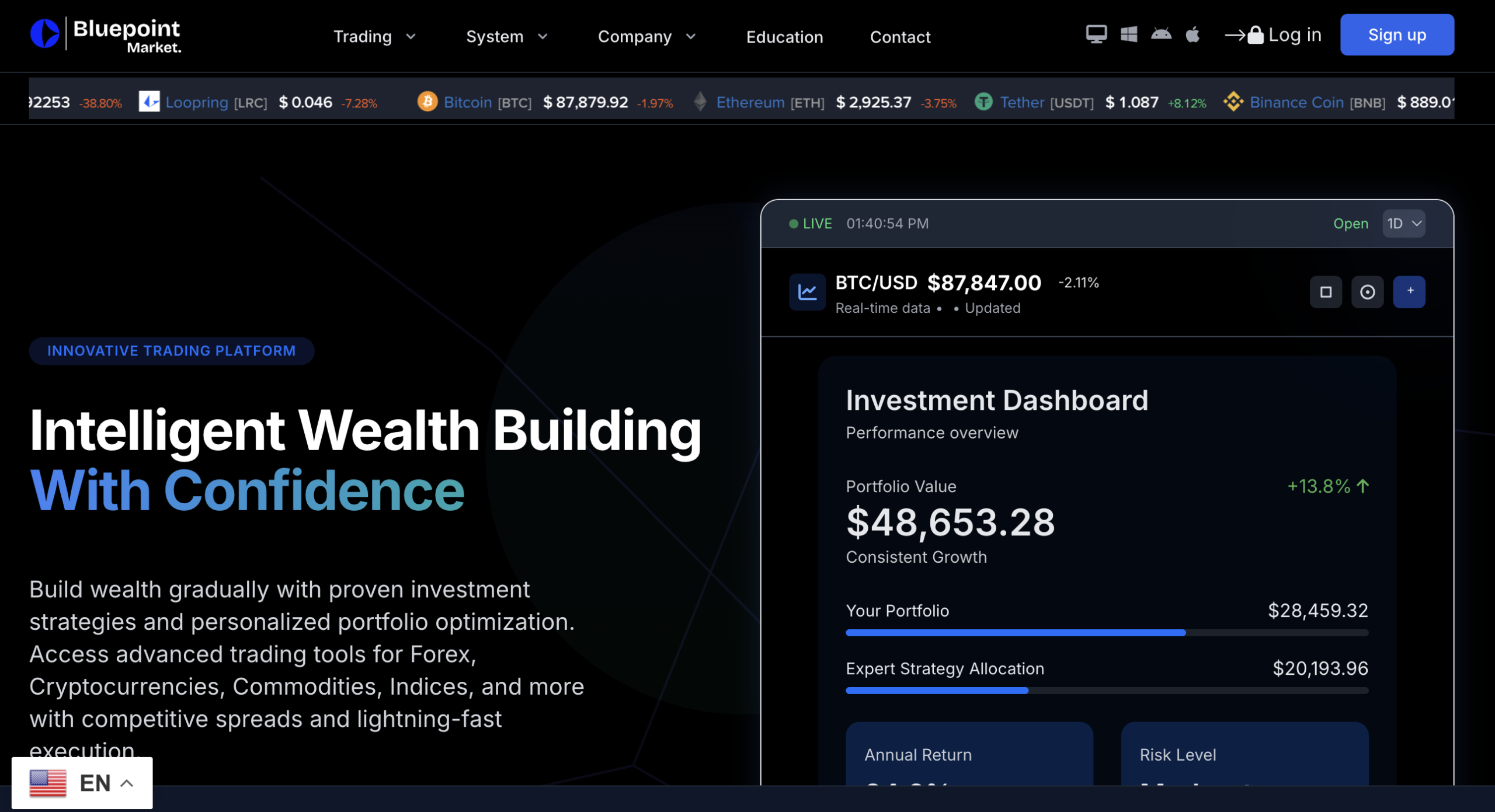

BluePointMarket.com and Online Trading Analysis

BluePointMarket.com markets itself as an online trading platform offering access to forex, commodities, indices, stocks, and cryptocurrency CFDs. The site may appear professionally designed, with claims of competitive spreads and advanced tools for traders. However, a closer look at its operations, regulatory status, and credibility reveals serious issues that make the platform unsuitable and potentially unsafe for users.

