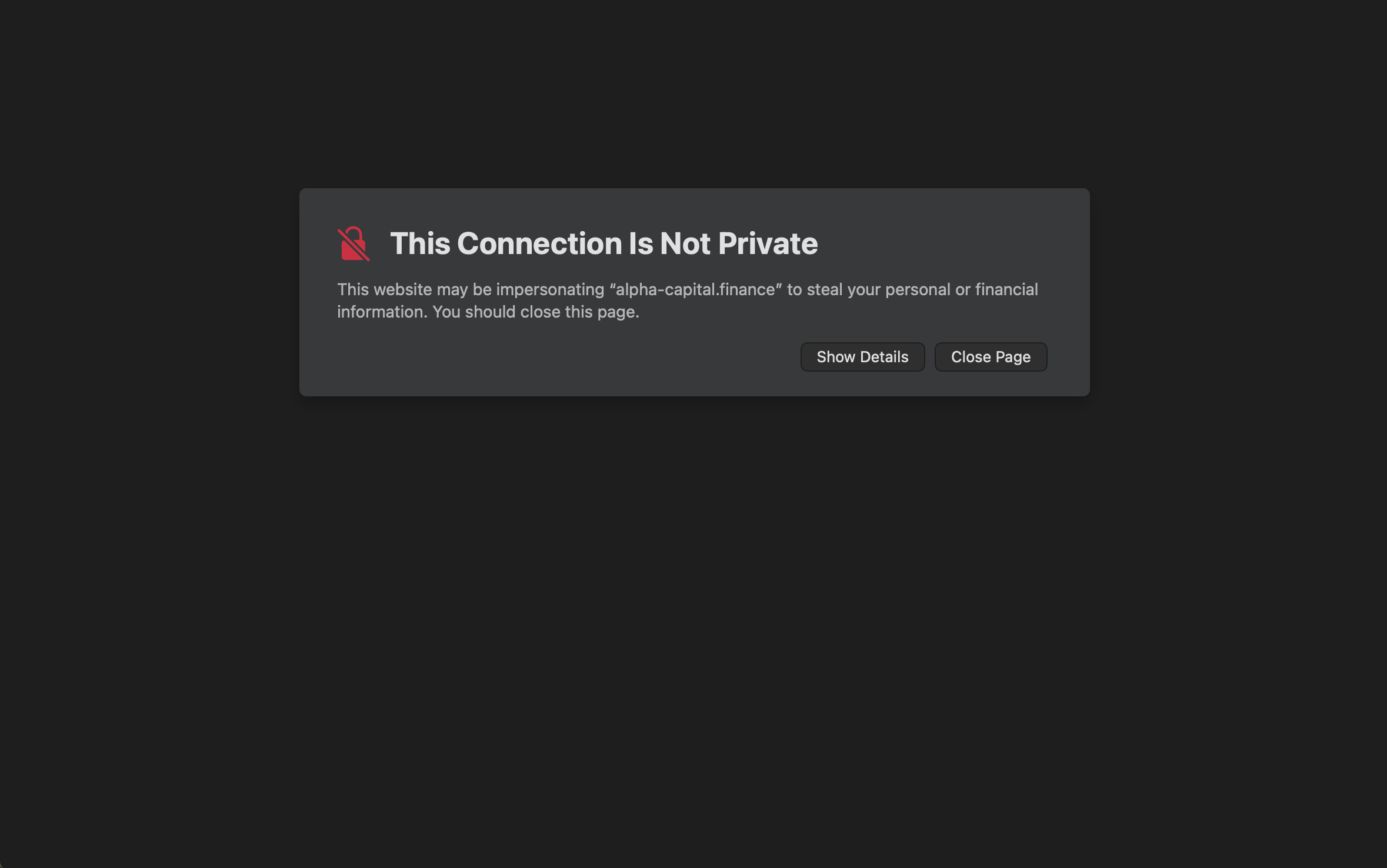

Alpha-Capital.finance Review: Key Scam Warning Signs

In the world of online trading and investments, many platforms promise quick profits, broad market access, and effortless earnings. For new or unsophisticated investors, these promises can be tempting. However — beneath polished websites and slick marketing language — some platforms exhibit patterns commonly associated with scams. Alpha-Capital.Finance is one such platform that deserves close scrutiny.

This review walks through what the platform claims to offer, the warning signs and underlying risks, how it compares to legitimate brokers, and why prospective users should approach with caution.

What Alpha-Capital.Finance Purports to Offer

Alpha-Capital.Finance presents itself as a full-service online broker or investment provider. Its promotional presentation typically includes claims such as:

-

Access to various financial markets — possibly forex, commodities, cryptocurrencies, or other speculative instruments.

-

“Professional-grade” trading or investment services, suggesting advanced tools and trading infrastructure.

-

Easy account setup and a simple deposit process, often with incentives or marketing pressure to invest quickly.

-

Promises of high returns or attractive investment yield potential, appealing especially to those seeking fast profits or significant returns on deposits.

