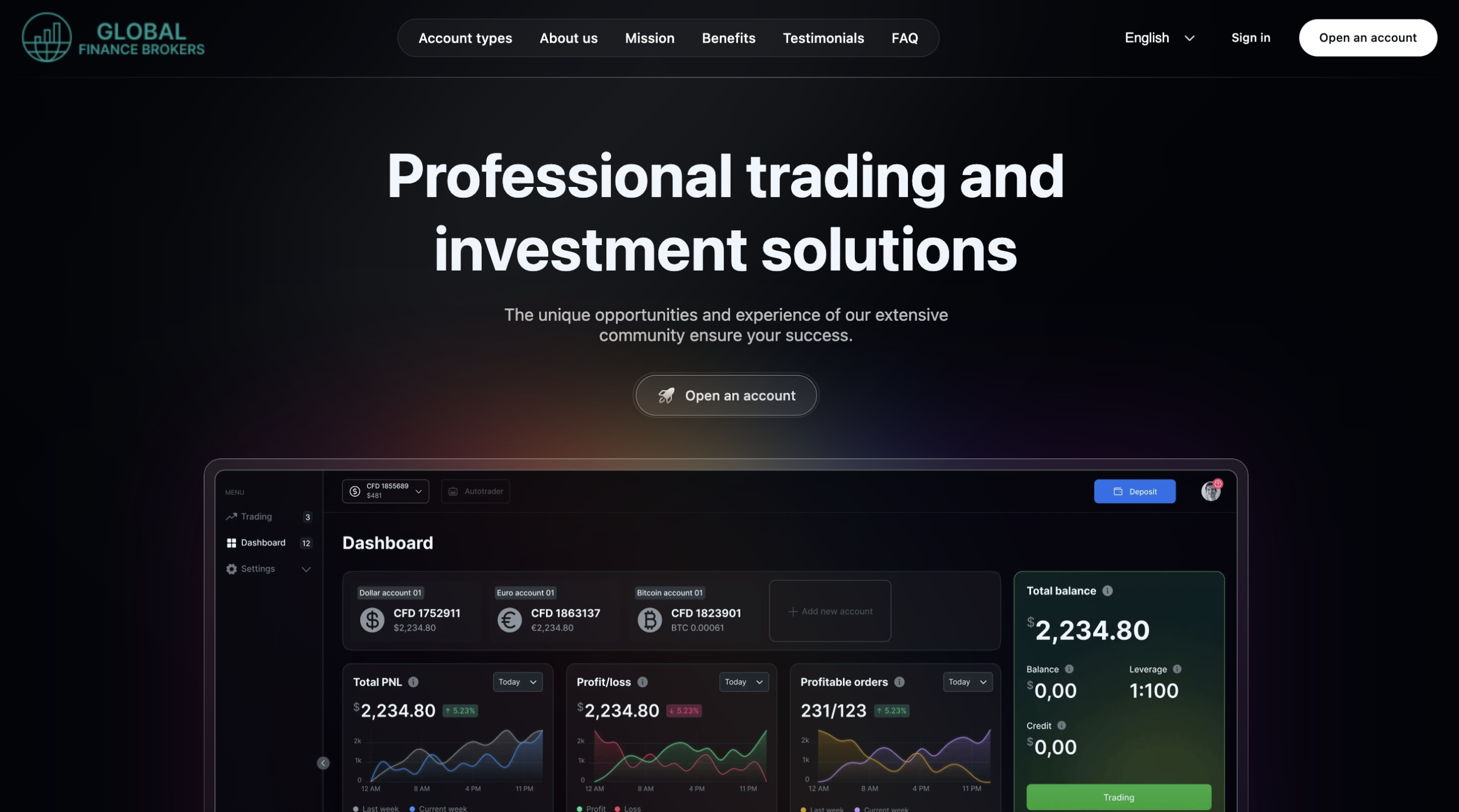

Glblfin.com Platform Review

In recent years, hundreds of online trading and investment platforms have appeared, promising easy profits from forex, crypto, stocks, and other markets. One such site is glblfin.com (often referenced simply as Glblfin). On the surface, glblfin.com positions itself as a financial services provider where users can trade or invest in financial instruments. But a closer examination reveals significant issues that suggest this platform should not be trusted with your money.

