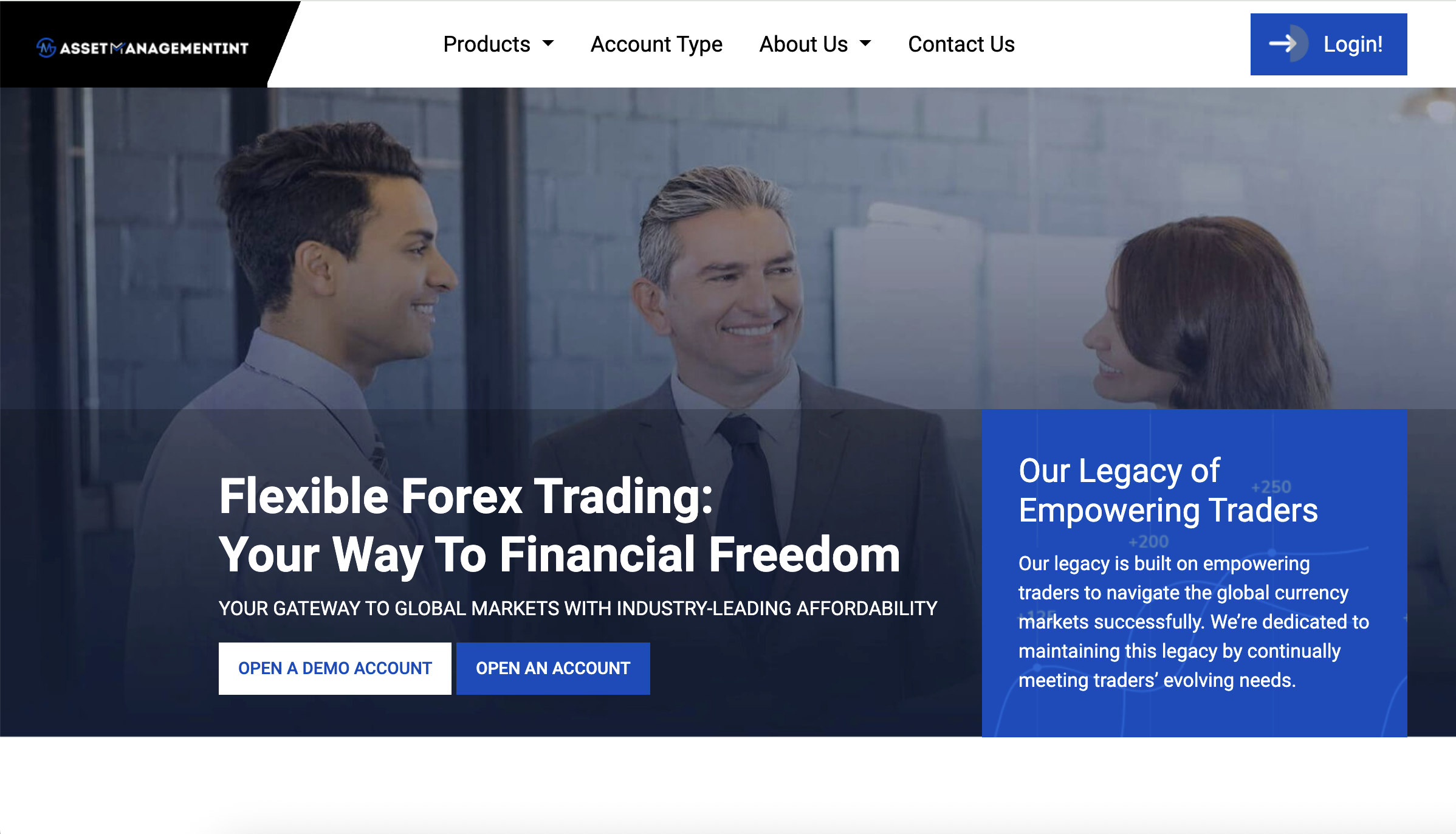

AssetManagementInt.com Review – A Thorough Investigation

In the increasingly complex universe of online investment platforms, AssetManagementInt.com has surfaced as a high‑risk operation masquerading as a legitimate asset manager. Claiming to provide crypto and forex trading services via “international” algorithms, the platform betrays almost every characteristic of a scam. Here’s why it should be avoided entirely.

1. Regulatory Blacklisting and Lack of Licensing

-

On April 10, 2025, Italy’s regulator CONSOB officially blacklisted Asset Management International Ltd, ordering authorities to block its operations in Italy for offering financial services illegally Reddit+9BrokersView+9Scam Detector+9.

-

Independent reviews from BrokersView classify the firm as unregulated—and likely a scam due to its failure to disclose legal incorporation or licensing details BrokersView.

In essence: no global financial authority recognizes or oversees this company, leaving users with zero consumer protection.

