HartmanGreyCapital Due Diligence

When evaluating online financial services, especially those promising access to markets like forex, crypto, and managed investment portfolios, credible credentials and transparent operation should be non-negotiable. HartmanGreyCapital.com presents itself as a multi-asset trading and investment platform, but a closer look at the available information raises significant doubts about its legitimacy and trustworthiness.

In this review, we’ll break down why many signals point toward this being a platform individuals should avoid engaging with and what specific indicators you should be aware of before considering any involvement.

1. Mixed Trust Indicators from Reputation Tools

Automated website reputation services provide a snapshot of how credible a platform appears based on observable data. For HartmanGreyCapital.com:

-

A ScamAdviser automated report gives the site a “fair” trust score, but this does not equate to high credibility; rather it reflects a lack of strong positive indicators and the presence of factors often associated with questionable sites. The analysis mentions issues such as a server hosting other low-trust websites, limited domain visibility, and detection of cryptocurrency services, which are commonly targeted by deceptive operations.

-

Even though the trust score isn’t at the very lowest tier, the qualifying notes — like hosting with other lower-rated sites and a generally low popularity ranking — are potential red flags when your financial data and money are concerned.

In short, the platform’s reputation in automated checks is not overwhelmingly positive; rather, it suggests that there’s insufficient credible evidence to categorically trust the site.

2. Lack of Clear Corporate Credibility

One of the foundational checks for any financial or trading platform is whether it clearly discloses who is running it, where the business is legally registered, and under what regulatory authority it operates. HartmanGreyCapital.com:

-

Offers a standard contact form and an email address on its contact page.

-

However, there is no publicly verifiable disclosure of corporate registration, regulator licensing, or leadership information on the site itself.

Credible brokers and investment platforms typically provide detailed corporate information and regulatory credentials — for example, registration IDs with authorities like the UK’s FCA, Australia’s ASIC, or European regulators — so that prospective users can verify legitimacy independently with official registries. The absence of this transparency is not a minor detail; it is a core concern when assessing whether a company meets minimal standards for financial services trustworthiness.

