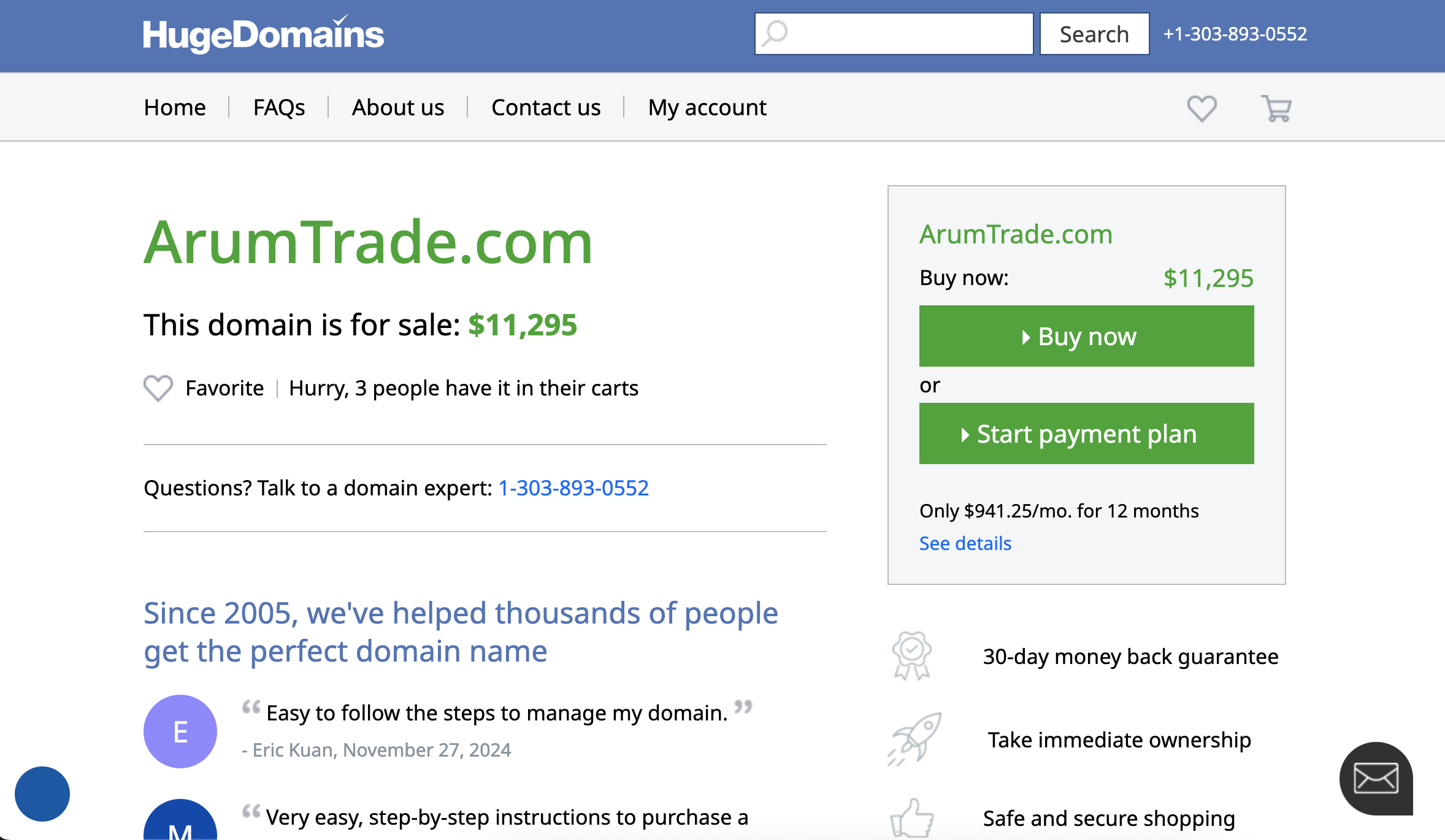

Arumtrade.com Review – Warning Signs of a Scam Broker

Online trading has grown rapidly in recent years, offering opportunities in forex, cryptocurrencies, commodities, and stocks. Unfortunately, the growth of digital investing has also led to an increase in fraudulent trading platforms. One name that has surfaced repeatedly in complaints is Arumtrade.com.

This review takes an in-depth look at Arumtrade.com, exposing the red flags, the methods used to lure investors, and why this broker is widely considered a scam.

First Impressions of Arumtrade.com

At a glance, Arumtrade.com looks like a professional trading platform. Its website has a sleek design, with claims of advanced trading tools, expert support, and guaranteed profits. To the untrained eye, it might appear to be a legitimate brokerage.

But appearances can be deceiving. Behind the polished graphics and bold claims lies a broker that raises more questions than it answers. The lack of transparency, questionable practices, and repeated reports of blocked withdrawals make Arumtrade.com a platform to avoid.

Lack of Regulation and Licensing

The first and most important red flag is the absence of proper regulation. Any legitimate trading broker must be licensed by recognized financial authorities such as:

-

The Financial Conduct Authority (FCA) in the UK

-

The Australian Securities and Investments Commission (ASIC)

-

The Cyprus Securities and Exchange Commission (CySEC)

-

The Commodity Futures Trading Commission (CFTC) in the US

These regulators enforce strict standards, require brokers to segregate client funds, and provide oversight to protect investors.

Arumtrade.com, however, does not provide proof of being regulated by any recognized authority. Claims of registration are vague or unverifiable. Without regulation, there is no oversight or protection, leaving investors fully exposed to the platform’s actions.

