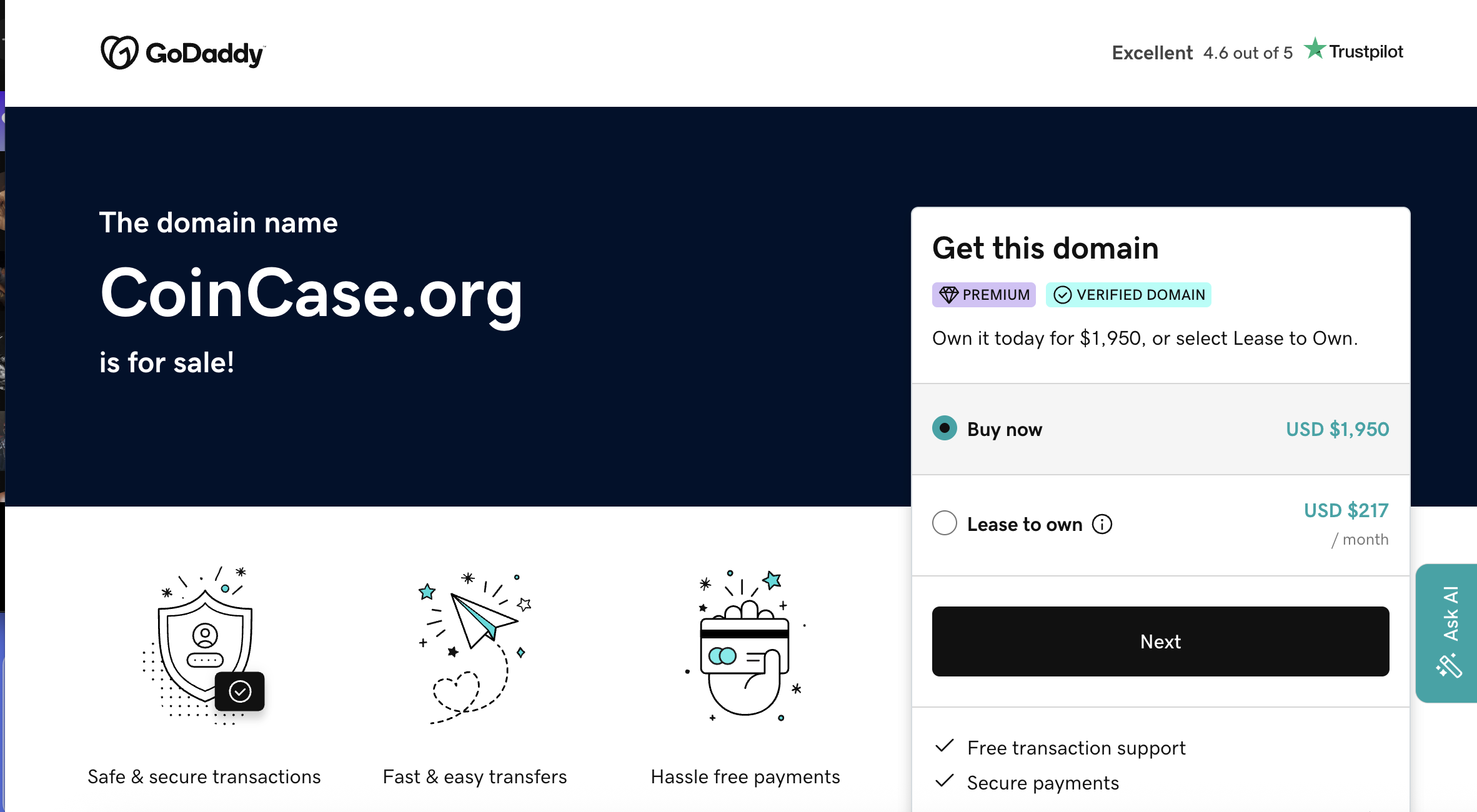

Coincase.org Scam Review– Red Flags Traders Must Know

Introduction

The cryptocurrency market has exploded over the past decade, offering investors numerous opportunities to profit from digital assets. However, this rapid growth has also attracted fraudulent brokers and exchanges. Coincase.org is one such platform that has raised concerns among traders.

While the website markets itself as a reliable and innovative crypto trading platform, several red flags suggest that Coincase.org may not be trustworthy. In this review, we will examine its operations, warning signs, and why traders should exercise caution before investing.

What is Coincase.org?

Coincase.org claims to be a cryptocurrency trading and investment platform that provides users with access to various digital assets. The platform promotes advanced trading tools, automated systems, and the promise of high returns with minimal risk.

It targets both novice and experienced investors, offering multiple account types and incentives to deposit larger amounts of money. However, the website provides little verifiable information about the team behind it or its operational history, making it difficult to assess its legitimacy.

