FUSD.me Investor Warning: Not a Safe Platform

FUSD.me presents itself as an online financial platform connected to digital assets and investment opportunities. At first glance, the website appears simple and modern, which may give some users a sense of legitimacy. However, once you examine the platform more closely, multiple warning signs emerge. These red flags strongly suggest that FUSD.me is a high-risk platform that users should avoid.

This review takes a detailed look at how FUSD.me operates, the tactics it uses to attract users, and the reasons why engaging with this platform could lead to serious financial loss.

What FUSD.me Claims to Offer

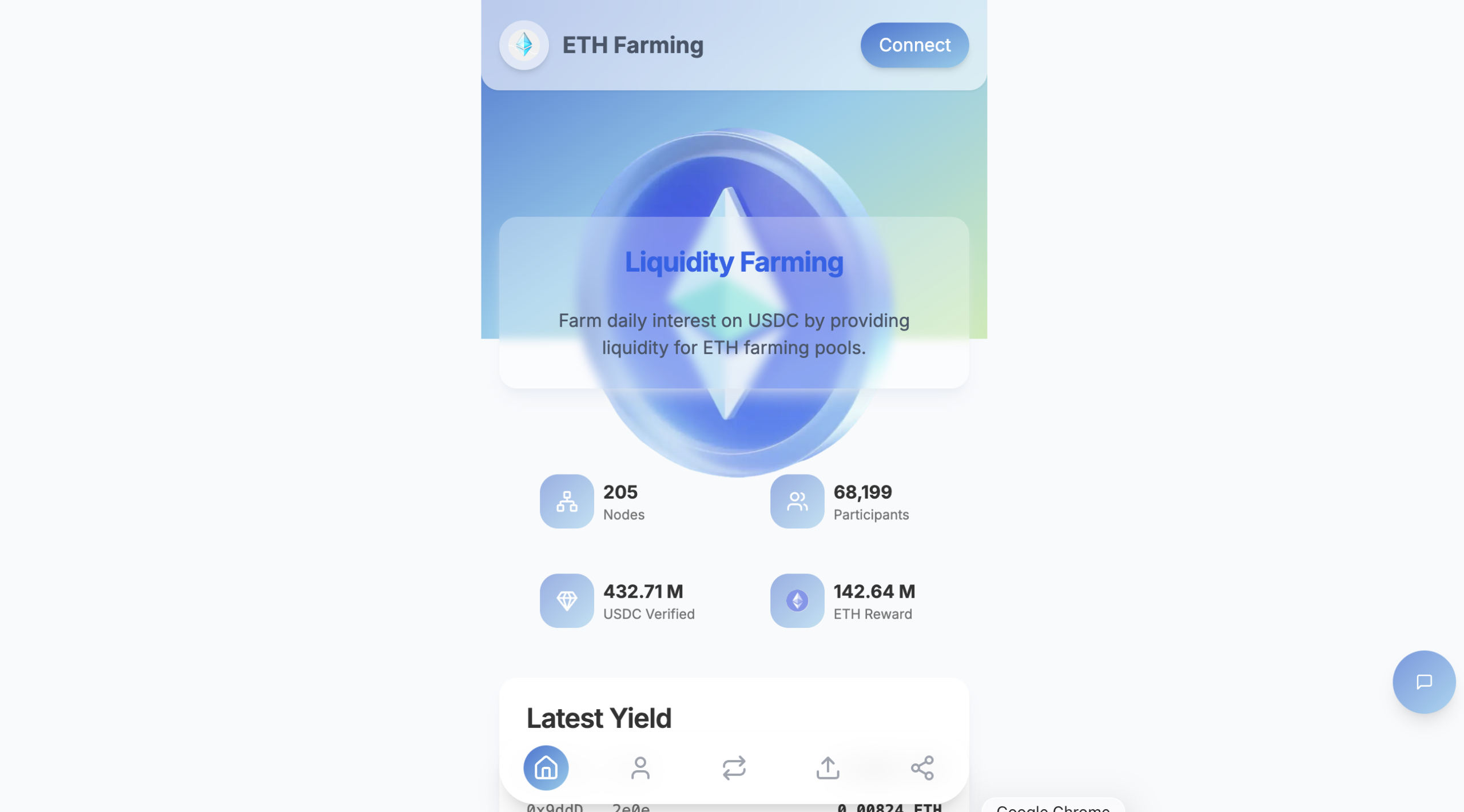

FUSD.me promotes itself as a digital finance or investment-related service, often implying connections to cryptocurrency, stable assets, or fast-growing online financial systems. The platform suggests that users can deposit funds and benefit from favorable conditions, ease of use, and potential growth opportunities.

