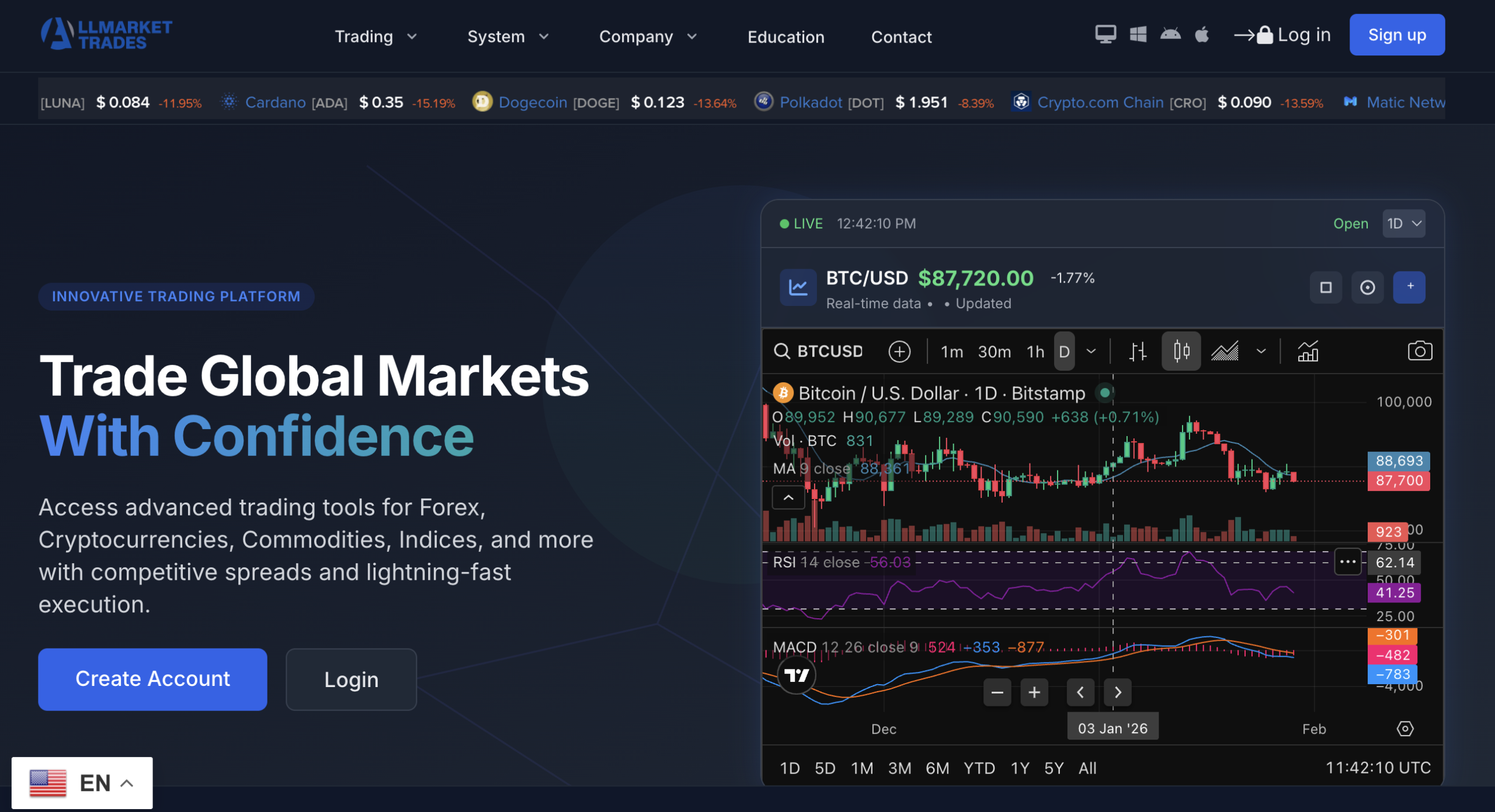

AllMarketTrades.com Review: Key Details

AllMarketTrades.com presents itself as a global online trading platform offering access to forex, commodities, cryptocurrencies, and CFD markets. The website is professionally styled and promises advanced tools, market insights, and supposedly regulated service. However, looking beyond the marketing claims reveals a very different picture — one that strongly suggests prudence and avoidance, especially for anyone considering investing money or trading through this platform.

In this review we’ll break down the issues, contradictions, and regulatory warnings surrounding AllMarketTrades.com so you can clearly see why it’s a platform that should be approached with caution.