First Impressions of the Website

Coincase.org appears professional at first glance. The website features a clean interface, promotional banners highlighting high returns, and claims of user-friendly trading. Key marketing messages include:

-

Quick and easy account setup.

-

Multiple account types with various benefits.

-

Advanced trading tools and analytics.

-

“Guaranteed” profits and minimal risk.

While visually appealing, several aspects of the website raise concerns:

-

No company details – There is no information about who owns or operates the platform.

-

Lack of regulation – Legitimate brokers display licensing and regulatory information, which Coincase.org does not.

-

Overpromised returns – Guaranteed profits in volatile markets are unrealistic.

These factors suggest that Coincase.org may not be a reliable trading platform.

Regulatory Concerns

A key indicator of a broker’s legitimacy is its regulation by recognized financial authorities such as the FCA (UK), CySEC (Cyprus), or ASIC (Australia). Regulation ensures that client funds are protected, operations are transparent, and traders have legal recourse if issues arise.

Coincase.org provides no evidence of regulatory compliance, which is a significant red flag. Without regulation:

-

Deposits are at risk.

-

The broker can operate without accountability.

-

Traders have no legal protection if funds are lost.

Unregulated platforms often take advantage of this lack of oversight, making them a high-risk choice for investors.

Trading Conditions on Coincase.org

Coincase.org advertises several trading options and account types, but the details raise suspicion:

-

High leverage – Unusually high leverage increases the risk of rapid losses.

-

Vague fees – There is no clear breakdown of spreads, commissions, or withdrawal fees.

-

Account tiers – Higher account tiers require larger deposits, often with promises of better returns.

These conditions are typical of platforms designed to maximize deposits rather than provide a safe trading experience.

Withdrawal Issues

Withdrawal problems are a common sign of a fraudulent broker. Users have reported several issues with Coincase.org, including:

-

Delayed or blocked withdrawals.

-

Requests for additional fees before releasing funds.

-

Account restrictions once withdrawal requests are made.

These practices indicate that Coincase.org may prioritize collecting deposits rather than facilitating legitimate trading.

Aggressive Sales Tactics

Coincase.org reportedly employs high-pressure tactics to encourage traders to deposit more money. Account managers often:

-

Frequently call or email users, urging larger deposits.

-

Promise guaranteed returns to lure investors.

-

Pressure traders to upgrade accounts for “exclusive benefits.”

Such tactics are commonly used by scam brokers to extract as much money as possible from unsuspecting traders.

Red Flags Identified

Analyzing Coincase.org reveals several concerning red flags:

-

No regulatory license – A major concern for investor protection.

-

Unrealistic profit claims – No legitimate broker can guarantee profits.

-

Opaque company information – Lack of ownership and operational transparency.

-

Withdrawal difficulties – Users report blocked or delayed payouts.

-

Aggressive deposit pressure – Account managers push for larger deposits.

Each of these issues is concerning, and collectively, they indicate a high-risk platform.

How Coincase.org Operates Like a Scam

Coincase.org follows a pattern commonly seen with fraudulent brokers:

-

Attractive marketing – Promises of easy profits and minimal risk.

-

Small initial payouts – Early withdrawals may succeed to build trust.

-

Deposit pressure – Encouraging larger investments through account managers.

-

Blocked withdrawals – Significant deposits become difficult or impossible to withdraw.

-

Eventual disappearance – Scam platforms often vanish, leaving investors with losses.

This pattern matches user complaints and highlights the platform’s risky nature.

Comparison With Legitimate Brokers

To highlight the differences, here’s how Coincase.org compares to a regulated broker:

|

Feature |

Coincase.org |

Regulated Broker |

|---|---|---|

|

Regulation |

None |

FCA, CySEC, ASIC |

|

Transparency |

Low |

High |

|

Withdrawal Security |

Not guaranteed |

Fully guaranteed |

|

Risk Warnings |

Absent |

Mandatory |

|

Client Fund Protection |

None |

Yes |

The comparison shows that Coincase.org fails to meet the minimum standards of safety and credibility expected from legitimate brokers.

User Experiences

User feedback highlights recurring issues:

-

Aggressive deposit pressure from account managers.

-

Withdrawal requests delayed or denied.

-

Promised profits that never materialize.

-

Accounts being restricted without valid explanations.

These reports reinforce the suspicion that Coincase.org is not a trustworthy platform.

Conclusion

Coincase.org presents itself as a professional crypto trading platform, but a detailed examination reveals numerous red flags. Lack of regulation, withdrawal difficulties, opaque operations, and unrealistic profit claims indicate a high-risk broker.

Investors should prioritize platforms that are regulated, transparent, and accountable. Coincase.org does not meet these standards and should be approached with caution. Choosing trustworthy exchanges and brokers is essential for safeguarding funds in the volatile world of cryptocurrency trading.

Report. Coincase.org And Recover Your Funds

-

If you have lost money to coincase.org, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like coincase.org continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.