2. Opaque Corporate Identity

AssetManagementInt.com offers no real information about its legal structure, team, or physical location. Whois records are privacy‑protected, with no verifiable company registration information. BrokersView explicitly notes this total transparency absence as a major red flag ScamMinder.

This anonymity prevents any legal or practical accountability.

3. Suspicious Domain and Security Ratings

-

ScamDetector assigns this site one of its lowest possible trust scores (≈9 out of 100), tagging it as risky, untrustworthy, and dangerous based on proximity to suspicious sites, malware/spam flags, and domain ageMedium+14Scam Detector+14Reddit+14.

-

ScamDoc similarly rates it poorly (≈25%) and flags it as a newly created domain (October 2024), without identifiable ownership, and no user reviews—another hallmark of a likely scam operation Scamdoc.

-

Gridinsoft’s security assessment reflects high caution, citing suspicious content, AI‑generated text, and young domain registration as signs of risk Gridinsoft LLC.

4. Classic Fraud Mechanics Observed

Reviews of unregulated brokers—and platforms like this—highlight familiar scam tactics:

-

Automated outreach soliciting initial deposits under enticing offers or high returns.

-

Investment “advisors” or “account managers” working to build rapport, then escalating deposit pressure.

-

Simulated dashboards showing fake profits to build trust and prompt larger investments.

-

Layered excuse tactics when users request withdrawal—hidden fees, verification charges, or sudden policy “violations.”

-

Delays or outright refusal of payouts, especially after profits accumulate Medium+5Personal Reviews+5BrokersView+5.

These are all typical strategies identified with forex and crypto scams.

5. Public Reports Echo Scam Patterns

While fewer mainstream victim reports target AssetManagementInt.com specifically, Reddit commentary from other fraudulent investment schemes underscores the modus operandi:

“Very elaborate devious bitcoin scam… the perpetrators are 3 Hartnett, Yasmina and Catherine”Reddit+9Scam Detector+9Medium+9Reddit

This aligns with patterns of fraud groups operating under several front names, using personal contacts to advance persuasion—all in line with how AssetManagementInt appears to behave.

6. Psychological Manipulation and Escalation

AssetManagementInt.com leverages emotional bias and manipulation:

-

Greed and urgency through promised fast returns from crypto portfolios.

-

Social proof illusions in the form of glowing internal testimonials or fake performance reports.

-

Sunk-cost escalation, where early profits (simulated) lure users into deeper investment believing withdrawal is near.

-

Authority bias, using financial jargon or terms like “asset management,” despite no verified team or credentials.

7. Why It’s High Risk to Invest Here

| Issue | Why It’s Dangerous |

|---|---|

| No financial licensing or regulation | Funds are unprotected; no oversight or recourse |

| No corporate transparency | No link to a legitimate legal entity |

| Very low digital trust and security scores | Site likely unsafe or fraudulent |

| Scam tactics documented by reviews | Matches ransomware/pig‑butchering fraud patterns |

| Anonymous domain; no user verification | Risk of phishing or credential theft |

8. Consequences Witnessed with Similar Platforms

Users typically report:

-

Funds disappearing after withdrawal requests.

-

Long delays followed by vague emails or phone calls demanding more deposits.

-

Sudden “account blocking” once users question or attempt to withdraw.

-

Platform disappearing to a new domain, leaving users without contact.

These mirror exactly what is known about AssetManagementInt.com and similar unregulated brokers.

9. No Credible Trading Technology or Proof

Despite claims of global asset management, algorithmic trading tools, or proprietary investment systems, AssetManagementInt.com delivers zero legitimate proofs—no whitepapers, no audit trails, no verified trading history, no public reviews outside its own site. This is symptomatic of fraud that relies on buzzwords, not verifiable substance.

10. Final Assessment & Call to Stay Away

AssetManagementInt.com is best classified as a scam platform. Its operation is built on anonymity, lack of regulation, psychological manipulation, and technology illusions without substance. If depositors face withdrawal requests, they’ll likely meet delays, excuses, or vanished access entirely.

Investing with such a site is essentially giving money to an opaque entity with no justification, no oversight, and no accountability.

Conclusion

AssetManagementInt.com (Asset Management International Ltd) embodies nearly every warning sign of an online financial scam:

-

Fully blacklisted by CONSOB for unauthorized operations.

-

Operates without licensing or identity clarity.

-

Scored extremely low on trust, security, and transparency by independent analysis.

-

Exhibits common scam behaviors: outreach, simulated profits, withdrawal barriers.

-

No verifiable proof of operation, team, or system.

If you’ve encountered this platform—registered, shared personal data, or considered investing—the safest action is to disengage entirely. There are no protections, no ways to verify performance, and high likelihood the entire operation exists only to take deposits.

Stay informed. Stay cautious. And avoid AssetManagementInt.com completely.

-

Report Assetmanagementint.com And Recover Your Funds

If you have lost money to assetmanagementint.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like assetmanagementint.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.