The online financial services industry has expanded rapidly in recent years, giving individuals easier access to digital payment solutions, trading platforms, and financial management tools. Among the numerous services available, AllHoursPay.com has emerged as a platform claiming to provide online payment solutions, digital asset management, and other financial services for users worldwide. While these types […]

In recent years, online investment platforms have flourished, offering a range of services from traditional brokerage accounts to digital asset trading and algorithmic tools. One name that has surfaced in investor discussions and online reviews is Allexbit. This platform presents itself as a modern solution for individuals seeking to participate in financial markets, including cryptocurrencies, […]

Allerainvest.com is an online investment platform that has drawn interest from individuals exploring digital trading and financial markets. While the site presents itself as an innovative solution for investors, several aspects of its structure and claims warrant careful evaluation. This review outlines what Allerainvest.com appears to offer, areas of concern based on publicly observable information, […]

Online trading continues to attract new investors seeking exposure to cryptocurrency, forex, and other digital markets. However, not every platform offering investment opportunities operates with transparency or regulatory oversight. One name that has recently surfaced is AllcTrades. This review takes a critical and structured approach to examining AllcTrades — focusing on operational credibility, platform claims, […]

The cryptocurrency industry has seen massive growth in recent years, attracting a wide range of trading and investment platforms. One platform gaining attention is AllCryptCapital, which claims to provide high returns, advanced trading tools, and a secure investment environment. This review examines AllCryptCapital’s operational structure, transparency, regulatory standing, and potential risks to help investors make […]

The rapid expansion of cryptocurrency trading has created both legitimate opportunities and significant risks for investors worldwide. As digital assets gain mainstream acceptance, new investment platforms appear almost daily, each promising innovation, security, and high returns. One such platform drawing attention is allcryptoinvest.com. This professional review provides a structured and detailed examination of allcryptoinvest.com, focusing […]

Cryptocurrency and online trading have opened doors for many investors seeking high returns. With that popularity comes a flood of new platforms promising fast profits and cutting-edge trading tools. One of these platforms is Aliextrade — a site that claims to offer automated trading, advanced investment options, and superior market execution. This review examines Aliextrade’s […]

The cryptocurrency market has generated substantial interest from investors around the world, and as a result, numerous online platforms have emerged offering automated trading and investment solutions. One such platform that has gained attention is algovibe.com. This review provides a detailed look at the platform’s operations, claims, transparency, user feedback, and potential risks to help […]

