Bluestone Luxent Scam: Why You Should Avoid It

In the sprawling digital marketplace, where opportunities for investment and wealth-building abound, it is crucial to navigate carefully and distinguish between legitimate ventures and deceptive schemes. One such platform that has recently drawn considerable attention for all the wrong reasons is Bluestone Luxent. Despite its alluring promises and sleek online presence, Bluestone Luxent has emerged as a cautionary tale—a risky platform that investors and users should avoid. This detailed review aims to shed light on the nature of the Bluestone Luxent scam, its modus operandi, and why steering clear of it is a prudent choice.

What Is Bluestone Luxent?

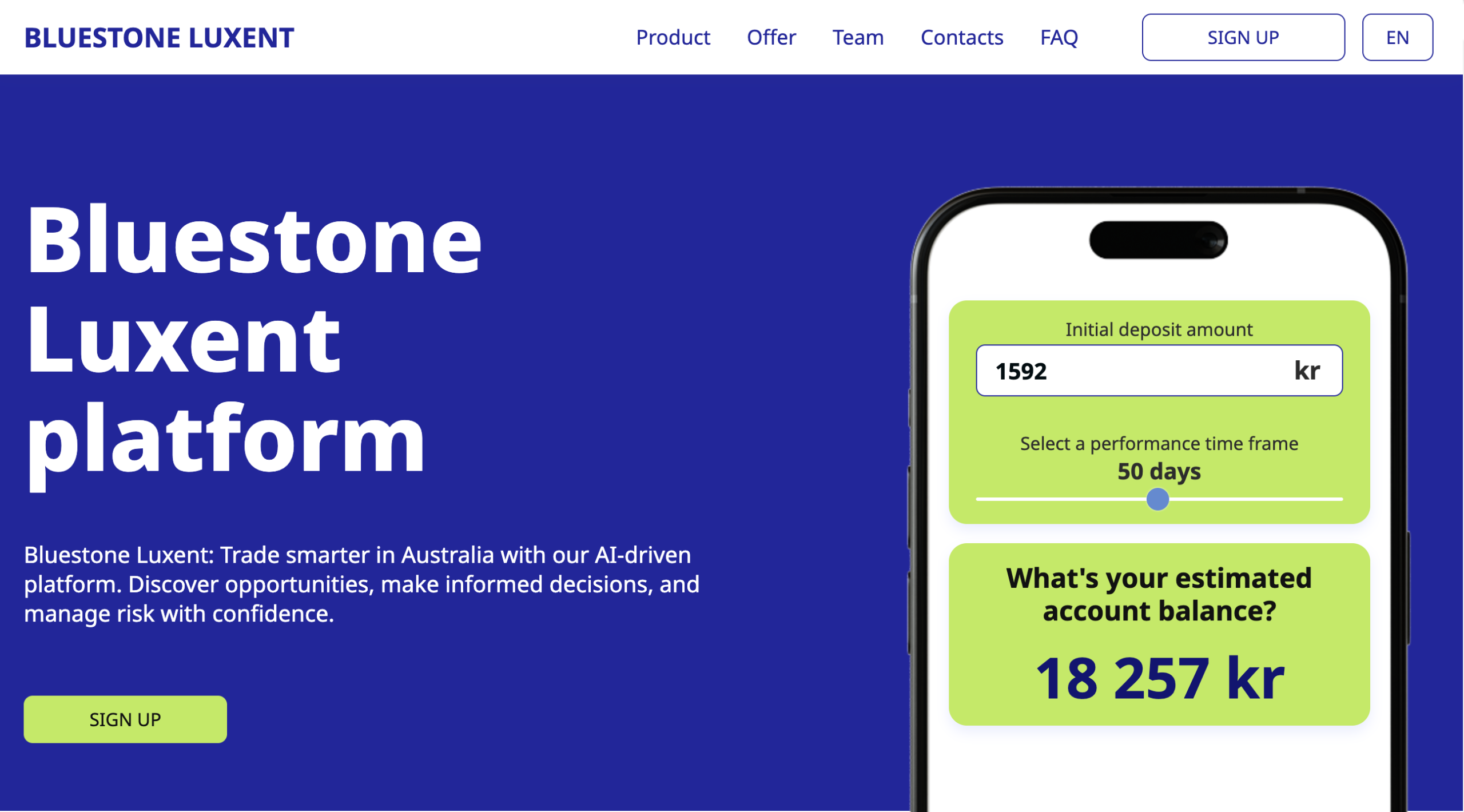

Bluestone Luxent presents itself as a sophisticated investment platform, often targeting individuals eager to grow their wealth through innovative financial products or cryptocurrency investments. The platform typically boasts high returns in short periods, leveraging flashy marketing tactics, testimonials, and fabricated success stories to lure unsuspecting users.

At first glance, Bluestone Luxent may appear legitimate. Its website is professionally designed, with promises of cutting-edge technology, expert advisors, and user-friendly interfaces. However, beneath this polished exterior lies a system designed to exploit trust and siphon money from investors.

