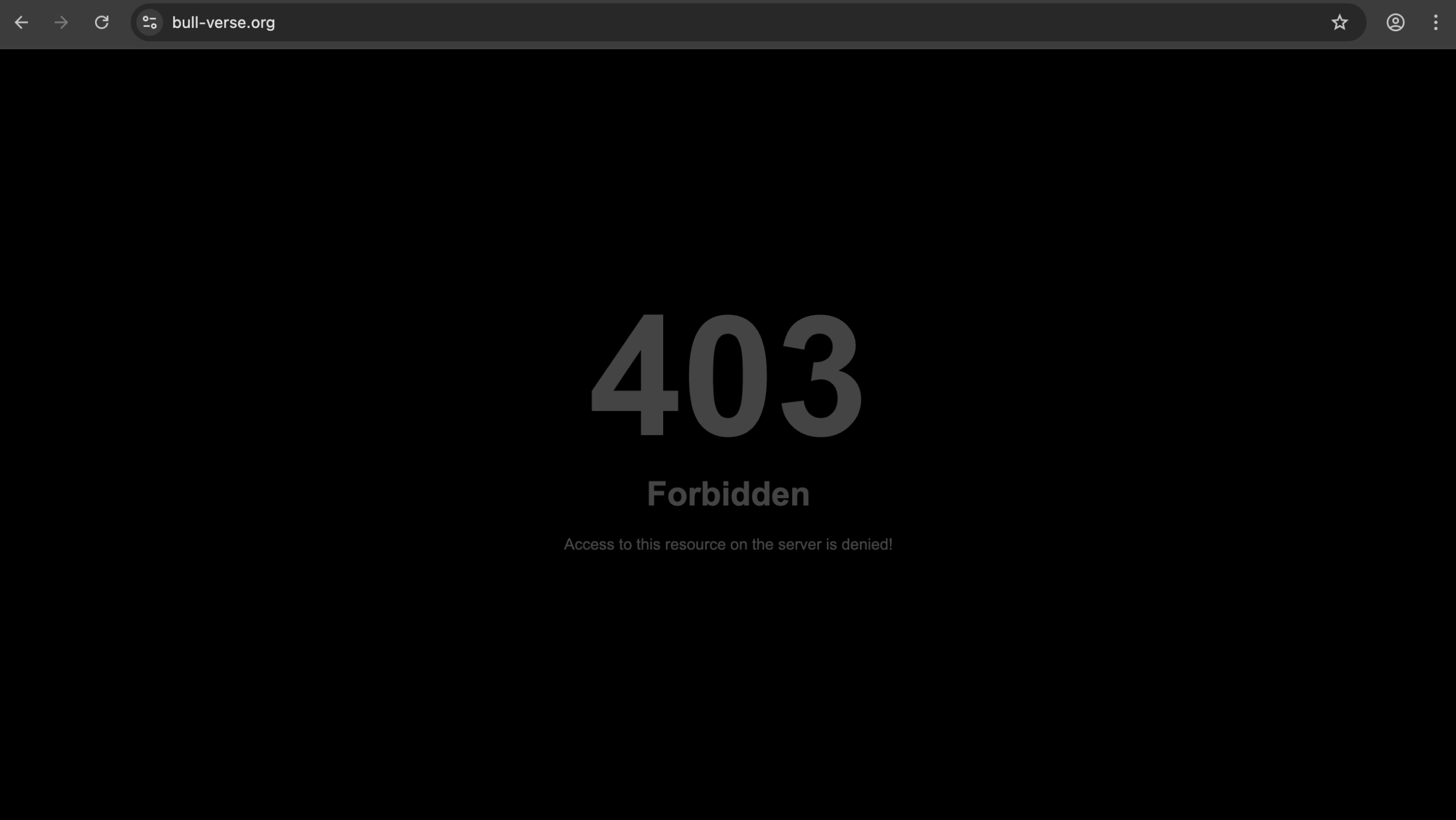

Bull‑verse.org Investor Caution Guide

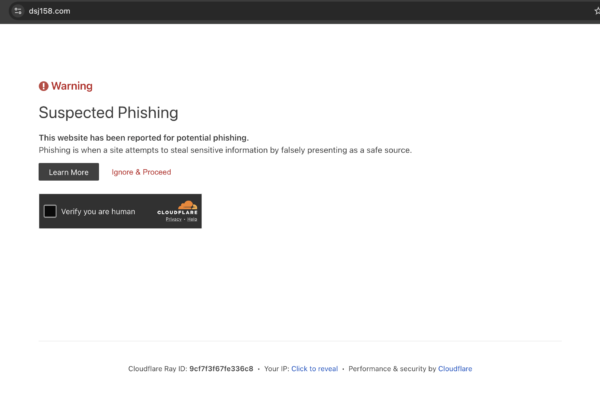

The website bull‑verse.org has begun circulating online as a “crypto investment and trading platform.” However, a closer examination of available data, independent trust assessments, and external critiques suggests serious problems with the platform’s legitimacy and safety — far from what its marketing promises. Here’s a comprehensive review explaining why you should be extremely cautious and avoid entrusting this site with your money or personal details.

Extremely Low Trust Score and Hidden Ownership

One of the most credible early warnings about a website’s integrity is its trust score assigned by independent website risk rating services. bull‑verse.org has been given an exceptionally low trust score, suggesting a strong likelihood it is unsafe or associated with fraudulent activity.

-

Domain registration information is hidden through privacy protection, making it impossible to verify who owns or runs the platform.

-

The registrar used for bull‑verse.org is known to host a high percentage of suspicious and spam‑associated sites.

-

The website is very young, having been registered only recently, which is a common trait among sham or temporary fraudulent operations.

While SSL encryption is present — which simply means that any data entered is technically encrypted — this does notindicate legitimacy or trustworthiness. Scammers also use basic SSL certificates to give a false sense of security.

Risky or Misleading Claims About Services

Content from various critiques paints a picture of bull‑verse.org as more style than substance:

-

The site reportedly promises high returns and advanced trading features intended to attract crypto investors.

-

Reviews and analyses argue that this platform is constructed using generic marketing pitches, including vague claims of profitability and “intuitive tools,” without transparent explanations of how profits are generated.

-

Some external reviews note the platform’s use of fabricated testimonials or stock images to create a misleading impression of legitimacy.

These tactics — including promises of guaranteed or inflated returns — are commonly used to lure inexperienced investors into depositing funds.

Mixed or Conflicting Public Reviews

One striking feature of bull‑verse.org is the stark contrast between independent risk assessments and online reviews displayed on or associated with the platform:

-

On independent trust‑rating sites, bull‑verse.org shows extremely low trust indicators with no verified industry credentials or transparent details.

-

However, review widgets shown on the platform or related review aggregators claim high satisfaction rates and glowing user reviews.

