ApexFXGroup.com: Investor Beware

When evaluating an online broker or trading platform, the first and most critical question is whether the company is properly regulated and licensed to offer financial services. In the case of ApexFXGroup.com, recent regulatory alerts and independent checks reveal serious concerns that strongly suggest this platform should not be trusted with your money.

This review breaks down the key issues, explains why this platform raises alarm bells, and provides clear reasons to steer clear of ApexFXGroup.com before risking your funds.

1. Unauthorised by Financial Regulators

The UK Financial Conduct Authority (FCA) — one of the most widely respected financial regulatory bodies — recently added a firm associated with this platform (“Apex FX Trading” at apexfxgroup.com) to its Warning List. The FCA specifically stated that this firm may be providing or promoting financial services or products without its permission, and that consumers should avoid dealing with it.

This is a major red flag. Legitimate brokers offering forex, CFDs, indices, commodities, or other financial instruments must be authorised by regulators such as the FCA, ASIC (Australia), CySEC (EU), or similar agencies. If a platform isn’t on these registries, there is no regulatory oversight, no mandatory financial reporting, no client money protections, and no recourse through formal dispute resolution mechanisms.

2. Misleading Public Claims vs. Reality

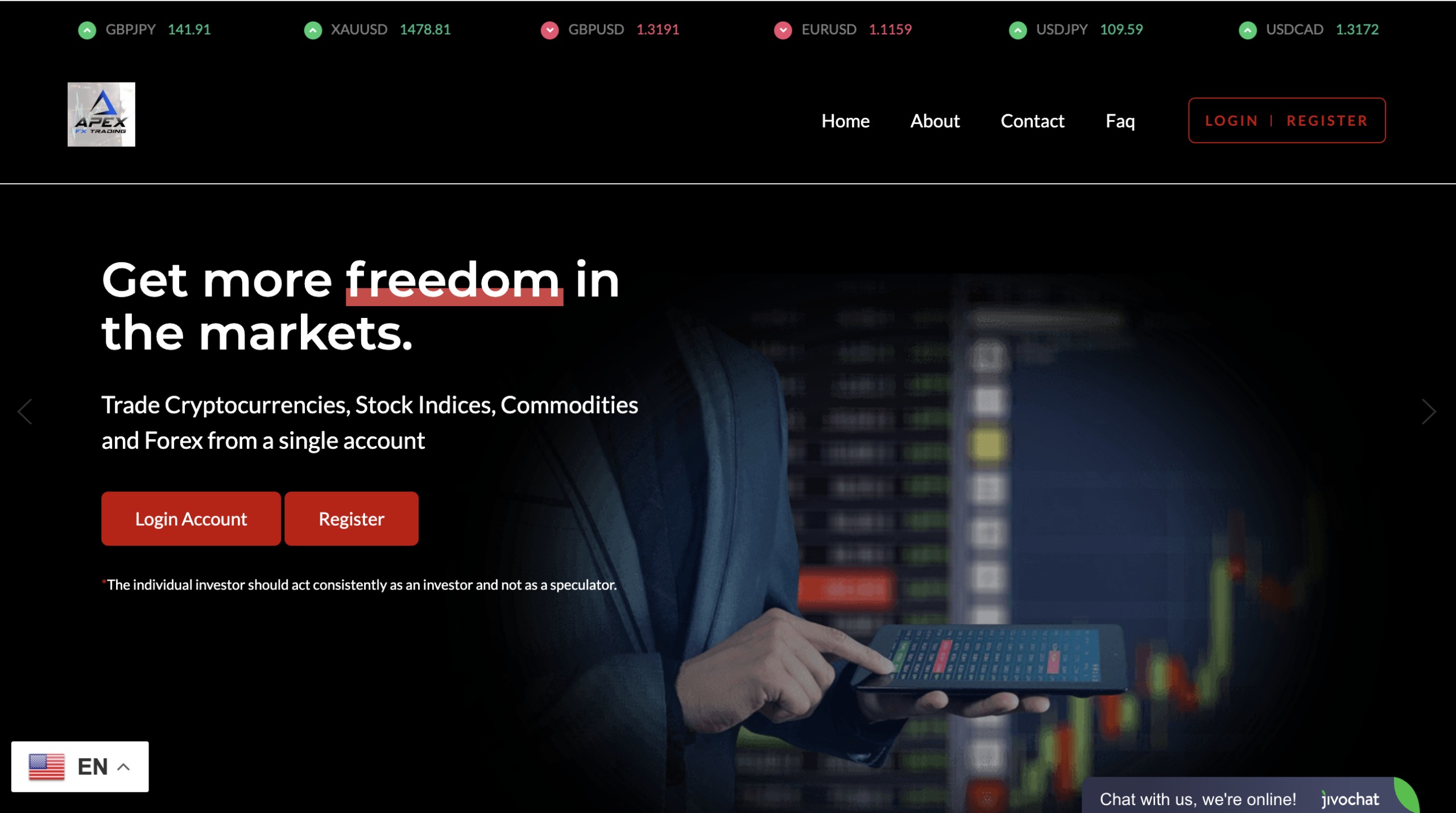

ApexFXGroup.com’s own website displays marketing language that claims things like “globally licensed & regulated”and “unparalleled trading conditions”, but these claims are false or unverified. Their homepage shows promises of guaranteed profits, extensive trading tools, and professional market analysis — all without any verifiable licensing information.

This disconnect between public-facing claims and actual regulatory status is common in fraudulent sites: they use buzzwords like “licensed” or “expert traders” to appear legitimate, while omitting any traceable licensing number or verifiable registration.

3. High‑Risk Marketing and Profit Claims

Platforms like ApexFXGroup.com often use aggressive promotional language aimed at novice traders, including:

-

Claims of high expected profits with minimal risk.

-

Statements about professional or expert teams managing trades.

-

Patterns of “join now — limited offer” calls to action.

Such marketing is typical of high‑risk or fraudulent brokers. In real financial markets, no legitimate broker can guarantee profits, and reputable firms always disclose that trading carries risk.

4. Lack of Transparent Corporate Information

A legitimate financial services provider must clearly disclose:

-

Corporate registration details

-

Physical office address

-

Names of directors or principals

-

Official regulatory license numbers

