Emeraltrade.com Scam Review: Unmasking The Tactics of This Fraudulent Platform

In the fast-paced digital economy where online trading and investment platforms are flourishing, not all that glitters is gold. A growing number of platforms masquerade as legitimate financial services while engaging in deceitful schemes designed to exploit unsuspecting investors. One such suspicious and problematic entity is Emeraltrade.com, a platform that has triggered a wave of complaints and red flags across various online communities.

On the surface, Emeraltrade.com presents itself as a sophisticated, reliable investment platform offering opportunities in forex trading, cryptocurrency, commodities, and other financial instruments. However, beneath its polished digital façade lies a calculated scam operation that preys on novice and inexperienced investors. This blog post delivers an in-depth review of the Emeraltrade.com scam, unpacking its manipulative structure, warning signs, and user experiences, while explaining why investors should steer clear of this fraudulent platform.

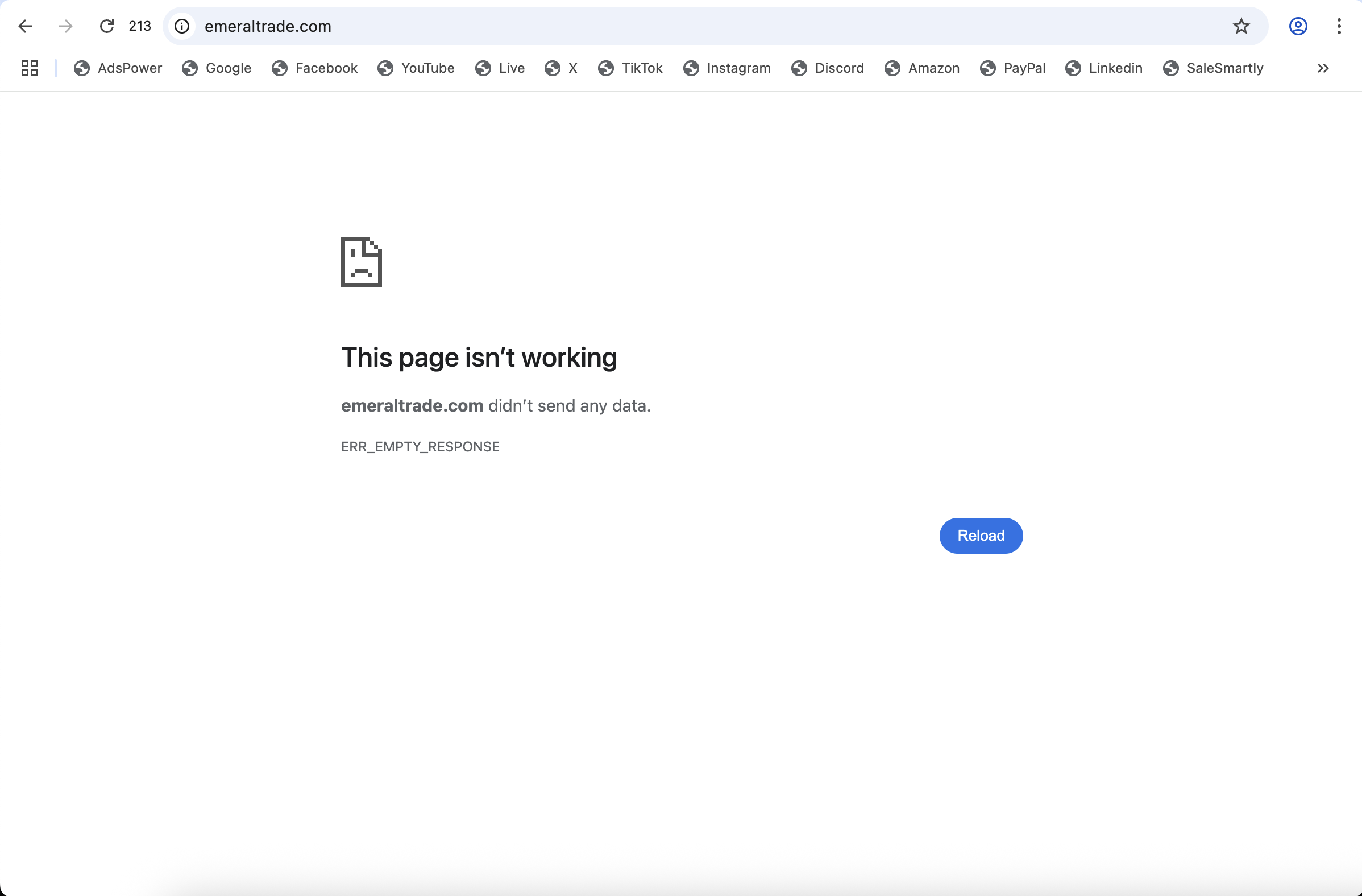

A Slick Front for a Sinister Scheme

When visiting Emeraltrade.com for the first time, the website might appear credible. With modern web design, professional stock imagery, and catchy slogans like “invest with confidence” and “your trusted partner in financial freedom,” the platform seeks to instill a sense of security and promise. They advertise highly lucrative returns, advanced trading tools, and account managers ready to help users maximize their portfolios.

However, all of this is smoke and mirrors. These glossy aesthetics serve only one purpose: to gain the trust of potential victims. Once someone takes the bait, the real face of Emeraltrade.com begins to show.

How the Scam Unfolds

Scam operations like Emeraltrade.com follow a predictable yet highly manipulative pattern. Each step is strategically designed to draw the user deeper into the scheme and extract as much money as possible.

Step 1: Initial Contact and Trust-Building

Emeraltrade.com often initiates contact through:

-

Online ads boasting unrealistic profits from trading.

-

Social media DMs posing as “trading experts” or “financial advisors.”

-

Spam emails promising “exclusive investment opportunities.”

Sometimes, the contact comes through dating apps or social media platforms, disguised as personal connections that later pivot into financial discussions. The aim is always the same: build rapport and create urgency.