To someone unfamiliar with industry standards or regulatory requirements, these claims may appear tempting — especially when combined with confident marketing and a polished website user interface.

However, a deeper review raises serious concerns that potentially negate any perceived advantages.

Major Red Flags and Issues: Why Alpha-Capital.Finance Looks Risky

When evaluating any investment or trading platform, there are baseline criteria to expect: clear regulation/licensing, transparency about ownership and operations, realistic risk disclosure, fair withdrawal and deposit policies, and consistent feedback from users. On many of these fronts, Alpha-Capital.Finance appears to fall short.

1. Absence of Verified Regulation or Licensing

One of the most critical indicators of a trustworthy broker or financial platform is licensing and oversight by a recognized and reputable financial authority. Regulated brokers are typically required to follow strict rules for transparency, client fund segregation, and ethical business practices. iux.com+2TopForex.Trade+2

Alpha-Capital.Finance, based on available information and third-party analysis, lacks evidence of being regulated by any top-tier financial authority. This absence of regulation is a strong warning sign — without oversight, there is no guarantee that funds are handled properly, nor that the platform operates under enforceable standards.

2. Lack of Transparency: Ownership & Company Information Unclear

Legitimate brokers typically provide clear information about their legal identity: corporate name, registered address, contact details, regulatory registration, and transparent company history. PrimeXBT+2southafricanbusinessmatters.co.za+2

In contrast, platforms like Alpha-Capital.Finance — similar to other suspicious services — often do not supply verifiable information about ownership, headquarters, or regulatory registration. Without these publicly available and verifiable details, investors have no realistic way to confirm who runs the platform, where funds are held, or under what jurisdiction the platform operates. This lack of transparency makes accountability nearly impossible.

3. Offering High-Risk Products & Promising Unrealistic Gains

One of the most common tactics among scam-style brokers is to market high-risk financial instruments (e.g. high-leverage forex, derivatives, speculative crypto, or other volatile trading assets) with promises of quick and large returns. TopForex.Trade+2NYCServers+2

Alpha-Capital.Finance appears to lean heavily on this model: marketing that emphasizes opportunity, yield, and easy growth — while offering little credible risk disclosure. When platforms promote “high returns with little risk,” it is often a red flag suggesting that risk is downplayed or hidden entirely. investor.gov+2iux.com+2

4. Potential Issues With Withdrawals, Fund Safety & Client Protection

A major red flag with suspect platforms lies in how they manage client funds, withdrawals, and overall transparency. Legitimate brokers usually provide clear withdrawal policies, segregate client funds from company funds, and offer user protections. Investopedia+2iux.com+2

In many documented scams, funds deposited by users end up difficult or impossible to withdraw. Issues may include delays, hidden fees, sudden new conditions to withdraw, or outright refusal. marketinvestopedia.com+2quantvps.com+2

Given Alpha-Capital.Finance’s lack of verified regulation and opaque operations — there is a substantial risk that deposited funds are not secure, may be commingled with operational funds, and may not be returned when requested.

5. Use of Aggressive Marketing, Pressure Tactics and “Too Good to Be True” Promises

Scam investment platforms often rely on psychological triggers: urgency (“limited time offer”), exclusivity (“VIP accounts”), or high reward promises (“Easy profits, high yield”) to push potential clients into depositing quickly — often without due diligence. international-adviser.com+2GetSmarterAboutMoney.ca+2

Alpha-Capital.Finance appears to fit that pattern: the marketing emphasis tends to focus on opportunity and rewards rather than realistic risk, and the user experience may prioritize deposits over transparency.

6. Lack of Independent Verification or Positive Long-Term User Feedback

A sign of a legitimate, stable brokerage or trading platform is a long-term track record of transparent operations, publicly verifiable performance, and authentic user feedback. Scams often lack these — instead appearing abruptly, offering high returns, and disappearing or shutting down under pressure. southafricanbusinessmatters.co.za+2iux.com+2

With minimal or no verifiable history, little independent reputation, and no credible regulatory accountability, Alpha-Capital.Finance lacks the foundational trust elements that would support a safe investment environment.

What Could Go Wrong: Real Risks for Users of Alpha-Capital.Finance

Given the structural and operational red flags, users who invest or trade through Alpha-Capital.Finance could face serious negative consequences. Some of the most significant potential risks are:

-

Loss of invested funds: Without fund segregation or regulatory protections, deposits could be misused or simply lost — with no guarantee of return.

-

Inability to withdraw funds or profits: Once funds are deposited — especially larger amounts — users might find withdrawal requests delayed, denied, or subject to unexpected “conditions.”

-

Misleading account balances or fake profits: The platform might display attractive returns or growth on paper — but without real underlying assets or trades, such balances may be fabricated, making actual cashouts impossible.

-

Lack of recourse or legal protection: Because the platform is unregulated and lacks transparency, users have almost no realistic means of legal, regulatory, or financial recourse if things go wrong.

