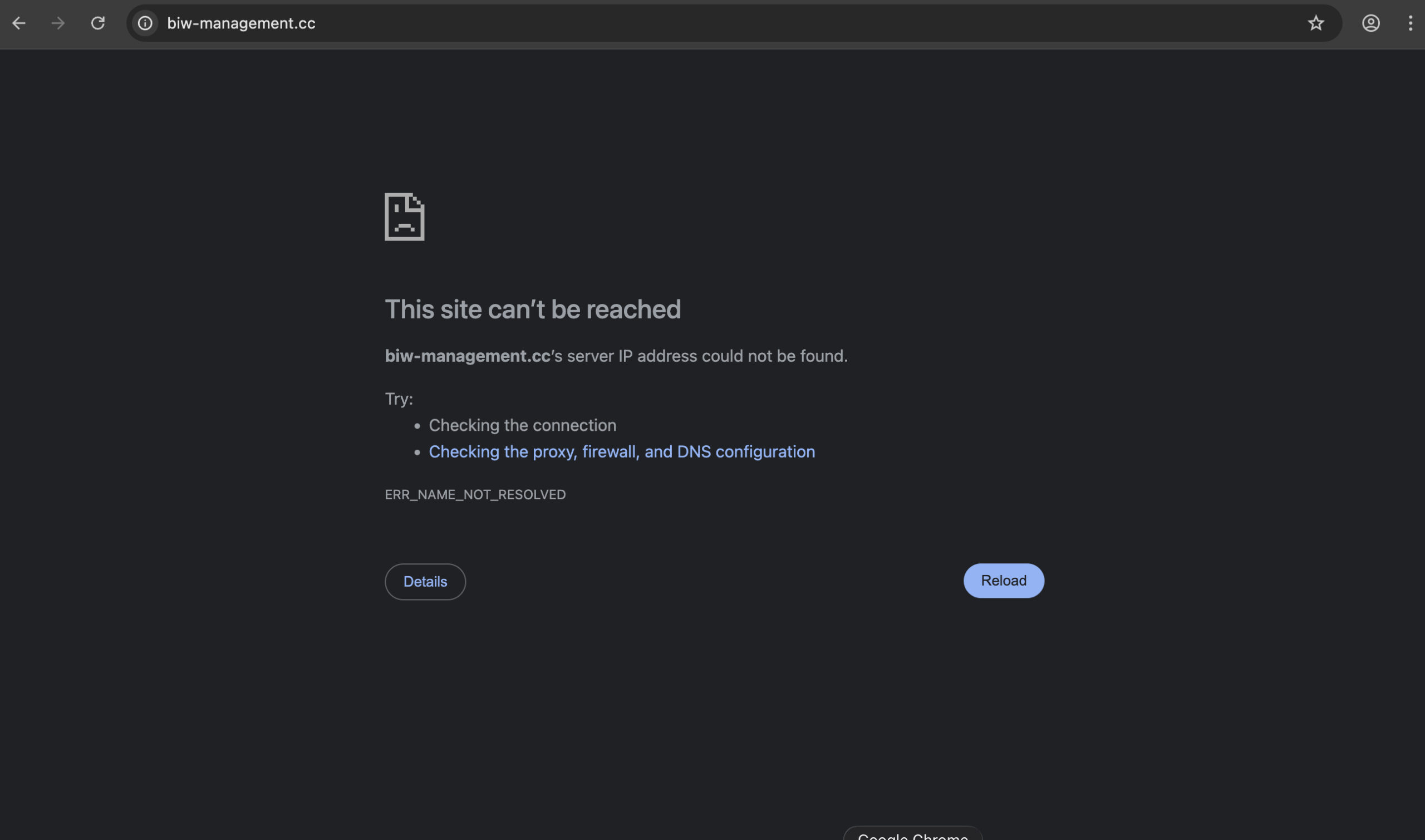

BIW‑Management.cc: Risky Investment Platform

In recent years, an increasing number of online investment platforms have emerged, promising fast profits, cutting‑edge technology, and simplified access to global financial markets. While some brokers operate legitimately under regulatory oversight, others have exploited investor interest to attract funds without delivering real services. BIW‑Management.ccis one such platform generating concern among traders and financial observers. Although the company markets itself as a professional investment management service, multiple indicators strongly suggest it operates as a risky and unreliable platform. This detailed review explains the concerns, common scam tactics present on the site, and why investors should avoid engagement.

The Illusion of Professional Investment Management

BIW‑Management.cc presents itself as a sophisticated financial services provider offering portfolio growth, asset management, and online trading capabilities. From the homepage onward, the platform uses polished language and industry jargon designed to project credibility. It promises services that include diversified investment opportunities, personal account managers, and supposedly optimized returns through specialized strategies.

However, professional investment services build trust through verifiable credentials, transparent disclosures, and regulator‑mandated reporting. BIW‑Management.cc, by contrast, relies on high‑level claims with minimal verifiable backing. It emphasizes performance results without presenting audited data and uses generic promotional wording that could apply to numerous unrelated businesses.

Lack of Transparent Corporate Identity

One foundational red flag with BIW‑Management.cc is the lack of clear corporate identity. Legitimate brokers and asset managers provide easily verifiable information about their corporate structure, leadership, regulatory status, and physical operational locations. These details typically appear in legal disclosures, terms of service, and regulatory filings.

