Evo Global Trade Warning Signs Traders Know Now

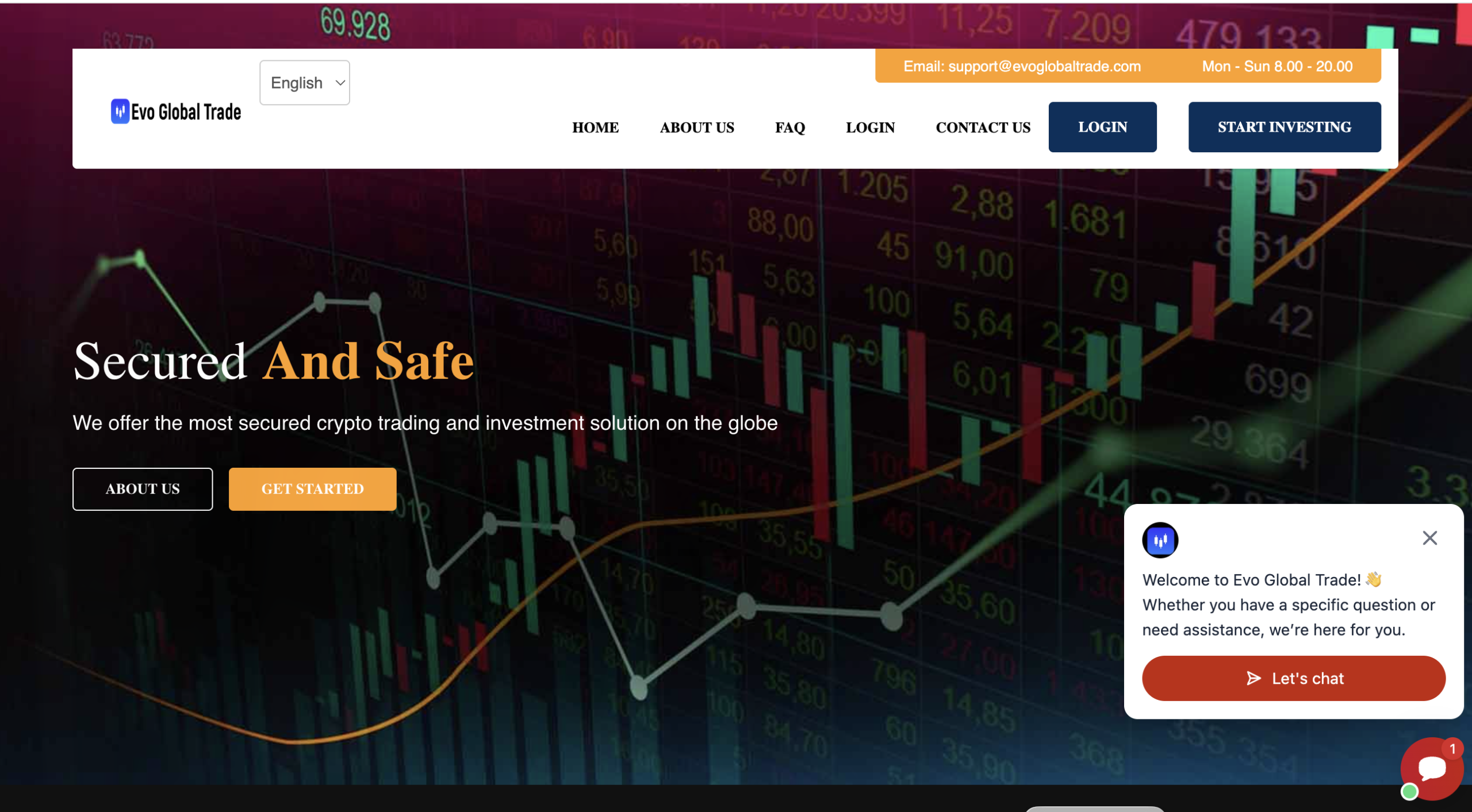

In the fast-moving world of online investing and cryptocurrency trading, new platforms emerge daily promising quick returns, minimal risk and easy access to global markets. One such platform that has recently drawn significant scrutiny is Evo Global Trade, accessed through evoglobaltrade.com. On the surface, it markets itself as a financial services provider facilitating trading in digital assets like Bitcoin, Ethereum and other popular cryptocurrencies. It also makes broad claims about generating wealth with little to no investment risk. However, a careful examination of the platform’s structure, regulatory standing, transparency and track record reveals a number of red flags that strongly indicate this is not a legitimate investment service.

