AllGlobalFin.com Review – A Deep Dive into a Suspicious Platform

Online trading has exploded in popularity over the past decade. From forex and stocks to cryptocurrency and commodities, thousands of platforms now compete for investors’ attention. With this boom, however, comes a darker side: fraudulent platforms designed to take advantage of unsuspecting traders. One such platform that has raised multiple red flags is AllGlobalFin.com.

In this review, we will take a detailed look at the operations, claims, and tactics used by AllGlobalFin.com. By the end, you’ll understand why many industry observers categorize this broker as suspicious, and why traders should exercise extreme caution.

What Is AllGlobalFin.com?

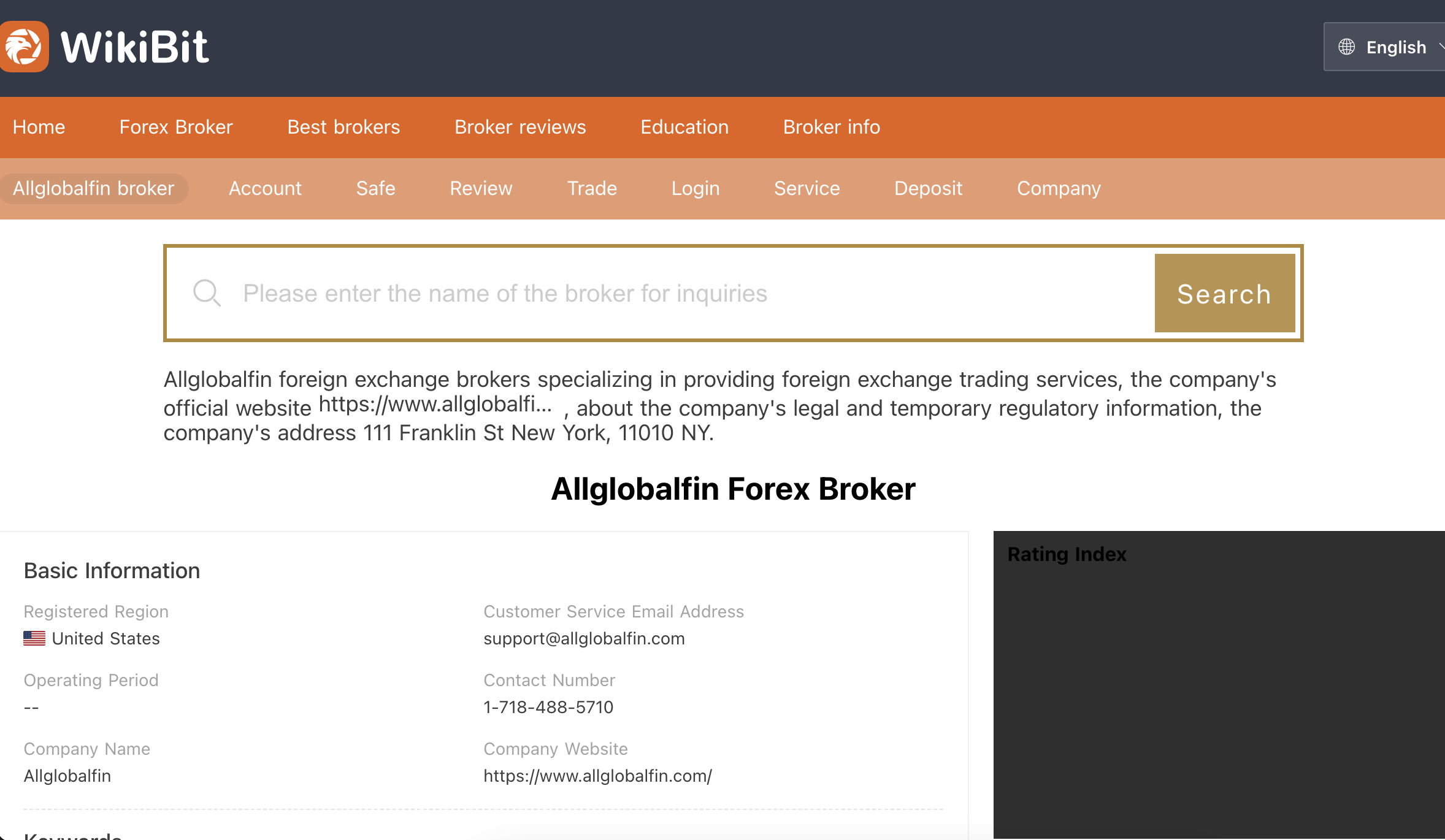

At first glance, AllGlobalFin.com presents itself as a global trading broker offering access to a variety of financial markets. Their website highlights services such as forex trading, crypto trading, and investment packages. They claim to provide advanced technology, low spreads, and high returns for clients who choose to sign up.

While these promises may sound attractive, it’s important to remember that legitimate brokers are heavily regulated and rarely make sweeping guarantees about profit. Many of the statements on AllGlobalFin.com’s website appear exaggerated and, in some cases, outright misleading.

Lack of Regulation and Licensing

One of the biggest warning signs is the absence of credible regulation. Any reputable trading broker must be licensed by a recognized authority, such as:

-

The Financial Conduct Authority (FCA) in the UK

-

The Commodity Futures Trading Commission (CFTC) in the USA

-

The Australian Securities and Investments Commission (ASIC)

-

The Cyprus Securities and Exchange Commission (CySEC)

AllGlobalFin.com does not display proof of oversight from any trusted regulator. Instead, their website uses vague language, suggesting compliance without providing verifiable documentation. This lack of transparency is a strong indicator that the platform is operating without proper authorization, leaving users vulnerable.

Website Red Flags

When analyzing the AllGlobalFin.com website, several inconsistencies stand out:

-

Unclear Ownership – There is little to no information about the parent company, leadership team, or registered office.

-

