AquillaFX Scam Review – Comprehensive Breakdown

1. Regulatory Action from CONSOB (Italy’s Securities Watchdog)

On October 3–4, 2024, Italy’s regulator CONSOB officially ordered the blocking of the AquillaFX website(aquillafx.com and client.aquillafx.com) for offering financial services without authorization. This blacklisting is not symbolic—it confirms the platform operates illegally under Italian law and deprives users of any legal protection. ([turn0search2]/[turn0search1])

2. No Regulation in Any Jurisdiction

While the site claims to operate under the name Aquilla Nummus Ltd and asserts regulation by CySEC (Cyprus) or CONSOB, there is absolutely no verifiable record of such authorization. CySEC License 345/17 belongs to aquillanummus.com, not aquillafx.com. None of the leading regulators—the FCA (UK), CySEC, ASIC (Australia), FINMA (Switzerland), or CONSOB—list this platform as regulated. ([turn0search3]/[turn0search11])

3. Anonymous Ownership & Highly Suspicious Web Infrastructure

-

The domain is recently registered (April 2024) and WHOIS ownership is completely hidden behind privacy services.

-

Scam tracking tools like Scamminder assign it a near-zero trust score, citing “anonymous website,” “hidden WHOIS,” and generic Cloudflare hosting. ([turn0search0])

-

The site uses stock images, fabricated staff profiles, and generic page layouts—traits typical of scam infrastructure. ([turn0search3]/[turn0search0])

4. Misleading Claims & Fake Testimonials

AquillaFX uses fabricated testimonials and unverified staff bios to create the illusion of legitimacy. Reviews note overblown promises—mentioning “world‑class trading platforms” or zero-commission accounts—without any supporting documentation or proof of actual trading volume. Risk disclaimers are generic and vague, a red flag for manipulation. ([turn0search3]/[turn0search0])

5. Scam Workflow Aligns with Known Fraud Tactics

Several reviews describe how the platform operates as a classic “pig‑butchering” scheme:

-

Aggressive outreach via calls or emails to entice depositors.

-

Small initial deposits are accepted, with a fake platform balance showing profit.

-

Upselling to higher account tiers requiring additional crew.

-

Withdrawal requests blocked or delayed, with bogus verification, tax, or processing fees.

-

Accounts eventually freeze, the platform disappears, and communication ceases. ([turn0search3])

6. Confirmed Complaint Sources

-

WikiInvest (warning resource) labels AquillaFX as “dangerous and highly risky,” citing fake regulatory claims and negative user feedback. ([turn0search3])

-

Personal-Reviews.com classifies it as a scam, emphasizing cloner behavior and lack of regulation. ([turn0search10])

-

Lycan Retrieve’s analysis also names AquillaFX as unregulated, referencing widespread withdrawal issues, delays, and user deception. ([turn0search6])

7. Withdrawal & Fund Security Red Flags

No protection mechanisms exist—no segregated client accounts, no negative balance protection, no regulatory insurance. The platform may claim funds are held in Tier‑1 banks, but there is no proof of third‑party audit or banking partner relationships. Most review platforms report users being unable to withdraw amounts—even small ones—without paying additional unexplained fees. ([turn0search11]/[turn0search9])

8. Pressure Tactics & Emotional Manipulation

Victim testimonials describe common themes:

-

Gloating account managers offering doubling of deposits.

-

Urgency messaging: “limited offer,” “today only,” etc.

-

“Retention agents” or senior brokers coaxing users to send more money when profits appear.

-

Isolation: Once a withdrawal is requested, support disappears.

These techniques correlate exactly with fraud methods outlined by ethical fraud-prevention researchers. ([turn0search10]/[turn0search3])

9. Infrastructure Designed to Disappear

-

The domain uses Cloudflare to hide server IPs.