Too-Good-to-Be-True Promises

One of the clearest signs of a scam is the promise of guaranteed profits. Arumtrade.com promotes itself with phrases suggesting risk-free investments, fast returns, and extraordinary profits.

In reality, financial trading always involves risk. Even the most skilled traders cannot guarantee profits. Any broker promising otherwise is being deceptive and is likely manipulating potential clients into depositing money.

Aggressive Marketing Tactics

Victims of Arumtrade.com often report receiving persistent phone calls and emails from so-called “account managers.” These representatives use high-pressure tactics to push individuals into depositing funds.

Common tactics include:

-

Suggesting a limited-time investment opportunity

-

Claiming that delay will result in missed profits

-

Offering “bonus credits” if the investor deposits immediately

These psychological tricks are designed to create urgency and prevent investors from carefully evaluating the risks.

Fake Trading Platforms

Scam brokers often use manipulated trading platforms to give the illusion of profits. Victims report that their accounts on Arumtrade.com appeared to be growing quickly at first, showing impressive returns.

However, these numbers are usually fabricated. When traders attempt to withdraw funds, they face obstacles, delays, or outright refusals. The apparent profits are nothing more than digital numbers designed to keep people depositing more money.

The Withdrawal Problem

Perhaps the most damaging sign of fraud is the difficulty in withdrawing funds.

Many investors report that:

-

Withdrawal requests are delayed indefinitely.

-

Additional fees or taxes are demanded before funds can be released.

-

Customer service stops responding once larger amounts are requested.

-

Accounts are suddenly frozen when users attempt to cash out.

A legitimate broker will always allow withdrawals quickly and transparently. Arumtrade.com’s refusal to do so confirms that it operates dishonestly.

Fake Testimonials and Reviews

Another tactic used by Arumtrade.com is the use of fake testimonials. Their website and promotional materials often include fabricated success stories from supposed investors who claim to have made life-changing profits.

In reality, these testimonials are not linked to real people. They are marketing tricks designed to build false trust. Independent reviews from real victims tell a very different story: loss of funds, unreturned withdrawals, and silence from the company once deposits are made.

Psychological Manipulation

Scam brokers rely heavily on psychological tricks to manipulate their victims. Arumtrade.com is no different. The most common techniques include:

-

Authority Bias: Claiming to be licensed or linked to financial experts.

-

Fear of Missing Out (FOMO): Suggesting that everyone else is profiting except the hesitant investor.

-

Reciprocity: Offering small bonuses to make the victim feel obligated to deposit more.

-

Scarcity Pressure: Warning that opportunities are limited in time or availability.

These methods exploit natural human emotions and can deceive even experienced individuals if they are not careful.

Anonymous Operations

Another red flag is the lack of transparency about who is behind Arumtrade.com. The website provides no clear information about company leadership, physical office locations, or verifiable contact details.

Legitimate brokers proudly display their regulatory numbers, office addresses, and executive teams. The anonymity of Arumtrade.com suggests a deliberate attempt to avoid accountability.

The Impact on Victims

The consequences of dealing with a scam broker can be devastating. Many individuals deposit small amounts at first, only to be convinced to deposit more as they see “profits” accumulate on the fake platform. By the time they realize they have been scammed, their losses can amount to thousands of dollars.

The emotional toll is equally damaging. Victims report feelings of betrayal, stress, and financial insecurity. For some, the loss represents years of savings wiped out in a matter of weeks.

Key Red Flags of Arumtrade.com

To summarize, here are the main warning signs that Arumtrade.com is a scam:

-

No proof of regulation or licensing

-

Unrealistic promises of guaranteed profits

-

Aggressive marketing and cold calls

-

Fake trading platforms showing fabricated results

-

Blocked or delayed withdrawals

-

Anonymous company background

-

Fake testimonials and reviews

Each of these factors alone would be concerning. Together, they paint a clear picture of a fraudulent operation.

Lessons to Learn

The Arumtrade.com case provides important lessons for anyone interested in online trading:

-

Always verify regulation. A legitimate broker will be listed on a regulator’s official website.

-

Be skeptical of guaranteed returns. Trading carries risks, and no one can eliminate them.

-

Research before investing. Independent reviews and forums can reveal patterns of fraud.

-

Test withdrawals early. Before depositing large sums, attempt a small withdrawal to confirm reliability.

-

Listen to your instincts. If something feels wrong, it usually is.

Safer Alternatives

While Arumtrade.com has proven itself to be untrustworthy, there are legitimate brokers available. A genuine broker will:

-

Hold a license from a recognized regulator

-

Be transparent about fees and conditions

-

Provide responsive customer support

-

Allow smooth and timely withdrawals

-

Display clear risk warnings about trading

Choosing such platforms provides far greater protection and peace of mind compared to unregulated operations.

Final Thoughts

Arumtrade.com is a textbook example of a scam broker. From fake promises and aggressive sales tactics to blocked withdrawals and fabricated testimonials, the evidence is overwhelming.

Anyone considering investing with this platform should reconsider immediately. Protecting your funds begins with due diligence, skepticism toward unrealistic offers, and a strong understanding of how scams operate.

In the end, education and awareness are the best defenses. By learning from cases like Arumtrade.com, investors can safeguard their hard-earned money and avoid becoming victims of similar fraudulent schemes.

-

Report. Arumtrade.com And Recover Your Funds

If you have lost money to arumtrade.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like arumtrade.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.