Ethnest Finance Fake Platform

In early 2026, one of the most respected financial regulators in the world, the UK’s Financial Conduct Authority (FCA), publicly placed Ethnest Finance on its official Warning List of unauthorised firms — a list specifically compiled to alert consumers about companies that may be operating illegally or without proper oversight. According to the FCA, Ethnest Finance is not authorised to provide financial products or services in the United Kingdom, yet it appears to be marketing itself as a legitimate investment or trading platform.

This warning is not a trivial matter. Financial regulators like the FCA exist precisely to protect investors from fraud, misuse of funds, misleading financial promotions, and unregulated operators that can cause devastating losses. Being named on such a list means that a platform is actively suspected of targeting retail investors with offers it doesn’t have the legal permission — nor the structural capacity — to fulfil.

Below is a comprehensive, no‑nonsense review of Ethnest Finance — what it claims to be, what regulators are saying, and why you should absolutely steer clear.

1. Ethnest Finance: What It Claims to Be — and What It Really Is

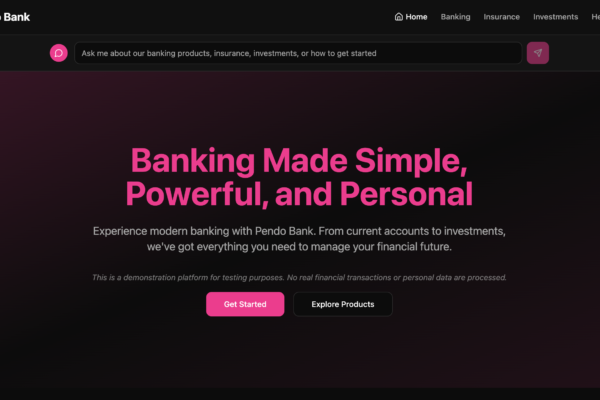

Ethnest Finance presents itself superficially like many online investment platforms:

-

A slick website with promises of easy profit

-

A professional‑looking homepage with financial language

-

Invitations to create accounts and fund trading or investment portfolios

However, behind this polished façade is an entity not recognised by major financial regulators. Whether it claims to offer crypto trading, forex investments, or other financial products, there’s no valid licence or registration attached to its name — at least according to the FCA’s latest warning list.

A legitimate investment firm, whether retail brokerage, crypto exchange, or trading marketplace, must be registered with a recognised regulator (e.g., FCA in the UK, SEC in the U.S., ASIC in Australia) before it can lawfully offer financial services to the public. Ethnest Finance has not passed this basic legal requirement, making it unregulated and potentially fraudulent.

2. Why Regulators Are Sounding the Alarm

The FCA warning about Ethnest Finance is significant — regulators don’t issue these lightly. The UK authority clearly states that the firm:

-

Is not authorised to provide financial services or products

-

May be targeting people in the UK without permission

-

Should be avoided until it obtains legitimate oversight

Being on a warning list means the regulator has seen either marketing activity or operations that resemble illicit conduct. Essentially, this is one of the strongest red flags an investment platform can receive short of an outright fraud conviction.

When a firm lacks regulatory approval, it means:

-

No legal protection if things go wrong

-

No financial safeguards (e.g., no compensation scheme)

-

No oversight or governmental accountability

-

A high likelihood the entity is engaging in illicit behaviour

If Ethnest Finance were a legitimate operation, it would be fully transparent about its authorisations. Instead, it is not recognised on any major register, which is exactly why the FCA has placed it on its watchlist.

3. Typical Scam Characteristics Found in Platforms Like This

While the specific details of Ethnest Finance’s operations aren’t fully public yet, its regulatory status and behaviour align with classic patterns seen in investment scams, especially in the crypto and forex sectors. Here are the common traits:

a) Unauthorised Services

Scammers often launch trading platforms without any official licence, then promote them as if they were legitimate. Regulators worldwide, including the FCA, explicitly caution against dealing with such firms.

b) Promises of Unrealistic Returns

One mark of fraud is guaranteeing returns or extremely high yields without credible evidence or regulation backing those claims.

c) Lack of Transparency

Legitimate firms clearly list headquarters, financials, regulatory licence numbers, and audited statements. Scam sites do not.

d) Social Engineering and Pressure Tactics

Many investment scams use unsolicited contact via email, social media, or phone to lure victims — then insist on quick deposits.

e) Withdrawal Barriers

Often, platforms will allow small deposits only to block withdrawals later — demanding “fees” to release funds.

Scammers use these and other tricks to extract money and then vanish. While there are no verified, detailed testimonials yet about Ethnest Finance specifically freezing funds, being listed as unauthorised is enough to raise alarms consistent with these scam traits.

4. Real‑World Complaints Highlight Broader Industry Risks

Although there aren’t widespread public complaints online specifically for Ethnest Finance yet, the crypto and online investment landscape is notorious for scams. For example, similar platforms using unregulated setups have been flagged by consumer fraud trackers and securities watchdogs for unsolicited approaches, withdrawal issues, and account lockouts. This fits patterns seen in alerts issued by regulators in places like Washington State, where fraudulent crypto platforms told investors they needed to add funds to “unfreeze withdrawals,” a classic advance‑fee fraud tactic.

These industry examples show how scammers exploit trust, encourage ongoing deposits, and then make withdrawal impossible.

5. Four Crucial Reasons to Steer Clear Right Now

If you’re considering dealing with Ethnest Finance, here are clear, practical reasons to avoid it:

-

No regulatory authorisation: Which means no legal oversight and high risk of wrongdoing.

-

Not recognised on official financial registers: Websites and claims are not backed by genuine licences.

-

Typical scam characteristics: Unregulated platforms behave like known frauds.

-

Industry patterns support caution: Similar schemes have caused enormous investor losses.

Final Verdict: Ethnest Finance Is Not Trustworthy

When an entity offering financial services is explicitly warning investors away, it’s not something to brush off. The FCA’s listing of Ethnest Finance as an unauthorised firm should be taken seriously by anyone contemplating deposits or investments.

This isn’t simply a matter of poor performance or riskier investment — it’s a fundamental gap in legal legitimacy. Firms that cannot comply with regulatory frameworks are by definition operating outside investor protection systems. That means your capital could disappear without recourse.

If you value your money and your financial security, the safest course of action is simple: do not engage with Ethnest Finance in any financial transaction whatsoever. This is not an opportunity; it is a doorway to loss.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to Ethnest Finance, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as Ethnest Finance continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.