This discrepancy is typical of sites that embed or host their own internal reviews rather than rely on third‑party verified ratings. Internal or self‑curated review systems can be manipulated to present a positive image, making them unreliable.

In contrast, genuine third‑party reviews on established platforms — when available — are what help verify real user experiences. In the case of Bullverse-related sites, such independent reviews are absent or extremely limited.

Lack of Verifiable Regulation and Transparency

A trustworthy financial services or crypto trading platform typically:

-

Displays clear regulatory licences and registrations with recognised authorities.

-

Provides transparent details about company ownership, legal structure, and compliance.

-

Offers verifiable contact information, including corporate addresses and customer support channels.

Bull‑verse.org lacks any credible indication of these essential elements. Instead, critics highlight:

-

Lack of verified regulation by legitimate financial authorities.

-

No authentic corporate documentation available to the public.

-

Contact information that cannot be independently confirmed.

This absence of real third‑party oversight or public legal registration records is a major red flag — especially in a landscape where regulatory compliance is designed to protect users.

What These Issues Could Mean for You

Platforms with very low trust scores and hidden ownership pose several risks to users:

-

Deposited funds may be irretrievable, especially with crypto, where transactions cannot be reversed.

-

Personal and financial data could be exposed or misused, thanks to opaque privacy practices.

-

Promises of profit may be purely fictional, designed to encourage larger and repeat deposits.

While some embedded reviews may paint a positive picture, these are not independently verified and therefore cannot be trusted as reliable evidence of service quality or safety.

Final Verdict: Avoid Bull‑verse.org

Bull‑verse.org exhibits multiple indicators associated with unsafe or fraudulent online platforms:

-

Low independent trust scores and hidden ownership.

-

Marketing claims that lack detailed substantiation.

-

Internal or dubious review systems that conflict with external risk assessments.

-

No publicly verifiable regulation or compliance records.

Given these factors, you should steer clear of bull‑verse.org and avoid providing them with any funds or sensitive information.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to bull-verse.org, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as bull-verse.org continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.