bosonalfa‑aI.com Review: Why Investors Should Be Cautious

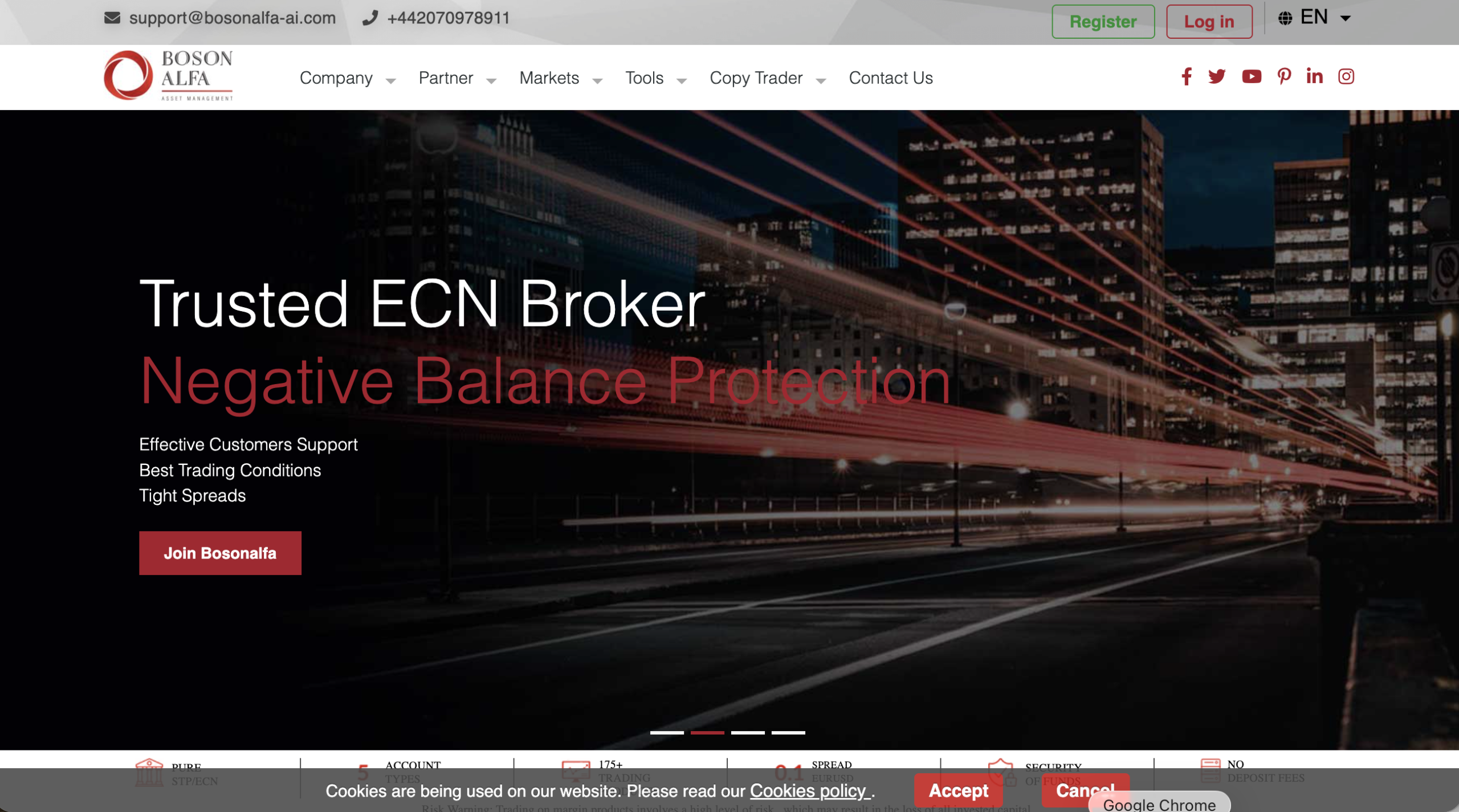

Online trading and investment platforms often promise powerful tools, fast execution, and attractive returns. Among these, Bosonalfa‑AI.com positions itself as a global forex and multi‑asset broker, seemingly offering diverse trading opportunities across markets such as currencies, metals, indices, and cryptocurrencies. While the platform’s website projects polish and capability, a deeper inquiry reveals several concerning issues that make this service highly risky for investors.

This article explains the major areas of concern — from questionable legitimacy and lack of regulation to internal inconsistencies — and why you should seriously reconsider engaging with Bosonalfa‑AI.com.

