Fred-Frost.com: A Reality Check for Traders

In recent months, fred-frost.com has become a topic of heated debate across trading forums, consumer review sites, and social media. On the surface, the platform presents itself as a gateway to easy profits, trading education, and signals — but a closer look at user experiences and independent risk assessments reveals a far more concerning picture. This review examines the evidence, identifies patterns of deception, and explains why prudent investors should steer clear of this platform.

What Fred-Frost.com Claims to Offer

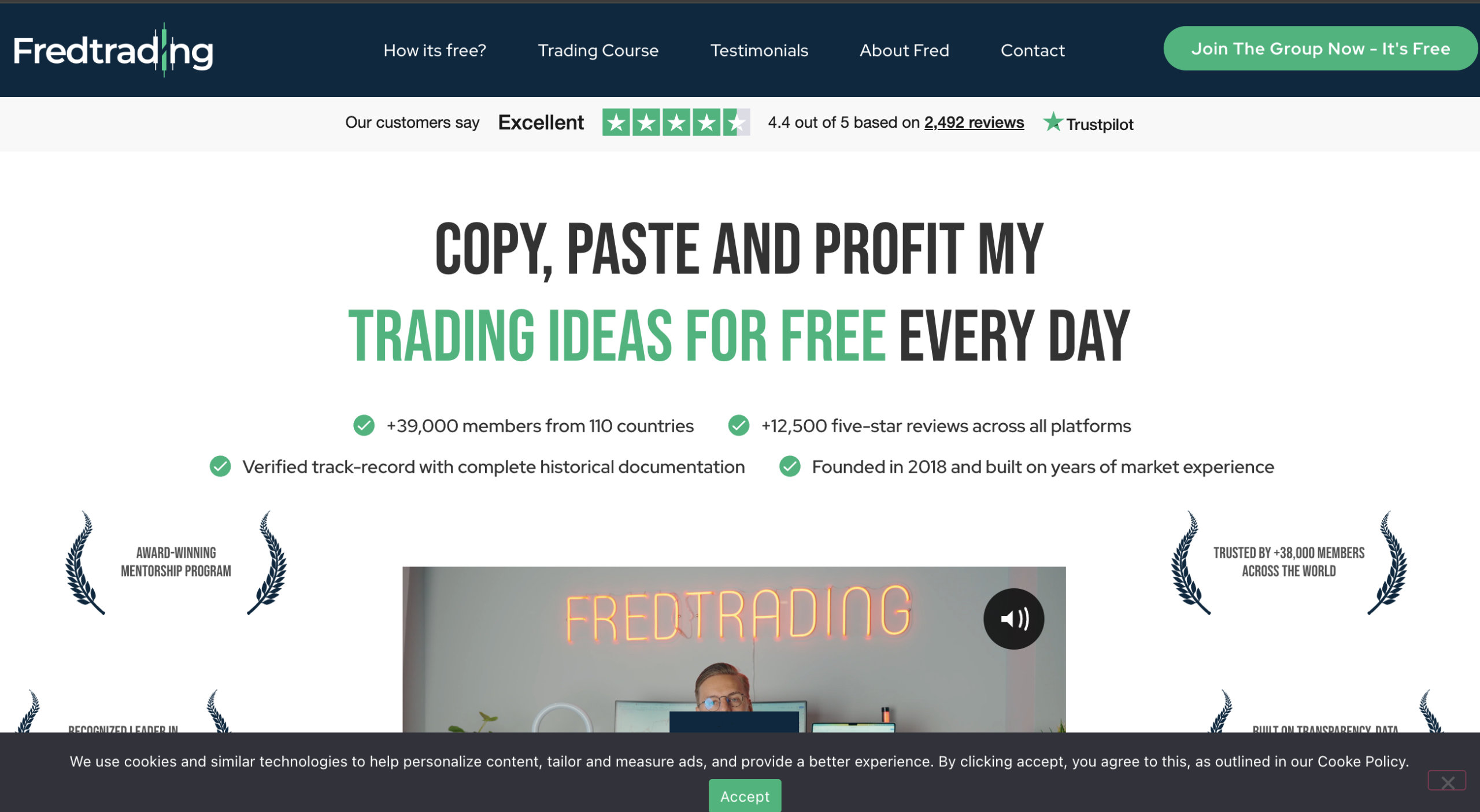

The website behind fred-frost.com markets itself as a trading community led by an individual known as “Fred” who purportedly provides free educational materials, trading signals, and market insights. The narrative goes that anyone, even beginners, can join the community, follow signals, and achieve consistent profits on assets such as forex pairs, cryptocurrencies, and commodities.

