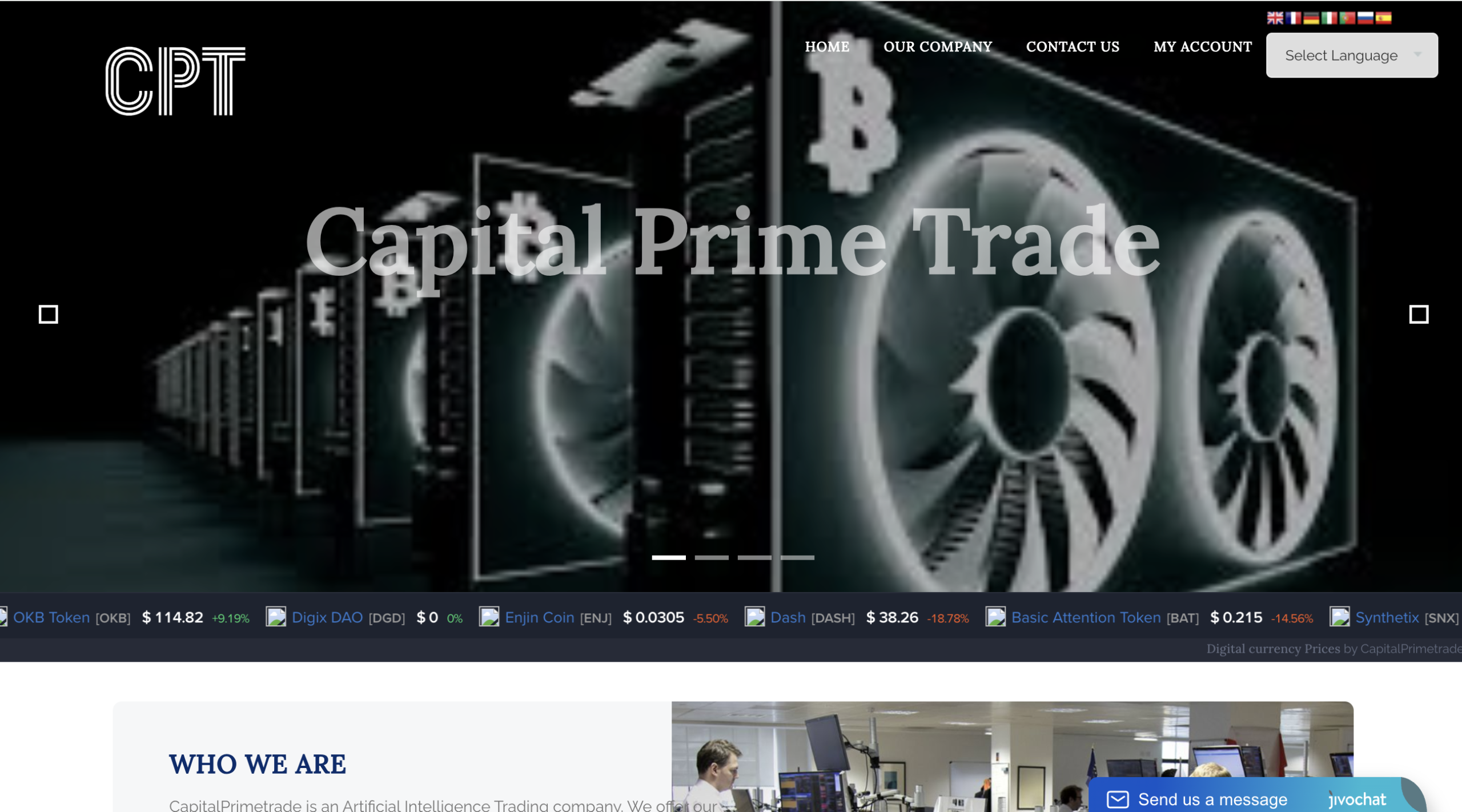

CapitalPrimeTrade Exposed: High-Risk Platform

CapitalPrimeTrade.com presents itself as a professional online trading and investment platform. It claims to offer advanced trading tools, high returns, and easy access to global markets. At first glance, the website appears polished and trustworthy. However, a deeper look reveals multiple red flags indicating that the platform is high-risk and likely unsafe for ordinary investors. This review explains the key issues with CapitalPrimeTrade.com and why users should steer clear.

Lack of Transparent Corporate Identity

A legitimate financial platform provides clear information about its ownership, company registration, and physical location. Reputable services list a verifiable company name, executive team, and registered address. CapitalPrimeTrade.com, however, offers little to no information about who runs the platform. There is no verifiable company registration, no listed headquarters, and no named executives that can be independently confirmed.

This lack of transparency makes accountability nearly impossible. Users have no reliable contact for disputes or issues. Without clear ownership, investors cannot perform proper due diligence. This absence of essential corporate information is a major warning sign.