Generic Content – Much of the website text is filled with buzzwords and generic promises, but lacks specifics about trading conditions.

-

Missing Legal Documents – Proper brokers always provide clear terms and conditions, risk disclosures, and privacy policies. AllGlobalFin.com either hides or fails to provide these essential documents.

-

Unprofessional Design – While not always a deal-breaker, many scam brokers cut corners on their websites, leading to poorly written content and incomplete pages.

Together, these factors make it difficult to trust the platform’s legitimacy.

Unrealistic Promises of Profit

One of the most common hallmarks of fraudulent platforms is the promise of guaranteed or exceptionally high returns. AllGlobalFin.com markets its services as a way for traders to secure substantial profits with minimal effort.

In reality, trading is inherently risky, and no legitimate broker or investment firm can guarantee profits. Reputable institutions are required to disclose these risks clearly. The absence of such disclaimers and the use of unrealistic advertising is a sign that the platform may be prioritizing recruitment over genuine trading services.

Account Types and Hidden Fees

AllGlobalFin.com advertises multiple account tiers, each requiring different deposit levels. Typically, scam brokers use this strategy to lure clients into depositing more money under the promise of better features or faster returns.

While the account descriptions may sound enticing, details about spreads, commissions, and withdrawal conditions are often missing. Traders report sudden changes in fees or additional charges when attempting to withdraw funds. Hidden costs and shifting goalposts are classic tactics used to prevent users from retrieving their money.

Withdrawal Complaints

One of the most consistent complaints against AllGlobalFin.com is difficulty with withdrawals. Many users state that after depositing funds, the platform makes it nearly impossible to withdraw profits—or even the initial investment.

Common strategies include:

-

Requiring excessive verification documents not initially disclosed

-

Charging unreasonable withdrawal fees

-

Citing “technical issues” that delay the process indefinitely

-

Blocking accounts when users insist on withdrawing

This is a glaring sign that the platform’s primary goal may be to retain client deposits rather than facilitate legitimate trading.

