CopyADK Copy Trading Claims Under Review

In the world of online trading and automated investment services, people are constantly searching for tools that can deliver profits with minimal effort. One such platform that has recently gained attention — not for positive reasons but for its potential to defraud users — is CopyADK.com. Despite flashy marketing and bold claims of easy passive income through automated copy trading, a wide range of evidence suggests that this platform is risky at best and outright fraudulent at worst.

This review delves into what CopyADK claims to offer, the real experiences of users, regulatory warnings issued against it, and why individuals should proceed with extreme caution or avoid it entirely.

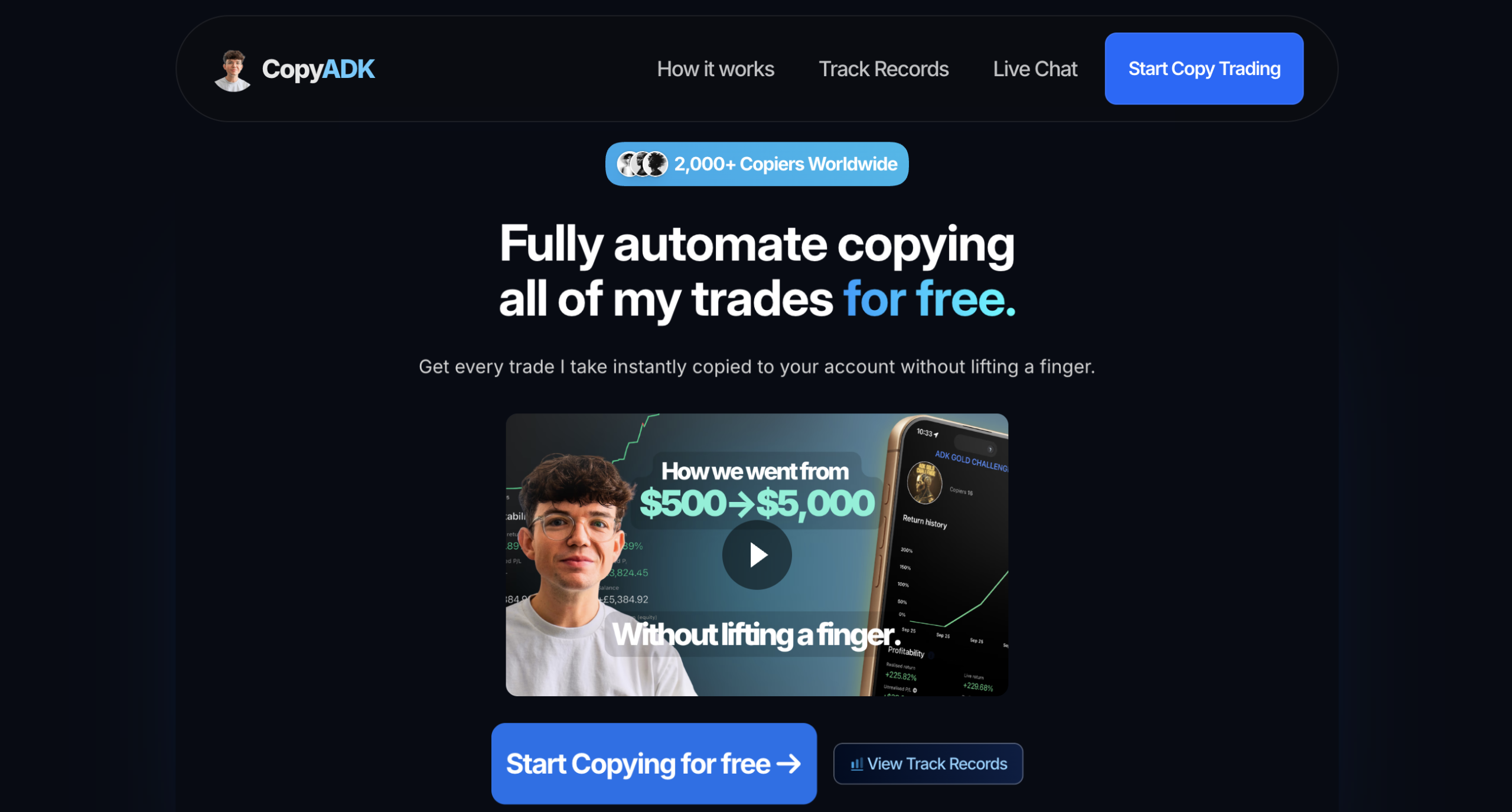

What CopyADK Claims to Be

CopyADK positions itself as a fully automated copy trading service, promising beginners the ability to “mirror” the trades of supposed expert traders without trading experience. According to the content presented on copyadk.com, users can sign up in minutes, connect to their trading accounts, and instantly begin duplicating profitable trades. The site emphasizes “verified results” through tools like MyFXBook and claims to serve hundreds of traders worldwide with minimal effort required from the user.