BIW‑Management.cc, however, offers scant reliable corporate detail. There is no clear information on who owns or operates the platform. Website disclaimers lack full corporate registration data, and contact details may include generic email addresses rather than verifiable business communication channels. This absence of transparency makes it difficult to confirm whether the company has any legal standing or whether it is simply a shell used for soliciting funds.

No Credible Regulatory Oversight

Regulation in financial markets serves as a protective framework for investors. Recognized authorities oversee brokers, asset managers, and financial advisors to ensure compliance with rules designed to prevent fraud, market manipulation, and misappropriation of client funds. Investors rely on this oversight as a minimum threshold for legitimacy.

BIW‑Management.cc does not demonstrate any affiliation with credible financial regulators. It does not publish verifiable licensing information or registration numbers from respected oversight agencies. Instead, the platform uses vague statements about “global access” and “compliance standards” without providing documentation or third‑party verification.

Investors should view the absence of regulatory licensing as a central concern. When a trading platform does not operate under recognized oversight, there is no independent accountability for how client funds are used, how trades are executed, or how disputes are resolved. This lack of third‑party supervision alone elevates the risk profile significantly.

Questionable Operational Practices

Beyond regulatory concerns, BIW‑Management.cc displays several operational characteristics that align with known patterns of high‑risk or fraudulent platforms.

Fabricated Performance Displays

One common tactic among scam platforms is the use of fabricated performance metrics. These may include dashboards that show automatic profit increases, inflated returns, or simulated account balances that do not reflect real market trades. Some websites even generate plausible‑looking graphs and charts that appear professional but lack underlying verification.

While BIW‑Management.cc showcases potential growth figures and account performance visuals, there is no independent audit or proof that these results derive from real trading activity. Without transparent trade logs, independent verification, or third‑party performance statements, such displays should be treated as speculative at best and misleading at worst.

Barriers to Withdrawal

Another typical sign of a risky trading site involves difficulty withdrawing funds. Many fraudulent platforms allow initial deposits to proceed without friction, but they later introduce obstacles when users attempt to withdraw their profits or principal.

Whether it takes the form of suddenly imposed fees, “verification” requirements, or unanticipated processing delays, these barriers are designed to delay and ultimately discourage withdrawal. While specific withdrawal experiences linked to BIW‑Management.cc are varied, the structural setup of the platform does not provide clear procedures or guarantees for seamless withdrawal. Unclear terms and hidden conditions create uncertainty around whether users can easily access their money.

Pressure Tactics and Upselling

High‑risk platforms often employ pressure‑based marketing to push users to make bigger deposits or purchase ancillary services. These tactics may include personalized account manager messages, promises of tiered benefits for larger balances, or claims that limited spots are available in exclusive strategies.

BIW‑Management.cc uses similar language suggesting tailored strategies and VIP services. Such upselling without clear disclosure of risk, cost, or realistic benefit is a hallmark of platforms that prioritize revenue extraction over client success.

Vague Terms and Conditions

When evaluating any online investment platform, the terms and conditions should be clear, comprehensive, and accessible. Legitimate brokers provide detailed agreements outlining fee structures, withdrawal rights, dispute resolution mechanisms, and risk disclosures.

In contrast, BIW‑Management.cc’s terms may be brief, lack specificity, or contain clauses that favor the company in ways that are opaque to users. Vague legal language may make it difficult for investors to understand their rights, obligations, or recourse options under dispute situations. Lack of clarity in legal documentation further tilts the balance of risk toward the investor.

Lack of Independent Verification

Reputable trading platforms often allow third‑party verification of account activity, audited financial statements, or connections to established trading infrastructure. Investors value transparency, especially when automated or algorithm‑based strategies are involved.

BIW‑Management.cc does not provide mechanisms for independent verification. There is no integration with recognized trading platforms, no published audit reports, and no visible partnerships with established financial institutions. This isolates the platform from industry norms and leaves users with little to assess beyond the website’s promotional content.

Why You Should Steer Clear

Given the concerns outlined above — including lack of regulation, opaque corporate identity, potential performance fabrication, withdrawal uncertainty, pressure marketing, and ambiguous legal terms — BIW‑Management.cc presents a high‑risk proposition. Investors should always prioritize platforms that offer transparent oversight, verifiable performance, and clear, fair terms.

Financial markets inherently involve risk, but that risk should not be compounded by avoidable uncertainties rooted in platform credibility. When a site operates without regulatory accountability, limits transparency, and uses marketing tactics common to fraudulent schemes, it is reasonable to conclude that the platform does not meet minimum standards for safe investment engagement.

Final Assessment

BIW‑Management.cc exhibits multiple red flags associated with untrustworthy online investment platforms. Its lack of transparent corporate identity, absence of credible regulatory oversight, and operational patterns suggest that it prioritizes asset acquisition over user protection. The combination of unverified performance claims, potential withdrawal hurdles, and unclear terms is inconsistent with industry norms practiced by reputable brokers.

For anyone exploring online investment opportunities, due diligence is essential. That process begins with confirming regulatory licensing, evaluating transparency, and validating performance claims independently. Based on the evidence and structural concerns associated with BIW‑Management.cc, the prudent decision is to avoid this platform and seek alternatives that operate under recognized regulations with clear commitments to investor safety.

Report Biw-management.cc And Recover Your Funds

If you have lost money to biw-management.cc, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like biw-management.cc continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.