CapitalGrandInvestment.com Observations

In the crowded market of online investment services, many names tout themselves as gateways to financial growth and enhanced portfolio returns. One such platform that has come under scrutiny recently is CapitalGrandInvestment.com — a site that claims to bring professional financial strategies and wealth‑building services to its users. However, a closer examination reveals a range of issues that should give investors serious pause before engaging with this platform.

This review examines the available information around CapitalGrandInvestment.com, highlights user feedback and platform characteristics, and helps you understand why many investors are choosing to stay away.

Claims vs. Reality: What the Platform Says

At first glance, CapitalGrandInvestment.com presents itself as a comprehensive investment hub serving a diverse global clientele. It suggests a blend of equity, alternative assets, credit and fixed‑income strategies, and even private equity interests. The marketing language projects the image of a sophisticated firm delivering disciplined, long‑term financial planning and tactical investment strategies.

Despite these claims, there is a stark contrast between how the platform markets itself and what can be independently verified. Publicly accessible content on the main service pages often emphasizes growth, strategic insights, and tailored financial planning — but lacks essential details about operational structure, regulatory oversight, or licensing frameworks that are normally expected from legitimate investment firms.

Regulatory Transparency — A Core Concern

One of the foundational pillars of any credible financial or investment service is clear regulatory status. Licensed platforms are typically overseen by recognized authorities, which enforce stringent standards of conduct and provide a safety net for investors in case of disputes.

CapitalGrandInvestment.com does not publicly offer verifiable regulatory information in a manner that can be independently confirmed. That absence of clear documentation is not a trivial omission — it means there’s no easy way for a user to check whether the platform operates under any enforceable legal framework or financial supervision.

When a platform does not disclose licensing or regulator affiliations, potential users are left without the legal frameworks that govern fair practice, transparency, or dispute resolution. This kind of opacity makes it difficult to assess the safety of entrusting money or personal data to the service.

User Feedback — What People Are Saying

Independent review platforms also provide insight into how real users have experienced CapitalGrandInvestment.com. On Trustpilot, the platform has an average score that is only moderate, based on a very small number of reviews. The score doesn’t indicate widespread satisfaction, and the limited volume of feedback suggests that few users have engaged with the service in depth or are willing to share their experience publicly.

One of the two reviews available describes frustration and alleged financial loss stemming from interactions with the platform. While such anecdotal feedback alone doesn’t represent an exhaustive assessment, it raises questions about reliability and customer support responsiveness.

