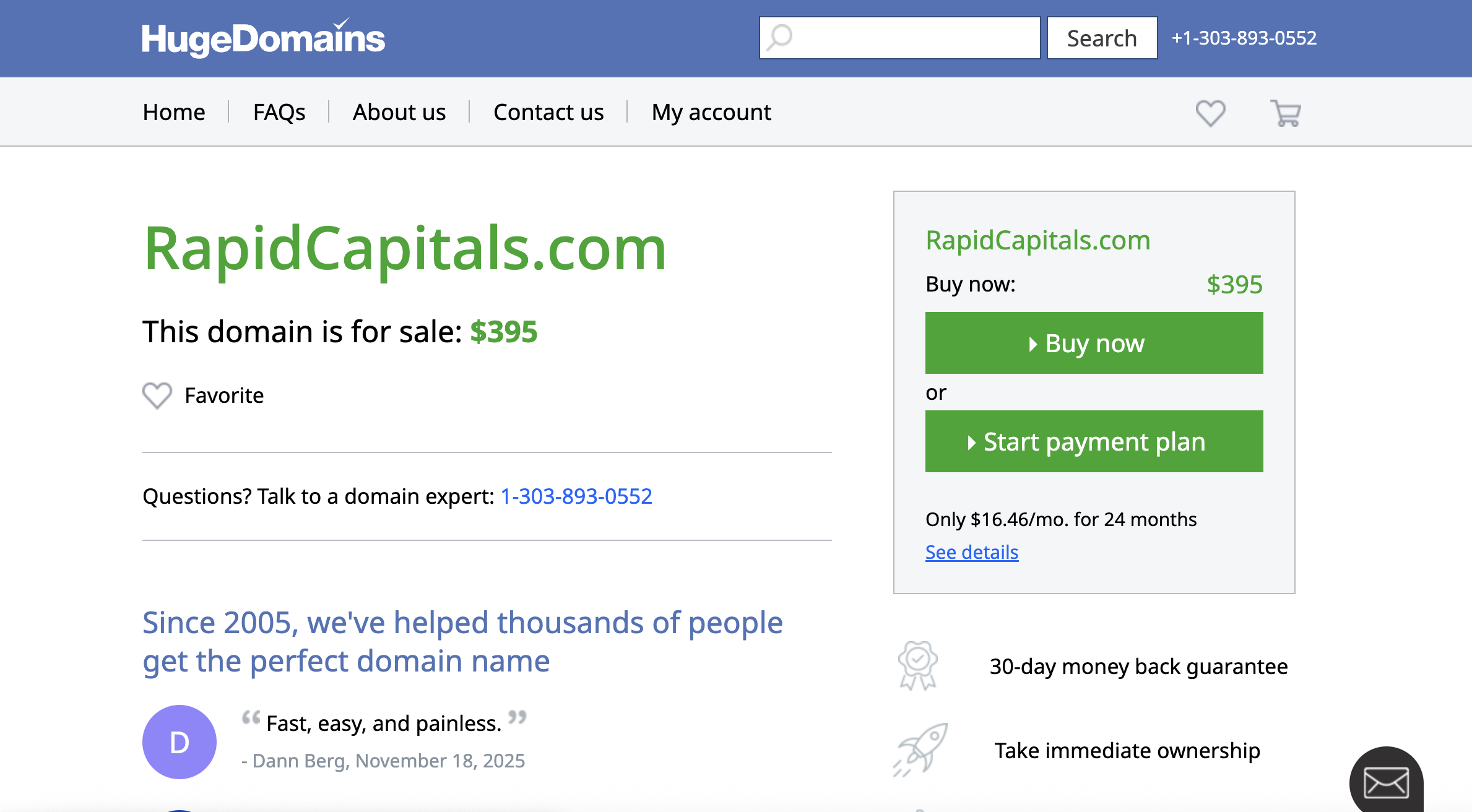

apidCapitals.com Fraud Review – What Investors Must Know First

Online trading platforms promise users convenience, speed, and access to global financial markets. However, not every website offering these services is genuinely committed to transparent and legitimate trading. RapidCapitals.com is one such platform that has recently caught the attention of many traders due to alarming behavior, unclear ownership, and a pattern of misconduct. This review takes a thorough look at RapidCapitals.com, examining its claims, platform structure, credibility problems, and the red flags that strongly suggest users should avoid it.

Overview of RapidCapitals.com

RapidCapitals.com presents itself as an accessible online trading platform that provides forex, cryptocurrency, commodities, stocks, and market analysis tools. At first glance, it appears modern and well-designed, with descriptions of advanced trading features and promises of high returns. However, as with many unregulated trading platforms, the outward appearance does not reflect what users actually experience.

The platform focuses heavily on attracting beginners with claims of simplicity, flexibility, and guaranteed profitability. These promises should already raise suspicion, as financial markets carry inherent risks, and no legitimate broker guarantees profits.

A closer look reveals a pattern of misleading statements, concealment of essential company details, and operational tactics that mirror those used by fraudulent brokers.