This post provides a detailed, evidence-based review of Evo Global Trade, highlights key concerns, and delivers a clear warning to readers: this platform should be avoided.

1. No Recognized Regulation or Licensing

Legitimate financial services firms — especially those offering trading in forex, CFDs, cryptocurrencies or other regulated instruments — are required to hold licenses from recognized financial authorities. These include bodies such as the UK’s Financial Conduct Authority (FCA), Australia’s ASIC or the Cyprus Securities and Exchange Commission (CySEC). These regulators enforce rules designed to protect investors, ensure transparency and require rigorous reporting and compliance standards.

Evo Global Trade, however, is not authorised or regulated by any of these bodies. The FCA, for example, has explicitly issued a warning indicating that this entity may be offering financial services without the necessary authorization. This means that the company operates outside the safeguards that protect retail investors and is free to solicit funds without oversight. Regulatory warnings are one of the strongest indicators that a platform should be treated with extreme caution.

2. Misleading Marketing and False Claims

A common trait among fraudulent trading platforms is the use of grandiose marketing claims that promise high returns with little risk. Evo Global Trade is no exception: its promotional materials suggest investor funds are safe and that users can achieve financial freedom effortlessly through their platform.

These assurances are not supported by any verifiable evidence. In the absence of regulatory oversight, these claims remain unverified marketing language. The platform’s own FAQ page makes bold assertions such as “there is no risk whatsoever” when investing — a statement that contradicts basic financial principles and is typically used to lure unsophisticated investors.

3. Lack of Transparency

When evaluating any online broker or investment service, transparency is crucial. Legitimate companies provide clear, verifiable details about:

-

Company ownership and headquarters

-

Registration and licensing numbers

-

Terms and conditions

-

Risk disclosures

-

Registered contact information

In the case of Evo Global Trade, there is no publicly verifiable evidence of corporate registration with any recognized authority. Listed contact addresses and email accounts often lack any traceable corporate identity, which is a major red flag. When key registration details are missing or unverifiable, there is no accountability mechanism — meaning investors cannot confirm who they are dealing with or pursue legal recourse if something goes wrong.

4. Early Warning Signs of Scam Behavior

Beyond regulatory issues, there are multiple behavioral signals that mark Evo Global Trade as highly suspect:

-

High-pressure inducements aimed at deposits with promises of guaranteed profits or no risk.

-

Optimistic marketing language that suggests easy money or predictable outcomes.

-

Ambiguous terms around withdrawals and investor funds.

While some information about this specific platform is limited, these types of operational cues mirror patterns seen in many documented scam brokers where investors experience difficulty withdrawing funds or face opaque conditions once money is deposited.

5. Scam Patterns: What We Know From Similar Platforms

Although Evo Global Trade itself is a relatively new entrant, the scheme shares several attributes common among fraudulent trading platforms:

-

Unregulated status despite claims of broad market access.

-

Marketing that emphasizes simplicity and guaranteed returns.

-

Sparse and unsupported risk disclosures.

-

Lack of credible third-party validations or mainstream media coverage.

Platforms operating under this model frequently evolve domain names, shift branding and attempt to create the impression of legitimacy through superficial website design. However, the fundamental absence of regulatory compliance and verifiable licensing remains consistent across such operations.

6. Risks to Investors

Investors considering Evo Global Trade face a series of significant risks:

-

Total loss of capital: Without regulatory protections, deposited funds could be seized or lost without legal recourse.

-

Data and privacy exposures: Providing personal and financial data to unverified entities carries inherent security risks.

-

Lack of dispute resolution: In the event of any disagreement or loss, investors have no formal channel to raise complaints with a governing authority.

Scams focused on financial trading typically rely on psychological and emotional triggers — such as fear of missing out (FOMO) or the allure of quick and effortless gains — to attract and retain victims. Investors must always approach platforms like this with strong skepticism.

7. Final Verdict: Steer Clear

Given the lack of regulatory standing, misleading marketing claims, absence of verified licensing and similarity to known scam models, Evo Global Trade should be considered a high-risk and highly suspect platform.

Investors interested in online trading or cryptocurrency exposure should instead seek companies that are:

-

Licensed by reputable financial authorities.

-

Transparent about their operations and legal entities.

-

Clear and thorough about risks, fees and withdrawal procedures.

-

Endorsed by independent reviews and credible financial media.

There is no universal guarantee against risk in financial markets, but regulatory compliance and transparency are minimum thresholds for safe participation. Evo Global Trade does not meet these thresholds.

For anyone evaluating this platform or similar services, caution is not merely advisable — it is essential.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to evoglobaltrade.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as evoglobaltrade.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.