Conflicting Claims vs. Official Regulatory Warnings

On its official site, AllMarketTrades.com claims that it is regulated and licensed, stating that it operates under global regulatory frameworks, offers segregated client accounts, and complies with strict financial rules. These statements are intended to reassure visitors about safety and legitimacy.

However, this portrayal directly conflicts with an official warning from the UK Financial Conduct Authority (FCA), which recently listed “ALLMarket Trades” as an unauthorised firm that may be offering financial services without permission. The FCA explicitly tells the public to avoid dealing with the firm because it is not authorised to provide regulated financial products in the UK.

This dual narrative — regulatory compliance in marketing vs. official regulatory warning — is a major red flag. Reputable brokers do not have contradictory compliance claims. If a platform is genuinely regulated, it will be verifiable independently through official registries; if it isn’t, then promotional assertions of regulation are misleading at best and deceptive at worst.

Lack of Trustworthy Verification

Reputable financial services providers always publish clear information about their regulatory status, including licence numbers, jurisdictions of operation, and links to official regulator listings. AllMarketTrades.com does not provide substantiated verification that can be independently confirmed through recognised regulators. The platform’s claims of “global regulation” and “40+ international awards” are unverified statements with no direct evidence from official authority databases.

In contrast, the FCA warning lists the company’s address and communication details — and notes that such information may even be incorrect or misleading. This pattern — mismatched or unverifiable corporate data — is one commonly seen with platforms that lack legitimate oversight and accountability.

Brand Messaging Versus Platform Reality

The site’s marketing focuses on features such as:

-

Advanced trading tools and real‑time analysis

-

Copy trading and “professional strategies”

-

24/7 multilingual support

-

Segregated client funds and insurance protection

These elements are framed to look reassuring and professional. However, such marketing language alone is not a substitute for verifiable proof of regulation and client protection schemes.

Contrast that with the regulatory warning specifically advising against engagement — a formal stance that carries more authority than corporate marketing text.

Inconsistency With Official Financial Rules

One of the most compelling points in investor assessments is whether a platform adheres to recognised financial standards. If AllMarketTrades.com truly operated under proper regulation (e.g., CySEC, FCA, ASIC), its registration details would be publicly listed in those regulators’ firm directories.

The fact that the FCA lists the company as unauthorised to provide financial services in the UK suggests the site’s claims to be “globally regulated” are false or at least not applicable in major markets.

Furthermore, regulated platforms must comply with client asset protections, transparent fee disclosures, and audited operational practices — all of which require documented evidence. On the other hand, there’s no conclusive evidence that AllMarketTrades.com actually meets these obligations.

Patterns Seen in High‑Risk Platforms

While AllMarketTrades.com does not currently have a large volume of independent user reviews (positive or negative), the regulatory warning alone places it in the same category as many offshore trading operations that target retail traders without proper oversight.

Platforms flagged by financial regulators often share the following traits:

-

Claims of regulation that cannot be independently verified

-

Aggressive marketing without substantiated credentials

-

Conflicting information about company registration and licensing

-

Lack of transparent legal documentation and audited disclosures

All of these traits appear present in the case of AllMarketTrades.com — notably when contrasted with the FCA warning that the firm is not authorised in the UK.

So What Does This Mean for Traders?

If you choose to engage with a trading service that lacks verified regulation and that has been officially warned against by a major financial authority, you are effectively placing your funds under conditions with limited accountability, limited legal protection, and unpredictable oversight.

Regulated brokers are subject to periodic reviews, client asset segregation rules, and mandatory reporting — protections that help ensure fairness and transparency. Unauthorised firms, by definition, are not held to the same standards, and there is no external body enforcing compliance or safeguarding traders’ interests.

In this context, the regulatory warning against AllMarketTrades.com carries real weight.

Conclusion: Critical Caution Is Necessary

While AllMarketTrades.com promotes itself as a sophisticated, regulated trading platform, the reality — backed by official financial authority warnings — suggests that its legitimacy is seriously questionable. Discrepancies between its marketing claims and independent regulatory oversight make it a platform that traders should avoid engaging with.

Until a platform’s regulatory status can be independently verified through credible registries and its compliance substantiated, the safest course of action is to focus on brokers with transparent, recognised authorisations and established track records.

For anyone considering online trading, prioritising verified and regulated providers is essential — not just for performance, but for accountability and protection.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to allmarkettrades.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as allmarkettrades.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.