Egalite.bond Scam Review: Avoid This Platform Without Question

Egalite.bond presents itself as a legitimate investment provider promising easy access to high-profit bond-based or crypto returns. Yet multiple verified alerts, opaque operations, and classic scam signatures demonstrate that it is not regulated or credible. Here’s a thorough breakdown of the warning signs.

🚨 1. Official Warning & Block by Italy’s CONSOB

Italy’s financial regulator (CONSOB) has formally flagged and blocked Egalite.bond for offering investment services without any licensing. The platform was added to its whitelist of illicit sites and barred from operations in September–December 2024. This legal action signals a serious violation of EU investment laws and should be considered a global red flag. BrokerChooser+7FraudReviewWatch+7FraudReviewExposed+7

❌ 2. No Recognized Regulation or Licensing

Egalite.bond is not listed with any top‑tier regulator such as:

-

FCA (UK)

-

SEC (United States)

-

ASIC (Australia)

-

Swiss FINMA

-

CySEC (Cyprus)

No licence number or verification exists. Analysts confirm it is entirely unregulated, which means customer funds are not segregated or protected. FraudReviewExposed

🕵️♂️ 3. Anonymous Presence, No Transparency

The site provides no contact address, no phone number, no corporate identity, and no named individuals. It even lists operatives and management as “N/A.” Legitimate investment companies always maintain visible credentials; the absence of any is a hallmark of fraudulent intent. FraudReviewWatchFraudReviewExposed

💡 4. Ideal Scam Technique: “Pig-Butchering” and Fake Platforms

Investigative accounts describe how victims are first contacted via messaging apps like WhatsApp and Telegram, then gradually coaxed into investing small sums (€200–250). They are shown fabricated dashboards to show profits, only to be asked for “taxes” or “unlock fees” when attempting withdrawal. Withdrawals are delayed, or funds become unavailable altogether. This manipulation pattern matches high‑confidence pig‑butchering scams.LegitReviewOnline+1FraudReviewExposed+1

📉 5. FraudWatch Warnings and Trust-Score Ratings

Scam detection sites consistently rate Egalite.bond very poorly:

-

ScamAdviser scores it around 1 out of 100, citing domain anonymity, lack of traffic, and known links to fraudulent behavior. BrokerChooser+7Scam Detector+7Universum Wealth Ltd+7

-

FraudReviewWatch describes similar cases where victims were lured by false investment opportunities and never recovered their deposits. FraudReviewWatch+1FraudReviewExposed+1

☎️ 6. Known Scam Tactics of Fraudulent “Egalité” Entities

The legitimate Égalité association has publicly denounced fraudsters misusing its name and logo, posing as financial marketers and offering impossible earnings. They condemned platforms offering “easy income” via paid engagements or trading—clearly stating they do not offer such services. Scam operators use these misleading identities to attract trust before stealing funds. ProtectReviewsOnline+3egalite.org+3avvocatopenalistah24.it+3

📊 7. Promises of High Returns Without Risk

Egalite.bond promotes bond or trading returns far beyond realistic market levels. They suggest fast profit growth—no legitimate financial institution can guarantee daily or weekly cumulative returns. Such projections are a textbook indicator of manipulation or Ponzi-style operations. ProtectReviewsOnline+6Universum Wealth Ltd+6FraudReviewWatch+6

