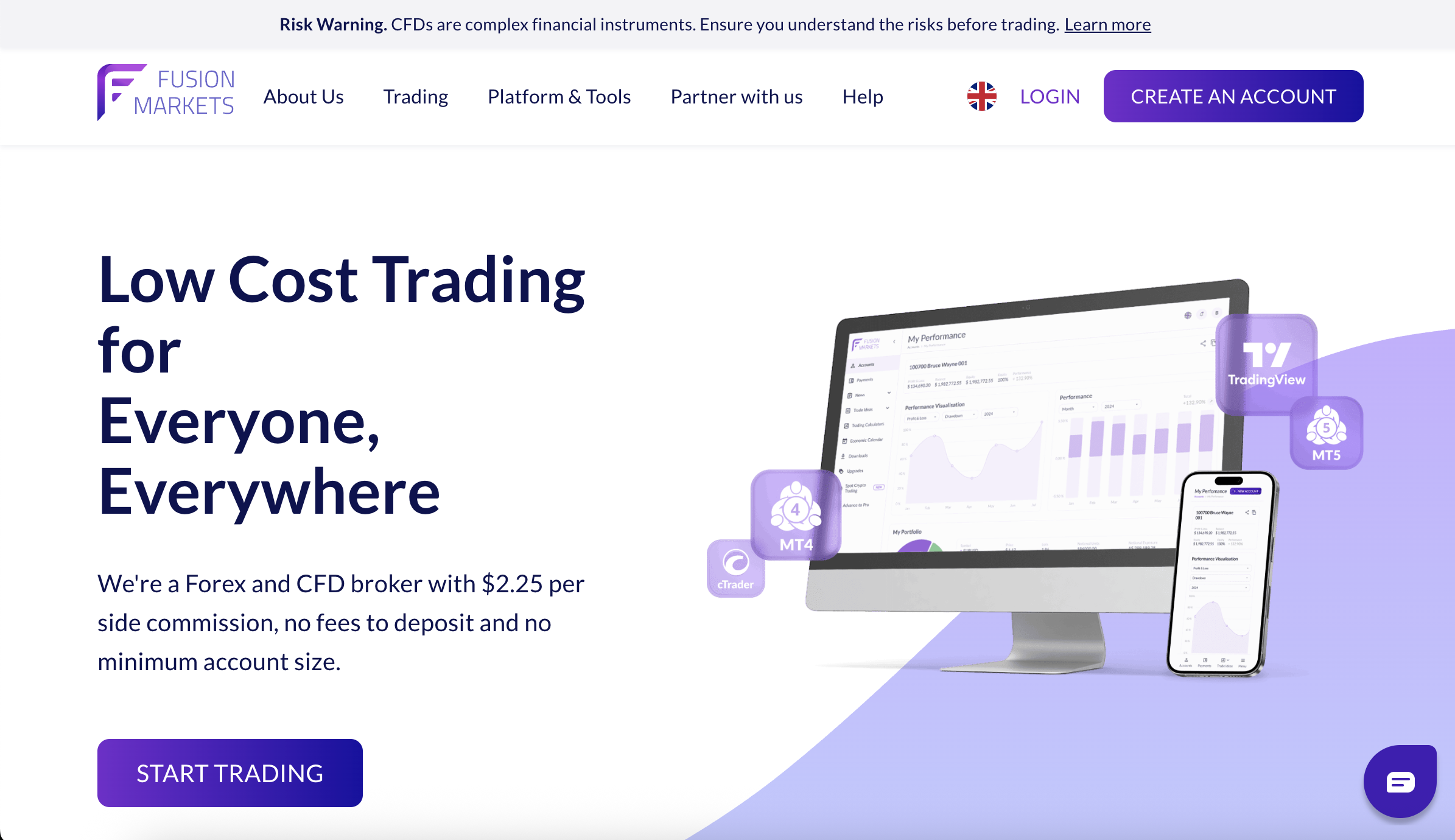

Fusion Markets Scam Review : Warning You Should Not Ignore

At first glance, Fusion Markets positions itself as a sleek, low-cost global broker with support for MT4/MT5, low spreads, and a reputation for affordability. But beneath the polished branding lie serious concerns. From user complaints to regulatory scrutiny and system failures, the hallmarks of a legitimate platform are sorely lacking.

⚠️ 1. Withdrawal Complaints and Regulatory Scrutiny

-

Across multiple independent review platforms, users report blocked or delayed withdrawals. One individual claims he couldn’t retrieve $1,319 after depositing—and support suddenly became unreachable. Another described being forced to deposit more to unlock funds, with no progress even after repeated requestsReddit+11val.forex+11Valforex.com+11Reddit+2WikiFX+2amdarklimited.com+2.

-

Some regulators, such as Japan’s FSA, have reportedly opened inquiries after seeing multiple complaint filings tied to Fusion Markets’ behavior—emphasizing the seriousness of ongoing issues amdarklimited.com.

Withdrawal barriers point to deeper structural flaws—trust vanishes when money cannot leave.

2. Account Manipulation & Mismatched Trades

-

On platforms like Sitejabber, users allege that stop-loss orders were disregarded: positions closed with spreads inflated to thousands of pips beyond standard—resulting in unexpected losses SiteJabber.

-

Forex Peace Army threads include trade data where users clearly show manipulated MT4 records or missing entries—and blame Fusion Markets for backend interference Reddit+10Forex Peace Army+10amdarklimited.com+10.

These cases suggest tampering with trade execution—a blatant breach of trust and integrity.