Once contact is made, victims are urged to sign up, promising minimal risk and maximum returns. The onboarding is easy, with no real verification or compliance checks—another red flag.

Step 2: Initial Deposit and False Gains

Users are encouraged to start with a small investment, often as low as $250. After depositing, they are given access to a trading dashboard that simulates profits and activity. Charts appear to show market fluctuations, trades are marked as executed, and account balances begin to grow rapidly.

These numbers are fake—completely fabricated to give the illusion of successful investing. This stage is crucial because it builds false confidence and sets the trap for larger investments.

Step 3: Pressure to Deposit More

After a few days of seeing impressive but bogus gains, the platform’s so-called “account managers” reach out with recommendations. They suggest:

-

Upgrading to a VIP account for better returns.

-

Depositing more to “unlock” market opportunities.

-

Taking advantage of a time-sensitive promotion or bonus.

These representatives are trained in psychological manipulation, using urgency, flattery, and fear of missing out (FOMO) to push users into sending more funds. In some cases, victims have reported being harassed with constant phone calls and emails.

Step 4: The Withdrawal Blockade

Once the victim attempts to withdraw their supposed profits—or even their initial deposit—they encounter resistance. The withdrawal process is deliberately convoluted, often citing reasons like:

-

KYC verification delays.

-

Unpaid processing fees or taxes.

-

Minimum withdrawal thresholds.

-

Need for further deposits to “unlock” funds.

Victims who comply with these demands and pay additional fees find themselves further defrauded, as the platform continues to withhold funds and invent new excuses.

Eventually, all communication stops. The victim is locked out, the website support becomes unresponsive, and the scam is complete.

Red Flags That Expose Emeraltrade.com

Despite its attempts to appear legitimate, Emeraltrade.com is riddled with warning signs. Investors familiar with the traits of scam platforms will recognize several of the red flags below:

1. No Regulatory Oversight

Emeraltrade.com is not regulated by any recognized financial authority. Legitimate trading platforms are overseen by institutions such as the FCA (UK), CySEC (EU), ASIC (Australia), or similar regulatory bodies, which impose strict operational standards to protect consumers. Emeraltrade.com, by contrast, offers no valid registration details or licensing credentials.