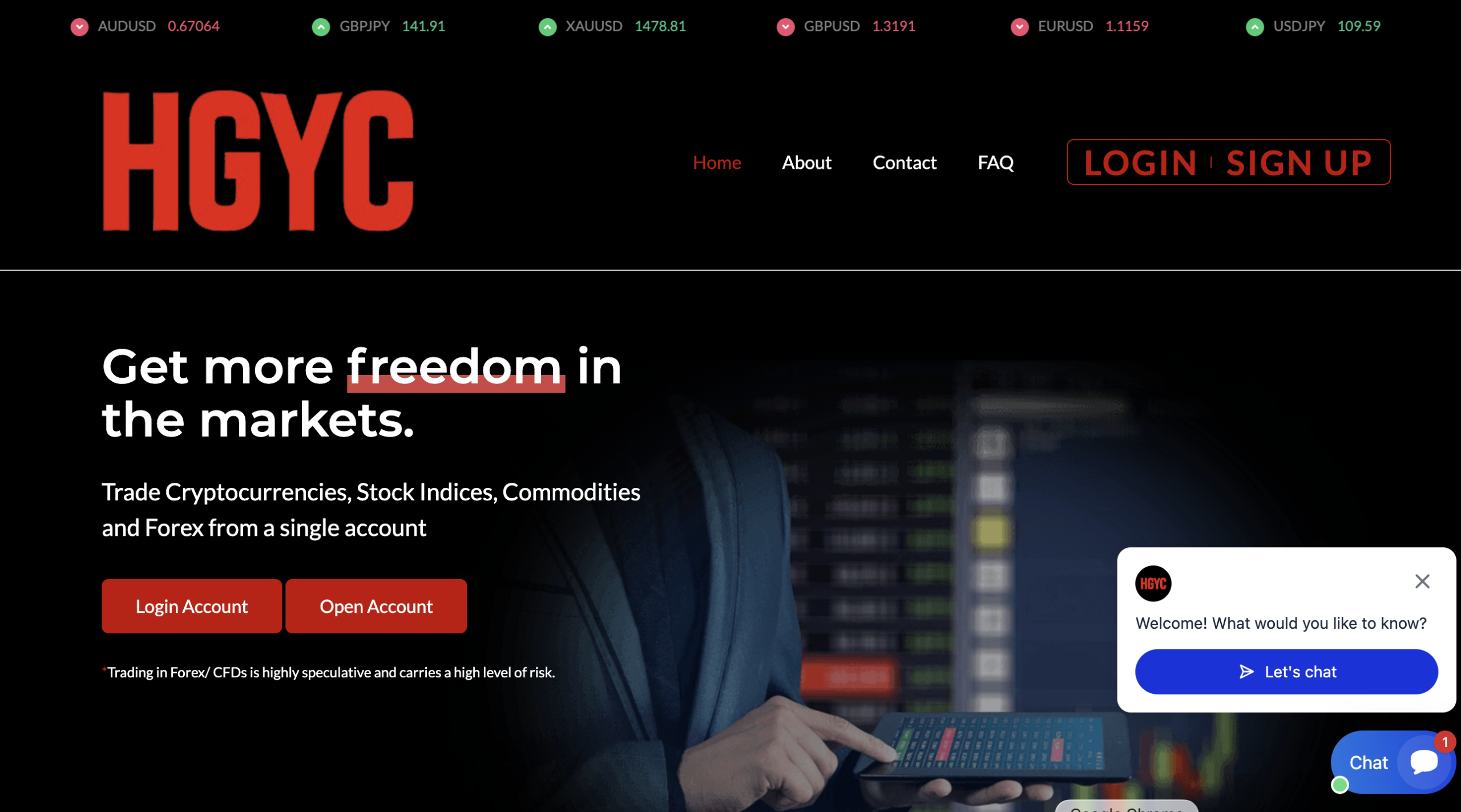

3. Website Content Promises vs. Evidence

The homepage content for HartmanGreyCapital.com presents optimistic scenarios about trading and investment performance, including claims of:

-

Various asset classes being available

-

“Professionally managed” portfolio options

-

Tools like expert guidance and automated trading features

But look closely: the site does not substantiate these claims with third-party verification, audited performance data, or official regulatory endorsements. These kinds of claims — without verifiable backing — are common in promotional materials for platforms that have no regulated track record or transparent performance reporting.

This pattern — glossy promises coupled with no verifiable substance — is something experienced investors have learned to treat with skepticism when deciding where to allocate funds.

4. Cryptocurrencies and CFD Trading Should Be Scrutinized

HartmanGreyCapital.com’s business model appears to include access to crypto, forex, and CFD trading. While these markets are legitimate, they are commonly used by deceptive platforms to lure clients with high-leverage offers and vague profit claims.

Independent financial advisories routinely highlight that services offering trading of crypto and CFDs should be fully regulated and transparent, because:

-

Crypto trading and CFD investment inherently involve complex risk profiles.

-

Regulated brokers must provide clear risk disclosures, segregation of client funds, and audited financial practices.

Absent verifiable regulatory oversight from a recognized authority — information that HartmanGreyCapital.com does not publicly present — a platform’s claims about trading efficiency or market insight cannot be independently confirmed.

5. Domain and Technical Footprint Are Unsettling

Some critics of automated reputation tools argue that a fair trust score alone doesn’t prove wrongdoing. That said, when a domain:

-

Is relatively new,

-

Is hosted on a server with other low-trust sites,

-

Has limited external traffic or recognition,

…these factors together suggest there isn’t a longstanding, reputable operational history behind the site — which should make anyone cautious about trusting it with funds or personal data.

A credible financial service with genuine market pedigree would typically show:

-

Years of independent reviews

-

Transparent regulatory credentials

-

Clear management disclosure

-

Confirmable customer support channels

None of these are evident for HartmanGreyCapital.com.

Final Thoughts — Why You Should Steer Clear

After reviewing the available data, the conclusion is clear: HartmanGreyCapital.com does not meet the basic standards of transparency, verification, or commercial credibility expected of trusted financial and investment platforms.

The combination of:

-

ambiguous corporate disclosure,

-

questionable reputation tool indicators,

-

marketing claims unsupported by independent verification,

-

and an unremarkable technical footprint,

…suggests this platform should not be used for investing, trading, or asset management.

Financial decisions — especially those involving personal savings or cryptocurrencies — demand platforms that are fully regulated, independently audited, and transparent in their operations. HartmanGreyCapital.com does not currently demonstrate these qualifications. Given the available evidence and typical industry standards, a prudent choice is to avoid this platform entirely and allocate your capital only to services with verifiable credentials.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to hartmangreycapital.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as hartmangreycapital.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.