Cadence Capital Analytics Report 2026

The online investment space continues to grow rapidly, attracting both legitimate financial firms and questionable operators. Among the newer names circulating is cadence-capital-analytics.com, a website that presents itself as a sophisticated analytics and capital management platform. It claims to offer advanced financial insights, portfolio strategies, and high-level investment performance tools.

However, a closer evaluation of this platform reveals multiple red flags that potential users should carefully consider before engaging. In this review, we will break down the structural, operational, and credibility concerns associated with cadence-capital-analytics.com and explain why it should be approached with extreme caution.

The Illusion of Institutional Credibility

At first glance, the website attempts to project professionalism. It uses financial jargon such as “capital allocation models,” “predictive analytics,” and “institutional-grade portfolio optimization.” The layout often mirrors the aesthetic of legitimate asset management firms, featuring stock imagery of office buildings, trading screens, and corporate meeting environments.

But surface-level branding is not proof of legitimacy.

Legitimate capital analytics firms typically provide:

-

Transparent executive leadership profiles

-

Clear regulatory disclosures

-

Detailed methodology documentation

-

Verifiable company registration data

-

Independent media mentions or industry recognition

Cadence-capital-analytics.com does not provide meaningful verification of these elements. The lack of identifiable executives or verifiable operational headquarters raises immediate concerns about accountability.

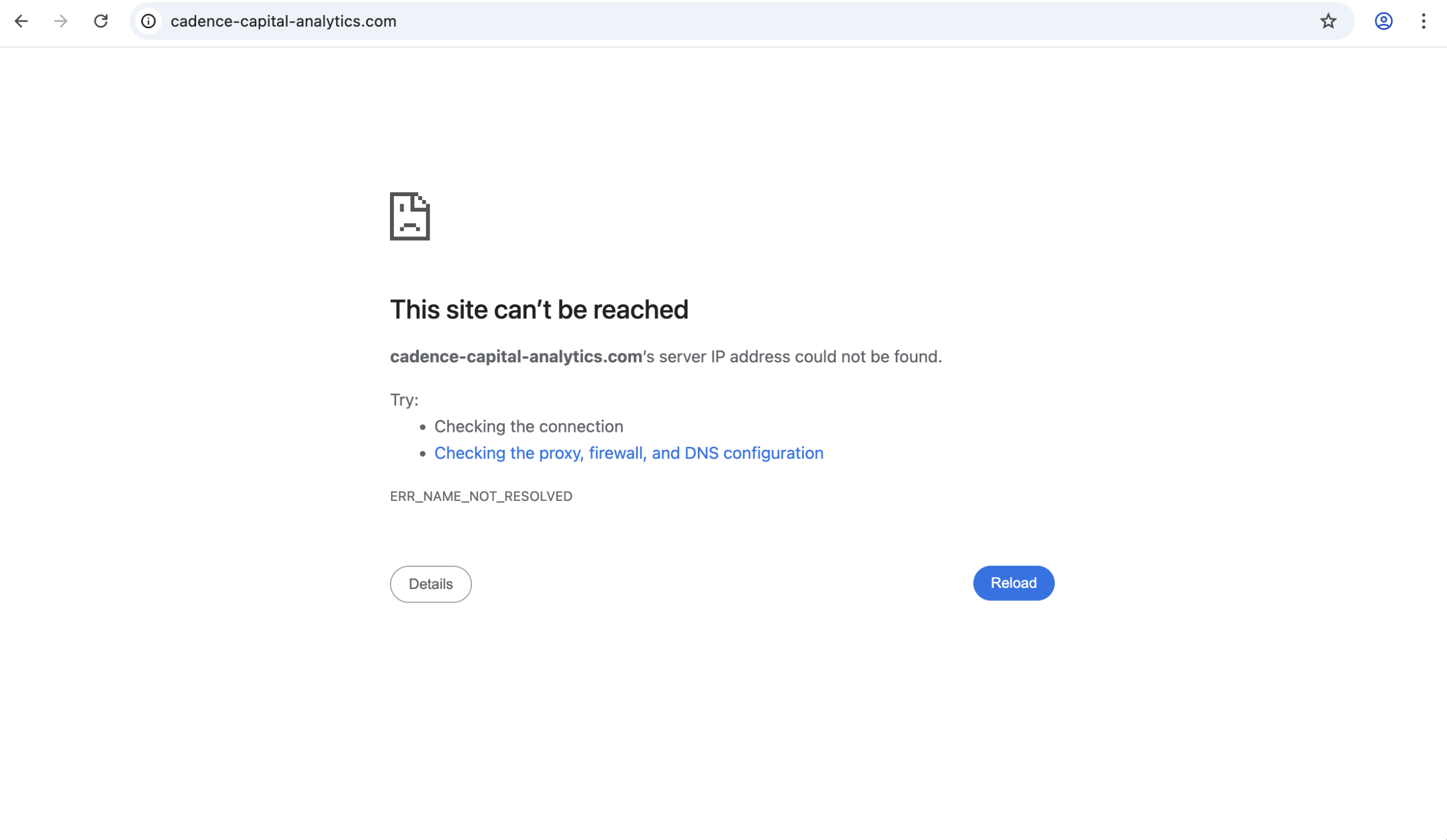

Domain and Operational Transparency Issues

One of the most common patterns in questionable financial platforms is limited transparency around ownership and operational history. When reviewing cadence-capital-analytics.com, several issues stand out:

-

Minimal Corporate Footprint

There is no visible corporate registry reference that can be independently verified. A legitimate capital analytics firm would normally list company registration numbers, regulatory affiliations, or licensing details. -

No Documented Track Record

The platform makes broad performance claims but does not provide independently audited reports or third-party verification of investment returns. -

Limited External Presence

Established financial analytics firms usually have a digital footprint beyond their website — such as press coverage, conference appearances, LinkedIn executive profiles, or industry partnerships. The absence of such presence is notable.

When a company handles financial data or capital allocation strategies, transparency is not optional — it is foundational.

Overpromising Performance Metrics

Another significant concern is the language used to describe potential outcomes. Many questionable platforms rely on persuasive messaging such as:

-

“Consistent outperforming of market benchmarks”

-

“Low volatility, high yield opportunities”

-

“Algorithmic precision trading signals”

While these phrases sound compelling, legitimate financial service providers are required to include balanced risk disclosures and clear explanations of methodology. When performance language is emphasized without adequate disclosure of downside risks, it suggests marketing priority over compliance.

Investing inherently involves uncertainty. Any platform that implies predictable or unusually stable returns without detailed explanation should be treated with skepticism.

Ambiguity Around Service Model

Cadence-capital-analytics.com does not clearly define whether it operates as:

-

An asset manager

-

A signal provider

-

A data analytics consultancy

-

A brokerage intermediary

-

Or a capital pooling structure

This ambiguity is concerning. Financial services must clearly outline their service structure, especially when client funds or personal financial data are involved. A vague description of “capital analytics solutions” does not explain whether users are depositing funds, purchasing software access, or subscribing to advisory services.

When the business model is unclear, so are the legal protections available to users.

Withdrawal and Support Concerns

Although publicly available reviews may be limited, a pattern frequently associated with similar platforms involves issues such as:

-

Delayed communication from support teams

-

Difficulty withdrawing funds once deposited

-

Requests for additional fees before processing transactions

-

Account restrictions without transparent explanation

While not every user may report such problems, these patterns are common among platforms that lack regulatory oversight. The absence of a clearly documented dispute resolution process further compounds the concern.

Legitimate financial platforms outline complaint handling procedures and provide contact channels that are verifiable and responsive.

Missing Regulatory Clarity

One of the most important safeguards in financial services is regulatory supervision. Authorised firms must comply with capital requirements, reporting standards, conduct rules, and consumer protection frameworks.

Cadence-capital-analytics.com does not prominently display clear, verifiable regulatory licensing information. This omission is critical.

When a platform deals with investments, trading signals, or capital management without confirmed regulatory status, users are left without structured protection. That means if disputes arise, there may be no formal recourse mechanism.

Regulatory oversight exists precisely to prevent the kinds of operational opacity that this platform demonstrates.

Psychological Marketing Tactics

Another feature often seen in questionable financial platforms is psychological urgency:

-

Limited-time investment windows

-

Countdown timers

-

Exclusive membership messaging

-

“Only a few spots remaining” claims

Such tactics are designed to trigger impulsive decisions rather than informed analysis. Legitimate capital analytics firms do not pressure potential clients into rushed commitments. Instead, they encourage due diligence and provide comprehensive documentation.

If a platform relies heavily on urgency and exclusivity language, it is usually prioritizing conversion over transparency.

Why This Matters

Financial data and capital are sensitive assets. Entrusting them to an opaque or unverified entity can result in:

-

Loss of invested funds

-

Exposure of personal information

-

Inability to resolve disputes

-

Lack of accountability

Professional financial firms operate under strict compliance frameworks for a reason. When those frameworks are absent or unclear, the potential downside increases substantially.

Final Assessment

Cadence-capital-analytics.com presents itself as a sophisticated financial analytics and capital management solution. However, the absence of verifiable corporate details, unclear regulatory status, ambiguous service structure, and promotional performance language collectively raise serious concerns.

A legitimate financial analytics platform should provide transparent leadership, independently verifiable credentials, audited performance reporting, and clear regulatory oversight. Cadence-capital-analytics.com does not demonstrate these standards.

For those considering engaging with online capital or analytics services, thorough independent verification is essential. Based on the observable indicators, this platform does not meet the transparency benchmarks expected of trustworthy financial service providers.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to cadence-capital-analytics.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as cadence-capital-analytics.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.