BestFixedRates.co.uk and Its Hidden Issues

In the sprawling landscape of online financial services, consumers are often vulnerable to platforms that promise attractive deals but deliver disappointment or worse. One such platform that has raised serious concerns is BestFixedRates.co.uk. This review aims to shed light on the troubling aspects of this platform and advise potential users to exercise extreme caution and, ultimately, steer clear of it.

Understanding BestFixedRates.co.uk

BestFixedRates.co.uk presents itself as a service offering competitive fixed-rate financial products, primarily targeting consumers looking for mortgage deals, loans, or savings accounts with guaranteed returns. At first glance, the platform’s sleek website and promises of “best rates” might attract individuals eager to lock in stable financial terms in an uncertain economic climate.

However, beneath this polished surface lies a platform fraught with red flags that question its legitimacy and ethical standing.

Red Flags and Warning Signs

1. Lack of Transparency

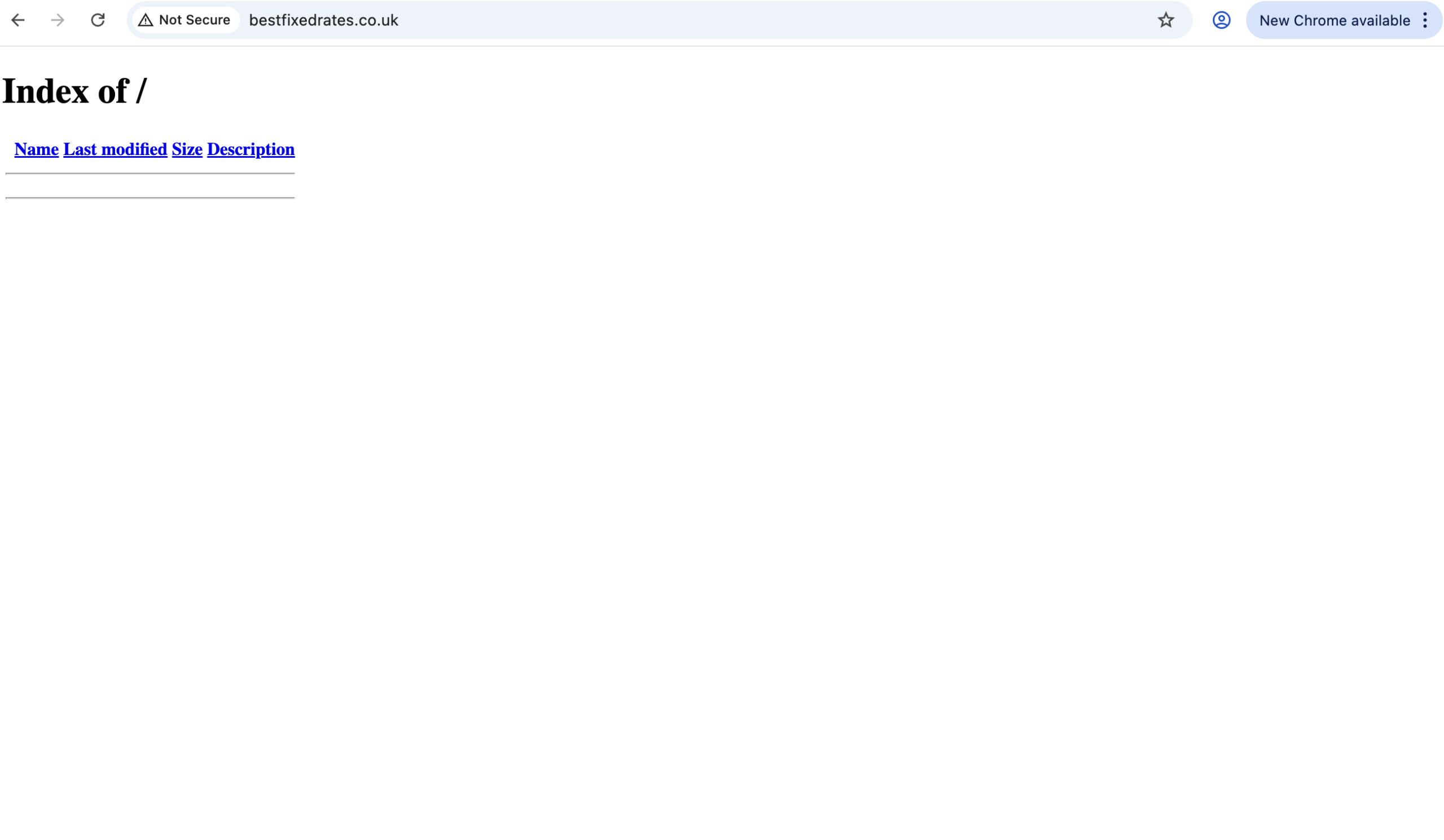

One of the most glaring issues with BestFixedRates.co.uk is its lack of transparency. The platform offers limited information about its ownership, physical address, or regulatory status. Legitimate financial service providers typically display clear licensing details and regulatory oversight, reassuring users that their investments or loans are protected by established financial authorities. The absence of such information on BestFixedRates.co.uk raises immediate suspicion.

2. Unverifiable Claims and Testimonials

The website features glowing testimonials and claims of unbeatable rates, yet these endorsements are unverifiable. Genuine customer reviews usually appear on independent platforms or forums, but BestFixedRates.co.uk’s testimonials seem curated and lack credible sources. This tactic is common among scam operations to create a false sense of trust and reliability.

3. Aggressive Marketing and Pressure Tactics

Users have reported that the platform employs aggressive marketing techniques, including unsolicited calls and emails urging immediate action to “lock in” special rates. This pressure to act quickly is a classic hallmark of scams, designed to prevent potential victims from thoroughly researching or considering alternatives.

4. Requests for Upfront Fees

Another critical warning sign is the demand for upfront fees before any service is rendered. BestFixedRates.co.uk reportedly asks for payment to process applications or secure rates, yet there is little evidence that these transactions lead to any legitimate financial product or service. Legitimate financial institutions typically deduct fees only after services are confirmed and contracts signed.

5. Poor Customer Service and Communication