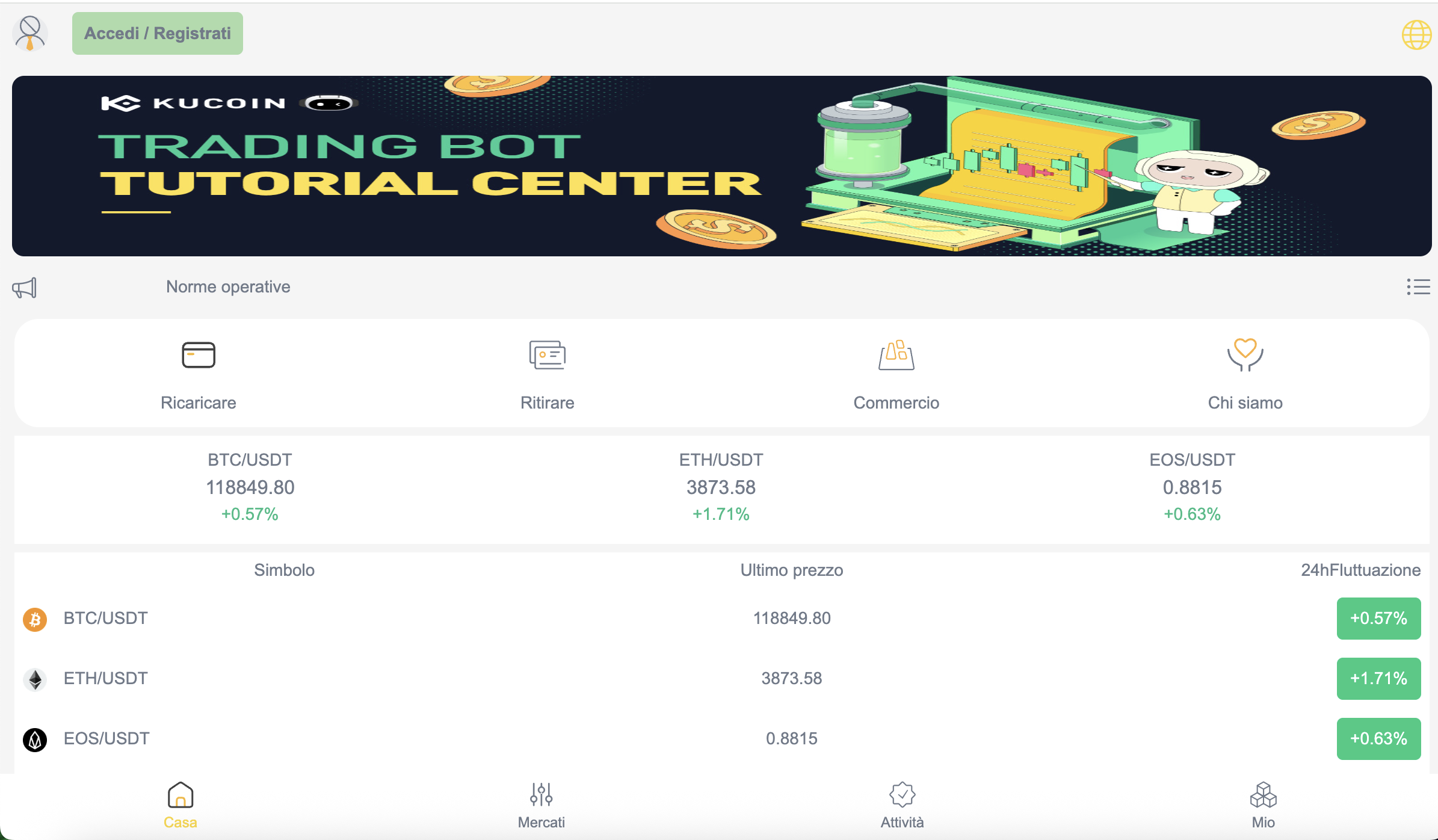

🔧 8. Fake Dashboards & Controlled Trading Interfaces

Reports show victims downloading apps or logging into dashboards that display fabricated numbers. Small payouts may be honored initially to build trust, but as larger sums accumulate, the platform freezes accounts and demands additional “fees” to withdraw. That is a standard trick seen in fraud remediation stories. avvocatopenalistah24.itFraudReviewWatch

🧾 9. Horrible Review Feedback and No User Credibility

User comments on ScamAdviser and related platforms describe losing €500 or more after following the process and seeing initial “profits” that disappeared when withdrawal was requested. Reviews are overwhelmingly negative, detailing unresponsive support and blocked access. There are no verified success stories or reputable testimonials. Scam DetectorFraudReviewWatch

⚠️ 10. Core Scam Patterns Perfectly Matched

Egalite.bond checks almost every box for confirmed fraudulent behavior:

-

Unlicensed and unregistered across known regulators

-

Anonymous domain owner and lack of transparency

-

Engagement via cold outreach (WhatsApp, calls)

-

Fake dashboards showing inflated returns

-

Withdrawal blockage and “fee” extortion after initial interaction

-

Victims left with no support or accountability

This behavior aligns with documented risks involving clone schemes and romance-based investment scams. scam-tracker.netUniversum Wealth Ltd+7FraudReviewWatch+7FraudReviewExposed+7

✅ Red Flag Summary Table

| Risk Factor | Egalite.bond Status |

|---|---|

| Top-tier financial regulation | ❌ Not regulated by FCA, ASIC, CySEC |

| Blocked or warned by financial authority | ✅ Yes—CONSOB official listing |

| Transparent ownership or business info | ❌ Fully hidden |

| Visibility of contact/support info | ❌ None available |

| Improbable guaranteed returns | ✅ Promised |

| Fake trade platform with simulated profits | ✅ Reported |

| Withdrawal penalties or “exit fees” | ✅ Known pattern |

| User complaint visibility | ✅ Yes – small refunds then prohibited |

| ScamScore or trust rating | ❌ Extremely low (1‑3/100) |

| Identity misuse of legitimate brand | ✅ Copying of Égalité identity |

🧠 Final Takeaway: Avoid Egalite.bond at All Costs

Egalite.bond is a high‑risk scam platform with overt indicators of fraud. It operates without legal licensing, is officially blocked by Italian regulators, and relies on fake investment dashboards, cold outreach, and fake branding to lure users. Your money is at serious risk, and depositors have no legal protection or recourse.

If you’ve been contacted by masterminds of Egalite.bond—whether via ads, WhatsApp, Telegram, or email—do not register, do not deposit, and do not comply with withdrawal demands.

🔐 Protection Checklist: Best Practices

-

Never invest in platforms not listed by official authorities like FCA, ASIC, CySEC, or SEC.

-

Always verify stated licensing directly via regulator websites.

-

Avoid offers received through unverified messaging apps or cold contacts.

-

Be skeptical of platforms showing no real team or company details.

-

Be wary of guaranteed or high return promises, especially without disclosures.

-

Use search engines to check for scam warnings or official regulator blacklists.

-

If you deposit small funds, test the withdrawal process immediately.

-

Never pay additional fees to “unlock” funds—this is a common scam trick.

Choosing a platform that lacks transparency, credible licensing, or user feedback is dangerous. Egalite.bond embodies those dangers. Steer clear.

-

Report Egalite.bond and Recover Your Funds

If you have lost money to egalite.bond, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like egalite.bond continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.