ApexFXGroup.com lacks independent verification of these details. While the site lists an address and contact information, regulators did not find the firm authorised at any jurisdiction it claimed to operate in — a hallmark of unreliable brokerages.

5. Hidden Dangers: No Client Money Protection

Because the firm is not regulated, clients have no guarantee that their funds are held in segregated accounts with reputable banks.

Regulated brokers are required by law in most major markets to segregate client assets from corporate operating funds, meaning that if the broker fails or commits fraud, client funds can be returned via compensation schemes. ApexFXGroup.com does not offer this protection — you would likely have no recovery options whatsoever should something go wrong.

6. Independent Risk Indicators Are Negative

Independent checks on related “Apex FX” broker domains have repeatedly shown:

-

Lack of regulation and warnings from authorities.

-

Domain registrations that are very recent — another indicator of potential scam operations.

-

Broker analysis sites labelling similar Apex entities as scams or unregulated risk.

These combined patterns are consistent with high‑risk, non‑compliant trading platforms that attempt to attract funds with polished marketing but lack any legitimate regulatory or financial backing.

7. Real Risks You Could Face

If you use an unregulated platform like ApexFXGroup.com, you face multiple specific threats:

-

Loss of deposited funds with no repayment guarantee.

-

No access to formal complaint resolution through financial watchdogs.

-

Potential exposure of personal and banking information without adequate safeguards.

-

Marketing pressure to deposit more money once your account is open.

Platforms that operate without oversight often engage in opaque fee structures, hidden terms, and unilateral ability to adjust user account balances or deny withdrawals — all without legal accountability.

Final Assessment — Avoid at All Costs

Based on regulatory warnings, mismatch between marketed claims and public records, and independent risk profiles:

ApexFXGroup.com is not a reliable or trustworthy trading platform.

-

It is not authorised by reputable financial regulators, like the FCA in the UK.

-

It uses misleading marketing that contradicts its real licensing status.

-

It exposes users to high levels of risk with no legal safeguards.

There are numerous regulated brokers globally with transparent compliance frameworks that safeguard client funds and respect legal standards. Choosing one of those alternatives — rather than an unregulated platform like ApexFXGroup.com — is essential for responsible investing and financial security.

Proceed with caution, prioritise platforms that can prove their regulatory legitimacy, and always verify broker registration with official regulator databases before depositing funds.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to apexfxgroup.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as apexfxgroup.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.