-

Emotional, psychological and financial stress: Victims may suffer significant losses, especially if they invested money they could not afford to lose — potentially affecting life savings, trust, and financial stability.

These risks make operating with Alpha-Capital.Finance more akin to gambling or speculative risk than to informed investment.

How Alpha-Capital.Finance Mirrors Common Scam Patterns

When mapping the observed traits of Alpha-Capital.Finance against known characteristics of fraudulent or scam trading platforms, the overlap is alarming. Here are the typical patterns:

-

Unregulated / unlicensed operations — one of the strongest signs of risk. Dukascopy+2Commodity Futures Trading Commission+2

-

Opaque corporate information, hidden ownership, lack of verifiable credentials — designed to avoid accountability and traceability. PrimeXBT+1

-

Promises of high returns, minimal risk, and easy profits — classic lure tactics used by scam operations to attract inexperienced investors. NYCServers+2investor.gov+2

-

Withdrawal difficulties, fund safety concerns, and poor transparency of fund management — a typical downstream consequence of unregulated operations. marketinvestopedia.com+2Investopedia+2

-

Use of pressure sales tactics, urgency, and aggressive marketing to push deposits — a commonly reported strategy in scam-broker contexts. international-adviser.com+2GetSmarterAboutMoney.ca+2

Taken together, these patterns strongly suggest that Alpha-Capital.Finance fits the profile of a high-risk or potentially fraudulent operation rather than a legitimate, transparent broker.

Who Is Most at Risk — Profiles Vulnerable to Platforms Like Alpha-Capital.Finance

While anyone can fall victim to unregulated or deceptive platforms, certain types of individuals are particularly vulnerable:

-

New or inexperienced investors — people who may lack knowledge about regulation, risk, or red-flag signs.

-

People attracted by fast-profit promises or big returns — especially those under financial stress or hoping to “recover losses” or make quick gains.

-

Those unfamiliar with due diligence or regulatory verification — investors who don’t check license status or corporate transparency before depositing.

-

Individuals swayed by slick marketing or high-pressure sales tactics — those who act quickly under urgency without careful research.

-

Investors placing significant funds without testing small amounts first — increasing their exposure in case of loss or fraud.

For these groups, the dangers posed by Alpha-Capital.Finance are especially acute and deserve serious attention.

What Legitimate Brokers Offer — And How Alpha-Capital.Finance Fails to Meet Those Standards

To better understand just how far Alpha-Capital.Finance is from the standards of a legitimate broker, here is a contrast between what trustworthy brokers typically deliver — and what this platform appears to lack.

✅ What Legitimate Brokers Usually Provide:**

-

Regulation by recognized, credible financial authorities — ensuring oversight, transparency, and client protection. Investopedia+1

-

Clear, verifiable company information: legal name, corporate address, registration data, contact details, and transparent ownership structures. PrimeXBT+1

-

Transparent and fair terms: clear fees, commissions, spreads, withdrawal terms, risk disclosures, and realistic performance expectations. Dukascopy+2iux.com+2

-

Separation of client funds from company funds (segregated accounts), to protect investors in case of company insolvency or legal issues. Investopedia+1

-

Balanced, honest marketing that does not promise “easy riches,” but clearly states risks, potential losses, and volatility. investor.gov+1

-

Reliable customer support, transparent withdrawal processes, and documented track records of fair dealings and payouts.

❌ What Alpha-Capital.Finance Appears to Offer (or Lack):

-

No evidence of authorization or licensing by any top-tier regulator.

-

No publicly verifiable ownership, address, or legal entity data.

-

Vague or absent documentation on fees, spreads, withdrawal terms, and risk disclosure.

-

No visible client-fund protection mechanisms or segregated fund accounts.

-

Marketing that emphasizes opportunity, high returns, and sometimes uses pressure tactics.

-

No trustworthy track record, independent audits, or long-term user feedback from reputable sources.

This gap between standards and reality presents a clear warning: Alpha-Capital.Finance fails to meet the minimum criteria expected of a legitimate, trustworthy broker or investment platform.

Final Verdict: Alpha-Capital.Finance — High Risk, Low Credibility

Based on the substantial evidence, structural issues, and well-documented risk patterns, Alpha-Capital.Finance should be approached with extreme caution. The platform exhibits many of the classic warning signs associated with scam brokers or fraudulent investment operations.

The combination of: no verified licensing, lack of transparency, risky marketing, poor or missing fund protection mechanisms, and absence of credible track record — suggests that Alpha-Capital.Finance is not a safe or reliable place for trading or investment.

For individuals searching for a trustworthy broker or investment service, it is strongly advisable to focus on platforms that are regulated, transparent about their operations, provide verifiable information, and treat client funds with the seriousness they deserve.

In the complex world of online trading, careful due diligence, skepticism toward high-reward promises, and a demand for transparency remain the most important defenses against potentially harmful platforms.

Report Alpha-capital.finance And Recover Your Funds

If you have lost money to alpha-capital.finance, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like alpha-capital.finance continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.