This review breaks down the key concerns around Glblfin, including regulatory status, credibility problems, and the common tactics associated with websites like this. The conclusion is clear: this is not a platform you should engage with.

No Recognized Regulatory Approval

One of the most fundamental requirements for any legitimate financial intermediary or broker is registration with a reputable regulator. Regulated firms are overseen by authorities such as the U.S. Securities and Exchange Commission (SEC), UK’s Financial Conduct Authority (FCA), Australian Securities & Investments Commission (ASIC), or similar bodies around the world.

Glblfin fails this test. There is no evidence that this platform is licensed with any major financial watchdog. In fact, the UK’s Financial Conduct Authority lists glblfin.com specifically on its warning list as a clone of a legitimate authorised firm — meaning fraudsters have copied the identity of a real regulated company to mislead consumers.

This means:

-

The firm does not appear on any verified regulatory register.

-

Clients would not have legal protection or access to compensation schemes if anything goes wrong.

-

There is no meaningful oversight or accountability governing its activities.

Simply put, the regulatory status on its own should dissuade anyone from using it.

Clone Firm Tactic — A Known Deceptive Strategy

Regulators warn that fraudsters sometimes launch clone firms — digital platforms that pretend to be associated with a legitimate financial institution. In the case of Glblfin:

-

It has been identified as a clone of a genuine UK-regulated firm called Global Finance Brokers Limited, yet is not authorised by the FCA itself.

-

Fraudsters may mix real company details (name, address, registration numbers) with false contact information to make the site appear authentic.

Clone firms use this deceptive camouflage to lure prospective investors who trust the brand or believe the operation is regulated. But this tactic provides no assurances about how your funds are held or used — and investors have no formal recourse if losses occur.

Website Credibility and Trust Signals

Independent investigations into glblfin.com reveal additional red flags:

-

The platform has been mentioned by multiple monitoring sites as unregulated and lacking public verification of legal credentials.

-

The domain is relatively new, with limited online presence or history, which is typical of many quickly constructed fraudulent platforms.

-

Security and reputation checkers show low trust scores or place the site in risky territory due to lack of authoritative data.

Legitimate brokers typically have long track records, transparent disclosures, and independent reviews — none of which clearly exist for Glblfin.

Common Deceptive Practices in Unregulated Platforms

While there is no official data on how Glblfin operates internally, platforms without legitimate oversight often exhibit one or more of the following practices, based on patterns seen in similar cases:

1. Misleading Performance Displays

Unverified dashboards may show fake profits or exaggerated returns to entice investors to deposit more funds.

2. Withdrawal Hurdles

Users might be allowed to make small withdrawals initially to build trust, only for larger withdrawal requests to be blocked, delayed, or conditioned on additional “fees”.

3. Aggressive Outreach

Cold calls, unsolicited messages, or advertisements pushing fast-moving opportunities are hallmark signs of predatory marketing.

These tactics are widely associated with online trading sites that are not bound by regulatory transparency or audits.

Why This Matters to Investors

Without regulation or transparency:

-

There is no external body ensuring your money is held securely.

-

You cannot access formal dispute resolution services if the company fails to honour commitments.

-

Approval does not imply financial safeguards such as client asset protection or segregated accounts.

Regulators specifically caution that trading with an unauthorized or cloned firm leaves consumers exposed without legal protections if the platform conducts business improperly.

Conclusion — Steer Clear of Glblfin

In summary, glblfin.com lacks the hallmarks of a legitimate financial services provider. It is not licensed with reputable regulators, is publicly identified as a clone of another company, and shows the typical characteristics of an untrustworthy online trading site. Engaging with such platforms puts your money in a vulnerable position without recognized safeguards.

If you come across outreach from entities behind glblfin.com — whether through email, social media, or online ads — approach with extreme caution, and do not provide personal or financial information. Investigate thoroughly and prioritize platforms that are transparently regulated and verifiably authorised.

Avoiding this platform is not just cautious — it is essential for protecting your financial interests.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to glblfin.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as glblfin.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.