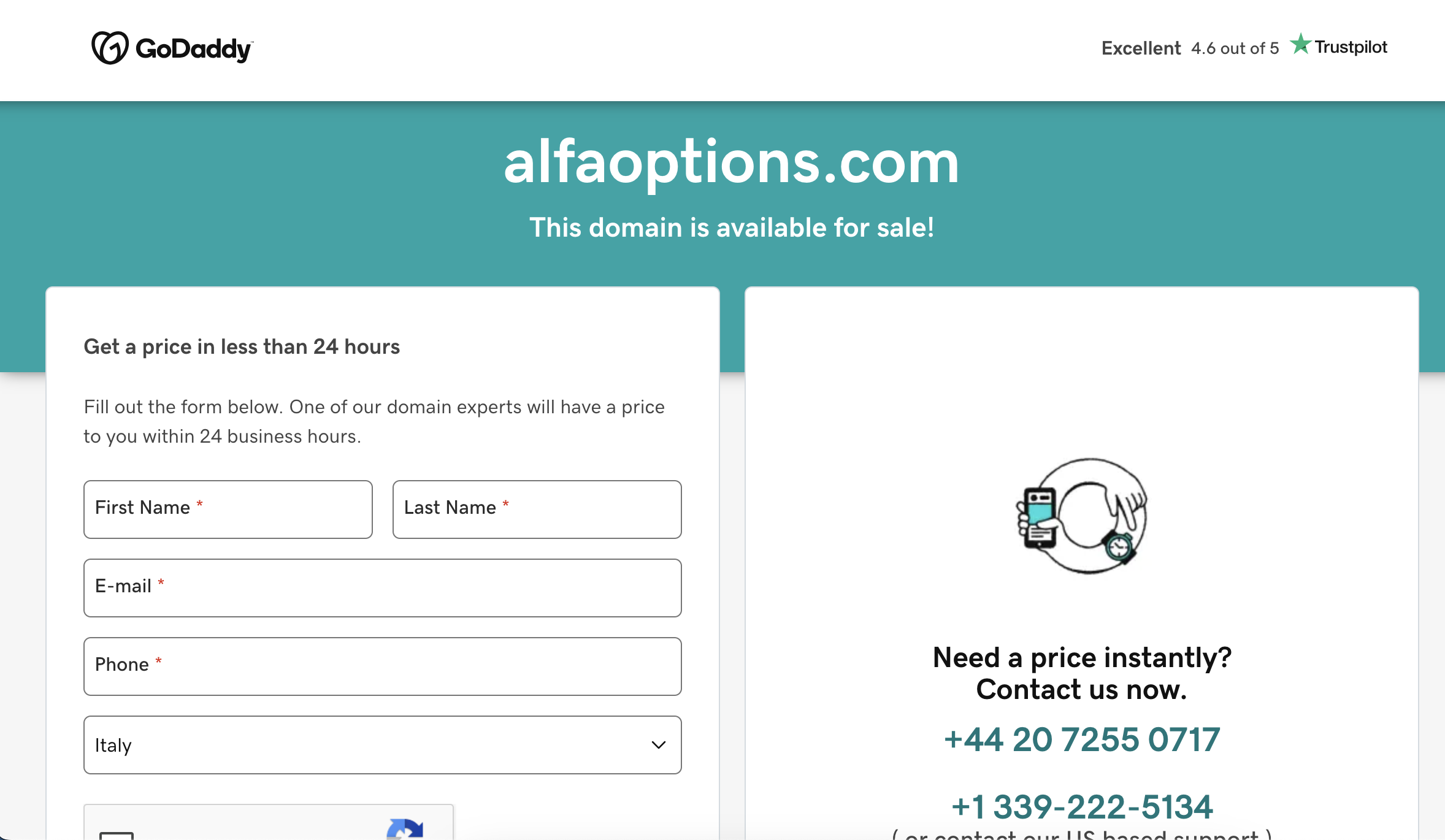

AlfaOptions.com Scam Review – What You Need to Know

The world of online trading has grown rapidly over the past decade. From forex to cryptocurrencies, binary options, and CFDs, investors are drawn by the promise of quick profits and easy access to global financial markets. Unfortunately, the industry has also become a breeding ground for scams. One such platform that has recently raised serious concerns is AlfaOptions.com. In this review, we’ll take a deep look into how AlfaOptions operates, the red flags that indicate it may not be a legitimate broker, and why traders should approach it with extreme caution.

What is AlfaOptions.com?

AlfaOptions.com presents itself as a sophisticated online trading platform, offering users the chance to trade assets such as forex pairs, cryptocurrencies, indices, and commodities. The website is designed to look professional, with sleek graphics and promises of high returns. Like many questionable brokers, AlfaOptions claims to provide advanced trading tools, account managers, and educational resources to support clients.

On the surface, this might sound legitimate. But once you dig deeper, cracks quickly appear.

Signs of a Scam

There are several indicators that suggest AlfaOptions.com is not a trustworthy trading platform. Let’s break down some of the most glaring warning signs.

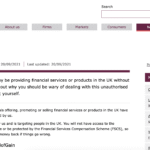

1. Lack of Regulation

One of the biggest red flags with AlfaOptions.com is the absence of credible regulation. Legitimate brokers are typically registered and licensed by well-known financial authorities such as the FCA (UK), ASIC (Australia), CySEC (Cyprus), or FINRA (USA). These bodies impose strict standards to ensure client funds are protected and trading practices remain fair.