The messaging is intentionally broad. Instead of providing clear explanations, FUSD.me relies on vague promises and generalized statements about value, stability, or performance. This lack of specificity makes it difficult for users to understand exactly how the platform operates or how their money is handled.

While legitimate platforms explain their services in detail, FUSD.me avoids technical clarity. This approach is often used to prevent users from asking critical questions before depositing funds.

No Verifiable Regulation or Licensing

One of the most serious issues with FUSD.me is the complete absence of verified regulatory oversight. Legitimate financial platforms clearly display their licensing information and identify the financial authorities that supervise their operations.

FUSD.me does not provide proof of registration with any recognized regulator. There is no indication that it operates under the supervision of authorities in major financial jurisdictions. As a result, users have no legal protection and no assurance that the platform follows financial compliance standards.

Without regulation, there is no independent body monitoring how funds are stored, managed, or transferred. This dramatically increases the risk of misuse, mismanagement, or sudden platform shutdowns.

Lack of Transparency and Anonymous Operations

Transparency is a cornerstone of trust in the financial sector. Unfortunately, FUSD.me provides almost no information about who owns or operates the platform.

The website fails to clearly disclose:

-

A registered company name

-

A physical office address

-

Executive or management identities

-

Corporate registration details

This anonymity is a major red flag. When users cannot verify who controls the platform, accountability disappears. Many scam platforms intentionally hide ownership to make it difficult for users to seek answers or take action when problems arise.

Vague Business Model and Unclear Functionality

Another concerning aspect of FUSD.me is its unclear business model. The platform does not adequately explain how user funds are used, stored, or grown. Instead, it relies on buzzwords and simplified descriptions that lack substance.

Users are left with unanswered questions such as:

-

How are funds actually managed?

-

Are assets traded, staked, or pooled?

-

What risks are involved?

-

Who controls transactions and liquidity?

Legitimate platforms provide clear documentation, terms, and risk disclosures. FUSD.me avoids these details, which prevents users from making informed decisions.

Unrealistic Impressions and Marketing Tactics

FUSD.me appears to rely heavily on marketing rather than transparency. The platform’s presentation suggests ease, speed, and opportunity while downplaying risk. This style of messaging is common among deceptive platforms that aim to create urgency and excitement.

By avoiding direct discussion of potential losses or operational risks, FUSD.me creates an unrealistic impression of safety. In real financial environments, risk is unavoidable and must be clearly communicated. Platforms that ignore this reality should always be treated with caution.

Concerns About Deposits and Withdrawals

One of the most common problems with high-risk platforms involves fund accessibility. FUSD.me provides limited information about how withdrawals work, how long they take, or under what conditions they may be restricted.

In similar platforms, users often encounter issues such as:

-

Withdrawal delays without explanation

-

Sudden account limitations

-

Additional requirements before funds are released

-

Lack of responsive customer support

When withdrawal rules are unclear, users risk losing control over their own funds. A trustworthy platform makes deposit and withdrawal terms transparent from the beginning.

Weak or Nonexistent Customer Support

Reliable customer support is essential for any financial service. FUSD.me does not clearly demonstrate that it offers responsive or professional support channels. There is little evidence of structured assistance, escalation processes, or dedicated support teams.

Platforms that lack effective customer support often leave users without answers when technical issues, account problems, or transaction delays occur. This absence of support further increases the overall risk of using the platform.

Targeting Inexperienced Users

FUSD.me appears to appeal strongly to inexperienced users who may not fully understand how regulated financial platforms operate. By keeping explanations simple and avoiding technical depth, the platform attracts users who may be new to digital finance.

This strategy benefits risky platforms because inexperienced users are less likely to demand proof of regulation, transparency, or audited performance. Unfortunately, many only recognize the warning signs after encountering difficulties.

Overall Risk Evaluation

When you assess FUSD.me as a whole, several serious concerns stand out:

-

No verified regulatory oversight

-

Anonymous ownership and operations

-

Vague business model and unclear functionality

-

Weak transparency around withdrawals

-

Overreliance on marketing instead of facts

Each of these issues represents a significant risk. Together, they strongly suggest that FUSD.me does not operate with user safety or accountability as a priority.

Final Verdict

FUSD.me displays many characteristics commonly associated with scam or high-risk online financial platforms. While it attempts to appear modern and accessible, it fails to provide the transparency, regulation, and clarity expected from a legitimate service.

For anyone considering FUSD.me, the risks clearly outweigh any perceived benefits. Engaging with platforms that lack regulation, hide their operators, and avoid clear explanations can result in serious financial harm.

Steering clear of FUSD.me is a sensible decision for anyone who values the safety of their funds and wishes to avoid unnecessary exposure to high-risk and potentially deceptive platforms.

Report Fusd.me And Recover Your Funds

If you have lost money to fusd.me, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like fusd.me continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.