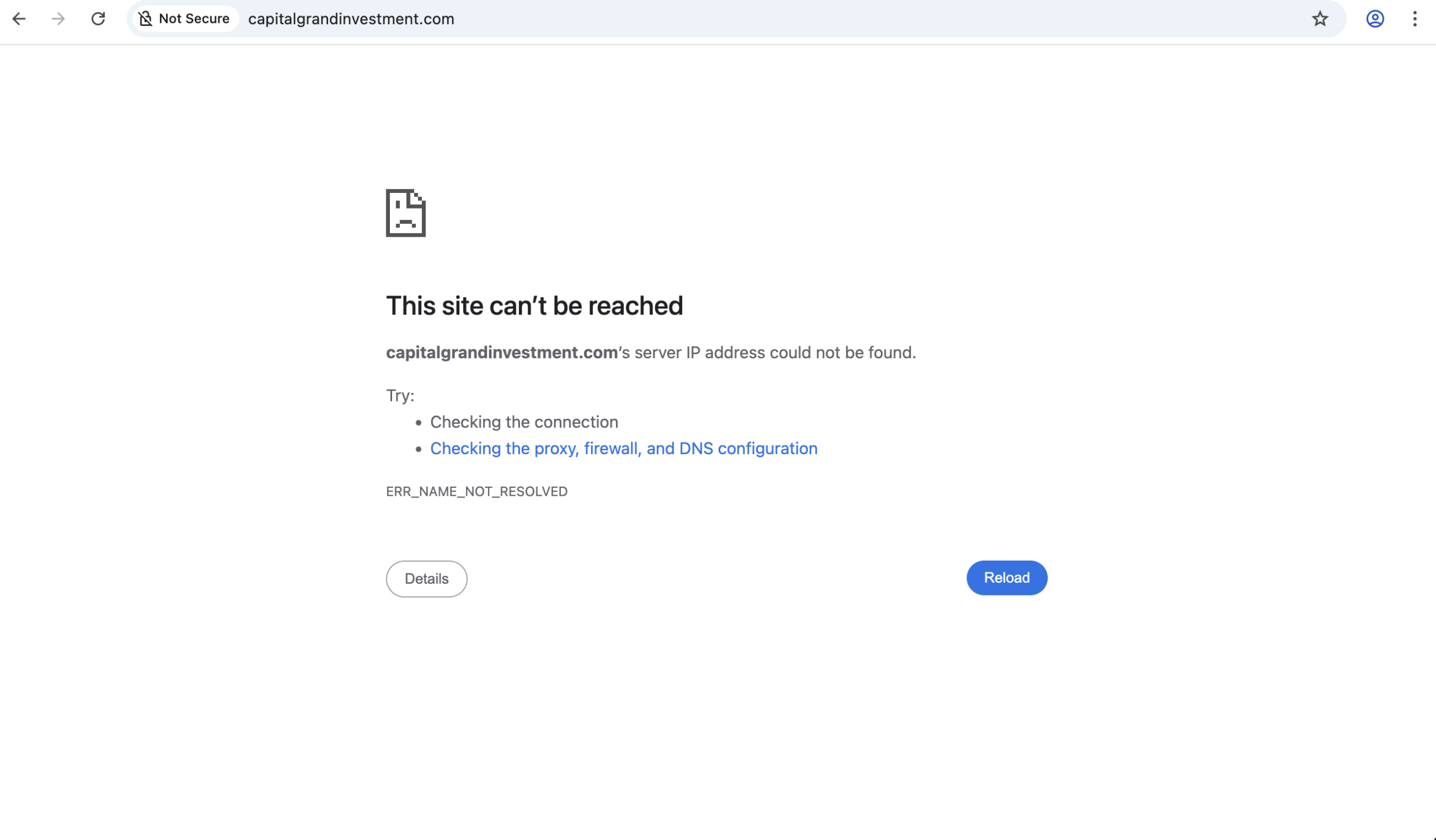

Technical and Website Signals

Automated website analysis tools, such as those used by online trust‑rating sites, have also flagged CapitalGrandInvestment.com for low confidence scores. These tools evaluate factors like domain age, traffic levels, ownership transparency, and other markers of legitimacy.

In multiple instances — including assessments of related domains — independent checks show fresh registrations, limited web presence, and little verifiable historical data on the company’s operations. These are signals that serious investors typically treat with caution, because long‑established, reputable firms tend to have measurable online footprints and traceable histories.

Red Flags Commonly Observed

Several characteristics identified through independent review converge around broader concerns:

-

Lack of visible regulatory credentials: No clear licensing details from authoritative financial bodies.

-

Limited user engagement: Few reviews and low traffic levels suggest low adoption or questionable visibility.

-

Sparse transparency around ownership: Essential information about company leadership and corporate background is hard to verify.

-

Mixed user sentiment: A combination of unexplained complaints and few positive reports results in an unclear reputation profile relative to expectations for an investment service.

When such indicators appear together, they often reflect a platform that hasn’t been through the scrutiny or operational maturity typical of established financial services.

Investor Advice: Proceed With Caution

Before committing funds or sharing sensitive financial information with any online investment service, including CapitalGrandInvestment.com, potential users should take a series of precautionary steps:

-

Verify Licensing: Confirm whether the platform is registered with a reputable financial authority in your jurisdiction or internationally.

-

Evaluate Independent Reviews: Look for feedback from multiple independent sources beyond the platform’s own marketing materials.

-

Request Documentation: Legitimate services will provide clear terms and documentation upfront, including fee schedules, service agreements and official compliance statements.

-

Consult Experts: When in doubt, a conversation with a certified financial adviser can clarify whether a platform fits your investment profile and legal protections.

Platforms that do not offer transparent and verifiable credentials leave investors without key safety nets that protect assets and personal information. In the world of digital finance, this lack of baseline transparency is enough to make many people rethink their involvement.

Final Thoughts on CapitalGrandInvestment.com

While CapitalGrandInvestment.com markets itself with confident language and professional services descriptions, the lack of clear regulatory information, limited independent user feedback, and minimal verified presence in authoritative financial databases all suggest a need for extreme caution. Independent tools flag low trust scores, and public review platforms offer mixed or limited sentiment.

Given these factors, anyone considering this platform should take time to dig deeper, confirm credentials through official financial authorities, and weigh alternatives that offer stronger transparency and oversight. Your financial decisions deserve clarity — and when a platform isn’t forthcoming with essential details, it’s sensible to look elsewhere.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to capitalgrandinvestment.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as capitalgrandinvestment.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.