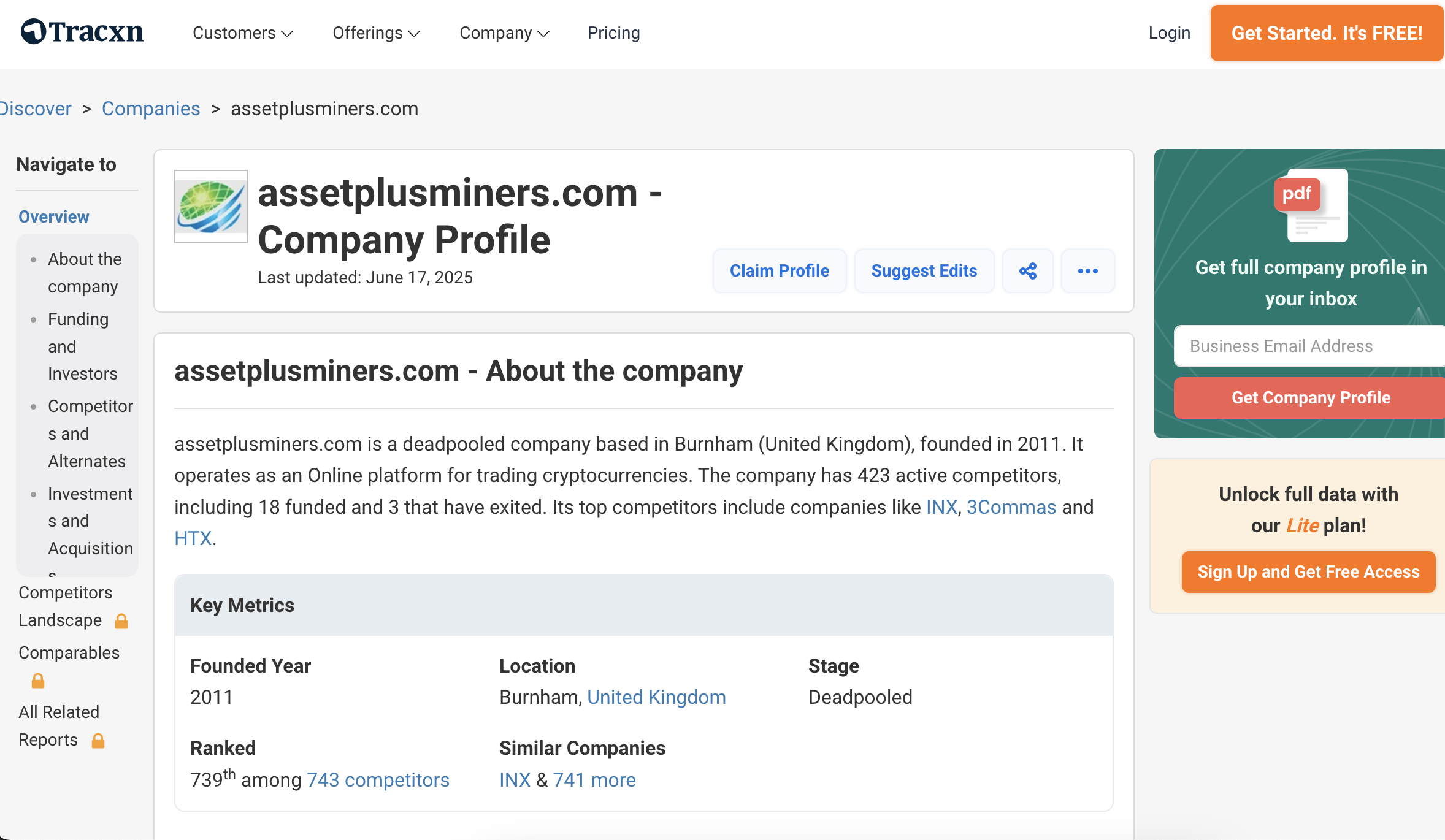

AssetPlusMiners.com Review – Is It Legit or Just Another Trap?

The internet has opened up endless opportunities to invest, trade, and earn money online. Cryptocurrency in particular has created a gold rush of new platforms promising quick profits and simple access to mining or trading services. But as with every boom, scams have followed closely behind. One platform raising questions is AssetPlusMiners.com, which advertises itself as a cloud mining and crypto investment provider.

At first glance, the promises sound attractive: automated income, simple deposits, and guaranteed returns. But once you scratch the surface, the picture looks much darker. In this post, we’ll dig into what AssetPlusMiners claims, what users have experienced, and the red flags that suggest it may not be what it seems.

What AssetPlusMiners Claims to Offer

The platform presents itself as a professional cryptocurrency mining and trading service. Some of its core promises include:

-

Automated mining systems with steady returns.

-

Crypto trading bots that take advantage of market inefficiencies.

-

Investment packages where customers can choose a plan and supposedly earn profits daily or weekly.

-

Simple sign-up and a low barrier to entry, making it look accessible to beginners.

The marketing emphasizes convenience, profit guarantees, and the idea that users don’t need to understand crypto technology deeply to make money.