Lack of Regulatory Oversight

The most concerning aspect of RapidCapitals.com is the total absence of regulatory licensing. Any legitimate trading platform must be regulated by a recognized financial authority, depending on where it operates. These regulators require transparency, security protocols, client fund protection, and regular audits.

RapidCapitals.com:

-

Does not list any regulatory body.

-

Provides no registration number.

-

Does not disclose the jurisdiction it supposedly operates under.

-

Offers vague contact details without a verifiable physical address.

This alone is a significant red flag. Unregulated platforms operate without accountability, meaning clients have no legal protection if something goes wrong. Funds deposited into such platforms can be mismanaged, frozen, or completely lost—conditions that legitimate regulators exist to prevent.

Anonymous Ownership and Company Background Issues

Transparency is a hallmark of any legitimate financial institution. Yet RapidCapitals.com hides almost everything about who owns or runs the platform.

Typical concerns include:

-

No information about the founders or management team.

-

No corporate documentation or operational history.

-

No clear disclosure of where the company is located.

-

No employee or team profiles to validate its operations.

Anonymous ownership is extremely suspicious. Fraudulent trading platforms often avoid giving verifiable information because it allows them to disappear easily once complaints or regulatory pressure increases.

Too-Good-To-Be-True Profit Claims

RapidCapitals.com consistently markets unrealistic earning potential. It promotes high profitability through online trading but fails to address the real risks involved. Some common red flag claims include:

-

“Guaranteed returns”

-

“High profits with minimal risk”

-

“Fully automated strategies that always win”

-

“Fast withdrawal and instant profit growth”

These kinds of promises contradict the very nature of financial markets. Legitimate brokers never make such guarantees because markets are inherently unpredictable. Platforms that make these claims typically aim to lure inexperienced traders who do not fully understand trading risks.

Suspicious Account Types and Trading Conditions

Another concerning aspect is the way RapidCapitals.com structures its account tiers. Many unregulated brokers push users into upgrading to higher account packages, each requiring a substantial deposit.

Common characteristics of questionable account setups include:

-

High minimum deposits

-

Pressure from account managers to deposit more

-

Promises of better returns with higher-tier accounts

-

Poor or unclear explanation of trading conditions

-

No guarantee of segregated client funds

Users often report they are encouraged to deposit more without any proper justification. As deposit amounts increase, communication from the platform tends to decrease—another tactic commonly used by scam platforms.

Manipulated Trading Interface

Several users have noted suspicious behavior within the trading interface. While these claims can vary, many fraudulent brokers use manipulated software to create an illusion of successful trades, especially early on.

Potential issues:

-

Fake profit displays

-

Artificially delayed charts

-

Inflated account balances

-

Trades that do not match real market conditions

-

Sudden unexplained losses after requesting a withdrawal

This creates a scenario where the user believes they are making progress until they attempt to withdraw funds.

Withdrawal Problems and Delayed Payments

A recurring issue with RapidCapitals.com is withdrawal blockage. Many scam brokers follow this pattern:

-

They accept deposits immediately.

-

They show supposed “profits” in the user dashboard.

-

When the user tries to withdraw funds, delays begin.

Users commonly experience:

-

Repeated document requests that never lead to approval

-

Additional fees demanded before withdrawal

-

Claims that accounts must be “verified”

-

Forced account upgrades

-

Unsupported excuses for delays

Eventually, communication slows or disappears entirely. This tactic aims to keep users from retrieving their money while making it appear like a legitimate process.

Poor Customer Support Quality

Another indicator of RapidCapitals.com’s illegitimacy is the lack of proper customer support. While the platform may advertise 24/7 assistance, real user experiences suggest otherwise.

Typical issues include:

-

Automated responses instead of real support

-

No replies to important inquiries

-

Aggressive sales tactics from account managers

-

Support agents that disappear after deposits are made

Fraudulent brokers typically prioritize communication only when convincing users to deposit more. Once a user asks difficult questions or requests a withdrawal, support becomes unhelpful or stops responding.

Negative User Experiences and Complaints

Although RapidCapitals.com tries to present itself as a thriving trading platform, numerous online reviews and user feedback tell a different story. Common complaints include:

-

Inability to withdraw funds

-

Misleading profit claims

-

Aggressive pressure from “account managers”

-

Fabricated trading results

-

Lack of transparency about who runs the platform

-

Requests for additional deposits to unlock withdrawals

These patterns align closely with behaviors seen in many online trading scams.

Final Verdict – Is RapidCapitals.com a Scam?

Based on the evidence, RapidCapitals.com shows numerous warning signs that indicate it is not a legitimate trading platform. The lack of regulatory oversight, hidden ownership, unrealistic promises, unethical account practices, and consistent reports of withdrawal issues all point to a high-risk environment.

A reliable broker must be transparent, licensed, and accountable. RapidCapitals.com fails on every one of these fronts.

Users should avoid investing or depositing money into this platform.

Report. Rapidcapitals.com And Recover Your Funds

-

If you have lost money to rapidcapitals.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like rapidcapitals.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.