Arotrade.com Exposed – Why Traders Call It a Scam

When it comes to online trading, the promise of quick profits and simple platforms attracts thousands of investors every year. Unfortunately, the rise of trading platforms has also given way to a surge in scams and unregulated brokers. One name that has come under heavy scrutiny is Arotrade.com.

In this review, we will take a closer look at the broker, how it presents itself, the tactics it uses to lure unsuspecting traders, the common complaints from users, and the red flags that make it clear why Arotrade.com is not a trustworthy broker.

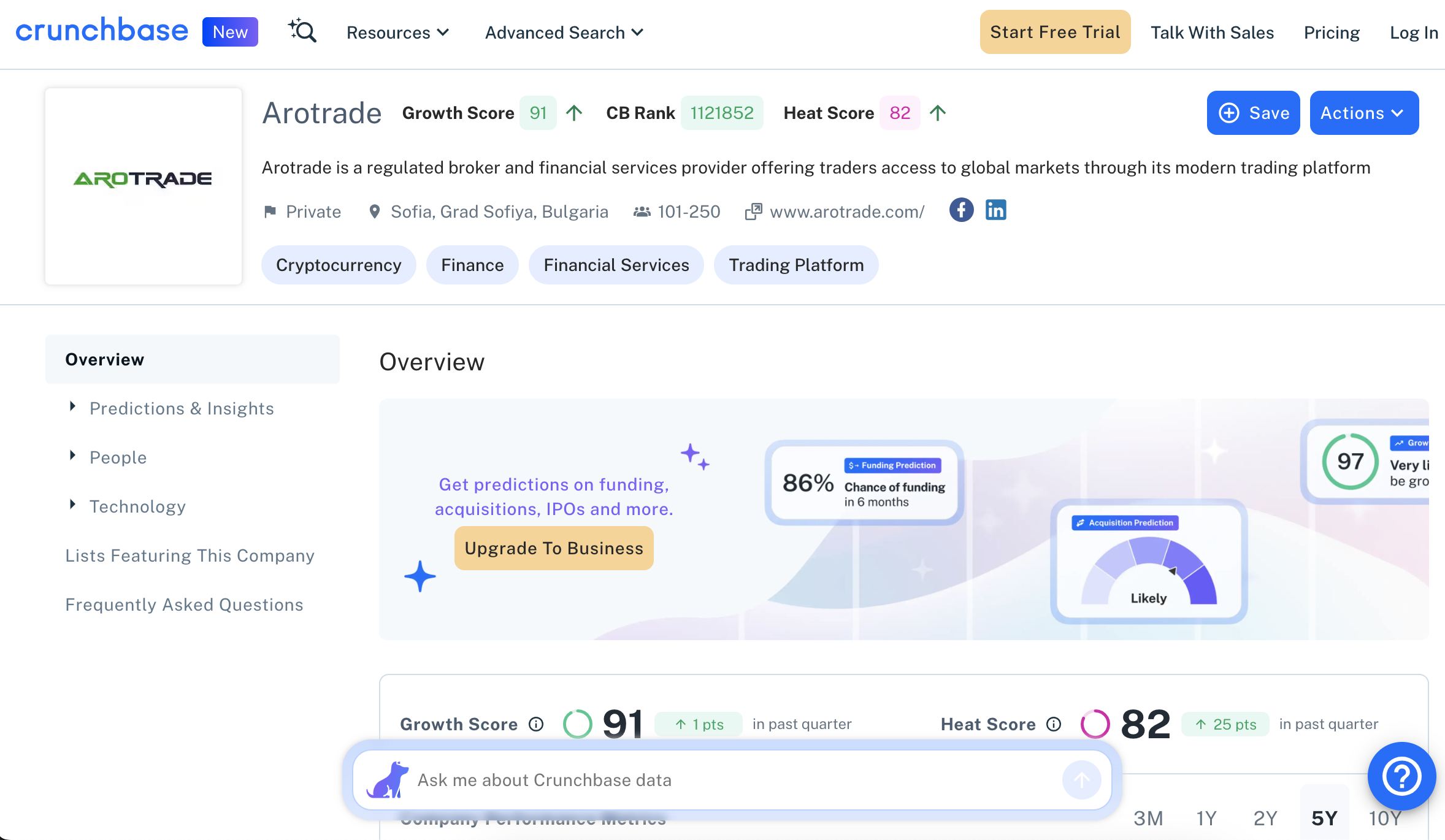

What Is Arotrade.com?

Arotrade.com presents itself as a global online trading platform offering access to forex, stocks, commodities, indices, and cryptocurrencies. On the surface, the website appears professional and user-friendly. It promises modern trading tools, educational resources, and “fast withdrawals.”

At first glance, it may seem like just another broker trying to compete in a crowded industry. However, behind the polished front, Arotrade.com operates in ways that raise serious questions about its legitimacy.

The Allure of Arotrade

Like many questionable brokers, Arotrade.com knows how to appeal to new traders. The website is full of buzzwords like “secure trading,” “award-winning platform,” and “unlimited opportunities.”

Some of the common selling points include:

-

Low barriers to entry: Claims of allowing trading accounts to be opened with small deposits.

-

Wide asset selection: Promises of access to forex, cryptocurrencies, and global markets.

-

Educational material: Offers of e-books, webinars, and trading guides to attract beginners.

-

Bonuses and incentives: Promotional offers designed to get users to deposit quickly.

These features are commonly advertised by unregulated brokers. They are crafted to build trust quickly and convince people that they are dealing with a legitimate financial company.

