Algoyatirim.com Scam: Exposing False Promises

Introduction

The digital age has transformed how people invest, trade, and grow their wealth. With just a few clicks, anyone can access platforms promising algorithmic trading, artificial intelligence‑driven insights, and instant profits. Yet, this convenience has also opened the door to fraudulent schemes. One platform that has drawn attention for deceptive practices is algoyatirim.com.

This article provides a comprehensive review of algoyatirim.com, unpacking its strategies, red flags, and the broader lessons it offers about online scams. The goal is not only to highlight the dangers of this specific site but also to empower readers with knowledge that applies across the digital investment landscape.

The Allure of Algorithmic Trading

Algorithmic trading sounds futuristic and appealing. It suggests that advanced software can analyze markets faster than humans, identify profitable opportunities, and execute trades automatically. Legitimate platforms do exist in this space, but scammers exploit the buzzwords.

Algoyatirim.com positions itself as a cutting‑edge solution, claiming to deliver consistent profits through proprietary algorithms. For newcomers, the pitch is compelling: no need for expertise, no need for effort — just deposit funds and watch them grow. This narrative is precisely what makes the scam effective.

The Polished Surface: First Impressions

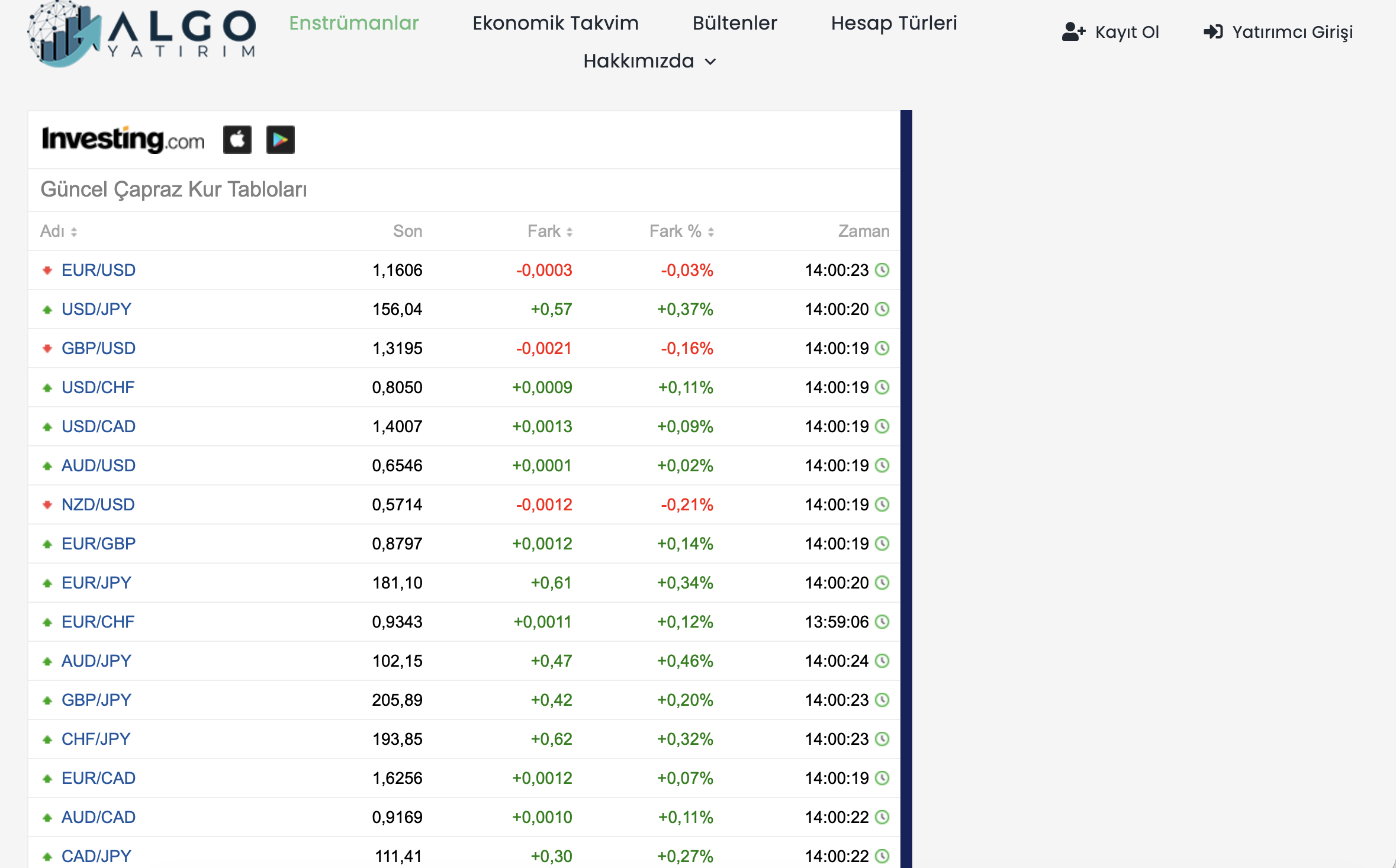

Visiting algoyatirim.com, one might initially be impressed. The design is sleek, the language is persuasive, and the promises are bold. It presents itself as a professional trading hub, complete with dashboards, charts, and testimonials.

