bluerock-wealth.com Analysis: Unsafe Platform

The online investment world continues to grow at a rapid pace, creating opportunities for both legitimate platforms and unsafe, unregulated websites. Many of these platforms present themselves as professional, trustworthy, and technologically advanced—but behind the marketing, some lack transparency, regulatory oversight, and credibility.

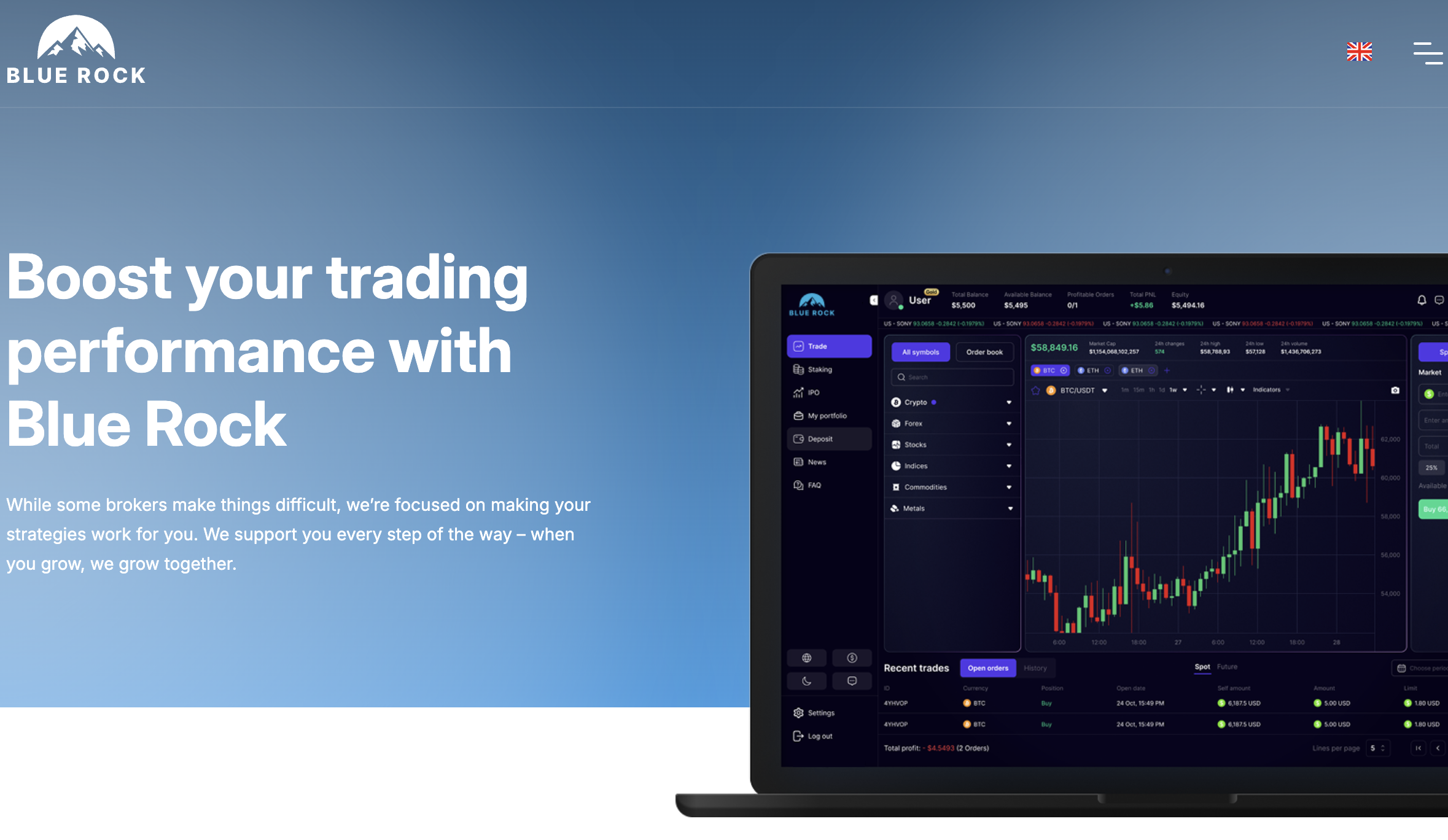

bluerock-wealth.com is one such platform raising major concerns. While its website may appear modern and appealing, a deeper look reveals patterns that are commonly associated with high-risk or unreliable financial operations. This detailed review examines those red flags and explains why it is safest to stay far away from this platform.

What bluerock-wealth.com Claims to Offer

According to its website, bluerock-wealth.com presents itself as a wealth-management or investment service offering:

-

Professional financial guidance

-

Advanced investment strategies

-

Attractive returns

-

Secure trading or crypto-related services

-

Easy onboarding and user-friendly dashboards

-

“Expert” support

These claims are designed to catch the attention of new or inexperienced investors. However, impressive promises are meaningless without transparency, regulation, and proven performance. Unfortunately, bluerock-wealth.com provides none of these essentials.

1. No Verified Regulatory License

In the financial world, regulation is the foundation of legitimacy.