3. Regulation Claims Don’t Hold Up

-

The broker claims licensing in Australia via ASIC and also from Vanuatu’s VFSC, with its Seychelles entity listed as registered under FSA license SD096 CapitalForexMarkets+1Reddit+1Reddit+3Fusion Markets | Low Cost Forex Broker+3Fusion Markets | Low Cost Forex Broker+3.

-

However, ASIC licensing applies only to its Australian entity—the other jurisdictions lack robust investor protections. Moreover, Tier-1 licensing like the FCA or CySEC is entirely absentBrokerChooserCapitalForexMarkets.

Relying on Vanuatu or Seychelles regulators offers limited protection—and is often used by firms seeking to appear licensed without genuine compliance.

4. No Segregation & Potential Misuse of Funds

-

ValForex specifically criticizes the broker’s fund safety: deposits are pooled, not segregated, potentially mingling with company or owner funds. In the event of insolvency, client funds are at risk. There’s no participation in any compensation scheme Reddit+13Valforex.com+13val.forex+13.

-

A trading platform that doesn’t safeguard client assets is inherently unreliable.

5. Poor Technical Reliability and Customer Support

-

One trader reported a two-hour system outage on MT4/MT5 during a major market opening, leaving him unable to execute desired trades—Fusion Markets conceded the glitch and issued a meager apology with minimal compensation Day Trading+1Reddit+1.

-

Multiple reviewers note slow live-chat responses, vague support, and difficulty in obtaining status updates—hallmarks of platforms hiding behind poor infrastructure Trustpilot+2Valforex.com+2val.forex+2.

Strong technical support is basic expectation; repeated failures or silences raise flags.

6. Marketing & Outreach Tactics Raise Alarm

-

Reddit accounts describe aggressive unsolicited calls from sales reps identifying as employees of unrelated programs. Ironically, one user recalled such a call posed itself as a follow-up to signing up for a brokerage—but felt suspicious due to tone and desperation Reddit.

-

Many fraudulent schemes rely on cold outreach and persuasive tactics rather than transparent engagement.

7. Mixed Community Reputation and Review Signals

-

Trustpilot and Sitejabber ratings are heavily polarized. One user reported withheld funds and sudden account closure—while others claim zero issues. Reviews appear inconsistent—raising suspicion about promotional manipulation SiteJabberTrustpilotDay Trading.

-

Some higher ratings may be incentivized or do not align with the most detailed complaints. Discrepancies like these are red flags for credibility concerns.

8. Known Reputation as a ‘Same Group’ Broker Network

-

Several users and community moderators note links between Fusion Markets, Global Prime, and other offshore entities. Shared ownership structures and overlapping branding concern many users—and suggest systemic issues in group practices BrokerChooser.

If multiple related brands attract complaints, it suggests organizational failure rather than isolated issues.

9. Unrealistic Promises with Limited Protection

-

While some reviewers highlight low-cost commission models (e.g. USD 2.25 side-per-lot), the lack of withdrawal consistency, no fund guarantees, and limited regulation negate any perceived cost benefits Reddit+11Day Trading+11Reddit+11CapitalForexMarkets+2Reddit+2Reddit+2.

-

Small trading profits may exist—but if withdrawals are denied or frozen later, it nullifies any earlier gains.

10. Matching Common Scam Patterns

Fusion Markets ticks many boxes in recognized scam frameworks:

-

Promises of superior access, low cost, and advanced platforms

-

Accept initial deposits easily

-

Simulate profit or smooth access early

-

Withdrawal requests trigger excuses, delays, or forced new deposits

-

Account closures or support cut-off follow

-

Alleged lack of key licensing beyond obscure offshore authoritiesSiteJabber+10Valforex.com+10Reddit+10CapitalForexMarkets+2amdarklimited.com+2Trustpilot+2Reddit

These patterns strongly resemble scams rather than regulated brokers.

✅ Red Flags Overview

| Risk Area | Fusion Markets Status |

|---|---|

| Regulation & Licensing | Partial; relies on Vanuatu & Seychelles only |

| Withdrawal reliability | Multiple reports of denied or delayed payouts |

| Trade integrity | Users report manipulated execution & missing stop-loss |

| Support & Alerts | Poor responsiveness, unexplained outages |

| Fund protection | No segregation, no compensation scheme |

| Marketing tactics | Cold outreach, aggressive sales, unverified claims |

| Cross-brand concerns | Connection to a cluster of offshore brokers |

| Technical stability | System failures at critical times |

| User reputation | Mixed, inconsistent; possibly incentivized reviews |

| Overall scheme similarity | Matches known scam funnels |

🎯 Final Takeaway: Be Highly Cautious—If Not Avoid

While Fusion Markets markets itself as a low-cost, professional broker, the complaints tell a different story: system failures, manipulated trades, blocked withdrawals, questionable licensing, and poor support. Even if you see positive reviews, they may not reflect deeper issues customers face later.

If you already have an account:

-

Test with a small withdrawal immediately to confirm payout reliability

-

Avoid submitting large deposits until that’s verified

-

Contact regulators directly (e.g. ASIC) to confirm licensing status

-

Record all communications and trade instructions in case of future dispute

If you’re looking for a broker, always prioritize those regulated by top-tier authorities (FCA, CySEC, ASIC, BaFin), with clear fund segregation and documented audit history.

Fusion Markets exhibits multiple risk indicators. A platform that traps funds, manipulates trade data, and avoids accountability is one to avoid—not trust.

-

Report Fusionmarkets.com and Recover Your Funds

If you have lost money to fusionmarkets.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like fusionmarkets.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.