How Bluestone Luxent Operates as a Scam

Understanding the mechanics of Bluestone Luxent’s scam is essential to recognizing its warning signs early:

- Unrealistic Promises of High Returns

Bluestone Luxent guarantees exceptionally high returns on investments, often far exceeding typical market rates. These promises are not only unrealistic but also a classic hallmark of fraudulent schemes. Genuine investments carry risks and do not assure profits, let alone sky-high returns in short timeframes. - Lack of Transparency and Regulatory Oversight

The platform operates with minimal transparency regarding its ownership, physical location, or regulatory compliance. Legitimate financial institutions are typically registered with financial authorities and provide verifiable licenses. Bluestone Luxent, in contrast, fails to disclose credible licensing information, leaving users vulnerable without legal protections. - Pressure Tactics and Aggressive Marketing

Users report experiencing aggressive sales tactics, including constant follow-ups, pressure to invest quickly, and promises of exclusive opportunities. These tactics are designed to rush decision-making and prevent thorough research or skepticism. - Withdrawal Difficulties and Account Freezing

One of the most alarming red flags is the difficulty users face when trying to withdraw their funds. Many investors find their accounts suddenly frozen or encounter endless delays and excuses when requesting withdrawals. This behavior is typical of scams that aim to trap users’ money indefinitely. - Fake Testimonials and Social Proof

Bluestone Luxent often promotes fake reviews and testimonials to create an illusion of trustworthiness and success. These fabricated endorsements are strategically placed to manipulate potential investors’ perceptions.

Why Bluestone Luxent Is Dangerous

The risks associated with Bluestone Luxent extend beyond mere financial loss. Engaging with such a platform can lead to:

- Significant Financial Loss

Investors may lose their entire capital, as the platform’s primary goal is to extract money rather than generate genuine returns. - Emotional and Psychological Stress

The experience of losing money to a scam can cause severe emotional distress, anxiety, and loss of confidence in future investment opportunities. - Compromised Personal Information

Providing personal and financial details to a fraudulent platform increases the risk of identity theft and further financial exploitation.

Recognizing the Warning Signs of Scam Platforms

Bluestone Luxent shares many traits common to online scams. Being able to identify these signs can help protect potential investors:

- Promises of Guaranteed or Excessive Returns

No legitimate investment can guarantee profits, especially not at rates that seem too good to be true. - Lack of Clear Contact Information or Physical Address

Reliable companies provide verifiable contact details and operate transparently. - Pressure to Invest Quickly

Scammers create a false sense of urgency to prevent due diligence. - No Verifiable Regulatory Registration

Always check if the platform is registered with financial regulatory bodies. - Unprofessional or Vague Website Content

Poor grammar, inconsistent information, and vague explanations can indicate a scam.

How to Protect Yourself from Platforms Like Bluestone Luxent

While the digital investment space offers exciting opportunities, it is vital to approach it with caution and informed skepticism. Here are key steps to safeguard yourself:

- Conduct Thorough Research

Investigate the platform’s background, read independent reviews, and verify regulatory status. - Consult Trusted Financial Advisors

Seek advice from certified professionals before committing funds. - Start Small and Test Withdrawal Processes

If you decide to try a new platform, start with a minimal amount and test how smoothly withdrawals work. - Avoid Sharing Sensitive Information

Be cautious about sharing personal or financial details on unverified platforms. - Trust Your Instincts

If something feels off or too good to be true, it probably is.

The Bigger Picture: The Importance of Digital Financial Literacy

The rise of scams like Bluestone Luxent underscores the urgent need for improved financial literacy and awareness in the digital age. As investment opportunities increasingly move online, understanding how to evaluate platforms critically is essential for protecting personal wealth and fostering a healthy financial ecosystem.

By educating oneself and others about the hallmarks of scams and the principles of sound investing, individuals can build resilience against fraudulent schemes. Communities, regulators, and technology providers also have roles to play in creating safer environments and swiftly addressing scams.

Conclusion: Steering Clear of Bluestone Luxent

Bluestone Luxent exemplifies a growing breed of online scams that prey on the hopes and ambitions of everyday people. Its enticing promises mask a dangerous trap designed to exploit trust and drain finances. The platform’s lack of transparency, unrealistic returns, and withdrawal issues paint a clear picture of a risky and unreliable venture.

Choosing to avoid Bluestone Luxent is a wise decision rooted in caution and awareness. Protecting your financial future means recognizing red flags, conducting diligent research, and prioritizing platforms with proven legitimacy and regulatory backing.

In the ecosystem of digital investments, vigilance is your greatest ally. By steering clear of risky platforms like Bluestone Luxent, you contribute to a safer, more trustworthy financial landscape where genuine opportunities can flourish, and scams find no fertile ground.

Report Bluestone Luxent And Recover Your Funds

If you have lost money to Bluestone Luxent, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Bluestone Luxent continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.