Licensed investment platforms:

-

Are monitored by regulatory bodies

-

Must follow strict financial rules

-

Provide consumer protection

-

Are required to treat client funds responsibly

-

Are accountable under the law

bluerock-wealth.com does not display any verifiable license or regulatory approval. This is the single most significant red flag.

Without regulation:

-

User funds are unprotected

-

There is no oversight on how money is handled

-

Investors have no legal avenue for complaints

-

The platform can shut down suddenly without warning

-

The company is not required to follow financial laws

Any platform offering investment services without proving regulation should be avoided immediately.

2. No Transparent Company Information

A legitimate investment company always reveals:

-

Registered corporate name

-

Physical office address

-

Leadership team

-

Contact details

-

Legal documentation

bluerock-wealth.com provides little to no verifiable company information. The website lacks transparency about who runs the platform, where the company is located, and whether the business legally exists.

Anonymous ownership is a major warning sign.

Financial platforms that hide their operators usually do so to avoid accountability. When the people handling your money remain unknown, you risk dealing with an entity that could disappear without trace.

3. Unrealistic or Misleading Return Implications

The site’s tone and presentation often imply that users can achieve high, consistent, or low-risk returns. These suggestions, even if not directly stated, are concerning because:

-

Real investments involve risk

-

No platform can promise steady profits

-

Markets fluctuate constantly

-

High returns always come with high risk

Unrealistic return language is one of the most common tactics used by unreliable investment websites. Whenever a platform focuses more on marketing than on risk disclosure, caution is necessary.

4. Vague Explanations of How the Platform Works

A trustworthy financial service clearly explains:

-

Investment strategies

-

Profit generation methods

-

Financial instruments used

-

Risk management approaches

-

Technology and systems behind the platform

bluerock-wealth.com fails to provide any detailed explanation. Its descriptions are broad, generic, and lacking any real operational clarity.

When a platform cannot explain how it generates returns, it raises the possibility that no legitimate investment activity is happening behind the scenes.

5. High Likelihood of Withdrawal Issues

One of the most common patterns found in high-risk platforms is withdrawal problems. While experiences may vary, unregulated and anonymous platforms often show similar behaviors:

-

Deposits are processed instantly.

-

User dashboards display profits that may not be real.

-

Withdrawal requests face delays.

-

“Unexpected fees” or “taxes” appear.

-

Customer support becomes evasive or unresponsive.

-

Accounts may be restricted without explanation.

Because bluerock-wealth.com has no regulatory oversight and no transparent identity behind it, the risk of withdrawal complications is extremely high.

A platform that cannot demonstrate reliable fund withdrawals should never be trusted with money.

6. Questionable or Limited Customer Support

Legitimate investment companies offer responsive, professional support with:

-

Real contact channels

-

Verifiable representatives

-

Transparent communication

-

Clear guidance

In contrast, high-risk platforms often provide:

-

Generic email support

-

Unresponsive chat systems

-

Automated or copy-paste messages

-

Lack of assistance with account issues

bluerock-wealth.com appears to operate more like the second category. When real money is involved, unreliable support becomes a major operational risk.

7. Website Structure Resembles Common Scam Templates

Many untrustworthy platforms use inexpensive template-based website designs to appear credible. Red-flag characteristics include:

-

Stock photos labeled as “team members”

-

Generic financial terminology

-

Repetitive or low-quality text

-

No detailed documentation

-

Overuse of buzzwords like “AI,” “smart trading,” or “secure investing”

bluerock-wealth.com displays several of these traits.

A visually polished site is easy to create today—what matters is the legitimacy of the business behind it.

8. Weak Online Presence and Zero Independent Credibility

Reputable financial companies have visible online footprints, such as:

-

Public reviews

-

Press mentions

-

Social media activity

-

Transparent discussions

-

Verified business listings

bluerock-wealth.com has almost no independent presence or recognition. The lack of credible third-party information makes it difficult to verify its history or legitimacy.

Platforms with weak online presence often disappear as quickly as they appear.

9. No Security Documentation or Technical Proof

Any platform dealing with investments—especially online—should provide:

-

Proof of security protocols

-

Data protection standards

-

Encryption information

-

Operational audits

bluerock-wealth.com provides none of these essentials.

Without security assurances, users cannot know:

-

How their funds are stored

-

Whether their data is safe

-

Whether the platform is technically reliable

-

If any system vulnerabilities exist

Lack of security documentation is a major risk factor.

Final Verdict: bluerock-wealth.com Should Be Avoided

Based on all observable factors, bluerock-wealth.com presents multiple red flags that make it far too risky for anyone seeking legitimate investment opportunities.

Key concerns include:

-

No regulatory approval

-

Hidden ownership

-

Vague investment explanations

-

Unrealistic profit implications

-

High withdrawal risk

-

Weak customer support

-

Generic website design

-

Limited online credibility

-

No technical or security documentation

These warning signs strongly indicate that the platform lacks transparency, accountability, and legitimacy.

For your financial safety, it is best to avoid bluerock-wealth.com entirely.

Legitimate investment platforms operate with clear regulation, verifiable business information, and open communication—qualities that bluerock-wealth.com does not demonstrate.

Report bluerock-wealth.com And Recover Your Funds

If you have lost money to bluerock-wealth.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like bluerock-wealth.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.