1. Operating Without Recognised Regulation

One of the most compelling concerns about BluePointMarket.com is that it is not authorised or regulated by any recognised financial authority. The UK’s Financial Conduct Authority (FCA) recently added Bluepoint Market to its Warning List, stating that the firm may be providing or promoting financial services or products without permission and advising people to avoid dealing with it.

Regulatory oversight exists to protect investors: brokers must comply with rules on client fund segregation, transparent pricing, risk disclosure, and dispute resolution. Because BluePointMarket.com does not have a verified licence, traders have no protection or accountability if funds are mismanaged, withheld, or lost.

2. No Verifiable Licensing Details

Platforms with legitimate operations typically display registration numbers and links to official regulator listings (e.g., FCA, ASIC, CySEC, FINRA). In contrast, BluePointMarket.com does not provide verifiable licence information from a recognised regulator. Independent broker checkers and industry tools rank the platform’s regulatory status as extremely low or non‑existent — often giving it a near‑zero credibility score.

This lack of official licensing is a critical red flag: without it, there’s no external authority monitoring the platform’s conduct or ensuring that client funds are held and treated appropriately.

3. Opaque Corporate and Ownership Information

Important aspects of trust in any financial service — identity of owners, legal entity details, corporate registration location, and compliance contacts — are either missing or obscured for BluePointMarket.com. Independent aggregated data suggest the company may use privacy services to conceal its true ownership and location, further reducing transparency and accountability.

A reputable financial firm clearly states its regulatory permissions and legal obligations; a platform that hides such details indicates a lack of transparency that serious traders should not overlook.

4. High Minimum Deposit Thresholds and Ambiguous Terms

Some review tools indicate that BluePointMarket.com may set high minimum deposit requirements (upwards of $3,000, according to external data aggregators), without clear or transparent instructions about fee structures, execution policies, or withdrawal conditions.

Legitimate brokers always disclose:

-

Spreads and commissions

-

Leverage limits aligned with regulation

-

Withdrawals and processing times

-

Risk disclosures

When a platform lacks clear disclosure of these operational terms, it makes it much harder for traders to plan and protect their investments.

5. Lack of Independent User Feedback and Verification

For well‑established trading platforms, it’s relatively easy to find multiple independent user reviews across forums, social media, and trusted broker review sites. With BluePointMarket.com, there’s a noticeable absence of verified user testimonials or credible independent experiences.

Without such feedback, it’s difficult for prospective traders to evaluate real outcomes — such as execution quality, withdrawal processes, and customer support responsiveness — before committing funds.

6. Patterns Seen in Unregulated or Dubious Trading Sites

BluePointMarket.com shares several characteristics commonly seen in online trading platforms widely regarded as unreliable:

-

Unverified regulatory claims and no official licences.

-

Concealed corporate and ownership information.

-

Minimal or no independent user accounts.

-

High minimum deposits with unclear terms.

-

Listings on regulatory warning lists (e.g., the FCA).

These traits are typical of platforms that may prioritise rapid onboarding of funds over long‑term client support and accountability. In worst‑case scenarios, unregulated trading platforms may make it hard for users to withdraw funds, or employ pricing practices that disadvantage traders.

Conclusion: Steer Well Clear of BluePointMarket.com

Despite promotional claims about CFD trading access and advanced tools, BluePointMarket.com lacks the most fundamental aspects of credibility and oversight. Its absence from official regulator registers, inclusion on a major authority’s warning list, opaque operational structure, and insufficient independent feedback combine to form a strong signal that this platform is not trustworthy or suitable for trading.

Whenever possible, traders should instead focus on platforms with verified regulation, transparent corporate details, documented user feedback, and clear operational terms. These qualities aren’t optional — they protect you from potential losses and ensure your rights as a market participant are upheld.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to bluepointmarket.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as bluepointmarket.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.