CargilFSE.ltd Scam Review: Risky Platform Alert

The online trading and investment space has grown rapidly in recent years, and with it has come a surge of fraudulent platforms designed to prey on unsuspecting users. Among these questionable operations is Cargill FSE Ltd, operating at the domain cargilfse.ltd. While the platform presents itself as a sophisticated global brokerage offering access to foreign exchange, cryptocurrencies, and advanced financial tools, a closer look reveals a deeply troubling picture. Beneath the polished exterior, Cargill FSE displays nearly every major red flag associated with modern online investment scams.

This comprehensive review breaks down the warning signs, the tactics used by the platform, and the reasons why anyone considering investing should steer clear completely.

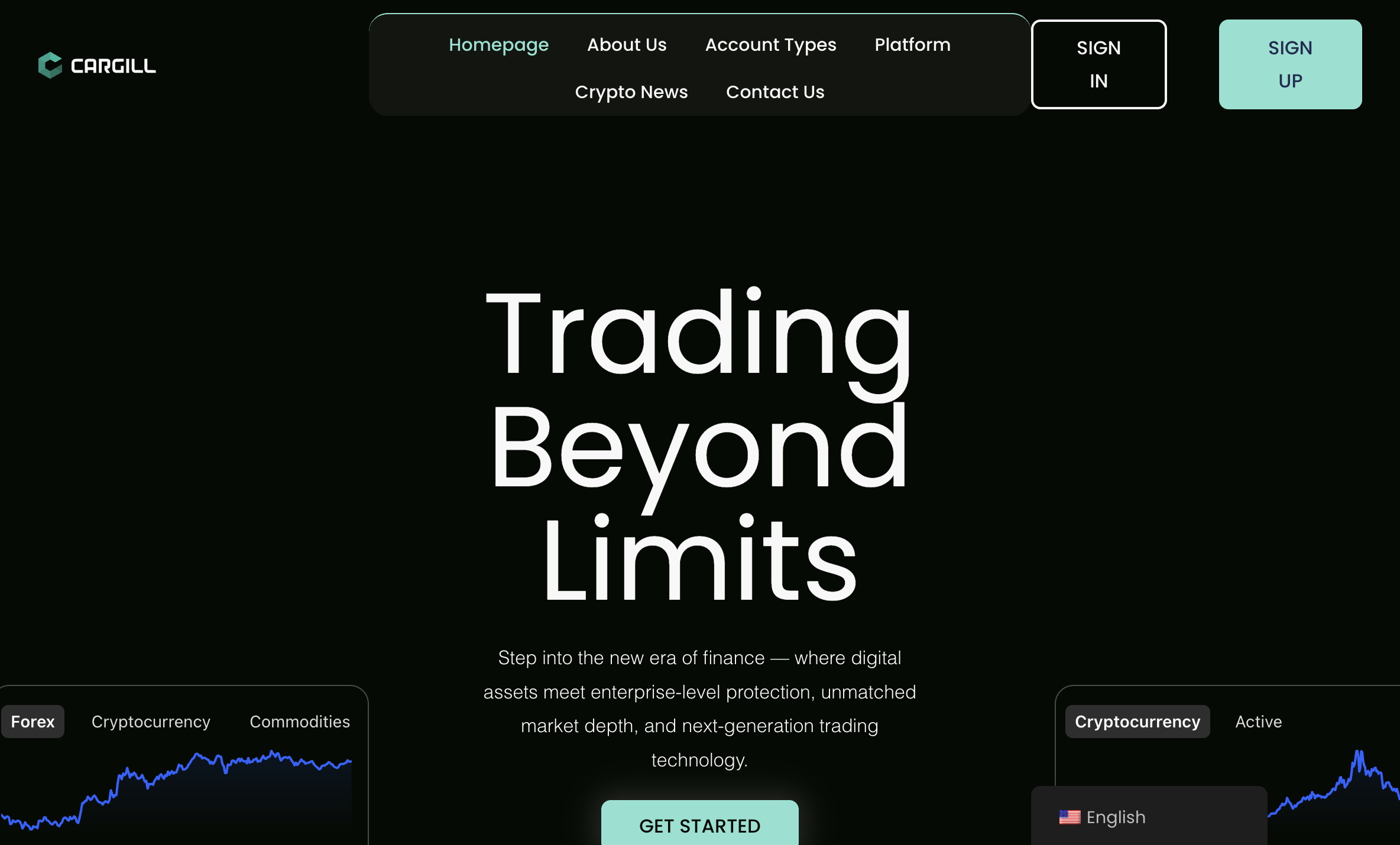

A Polished Website With a Hidden Agenda

At face value, Cargill FSE Ltd appears convincing. Its website uses professional design, trading-themed imagery, and promises access to “elite financial markets” through “cutting-edge trading systems.” It also showcases supposed user testimonials, a London business address, and claims of strong customer support.

However, scam operations often mimic real brokerage platforms with remarkable accuracy. The goal is simple: to create a false sense of legitimacy. In the case of Cargill FSE, nearly every “proof” of credibility falls apart under scrutiny.