Aggressive Sales Tactics

Another red flag associated with AllGlobalFin.com is the use of aggressive marketing and pressure strategies. Traders have reported receiving constant phone calls, emails, and messages urging them to deposit more money.

These tactics often include:

-

Promises of “limited-time offers” or exclusive investment opportunities

-

Pressure to upgrade to a higher account level

-

Manipulative language designed to create urgency

Legitimate brokers allow clients to make their own decisions without constant harassment. Excessive pressure to deposit is a strong indicator of a scam.

Fake Testimonials and Reviews

A quick search reveals that AllGlobalFin.com promotes positive testimonials on its own website and other suspicious online sources. However, many of these reviews read like scripted advertisements rather than genuine feedback from real traders.

Signs of fake reviews include:

-

Repetitive language with little detail about actual trading experiences

-

Overly positive claims without mentioning risks or downsides

-

Stock photos or anonymous user profiles

In contrast, independent forums and discussion boards are filled with negative reviews, primarily centered around withdrawal issues and poor customer service.

How Scam Brokers Operate

To better understand platforms like AllGlobalFin.com, it helps to look at the broader scam broker playbook. The typical process follows this pattern:

-

Attraction – Ads on social media or search engines draw potential investors with promises of wealth.

-

Onboarding – A smooth sign-up process with low minimum deposits makes it easy for users to start.

-

Encouragement – Traders are shown fake or manipulated profits to build trust.

-

Upselling – Aggressive tactics push clients to deposit more funds for “better results.”

-

Obstruction – When users attempt to withdraw, the broker invents hurdles to keep the money.

-

Disappearance – Eventually, communication stops, and the platform may even shut down or rebrand under a new name.

AllGlobalFin.com shows many of these patterns, reinforcing concerns that it may not be a legitimate broker.

Why Regulation Matters

Some traders underestimate the importance of regulation, believing that as long as they can trade, the platform is trustworthy. However, regulation ensures that brokers adhere to strict standards, such as:

-

Segregated Client Funds – Customer deposits are kept separate from company funds.

-

Fair Trading Practices – Brokers cannot manipulate trades or pricing.

-

Dispute Resolution – Clients have a legal pathway to raise complaints.

-

Transparency – All fees and conditions must be disclosed upfront.

Without regulation, there is little recourse for traders if the broker decides to withhold funds or engage in unethical practices. AllGlobalFin.com’s lack of credible oversight means clients are essentially unprotected.

Comparing with Legitimate Brokers

To put things in perspective, let’s compare AllGlobalFin.com with a regulated broker:

-

Ownership – Legitimate brokers publicly list their parent company, address, and executives. AllGlobalFin.com does not.

-

Regulation – Regulated brokers display license numbers and can be verified on government websites. AllGlobalFin.com provides no verifiable credentials.

-

Withdrawal Process – Real brokers process withdrawals within a clear timeframe. Users of AllGlobalFin.com report indefinite delays.

-

Customer Support – Reputable brokers offer professional support with documented policies. Complaints suggest AllGlobalFin.com’s support is evasive and unhelpful.

This comparison makes it clear why traders should be cautious when dealing with platforms that lack transparency and oversight.

Final Thoughts

AllGlobalFin.com markets itself as a global broker with lucrative opportunities, but the evidence points in another direction. The absence of regulation, the use of aggressive sales tactics, unrealistic promises, and widespread complaints about withdrawals strongly suggest that this platform should be approached with skepticism.

While the idea of quick profits can be tempting, traders must prioritize safety and transparency when selecting a broker. If a platform seems too good to be true, it often is. Based on the available information, AllGlobalFin.com shows multiple signs of being a scam, and investors would be wise to avoid it.

-

Report. Allglobalfin.com And Recover Your Funds

If you have lost money to allglobalfin.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like allglobalfin.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.