-

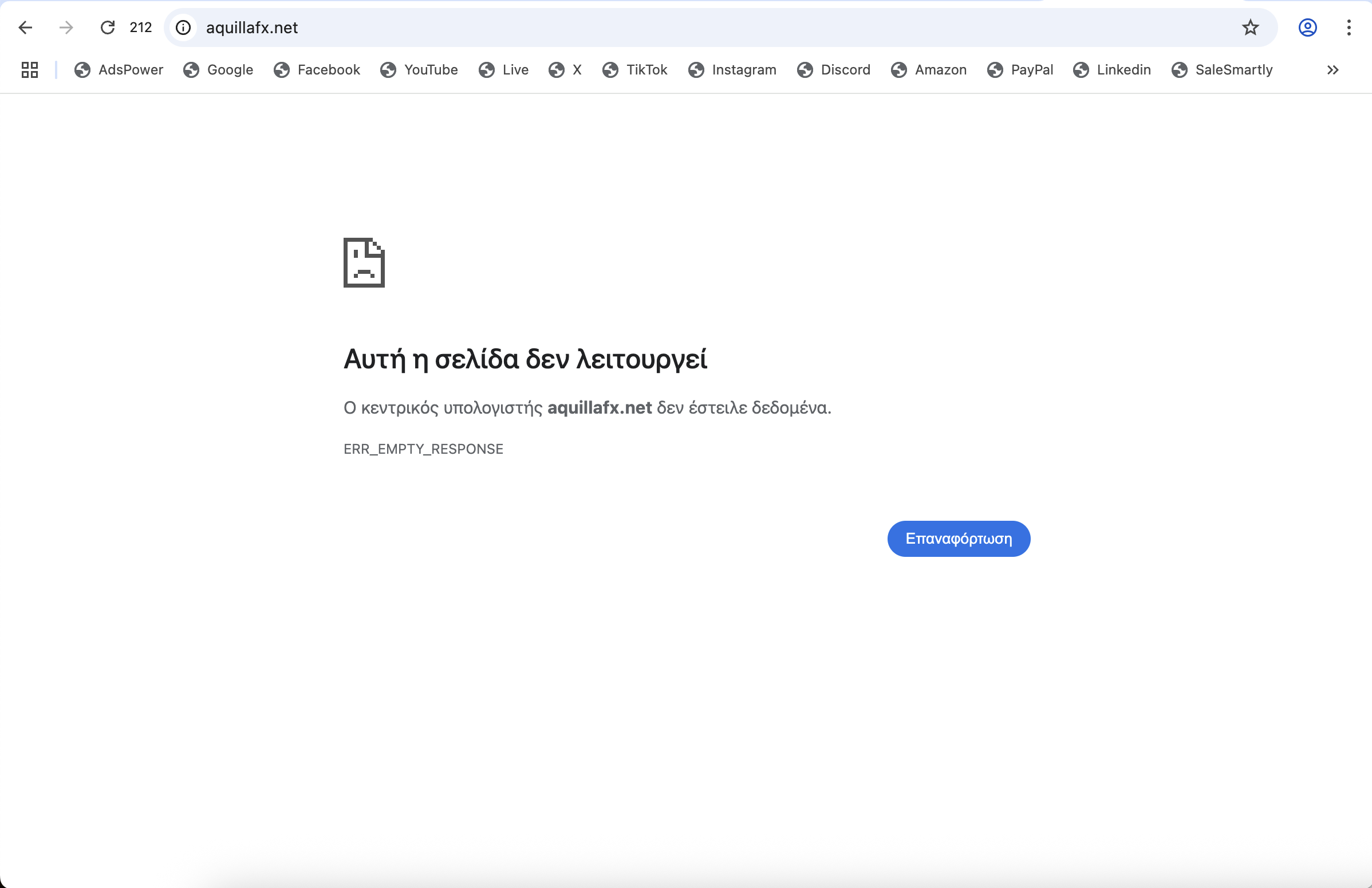

Registration was recent and the site now appears offline or unreachable in several cases.

-

Many reviews confirm AquillaFX disappears shortly after complaints escalate.

This setup is typical for platforms designed to vanish once trust is compromised. ([turn0search7])

10. Summary of Core Red Flags

| Warning Signal | What It Implies |

|---|---|

| Blacklisted by CONSOB | Illegal, unregulated operation in EU market |

| Hidden ownership & new domain | No accountability, potential for easy platform abandonment |

| False regulatory claims | Deceptive portrayal of legitimacy |

| Fake testimonials & staff bios | Misleading marketing to build unwarranted trust |

| Aggressive upselling and withdrawal blocks | Designed to extract maximum funds |

| Lack of verifiable banking or audit trail | No traceable infrastructure or compliance |

| Community warnings and poor trust scores | Consensus of scam behavior across multiple sources |

11. Why Consumers Should Avoid All Interaction

Even reaching out to this platform or providing personal data poses risk. As an unregulated entity, users are exposed to:

-

Potential financial loss.

-

Identity theft through KYC or document submission.

-

No lawful recourse or compensation if funds vanish.

-

Emotional distress from deception and false hope.

Legitimate financial platforms provide transparency; AquillaFX provides none.

12. Final Verdict: Capital Gate to Scam Warning

AquillaFX (aquillafx.net / com) is a fraudulent, unlicensed platform masquerading as a legitimate broker. It:

-

Was officially blocked by a national regulator.

-

Offers false regulatory claims.

-

Features opaque ownership and misleading content.

-

Pressures users into escalating deposits.

-

Obstructs withdrawals via fabricated fees.

-

Emerges with widely documented complaints.

Engaging with AquillaFX carries real risk—avoid at all costs.

Conclusion

In today’s saturated online investment world, only platforms backed by verifiable regulation, transparent structures, audited operations, and reliable user feedback deserve trust. AquillaFX has none of these. Instead, it fits every known disguise of a high-risk scam.

Protect yourself: do not provide any funds or information. Do not engage with any offers. And treat AquillaFX as a scam, not a broker.

Stay alert. Stay skeptical. Avoid AquillaFX.

-

Report Aquillafx.net And Recover Your Funds

If you have lost money to aquillafx.net, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like aquillafx.net continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.