Unverified Regulatory Status

Regulatory oversight is critical in trading and investment services. Legitimate platforms are registered with recognized financial authorities, and they provide verifiable license numbers. CapitalPrimeTrade.com does not provide credible regulatory credentials. Any claims of regulation are vague, lacking details about authorities or license numbers.

Without confirmed regulation, users cannot rely on protections or standards that licensed platforms provide. The absence of verifiable oversight is a strong indicator that the platform may operate outside the law, placing users at serious financial risk.

Misleading Profit Claims

CapitalPrimeTrade.com markets itself with promises of high and fast returns using advanced trading strategies. The site suggests users can earn large profits with minimal effort, appealing to those looking for quick gains. However, no legitimate trading service guarantees returns, especially without explaining risks.

The platform focuses on outcomes rather than process, prioritizing emotional appeal over factual transparency. Promises of “easy profits” are classic tactics to attract inexperienced investors. Any investment platform that oversells returns without emphasizing risk should be treated with extreme caution.

Opaque Fee Structure

Another major concern is the lack of clarity about fees. Reliable platforms provide clear and detailed information about deposit fees, trading fees, withdrawal charges, and other costs. CapitalPrimeTrade.com does not clearly disclose these fees upfront.

This ambiguity can result in unexpected costs during deposits, trades, or withdrawals. Platforms that hide fees or reveal them only after transactions are designed to maximize user losses. A lack of transparent fee structure is a strong warning sign that the platform prioritizes revenue over user protection.

Withdrawal Difficulties

Many risky platforms make deposits easy but withdrawals difficult. CapitalPrimeTrade.com exhibits this pattern. Users may encounter delays, extra verification requirements, or new “processing” fees when attempting to withdraw funds.

Obstructed access to deposited funds indicates that the platform is more focused on keeping money than on providing legitimate trading services. Safe and regulated platforms handle withdrawals efficiently, with clear terms and timelines. Any platform that complicates access to user funds is inherently high-risk.

Heavy Emphasis on Referrals

CapitalPrimeTrade.com also places strong emphasis on referral and affiliate programs. While legitimate companies may offer rewards for referring users, platforms that rely heavily on recruitment over product value are concerning.

When user income depends more on bringing in new members than on trading performance, the platform resembles a pyramid-like model. This structure is unsustainable and puts ordinary users at risk. Recruitment-heavy incentives are a major red flag.

Poor Customer Support

Good trading platforms offer responsive and transparent customer support through multiple channels. Users should be able to resolve issues, ask questions, and confirm transactions quickly. CapitalPrimeTrade.com, however, provides minimal support. Responses are often generic, evasive, or delayed.

Users attempting to clarify withdrawal issues or account problems frequently encounter unhelpful replies. Weak or evasive customer service indicates that the platform may not be committed to supporting its users responsibly.

Suspicious Testimonials

CapitalPrimeTrade.com prominently displays testimonials and user success stories. However, these reviews often appear overly polished, repetitive, or lack verifiable details. Independent reviews from external sources are notably absent.

Legitimate platforms accumulate reviews organically across multiple independent sites. When a platform only presents controlled testimonials, its credibility is questionable. This tactic is commonly used to mislead users about the platform’s performance and reliability.

Security Concerns

Security is critical for any platform handling sensitive financial and personal data. Legitimate platforms implement strong authentication, encryption, and clear privacy policies. CapitalPrimeTrade.com shows little evidence of robust security measures.

Weak or poorly explained security protocols expose users to identity theft, account compromise, and financial loss. Any platform that does not prioritize security is a significant risk to both funds and personal information.

Risky Payment Methods

The platform favors payment methods that are difficult to trace or reverse. While digital transfers or cryptocurrencies may be convenient, they provide minimal recourse in case of issues.

By discouraging traditional banking or credit card options, the platform reduces consumer protections. Users sending funds via irreversible channels risk losing money if the platform does not honor transactions.

Final Assessment: Avoid CapitalPrimeTrade.com

Taken together, CapitalPrimeTrade.com exhibits multiple warning signs of a high-risk or potentially fraudulent platform. These include:

-

Lack of transparent ownership

-

Unverified regulatory status

-

Unrealistic profit claims

-

Hidden or opaque fees

-

Withdrawal complications

-

Heavy reliance on referrals

-

Poor customer support

-

Suspicious testimonials

-

Weak security and risky payment methods

Investors seeking legitimate trading services are better served by regulated, transparent, and well-established platforms. CapitalPrimeTrade.com fails basic checks of accountability, reliability, and safety.

The safest approach is to avoid this platform entirely. Placing capital or personal data on unverified and risky platforms exposes users to unnecessary financial and identity risks. Protecting your funds and information should always be a top priority. Stepping away from platforms like CapitalPrimeTrade.com is the most responsible decision.

Report Capitalprimetrade.com And Recover Your Funds

If you have lost money to capitalprimetrade.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like capitalprimetrade.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.