Once users engage with the platform, many experience poor communication, delays, or complete lack of response. This breakdown in service is a common tactic used to avoid accountability once money has been transferred.

Impact on Consumers

The consequences of engaging with a platform like BestFixedRates.co.uk can be severe. Individuals may lose significant sums of money through upfront fees or deposits with no return. Beyond the financial loss, victims face stress, frustration, and the arduous process of trying to recover their funds or rectify their financial plans.

Moreover, the platform’s misleading promises can cause users to miss out on legitimate financial opportunities elsewhere, compounding their losses.

Why It Matters to Stay Vigilant

In an era where financial scams are increasingly sophisticated, vigilance is essential. Platforms like BestFixedRates.co.uk exploit the natural desire for financial security by offering too-good-to-be-true deals. Recognizing the warning signs early can save consumers from devastating financial and emotional harm.

Financial decisions should always be made with thorough research, verification of credentials, and consultation with trusted advisors or official regulatory bodies.

Practical Advice for Consumers

- Verify Credentials: Always check if the financial service provider is registered with relevant financial authorities, such as the Financial Conduct Authority (FCA) in the UK.

- Research Reviews: Look beyond the platform’s website for independent reviews and user experiences.

- Avoid Upfront Payments: Be wary of any service demanding fees before providing clear, written agreements.

- Take Your Time: Avoid pressure tactics and take the necessary time to evaluate offers carefully.

- Seek Professional Advice: Consult with a qualified financial advisor before committing to any financial product.

Conclusion: Steer Clear of BestFixedRates.co.uk

BestFixedRates.co.uk exhibits multiple characteristics typical of scam operations in the financial sector—lack of transparency, unverifiable claims, aggressive tactics, and poor customer service. These issues collectively signal a high risk to consumers who engage with the platform.

For anyone seeking fixed-rate financial products, the safest path is to rely on well-established, regulated institutions with proven track records. The promise of high returns or unbeatable rates should never overshadow the need for security, transparency, and trustworthiness.

In the ecosystem of financial services, integrity and accountability are as vital as the products offered. BestFixedRates.co.uk falls short on these essential principles, making it a platform to avoid for the sake of your financial well-being and peace of mind.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to bestfixedrates.co.uk, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as bestfixedrates.co.uk continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.