1. Absence of Recognized Financial Regulation

A well‑established and trustworthy trading platform operates under the oversight of recognized financial regulators (for example, the UK’s FCA, Australia’s ASIC, or the EU’s MiFID authorities). Such regulation ensures that the firm adheres to strict standards on capital adequacy, client fund protection, reporting accuracy, and ethical practices.

In the case of Bosonalfa‑AI.com:

-

The platform does not appear on any major regulatory register, and there is no clear evidence that it is authorised or supervised by internationally recognised financial authorities.

-

Independent risk assessment services flag it as lacking valid regulation — meaning there is no verifiable regulatory license protecting clients’ interests. WikiFX

Operating without oversight significantly increases the chance that the platform engages in unsafe practices, leaving users without protections common in regulated environments.

2. Blocked by Financial Authorities

One of the most authoritative indicators of serious risk is when an official market regulator takes action against a platform. In late 2025, Italy’s Consob regulator explicitly ordered the blocking of Bosonalfa‑AI.com as part of its crackdown on unauthorized investment services. The authority listed the platform alongside other unlicensed, high‑risk trading sites that “offer illegal investment services” and are not compliant with European financial laws. consob.it

When regulatory bodies place blocks or warnings on a platform, it reflects verified concerns about legality, compliance, or investor protection — not casual speculation.

3. Platform Transparency and Operational Questions

Bosonalfa‑AI.com promotes itself as a “trusted ECN broker” with features like tight spreads, multilingual support, and advanced trading tools. But independent reviews highlight inconsistencies beneath this outward positioning:

-

Domain Age and Ownership Masking: The website is newly registered with hidden WHOIS ownership information, which obscures transparency about who actually operates the service. Hiding ownership details is commonly used by high‑risk sites to avoid accountability. ScamAdvisor

-

Low Web Presence and Traffic: Traffic patterns show minimal organic search visibility and low domain authority, suggesting that the platform has not established a substantial or credible online footprint. TraderKnows

-

Claims Versus Reality: Some analyses indicate that educational sections and resources promoted on the site either lack substantive content or do not function as advertised — a sign that marketing language may outpace actual deliverables. TraderKnows

These factors reduce trust in the platform’s operational credibility and long‑term viability.

4. Questionable Marketing and Unverified Claims

The Bosonalfa‑AI.com website contains standard promotional language about advanced technology, secure funds, and industry leadership. However, third‑party assessments reveal that:

-

Claims of fund security and segregation with top global banks are not backed by verifiable evidence or documentation. Bosonalfa

-

Assertions about multilingual 24/5 support, technology prowess, and rapid execution are not independently confirmed by user reviews or external audits. Bosonalfa

Platforms that make broad, impressive claims without transparent proof or third‑party verification often use promotional rhetoric to mask insufficient substance.

5. Trust and Reputation Indicators

Credible platforms usually invite independent reviews, active social media presence, and clearly documented testimonials from real traders. Bosonalfa‑AI.com, by contrast:

-

Has a low trust score on automated evaluation services and is tagged as “questionable” or “controversial” due to aggregated factors like proximity to suspicious sites, threat profiles, and domain characteristics. Scam Detector

-

Does not maintain an established track record in financial markets or publish verified performance metrics recognized by the broader trading community. Scam Detector

-

Does not appear to engage meaningfully with external oversight mechanisms or independent verification organizations.

The lack of a robust reputation ecosystem makes it harder to justify entrusting significant funds to the platform.

6. High Risk of Financial Loss and Data Exposure

Because Bosonalfa‑AI.com is not regulated and has been subject to official blocking by a major financial regulator:

-

Users who deposit funds may face difficulties withdrawing them.

-

There is no compensation scheme or investor protection fund safeguarding those assets.

-

Personal data submitted to the platform could be at risk of misuse if security protocols are not independently certified.

Operating without regulation and with minimal transparency creates an environment conducive to financial loss and exposure of sensitive information.

Conclusion: A Platform to Approach with Extreme Caution

Based on available information and third‑party assessments, Bosonalfa‑AI.com displays several risk factors that strongly caution against engagement:

-

No credible international regulatory oversight

-

Official blocking by a financial market regulator

-

Obscured ownership and minimal transparency

-

Unsubstantiated marketing claims

-

Weak reputation and low trust indicators

While the platform markets itself as a capable broker with diverse trading opportunities, these claims lack independent validation and are overshadowed by serious structural and compliance concerns.

If you are considering online trading or investment platforms, it is essential to prioritise services that are regulated by recognised authorities, clearly documented in public registers, and supported by a substantial track record of verified user experiences. Bosonalfa‑AI.com does not meet these benchmarks.

Report Bosonalfa-ai.com And Recover Your Funds

If you have lost money to bosonalfa-ai.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like bosonalfa-ai.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.