But scams thrive on appearances. The polished surface is a mask, carefully crafted to build trust. Beneath it lies a system designed to extract money rather than generate wealth.

Red Flags That Signal Trouble

A closer look reveals several warning signs that should immediately raise suspicion:

- Unrealistic Guarantees: The platform advertises guaranteed profits and unusually high returns. In real markets, no system can promise certainty.

- Opaque Ownership: There is no verifiable information about the company’s founders, regulatory licenses, or headquarters. Transparency is a hallmark of legitimacy, and its absence is a major red flag.

- Pressure Tactics: Visitors are urged to sign up quickly, with claims that opportunities are limited. This urgency is a psychological trick to bypass rational decision‑making.

- Suspicious Testimonials: Many reviews on the site appear fabricated, using generic names and stock images. Genuine platforms rely on verifiable feedback, not staged endorsements.

These elements combine to create a façade that preys on trust and hope.

How the Scam Unfolds

Algoyatirim.com follows a predictable pattern common to fraudulent platforms:

- Attraction Through Marketing Ads and social media posts highlight effortless profits and advanced technology. The messaging is designed to appeal to both beginners and experienced traders.

- Onboarding With False Security Once registered, users are greeted with a professional‑looking dashboard. Charts and graphs simulate real trading activity, reinforcing the illusion of legitimacy.

- Encouragement to Deposit Funds Users are urged to deposit money, often with promises of bonuses or matched investments. The more someone deposits, the more they are told they will earn.

- Illusion of Profits The platform manipulates numbers to show fabricated gains. This encourages users to invest even more, believing they are on the path to success.

- Withdrawal Barriers When users attempt to withdraw, they face endless delays, hidden fees, or outright refusal. At this stage, the scam becomes undeniable, but funds are often already lost.

Psychological Manipulation at Work

Scams like algoyatirim.com are not just about technology; they are about psychology. The platform exploits human emotions and cognitive biases:

- Greed: The promise of quick wealth overrides caution.

- Fear of Missing Out (FOMO): Urgent messaging convinces users they must act immediately.

- Authority Bias: Claims of advanced algorithms and expertise create false credibility.

- Social Proof: Fake testimonials suggest that “everyone” is succeeding, making individuals feel safe to join.

By understanding these tactics, readers can better recognize when they are being manipulated.

The Human Cost of Scams

The damage caused by platforms like algoyatirim.com extends beyond financial loss. Victims often experience:

- Emotional Distress: Feelings of betrayal, shame, and regret.

- Loss of Trust: Skepticism toward legitimate financial institutions and online services.

- Community Impact: Scams erode confidence in digital innovation, discouraging participation in genuine opportunities.

It is important to emphasize that anyone can be targeted. Scams do not discriminate by age, gender, or background. Inclusive awareness ensures that all individuals, regardless of financial literacy, are equipped to protect themselves.

Legitimate Platforms vs. Algoyatirim.com

To highlight the differences, consider a comparison:

| Feature | Legitimate Platforms | Algoyatirim.com |

|---|---|---|

| Regulation | Licensed and overseen by financial authorities | No evidence of regulation |

| Transparency | Clear company details and compliance information | Opaque or missing |

| Customer Support | Accessible and professional | Evasive or unresponsive |

| Withdrawal Process | Straightforward and documented | Complicated or denied |

| Marketing | Balanced, realistic claims | Aggressive, exaggerated promises |

This table underscores how algoyatirim.com diverges from industry norms.

Why People Still Fall Victim

Despite the warning signs, scams continue to succeed. Several factors explain why:

- Limited Financial Education: Many individuals are unfamiliar with trading realities.

- Desire for Quick Wealth: The dream of instant success is powerful.

- Professional Appearance: A polished website creates false legitimacy.

- Social Influence: Fake testimonials and online buzz convince people the platform is trustworthy.

Recognizing these factors helps explain why scams thrive and why vigilance is essential.

Lessons From Algoyatirim.com

The case of algoyatirim.com offers broader lessons:

- Verify regulatory status before investing.

- Be skeptical of guaranteed profits.

- Demand transparency in leadership and company details.

- Review withdrawal policies carefully.

- Trust instincts — if something feels off, it probably is.

These lessons apply universally, equipping individuals to navigate the online investment world more safely.

Building Inclusive Awareness

Scams affect diverse communities. Inclusive awareness campaigns are vital to ensure that everyone, regardless of background, has access to information about how scams operate. Sharing experiences openly reduces stigma and strengthens collective defenses.

Victims should never be blamed. Instead, they should be supported and encouraged to share their stories. This collective approach builds resilience against fraudulent platforms.

Conclusion

Algoyatirim.com is a textbook example of an online scam. It presents itself as a sophisticated trading platform but relies on deception, manipulation, and false promises. Through fabricated profits and withdrawal barriers, it traps users in a cycle of loss.

By dissecting its methods, we gain insight into how scams operate and how to recognize them. The lessons extend beyond this single platform, reminding us to remain vigilant, question unrealistic claims, and prioritize transparency in financial dealings.

Awareness is the strongest defense. By fostering inclusive education and open dialogue, communities can reduce the impact of scams and create a safer digital environment for all.

Report algoyatirim.com And Recover Your Funds

If you have lost money to algoyatirim.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like algoyatirim.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.