Such promotional messaging is designed to appeal to those who seek quick profit opportunities or passive income without deep experience in financial markets.

Lack of Regulatory Authorization

One of the most serious concerns surrounding CopyADK is that it is not licensed, authorized, or regulated by any reputable financial authority.

The UK Financial Conduct Authority (FCA) has issued an official warning stating that Copy ADK may be providing or promoting financial services without permission, and that people should avoid dealing with this firm. Regulatory authorization matters because it demonstrates that a platform meets legal, financial, and ethical requirements designed to protect investors. Without such oversight, there is no guarantee of honesty, security, or accountability.

Platforms that trade or copy trade on behalf of clients must normally register with entities such as the FCA (UK), SEC (US), or similar regulators elsewhere. CopyADK’s absence from these listings is a significant red flag.

Anonymous Ownership and Lack of Transparency

Another critical issue is the lack of identifiable information about who runs CopyADK. Legitimate investment firms provide clear details about their corporate structure, leadership, physical office addresses, and registered contact information. In contrast, CopyADK lists only a generic email address and claims to be based in the United Kingdom, without verifiable registration details or a corporate address.

Scam review investigations have repeatedly highlighted that anonymous ownership and masked domain registration are consistent with fraudulent operations. Such entities are difficult to hold accountable, contact, or pursue legally if a dispute occurs.

User Reviews and Reported Experiences

Perhaps the most damning evidence against CopyADK comes from users who have engaged with the platform and shared their experiences online.

On Trustpilot, all available reviews for CopyADK are overwhelmingly negative, with users reporting losses and accusing the platform of deception. Multiple reviewers claimed that they followed instructions exactly, joined premium strategies, and ended up losing their deposited funds. Attempts to contact support reportedly went unanswered.

Some specific user reports include:

-

Investors claiming that their accounts were wiped out within a short time after deposits.

-

Users alleging that the trading “profits” shown on dashboards were artificial, only to have their real funds disappear once deposited.

-

Reviewers asserting that the entity behind CopyADK did not respond to attempts at assistance or clarification.

These patterns of feedback are consistent with platforms that lure users in with simulated short-term gains to encourage larger deposits, then make withdrawals difficult or impossible.

Classic Scam Traits in Operations

Beyond user complaints and regulatory warnings, CopyADK exhibits several hallmarks typical of high-risk fraudulent trading platforms:

1. Unrealistic Profit Promises

CopyADK markets the idea that anyone can generate sizeable returns with no trading experience using its system. Assurances of consistent gains or “verified live track records” without real, independently documented results are warning signs.

2. Withdrawal Obstacles

Reports indicate that individuals face difficulties or silence when attempting to retrieve funds. While it is typical for legitimate brokers to have terms and identity verification procedures before withdrawal, wholly unresponsive support with blocked access is a pattern associated with scams.

3. Fake or Misleading Dashboards

Fraudulent platforms often show fabricated profits — figures that appear promising on a user interface but bear no correlation to actual financial performance once you try to realize gains.

4. No verifiable history or track record

A legitimate investment service would have a transparent performance history backed by credible third-party auditors. CopyADK’s claims of performance verification through self-reported tools do not constitute independent proof.

Combined, these characteristics reflect an operation that prioritizes attracting deposits, not delivering real trading outcomes.

Why People Fall for Platforms Like CopyADK

There are several reasons why such platforms attract users in the first place:

-

Desire for passive income and financial freedom.

-

Influencer or social media marketing that glorifies easy gains.

-

Misinterpretation of financial buzzwords like “AI-powered trading” or “guaranteed profits.”

-

Lack of awareness about regulatory protections and safeguards.

However understandable the desire for profit may be, the reality is that anyone promising guaranteed or effortless financial returns is misrepresenting the nature of financial markets.

Conclusion: Steer Clear of CopyADK.com

Based on regulatory warnings, lack of licensing, transparent ownership information, and overwhelmingly negative user reviews, copyadk.com displays multiple red flags aligned with fraudulent investment platforms. There is no credible evidence that the service operates legitimately, and numerous indicators suggest individuals risk losing part or all of their funds by engaging with it.

Investors should only deal with regulated financial service providers and should be skeptical of platforms offering unrealistic trading shortcuts. Protecting your capital means conducting due diligence, verifying regulatory status, and avoiding platforms that mask their identity or lack accountability.

In an online world rife with high-risk investment options, caution and verification are essential. When it comes to CopyADK, all signs point toward avoiding it entirely.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to copyadk.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as copyadk.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.