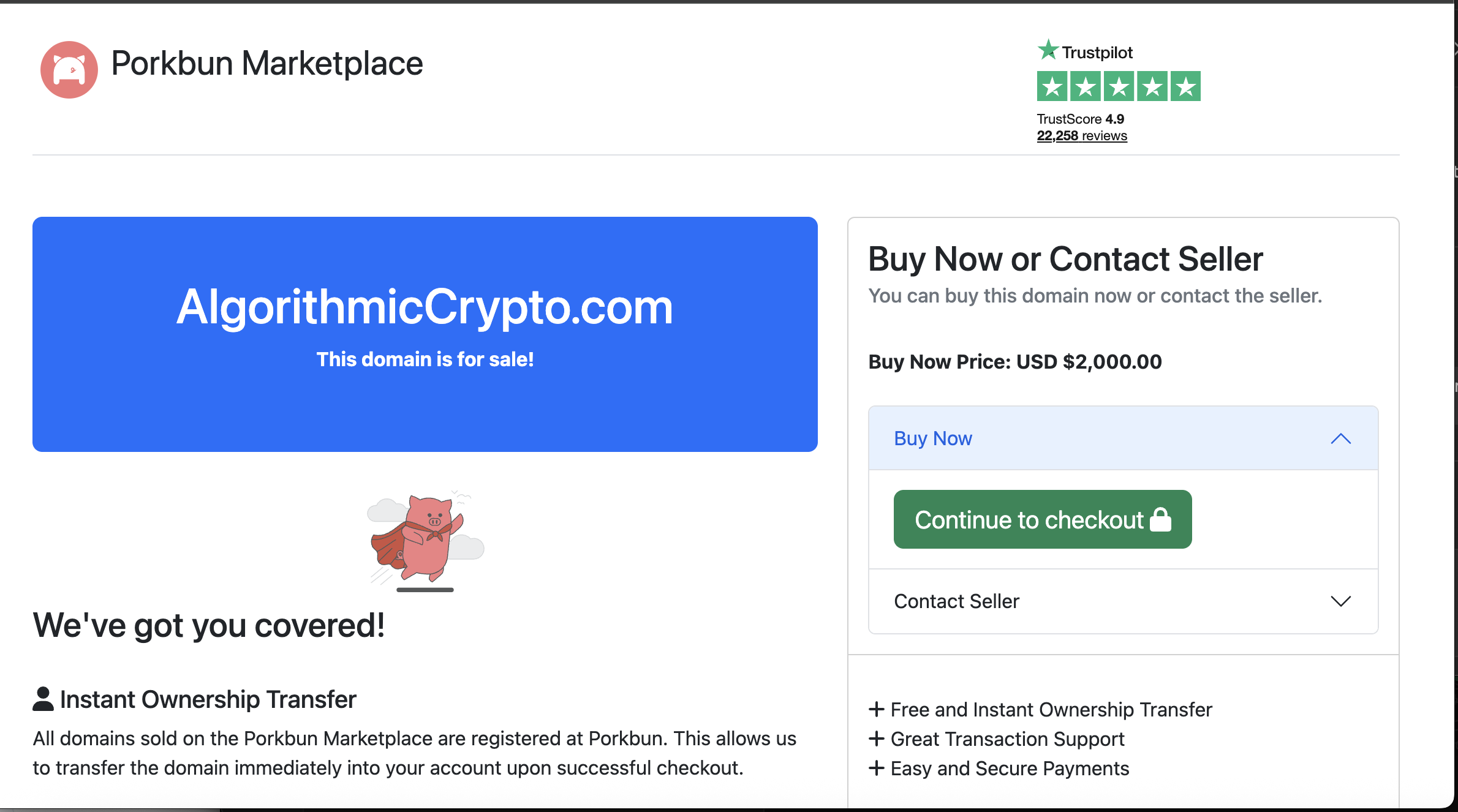

With the continued growth of cryptocurrency investments, many online platforms promise automated trading tools and high returns. One such platform that has drawn attention is AlgorithmicCrypto. This review takes a fresh and detailed look at the platform’s features, claims, user reports, and potential risks — offering insight you won’t find in standard promotional materials. What […]

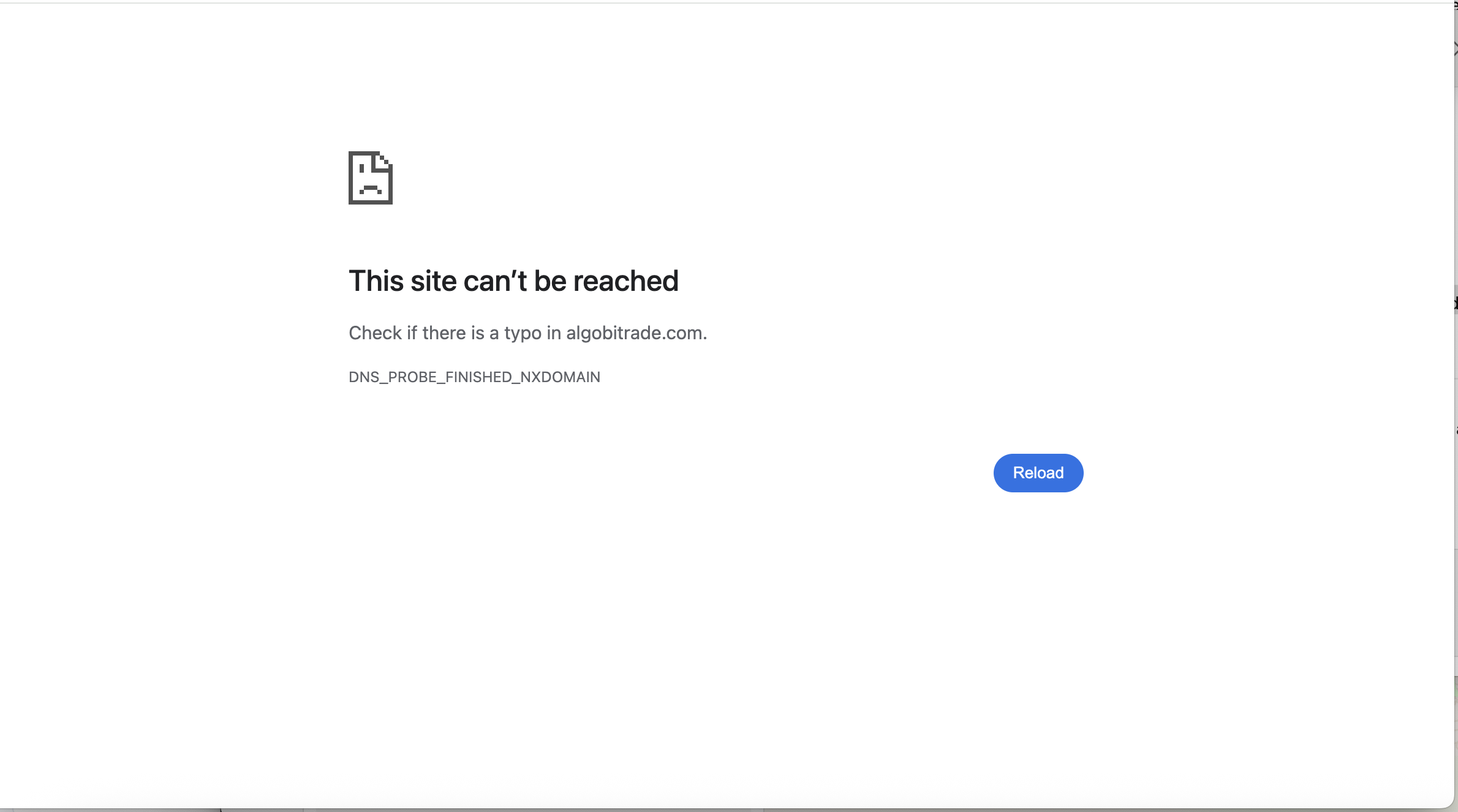

Online trading platforms that claim to use automated or algorithm-driven strategies continue to attract retail investors looking for simplified access to financial markets. Among the platforms gaining attention is Algobitrade, a website that presents itself as an advanced trading solution designed to generate returns through automation. In this in-depth Algobitrade scam review, we break down […]