Red Flag #1: No Valid Regulatory License

Legitimate trading platforms must be licensed by recognized financial authorities. Regulation ensures transparency, protects users’ funds, and prevents companies from operating anonymously.

Cargill FSE, however, holds no valid license from any reputable regulator anywhere in the world. The company claims to be registered or overseen by entities that simply do not exist or cannot be verified. Fake regulatory badges and fabricated documents are commonly used tricks in the industry, and Cargill FSE follows this pattern closely.

A financial service that operates without oversight exposes users to extreme risk. Without regulation, there is no accountability, no consumer protection, and no safeguard ensuring that deposits are actually used for trading rather than siphoned off by unknown operators.

Red Flag #2: Anonymous Operators and Fake Corporate Identity

A genuine financial institution makes its ownership, leadership team, and corporate structure publicly available. Transparency builds trust. Cargill FSE provides none of this.

Key questions have no answers:

-

Who owns the company?

-

Who are the executives or directors?

-

What is the real operating location?

-

Is the claimed London address authentic or rented virtual space?

Everything about the platform’s identity is hidden. Scam platforms hide behind anonymity because exposure would make it easier for authorities to track them. Cargill FSE offers no traceable individuals, no verifiable office, and no credible corporate history. This alone is enough reason to walk away.

Red Flag #3: Classic Scam Tactics and False Promises

Cargill FSE uses nearly every typical manipulation tactic seen in online investment fraud:

✓ Unrealistic Profits

Scam brokers often promise high returns with minimal risk. These claims are designed to attract beginners and vulnerable investors who may not understand that real trading involves volatility and uncertainty. Cargill FSE’s marketing strongly hints at effortless gains — a well-known trap used by scammers.

✓ Fake Advanced Tools

The platform advertises “AI-driven trading algorithms,” “smart-market prediction systems,” and other technical-sounding features. In reality, there is no evidence these tools exist. Such features are usually nothing more than visual graphics designed to impress inexperienced traders.

✓ Manipulated Dashboards

Users often report that scam dashboards show increasing profits to build confidence. These numbers may look real, but they are simply fabricated figures programmed to rise whether trading occurs or not. It creates the illusion of success until users attempt a withdrawal — the point at which the truth reveals itself.

Red Flag #4: Difficulty Withdrawing Funds

One of the most telling signs of a fraudulent broker is withdrawal obstruction. Cargill FSE fits this pattern perfectly.

Users commonly experience:

-

Delayed responses from “support teams”

-

Unexpected fees or taxes demanded before withdrawal

-

Requests for additional deposits to “unlock” funds

-

Sudden account suspension when money is requested

-

Completely silent communication once users insist on withdrawal

Legitimate brokers never block clients from accessing their own funds. Withdrawal games are a hallmark of a scam — the goal is to take as much money as possible, then disappear.

Red Flag #5: Fabricated Reviews and Testimonials

The platform displays glowing user testimonials and may even have a handful of positive comments on public review websites. But experienced analysts know that fake reviews are extremely common among fraudulent brokers. These fabricated stories are often:

-

Generated by automated scripts

-

Written by hired reviewers

-

Copied across multiple scam sites

Meanwhile, genuine user experiences — those describing lost funds, blocked withdrawals, or ignored support tickets — are usually buried or suppressed.

When a platform’s reputation depends on fake praise rather than transparent performance, caution is not just recommended — it is essential.

Red Flag #6: Suspicious Domain Behavior

The domain cargilfse.ltd shows characteristics that are widely associated with high-risk websites:

-

Recent registration

-

Hidden ownership details

-

Server protection masking the real location

-

No long-term operational history

Scam platforms frequently register domains for short-term use, knowing that once exposed, they can quickly shut down and reopen under a new name. The short-lived nature of cargilfse.ltd aligns perfectly with this pattern.

Why You Must Stay Away from CargillFSE.ltd

Cargill FSE Ltd is not just a risky investment platform — it is a highly deceptive operation designed to mislead and exploit users. Every major credibility indicator fails:

-

No regulation

-

No corporate transparency

-

No verifiable identity

-

No secure financial oversight

-

No proof of legitimate trading activity

Instead, it demonstrates a consistent pattern of behaviors commonly associated with organized online fraud.

Choosing to engage with an unlicensed, anonymous, and opaque platform is extremely dangerous. The risk of losing money is not hypothetical — it is almost guaranteed.

Final Conclusion

CargillFSE.ltd presents itself as a modern investment gateway, but beneath the surface lies a network of red flags too serious to ignore. Its lack of regulation, false identity claims, suspicious operational behavior, and misleading marketing tactics clearly indicate that the platform should never be trusted.

Anyone looking to invest online should prioritize transparency, regulatory oversight, and proven credibility. Cargill FSE offers none of these elements. The safest and wisest choice is to avoid the platform entirely.

If you are researching Cargill FSE, let your research guide you: this is not a platform to engage with — it is a platform to stay far away from.

Report cargilfse.ltd And Recover Your Funds

If you have lost money to cargilfse.ltd, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like cargilfse.ltd continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.