The Reality Behind the Promises

When examining AssetPlusMiners more carefully, the glitter starts to fade. Multiple factors raise serious concerns:

-

Anonymous Ownership

The people or companies running the site are hidden behind privacy shields. There’s no verifiable business registration, physical office address, or accountable leadership. Without transparency, there is no one to hold responsible if things go wrong. -

Recently Registered Domain

Scam operations often launch under fresh domains. A young website with no long-standing track record in finance or crypto is far less trustworthy than an established broker or mining provider. -

Unrealistic Returns

Promises of guaranteed profits or very high returns are a major red flag. In real investing, especially in the volatile world of crypto, there are no guaranteed outcomes. Legitimate platforms are careful to stress risk, not deny it. -

Withdrawal Problems

Many users have reported difficulties getting their money out. Typical complaints include withdrawals being blocked, delayed, or made conditional on depositing even more money to “unlock” funds. This is a classic hallmark of fraudulent platforms. -

Hidden or Additional Fees

Some reports suggest investors are told they must pay special “verification fees,” “licenses,” or “taxes” before their funds can be released. This tactic is widely used by scammers to squeeze more money from victims.

User Experiences and Complaints

A pattern of complaints repeats itself across various user feedback channels:

-

Initial Smooth Sailing: New users sometimes receive small withdrawals or bonuses at the start. This helps build trust and encourages larger deposits.

-

Pressure to Deposit More: Once initial funds are invested, platform representatives or automated messages may push for upgrades to higher packages, claiming larger returns are just around the corner.

-

Blocked Withdrawals: As soon as a user tries to withdraw substantial funds, obstacles appear—such as needing to verify accounts with extra payments, or unexplained “system errors.”

-

Disappearing Support: Communication tends to dry up once withdrawal issues begin. Emails go unanswered, live chats stop responding, and account managers vanish.

These are classic scam behaviors where the scheme operates smoothly until it’s time to pay out real profits.

Website and Technical Concerns

Looking at the website itself reveals further warning signs:

-

Generic Templates: The site design and text often resemble cookie-cutter layouts reused by many other known scam platforms.

-

Poor Quality Content: Spelling errors, vague descriptions, and inconsistent terms hint at a lack of professionalism.

-

No Regulatory Oversight: There is no mention of licensing by any recognized financial authority. Legitimate investment platforms highlight their registration numbers and regulators clearly.

-

Security Inconsistencies: Some versions of the site may lack proper encryption or have broken links, suggesting little care for user protection.

Why These Red Flags Matter

On their own, one or two of these issues might not prove fraud. But when they appear together, they create a strong case for caution. Anonymous ownership, unrealistic promises, withdrawal complaints, and a lack of transparency are exactly the ingredients found in many confirmed scam platforms.

For an investor, the risks are huge. Without a regulator or identified owners, there is no legal safety net. If funds vanish, there’s no guarantee of getting them back. Even if a few users report success, the long-term pattern overwhelmingly points to loss.

Common Tactics Used by Platforms Like AssetPlusMiners

Understanding the tricks can help you spot scams faster. AssetPlusMiners seems to use many of these familiar tactics:

-

High Returns with Low Effort

The idea that you can get daily profits with no knowledge of crypto trading or mining is appealing—but unrealistic. -

Early Small Payouts

Some users get small withdrawals at first, encouraging them to deposit more. But once the amounts grow, the problems begin. -

Fake Social Proof

Positive reviews and testimonials may be fabricated to create a false sense of security. -

Urgency and Pressure

Emails or messages often create a sense of urgency—limited offers, “last chance” promotions, or time-sensitive bonuses. -

Fee Traps

Demands for extra payments to release funds are designed to exploit hope and desperation.

Lessons Investors Can Learn

The AssetPlusMiners case highlights key lessons for anyone considering online investment platforms:

-

Research First: Always check the background of a company before depositing money. Look for licenses, addresses, and long track records.

-

Avoid Guarantees: Any service that guarantees profits, especially high ones, is almost certainly misleading.

-

Test Withdrawals Early: With any new platform, try withdrawing small amounts first. If this fails, it’s a clear red flag.

-

Be Wary of Pressure: Legitimate companies don’t pressure you to deposit more money. Aggressive sales tactics are a danger sign.

-

Trust Your Instincts: If something feels off, it probably is. Better to miss out on a supposed opportunity than lose your hard-earned savings.

Final Verdict: Is AssetPlusMiners a Scam?

Based on the evidence, AssetPlusMiners.com shows all the hallmarks of a scam platform. Its anonymous structure, unrealistic promises, repeated withdrawal complaints, and lack of regulatory oversight make it extremely high risk. While some users may see early returns, the overwhelming pattern suggests that long-term investors are likely to lose money.

The lure of easy profits is powerful, but caution is far more valuable. The crypto space does have legitimate investment opportunities, but they never come with guaranteed riches overnight. AssetPlusMiners, unfortunately, looks like a platform best avoided.

-

Report. Assetplusminers.com And Recover Your Funds

If you have lost money to assetplusminers.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like assetplusminers.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.