Red Flags With Arotrade.com

While the platform’s marketing is designed to impress, a closer inspection reveals multiple red flags that indicate Arotrade.com is not a safe place for traders.

1. Lack of Regulation

One of the most significant warning signs is the lack of credible regulation. A legitimate broker must be registered with recognized financial authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

Arotrade.com does not appear to be licensed by any top-tier regulator. This means there is no oversight, no accountability, and no protection for clients’ funds.

2. Vague Company Information

Reputable brokers are transparent about who they are. They provide company registration details, office locations, and corporate history. Arotrade.com is vague in this regard. In many cases, the broker hides behind shell companies or operates from offshore jurisdictions where financial regulations are weak.

3. Over-the-Top Promises

Any trading platform that guarantees profits or suggests that success is easy should be viewed with suspicion. Arotrade.com’s marketing often leans heavily on unrealistic claims that appeal to inexperienced traders.

4. Aggressive Sales Tactics

Many users have reported being bombarded with phone calls and emails from Arotrade representatives. These calls often pressure users to deposit more money quickly, using tactics such as:

-

Promises of “exclusive opportunities.”

-

Urgency (“markets are moving fast; you must act now”).

-

Insinuations that more deposits will lead to better returns.

5. Withdrawal Issues

Perhaps the most common complaint is the difficulty or impossibility of withdrawing funds. Traders have reported that once money is deposited, the broker creates endless excuses to delay or deny withdrawals. Some users have even claimed that accounts were suddenly closed after repeated withdrawal requests.

How the Scam Typically Works

Understanding the mechanics of scams like Arotrade.com helps potential victims see the warning signs early. The typical pattern is as follows:

-

Initial Contact – Potential traders often encounter Arotrade through flashy online ads, social media promotions, or cold calls.

-

Easy Account Setup – The platform allows new users to register with little verification, encouraging quick deposits.

-

First Deposit – Victims are encouraged to deposit a small amount, usually a few hundred dollars. Initial trades may even appear successful to build trust.

-

Pressure to Deposit More – Once hooked, users receive frequent calls and emails pushing them to invest larger sums.

-

Fake Profits – The platform may show fabricated profits on the trading dashboard, convincing users to invest even more.

-

Blocked Withdrawals – When the user attempts to withdraw funds, delays and excuses begin. Eventually, the withdrawal is denied, and communication may stop altogether.

This cycle is a hallmark of unregulated brokers and is the core reason why Arotrade.com is labeled a scam by so many who have encountered it.

Common Complaints From Traders

Across forums and user review sites, certain themes appear repeatedly in complaints about Arotrade.com:

-

Unable to withdraw funds despite multiple requests.

-

High-pressure tactics from “account managers.”

-

Unexpected fees or hidden charges.

-

Platform manipulation—trades closing automatically or showing false results.

-

Customer service ignoring messages once withdrawals are requested.

These patterns are consistent with fraudulent platforms rather than legitimate trading brokers.

Why People Fall for Arotrade

The sad reality is that platforms like Arotrade.com are effective at drawing in victims. Here’s why many people end up falling for the scam:

-

Professional-looking website: The sleek design gives the illusion of credibility.

-

Emotional appeal: Phrases like “financial freedom” or “quit your 9-to-5 job” prey on hopes and dreams.

-

Fake testimonials: Many of these platforms feature glowing reviews that are fabricated.

-

Information overload: For new traders, the abundance of terms and charts can create a sense of legitimacy.

-

Fear of missing out (FOMO): Aggressive marketing makes people feel they’ll miss out on life-changing opportunities if they don’t act immediately.

Lessons to Learn From Arotrade.com

The rise and fall of Arotrade.com should serve as a cautionary tale for anyone interested in online trading. Here are key lessons to take away:

1. Always Verify Regulation

Never deposit money with a broker unless they are regulated by a respected financial authority. Regulators enforce strict rules that protect investors and ensure brokers act transparently.

2. Be Wary of Aggressive Sales Tactics

Legitimate brokers do not need to hound clients with phone calls or pressure them to deposit more. If you feel pushed into making financial decisions, that’s a major red flag.

3. Avoid “Too Good to Be True” Promises

There are no guaranteed profits in trading. Any broker making such claims is not operating honestly.

4. Do Your Research

Before signing up, read reviews from multiple independent sources. If you find numerous complaints of fraud or withdrawal problems, stay away.

5. Protect Your Information

Scam brokers often ask for sensitive personal information that can later be misused. Always be careful about what details you share online.

The Bigger Picture

Arotrade.com is not an isolated case. The online trading world has become a breeding ground for scams, particularly targeting inexperienced retail investors. These scams exploit the growing popularity of forex and cryptocurrency trading.

Governments and regulators continue to warn investors about unlicensed brokers, but the responsibility also falls on individuals to stay informed and cautious.

Final Thoughts

Arotrade.com markets itself as a gateway to financial freedom, but in reality, it operates like many other unregulated trading scams. With vague company details, no proper regulation, high-pressure sales tactics, and a trail of unhappy customers who report lost funds, the platform shows all the hallmarks of a fraudulent operation.

For anyone considering online trading, Arotrade.com is a name best avoided. Instead, traders should focus on platforms that are fully licensed, transparent, and accountable. While the dream of easy profits is tempting, protecting your money should always come first.

-

Report. Arotrade.com And Recover Your Funds

If you have lost money to arotrade.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like arotrade.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.