Promotional materials often depict trading as simple and highly profitable, with bold claims about short paths to financial success and testimonials from supposed users who have achieved extraordinary returns. For many first-time or inexperienced traders, these narratives can be compelling — especially when contrasted with the steep learning curve of independent trading.

Trust Score and Independent Risk Reports

However, independent evaluations of fred-frost.com paint a troubling picture. Reputation and site-trust services have assigned very low trust scores to the domain, indicating a high likelihood of risk or fraudulent activity associated with it. Scoring systems that evaluate transparency, domain ownership, traffic rank, and technical markers have concluded that the platform exhibits characteristics typical of unsafe or potentially deceptive sites. Anonymous domain registration, hidden ownership details, and low external validation are among the factors contributing to these low assessments.

In the broader context of online financial services, transparency about licensing, regulatory oversight, and the identities of key personnel is essential. The absence of these elements in fred-frost.com undermines claims of legitimacy and places it outside standard industry practices for regulated financial platforms.

Divergent Reviews and User Experiences

A striking aspect of fred-frost.com is the wide disparity in user testimonials found across the internet. On some highly visible review platforms, the site displays an overwhelmingly positive rating supported by thousands of reviews. On the surface, this might give the impression of a thriving, trusted service.

But a deeper examination reveals that many of these glowing reviews appear generic, overly positive, or inconsistent with user feedback found elsewhere. Independent discussants on forums and less curated review boards report a very different experience — one marked by losses, misleading claims, and poor customer support. These conflicting narratives suggest that the ostensibly high star ratings may not be reliable indicators of genuine user satisfaction.

Common Complaints from Users

Among the recurring themes in negative user feedback are:

-

Significant financial losses: Multiple individuals report depositing funds after following platform guidance or “free” signals, only to see their trading accounts depleted. Some users indicate substantial losses, with accounts wiped out by repeated losing positions.

-

False promises of profits: Many reviewers describe promises of high win rates and easy gains that fail to materialize. According to these accounts, trades pushed through by the platform or its signal providers often hit stop-losses, resulting in net losses rather than profits.

-

Lack of transparency and responsiveness: Users have allegedly struggled to reach real support personnel when issues arise. Complaints range from unanswered messages to vague responses that fail to address specific concerns or requests for clarification.

-

Allegations of fake or paid reviews: Several users and commentators assert that positive reviews found on major platforms are either incentivised or artificially generated, rather than reflecting authentic trading experiences.

-

Pressure to sign up with third-party brokers: A number of people who interacted with the platform say they were encouraged to deposit money with specific external brokers. In some instances, this referral to external services is seen as a way for the platform to earn commissions, independent of whether the end user makes or loses money.

Mixed Signals and Why That Matters

The combination of high visible ratings and deeply negative personal accounts creates an environment of uncertainty. On one hand, prospective users may be drawn in by apparent social proof, testimonials, and marketing — particularly if those reviews are prominent on mainstream platforms. On the other hand, experienced traders and independent reviewers warn that these signals are inconsistent and potentially misleading.

This kind of mixed reputation is itself a red flag. Legitimate financial services, particularly those regulated in major jurisdictions, typically demonstrate consistent performance data, transparent licensing information, and verifiable customer service histories. When a platform’s positive reputation is largely confined to self-reported or heavily curated review systems, and independent sources assign a low trust score, caution is warranted.

Context from Wider Online Communities

Beyond formal review sites, discussions on trading forums, subreddits dedicated to forex and cryptocurrency, and consumer watchdog groups echo many concerns. Experienced traders often stress that the platform’s signals lack verifiable performance tracking, and that traders are essentially gambling rather than following a disciplined strategy.

Additionally, some commentators point to marketing tactics often associated with high-risk or fraudulent schemes, such as the use of flashy success stories, luxury imagery, and promises of minimal effort for large returns. These are common themes in online scams, designed to appeal to emotional — rather than rational — decision making.

Final Assessment: A Cautionary Tale

Based on the preponderance of external risk evaluations, user complaints, and the absence of industry-standard transparency, it is prudent to view fred-frost.com with significant skepticism. While there is a small subset of users who report positive experiences, the overall pattern of complaints and independent assessments suggests that the platform may operate in a way that disproportionately benefits its promoters rather than its users. In financial services, particularly in trading, risk is inherent — but risk compounded by lack of transparency and potential for misleading claims is avoidable.

For those considering a pathway into trading or investment, seeking out regulated brokers, accredited educational resources, and communities with clear accountability measures is strongly advised. Fred-frost.com does not meet these criteria, and the evidence suggests it is a platform that individuals should approach with extreme caution, if at all.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to fred-frost.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as fred-frost.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.