AlfaOptions.com, however, does not appear to hold a valid license from any reputable regulator. Instead, the platform often uses vague language about being “registered offshore” or “complying with international standards,” without providing verifiable details. For investors, this lack of oversight means there is no safety net if things go wrong.

2. Unrealistic Promises

Another classic hallmark of a scam broker is the promise of guaranteed or excessively high returns. AlfaOptions.com frequently advertises the potential to double or triple your investment in a short timeframe. Some reports even suggest that account managers encourage clients to invest larger sums with the lure of “special deals” or “exclusive strategies.”

No legitimate broker can guarantee profits. The financial markets are inherently risky, and any platform that downplays those risks should be treated with suspicion.

3. Aggressive Marketing and Cold Calls

Many users have reported receiving unsolicited emails, text messages, or even phone calls from AlfaOptions.com representatives. These sales agents use high-pressure tactics, pushing potential investors to deposit funds quickly before they “miss out” on opportunities.

Reputable brokers rarely, if ever, operate this way. Aggressive marketing is a strong indicator of a scam operation designed to extract money as quickly as possible.

4. Difficulties With Withdrawals

One of the most common complaints about AlfaOptions.com involves withdrawal issues. While depositing money seems easy, withdrawing funds often becomes an uphill battle. Clients have reported delays, hidden fees, and outright refusal of withdrawal requests. In many cases, the platform demands additional deposits or fabricated “tax payments” before releasing funds—tactics that are typical of fraudulent brokers.

5. Fake Testimonials and Reviews

If you visit AlfaOptions.com or search for the platform online, you’ll find glowing reviews and testimonials that praise its services. However, many of these appear to be fabricated or paid reviews designed to create a false sense of credibility. The language is often generic, overly positive, and lacks the nuance of genuine user feedback.

How the Scam Typically Works

Understanding how platforms like AlfaOptions.com operate can help protect investors from falling victim. Here’s a common pattern that many users have reported:

-

Initial Contact – A potential investor receives an enticing advertisement or a cold call offering incredible investment opportunities.

-

First Deposit – The investor is persuaded to make a small initial deposit, often as little as $250. The account manager then shows “profitable” trades on the platform to build trust.

-

Pressure to Invest More – Once the investor feels confident, the account manager pushes them to invest larger sums, claiming it will unlock better returns or exclusive offers.

-

Fabricated Profits – The trading dashboard may display large profits, but these numbers are often manipulated and do not reflect actual trades.

-

Withdrawal Problems – When the investor attempts to withdraw funds, the excuses begin. Additional fees, taxes, or new deposits are requested. Eventually, communication stops, and the investor loses access to their money.

Common Tactics Used by AlfaOptions

To further understand the dangers, let’s examine some of the psychological and technical tactics that platforms like AlfaOptions.com use:

-

Authority Bias: They introduce account managers or “senior analysts” who claim to have years of experience. This creates trust, even though these individuals often have no verifiable credentials.

-

FOMO (Fear of Missing Out): They constantly pressure investors by suggesting opportunities are limited and must be acted on immediately.

-

Fake Technical Tools: The trading platforms often look professional, with charts, graphs, and indicators. However, these are frequently just simulations rather than actual live data feeds.

-

Hidden Terms and Conditions: Buried in fine print, there are often clauses that allow the platform to block withdrawals or charge outrageous fees.

Real User Complaints

Numerous individuals who have interacted with AlfaOptions.com have shared their experiences, and the stories follow a familiar pattern:

-

“I was pressured to deposit more and more money. When I tried to withdraw, they stopped responding.”

-

“They promised me huge returns. My account showed profits, but when I asked to cash out, I was told I needed to pay additional fees first.”

-

“The support team kept stalling and making excuses. Eventually, my login stopped working altogether.”

These experiences underline the fraudulent nature of the operation and highlight why potential investors should stay away.

How to Identify Safe Brokers

If you’re considering investing in online trading, here are some key steps to avoid falling victim to scams like AlfaOptions.com:

-

Check Regulation – Always verify whether a broker is licensed by a reputable authority. Do not take their word for it—search official regulatory websites.

-

Read the Fine Print – Review withdrawal policies, fees, and terms of service before making any deposit.

-

Look for Independent Reviews – Seek genuine feedback from multiple sources, not just the broker’s website.

-

Test Withdrawals Early – If you do invest, start with the minimum amount and attempt to withdraw funds immediately. A legitimate broker will process requests without unreasonable delays.

-

Avoid High-Pressure Tactics – If someone is pressuring you to invest quickly, it’s likely a scam. Take your time and make informed decisions.

Final Thoughts

AlfaOptions.com may look polished and professional at first glance, but beneath the surface it exhibits all the classic signs of a scam broker. The lack of regulation, unrealistic promises, withdrawal issues, and fabricated testimonials all point to a fraudulent operation designed to extract money from unsuspecting investors.

Online trading can be profitable, but only if done through legitimate, regulated brokers who operate transparently. Investors should always exercise caution, conduct thorough research, and never rush into depositing money with platforms that cannot prove their credibility.

In the case of AlfaOptions.com, the best advice is simple: stay away.

-

Report. Alfaoptions.com And Recover Your Funds

If you have lost money to alfaoptions.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like alfaoptions.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.