In some cases, the site may mention fake regulatory affiliations or display badges of non-existent organizations to trick users into thinking they are protected. Always verify claims independently.

2. Lack of Transparency

The platform is extremely vague about its business structure. There is no verifiable information about:

-

Company registration.

-

Real office locations.

-

Executives or management team.

-

Audited financial data.

The absence of these critical details is a clear indication of fraud. Any real financial services provider would disclose such information openly and proudly.

3. Unrealistic Returns and Guarantees

Emeraltrade.com promises fixed or guaranteed returns, sometimes advertising daily, weekly, or monthly profits that far exceed what any real market could produce. Claims of “15% weekly” or “300% in 30 days” are financial impossibilitiesin genuine trading environments.

This kind of language is designed to seduce users into believing that they’ve found a shortcut to wealth—but in reality, it’s just bait.

4. Fabricated Testimonials and Fake Reviews

The testimonials on the Emeraltrade.com website are almost certainly fake. The people pictured are stock photo models, and the accompanying stories are filled with generic praise and unrealistic success stories.

Additionally, any online review platforms that show positive comments about Emeraltrade.com often turn out to be part of affiliate marketing schemes or bogus review farms.

5. Unprofessional Communication

Users who have interacted with representatives from Emeraltrade.com report aggressive, manipulative, and even threatening behavior once they resist depositing more money. Many are bombarded with calls or subjected to pressure tactics, a hallmark of fraudulent platforms.

Legitimate investment firms respect boundaries, adhere to data protection regulations, and do not harass their clients.

First-Hand Victim Experiences

Reports from individuals who have fallen prey to Emeraltrade.com follow a consistent narrative:

-

“I started with a small investment and watched my balance grow fast. But when I tried to withdraw even a portion, they asked for a $1,000 tax fee upfront.”

-

“They promised me that with just one more deposit, I could unlock my full profit. I sent the money and never heard from them again.”

-

“I sent emails, called them, submitted ID documents, and they just stopped responding.”

These experiences are not anomalies. They are part of a systematic and deliberate con that plays out over and over again, leaving a trail of financial and emotional ruin in its wake.

The Broader Impact of Scam Platforms Like Emeraltrade.com

Platforms like Emeraltrade.com aren’t just stealing money; they are damaging trust in the entire online investing ecosystem. When unsuspecting users are conned, they often become disillusioned with all investment opportunities—even legitimate ones. This creates a ripple effect where honest platforms are forced to work harder to gain and maintain user trust.

Additionally, the psychological toll on victims is significant. Beyond the financial loss, many victims experience shame, embarrassment, and a loss of confidence. Some suffer lasting emotional effects, especially if they had invested money intended for retirement, family, or critical expenses.

How to Protect Yourself from Investment Scams

To avoid falling victim to scams like Emeraltrade.com, consider the following safeguards:

-

Verify regulation with official government agencies.

-

Avoid unsolicited offers, especially those that promise guaranteed profits.

-

Research the platform independently—check user complaints, scam watchlists, and investment forums.

-

Be skeptical of high-pressure sales tactics and “limited-time offers.”

-

Use secure payment methods and never send cryptocurrency or wire transfers to unknown entities.

Final Verdict: A Platform Built on Deception

Emeraltrade.com is not a legitimate investment platform. It is a professionally disguised scam operation that uses manipulative tactics, fake data, and outright lies to steal from users. Every part of its system—from initial contact to withdrawal obstruction—is designed to create an illusion of profit while quietly extracting every possible dollar from victims.

If you are considering investing with Emeraltrade.com, do not proceed. If you’ve already sent money, cut off communication immediately and secure your accounts. Warn others and share your experience to prevent further victimization.

In today’s digital landscape, due diligence is essential. When it comes to your financial future, never substitute hope for caution. Emeraltrade.com offers nothing but false promises and real losses. Stay informed, stay vigilant, and protect your investments.

-

Report Emeraltrade.com And Recover Your Funds

If you have lost money to emeraltrade.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like emeraltrade.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.